Imagine your office just steps away. You make coffee, sit at your desk, and instead of checking in with a boss or prepping for a meeting, you’re scanning charts, watching prices, and preparing to trade. This vision inspires thousands to explore becoming a day trader from home.

This guide shows you how to become a day trader from home. We’ll cover essential tools, strategy, risk management, and consistent routines. Location matters—Asian traders face late U.S. sessions; Europeans benefit from overlapping hours. By the end, you’ll have a clear path from curiosity to practice.

What Day Trading From Home Really Means

Day trading means buying and selling financial instruments—stocks, forex pairs, futures, options, or even cryptocurrencies—within the same trading day. No positions are held overnight. The goal is to profit from small intraday price movements, often repeated many times a day.

When people first explore how to become a day trader from home, they may imagine it as a shortcut to wealth. They picture sitting in front of a laptop for a few hours, making quick trades, and cashing out big. But the reality is more demanding. Successful home traders:

Treat trading like a full-time job, not a side game.

Rely on tested strategies and strict routines.

Accept losses as part of the process and focus on managing risk.

In other words, if you want to master how to become a day trader from home, you must see it as building a profession, not gambling for quick wins.

The Essential Tools and Setup You Need at Home

Hardware and Software Components

The first step in how to become a day trader from home is building a solid technical setup. A weak laptop and slow Wi-Fi will cost you money in lost trades. At a minimum, you need:

A powerful computer: Day trading requires running charting software, data feeds, and multiple windows at once. A modern processor and at least 16GB of RAM help ensure smooth performance. If your computer freezes while you’re trying to close a losing position, the consequences can be costly.

High-speed internet: Markets move fast. A one-second delay in price updates can mean entering at the wrong level. Invest in fibre broadband if possible, and always keep a backup such as mobile data in case of outages. Many home traders even have two internet providers for redundancy.

Trading platforms: Systems like MetaTrader 4, MetaTrader 5, TradingView, or broker-specific platforms are where you execute trades and analyse charts. The platform you choose should match your market focus and style.

Broker account: Your broker is your gateway to the market. Choose one with strong regulation, competitive spreads, and reliable order execution. For those serious about how to become a day trader from home, this decision is as important as your strategy.

Market data and news feeds: Real-time quotes, economic calendars, and breaking news alerts are essential. A sudden interest rate decision or earnings release can shift the market in seconds.

Without these, even the best strategy won’t help you succeed at how to become a day trader from home.

Learning and Strategy Development Before Risking Real Money

Using Demo Accounts and Paper Trading

The safest way to start learning how to become a day trader from home is through simulation. Demo accounts allow you to practice in real-time market conditions using virtual money. This is where you can experiment with strategies, learn how to use the platform, and make mistakes without financial damage.

Paper trading is another useful step. Instead of executing trades, you write them down—entry price, exit price, and result. While it lacks the emotional impact of real trading, paper trading forces you to build the habit of documenting decisions. And in day trading, discipline and record-keeping matter as much as profits.

Studying Market Education Resources

Self-education is critical. No one masters how to become a day trader from home without study. Books on technical analysis, courses on candlestick patterns, and online webinars on market psychology are all valuable. Joining trading communities can also help. Reading how others analyse markets and share strategies can give you new perspectives and prevent tunnel vision.

But education must be structured. Instead of bouncing randomly from one YouTube video to another, build a curriculum for yourself. Start with basics: how markets work, what candlesticks mean, and how to read charts. Then move to strategies: scalping, momentum trading, or mean reversion. Finally, dive into psychology: handling losses, resisting overtrading, and building patience.

Backtesting and Small-Scale Testing

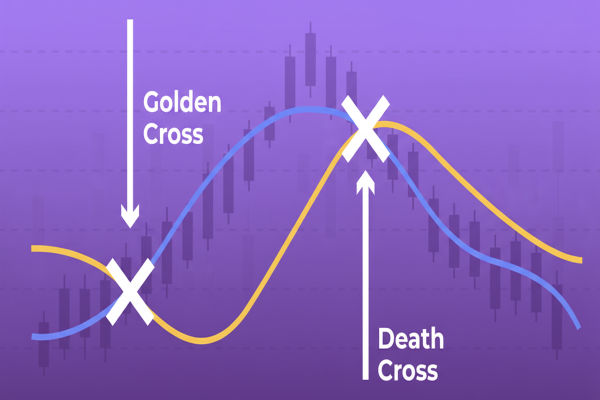

Backtesting is the bridge between theory and practice. This involves applying your strategy to historical data to see how it would have performed. For example, if you believe a moving average crossover signals a strong entry, you can test it on years of past data to measure win rates and drawdowns.

If the strategy shows promise, move to live testing. But here, keep positions very small. Start with the smallest possible lot sizes or amounts. The goal is not to make money yet—it is to experience the real emotions of trading. Even risking $5 feels different from risking nothing. That experience is vital for anyone learning how to become a day trader from home.

Daily Routine and Workflows That Support Consistency

Pre-Market Preparation

Preparation is half the battle. A professional day trader never wakes up and randomly opens trades. The routine for how to become a day trader from home begins before the market opens:

Check economic calendars for major announcements. A central bank speech or earnings report can reshape the market.

Review overnight market movements in other regions. Asian traders should check European and U.S. sessions; U.S. traders should check Asia and Europe.

Identify key support and resistance levels on charts. Mark them before the trading day starts.

During-Market Actions

When the market opens, discipline takes centre stage. This is the most intense phase of how to become a day trader from home. Traders must:

Wait patiently for setups that match their strategy.

Execute orders with precision.

Monitor positions closely without panicking.

The temptation to overtrade is strong, especially for beginners. But patience often separates profitable traders from losing ones.

Which Market Is Best to Start Trading From Home?

Not all markets are equal for beginners. Choosing the right one is part of mastering how to become a day trader from home.

Stocks: Familiar, but usually require more capital and are bound by strict trading hours.

Forex: Offers 24-hour access, low entry barriers, and high liquidity. Popular for beginners.

Futures: Highly leveraged and risky, but attractive for those with more experience.

Cryptocurrency: Open 24/7, highly volatile, and easily accessible.

Each option comes with pros and cons. Beginners often prefer forex or crypto due to flexibility and low costs. But the best choice depends on your personality, risk tolerance, and schedule.

Time Zone Challenges: Trading U.S. Markets From Asia

One overlooked factor in how to become a day trader from home is time zones. Markets don’t adjust to your location—you must adjust to theirs.

U.S. equities open at 9:30 a.m. ET. For traders in Asia, that means starting at 10:30 p.m. or later, depending on your country. Trading all night can disrupt sleep cycles and health.

European markets open earlier in the day, overlapping with Asian mornings and U.S. afternoons. For Asian traders, this may be a more practical option.

Forex runs 24 hours, but liquidity is highest during overlaps between London and New York. This is why many Asian traders shift their focus to forex instead of U.S. stocks.

Understanding these time-zone realities is part of preparing for how to become a day trader from home. Your strategy must fit not only the market but also your lifestyle.

FAQs: Becoming a Home Day Trader

Q1. How much capital do I need to start day trading from home?

The answer depends on your chosen market. For stocks, many recommend at least USD 5,000–10,000. For forex, brokers often allow you to start with USD 500–1,000. What matters is not the amount but how well you manage risk.

Q2. Can I become a full-time day trader from home?

Yes, but it takes time. Most traders begin part-time, learning and building consistency. Only after steady profitability should you consider transitioning full-time. Anyone asking how to become a day trader from home must be prepared for a long learning curve.

Q3. How do I deal with home distractions while trading?

The reality of how to become a day trader from home includes dealing with distractions. The best solution is boundaries: create a separate workspace, set fixed trading hours, and limit phone use during sessions.

Moving From Plan to Consistent Practice

The journey of how to become a day trader from home is challenging but rewarding. It’s not about chasing quick wins but building a sustainable routine. From tools and strategies to psychology and lifestyle adjustments, every step matters. Ultimately, success in how to become a day trader from home comes from consistency. With patience, preparation, and discipline, trading from home can shift from an experiment into a professional pursuit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.