Anyone interested in the investment market or who regularly listens to financial news will often hear the terms "long" and "short." So, what exactly does "long" mean in this context? If you're interested in investing, it's important to understand this concept. Today, we'll focus on explaining what a "long position" is.

What is Bullish?

The term “bullish” refers to a positive outlook on the financial markets. When an investor or trader is bullish, they expect asset prices to rise and adjust their investment strategy accordingly. This often involves purchasing stocks, futures contracts, or other financial instruments to profit from anticipated price increases.

In the stock market, it may buy shares in the hope that the share price will rise when it is sold in the future. In the futures market, one may buy futures contracts with the expectation of selling at a higher price in the future when the contracts expire. Their investment strategy is consistent with a bullish view of the market because the investor believes that the value of the asset will increase.

For example, if you buy a stock for $10.000. the price of that stock keEPS going up. This value is not getting more and more, so the upward movement is called long. And in the West, because in ancient times the bull represented wealth and the bull's horns were also going up for good, they would also call this period bull.

On the contrary, stocks will fall because investors take their money out, and the money inside the stock market is getting less and less and less, so it will be called short. Similarly, if you buy a stock for $10.000. if the stock price keeps falling, is that stock getting less and less valuable? The value is getting less and less, and the pockets are getting emptier and emptier, so the downward spiral would be called a short. And in the West, bears supply the time to lunge downward, so again, the market at this time is likened to a bear market.

Generally speaking, the market is compared to the broader market index as a criterion for judging the long and short term. When the index of the broader market is in the quarterly line above and there is a tendency to go up, it is called a long market. On behalf of this period of time, most of the investors who buy stocks are in the state of making money, so market optimism will be easier to sustain.

Then, when the market is below the quarterly line and there is a downward trend, it will be called a short market. This means that almost all investors who bought stocks recently are losing money. The market is also more likely to be filled with a pessimistic atmosphere.

From this come a few common phrases, such as bullish or bearish, which simply mean in favor of the bullish or bearish. Often heard, for example, is that the Federal Reserve interest rate cut is a big positive for the global stock market, meaning that the rate cut will be conducive to the stock market's rise. On the contrary, it is negative; that is, it will lead to a decline in Stock Prices. For example, Amazon announced a few days ago that its earnings figures were not good, which is a major negative. The result is that the stock price quickly fell.

The second thing you often hear is whether to go long or short. Going long means buying with a bullish view, expecting it to go up, and selling in the future to make a profit. Shorting, or short selling, is just being bearish on the stock market. So go to the brokerage firm to borrow stocks to sell, and wait for the decline to profit. Or directly buy the reverse of the commodity; these are called shorts. I often hear who wants to go short a certain company, short a certain grade of land, short the U.S. dollar, short gold, short oil—that is, after buying in the hope of going short to get the reverse of the payoff.

The third thing you often hear is to go long or short. When the stock price or index has been going up, more go long is called go long; on the contrary, if the price is going downward, lower, or more go short is called go short.

The fourth commonly heard term is "long side" and "short side." The long side represents the side that is optimistic and expects the stock market price to go up, while the short side is the side that is not optimistic and thinks that the stock market or the stock price will go down.

bullish vs bearish

|

Aspect

|

Definition

|

Performance

|

|

Bullish

|

An investor who expects the market to go up |

Profit on upswings, incur losses on downturns. |

|

Bearish

|

An investor who expects the market to fall |

Losses on upswings, gains on downturns. |

Ranking and Management

When a large number of investors or institutions in the market hold a bullish position, a long-term alignment may form. This may indicate that market participants are generally bullish on the asset and expect prices to rise. It may be associated with market optimism and strong buying trends, so investors often analyze it to assess the strength of the market and the likely direction of travel.

Long management usually refers to the management of watched positions in an investment or trading strategy, where the goal is to maximize portfolio returns and reduce risk.

It is therefore important to ensure that bullish positions in a portfolio are not over-exposed to market risk. This may involve establishing appropriate levels of stop-losses and using various tools and methods to monitor and manage the overall level of risk in the portfolio. Ensure that their positions are appropriately sized to protect the portfolio from unwanted volatility. Position management also involves ensuring that the investor has sufficient funds to back up their bullish positions and is able to meet Margin Requirements when required.

Conduct in-depth analyses of the market in order to make timely adjustments to bullish positions. This may involve a combination of fundamental technical analysis and market sentiment to make informed investment decisions. Establish call positions not only in different asset classes but also to diversify within the same asset class. This helps to reduce sector- or asset-specific risk and improve overall portfolio stability.

And the call positions in the portfolio are reviewed regularly to ensure that they remain consistent with the investment objectives and market conditions. These positions may need to be adjusted if market conditions change. In short, it is a comprehensive process that takes into account several factors and is managed effectively to achieve long-term investment success in the market.

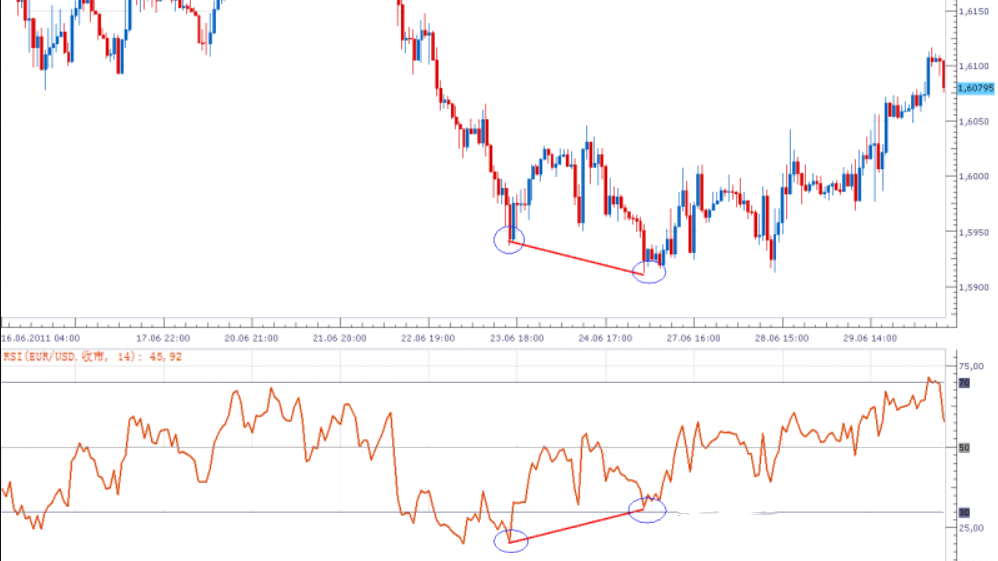

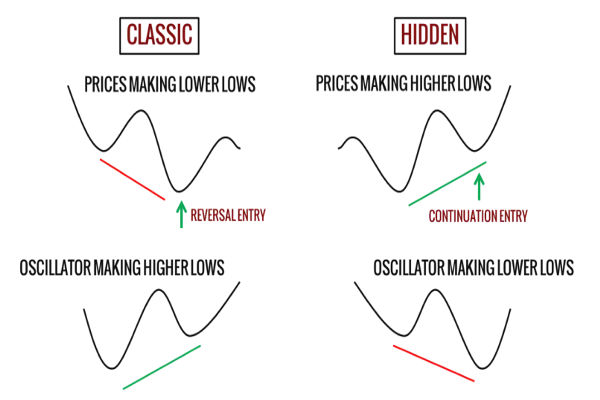

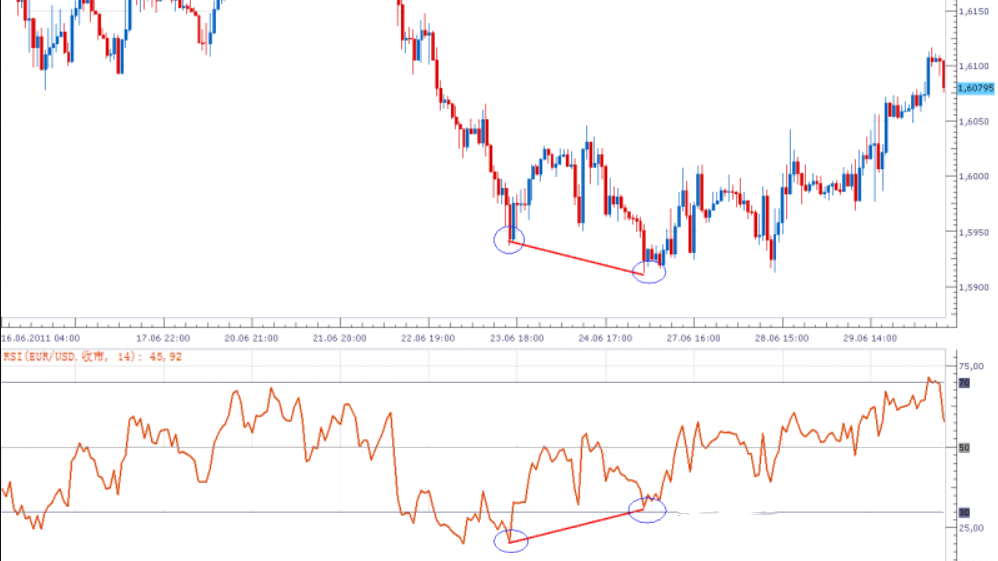

Long Position Divergence

It is a phenomenon in technical analysis that indicates that the trend on a price chart diverges from the trend of a technical indicator, which may suggest an impending change in the market. It refers to a situation where the market price forms a new low, but the related technical indicator forms a higher low during the same period. This situation may suggest that the market's upward momentum is building and that a price reversal may be in the offing.

It is generally characterized by market prices making new lows and the technical indicators corresponding to the price (e.g., Relative Strength Indicator RSI, Stochastic kdj, etc.) forming relatively higher lows in the same period. meaning that despite the price hitting a new low, the technical indicators are showing relatively strong or positive signals. This could suggest that the market's downward momentum is slowing down and bullish forces may be building up, possibly ushering in an uptrend.

Understanding Long Position Borrowing

It usually refers to an investor or trader using leverage (borrowing money) to increase a bullish position in their portfolio. In the financial markets, borrowing can be used to amplify an investor's investment, enabling them to take a larger position without using the borrowed funds. This generally involves steps such as borrowing, position creation, leverage, and risk management.

First, the investor typically borrows funds from a brokerage or financial institution to increase his or her investable capital. The borrowed funds are then used to increase their bullish position in a particular asset (e.g., stocks, futures, foreign exchange, etc.), i.e., to buy more of the asset.

By borrowing, the investor is able to take a larger position without using leverage. This allows the investor to earn higher returns when the price of the asset rises, but it also comes with higher risk, as the borrowed funds need to be repaid and losses are magnified.

Therefore, this type of borrowing requires more careful risk management, as losses are also magnified by the leverage effect. Investors usually set stop-loss levels to limit potential losses.

It provides investors with greater ability to participate in the market but also carries a higher level of risk. Market volatility may cause investors to face larger losses as they not only have to repay their borrowings but also pay interest. Investors therefore need to be cautious when using call borrowing and understand the associated risks and leverage.

Long Position Hedging

This is when an investor takes a bullish position in the market to hedge or mitigate other potential risks. The aim of this strategy is to hedge against potential losses that may come from other investment or trading positions by taking a bullish position in one asset or market.

For example, an investor may hold short positions (bearish positions) on certain assets, and in order to hedge the potential risk of these positions, they will take bullish positions on other assets. Other investors may hold multiple assets and, in order to reduce overall portfolio risk, take bullish positions on certain assets to hedge against other possible risks.

And in the face of an overall market downturn, an investor may offset potential losses in the overall market by taking positions on certain bullish assets. The key is to find hedging positions that correlate with other positions of the investor or trader in order to achieve some balance in different directions in the market.

long reversal pattern (finance)

|

Inversion form

|

Characteristics

|

When Prices Rise

|

When prices fall

|

|

Head and shoulders bottom

|

Three troughs, with the middle one being the lowest. |

Bullish Signals |

Possible Reversal |

|

Double bottom

|

Consists of two troughs with similar bottom patterns |

Bullish Signals |

Possible Reversal |

|

Triple bottom

|

Composed of three troughs with similar bottom pattern |

Bullish Signals |

Possible Reversal |

|

Inverted candle chart

|

Hammerhead, Inverted Hammerhead and other patterns |

Bullish Signal |

Possible reversal |

|

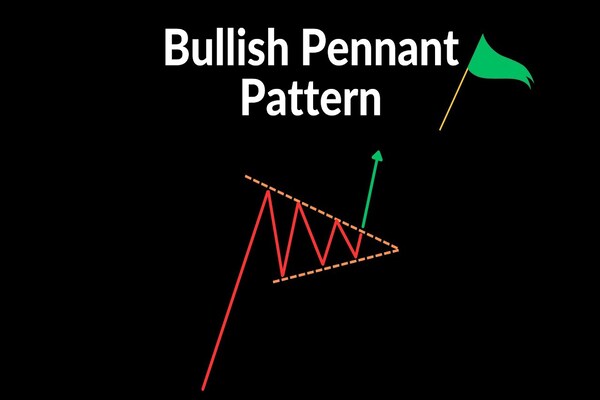

Inverted pattern

|

For example, pennant flags, cup handles, etc. |

Bullish Signal |

Possible reversal |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.