A broad crypto sell‑off followed more than $1.5–$1.7 billion in forced liquidations over roughly 24 hours, as prices broke support and margin thresholds triggered automatic closures across venues.

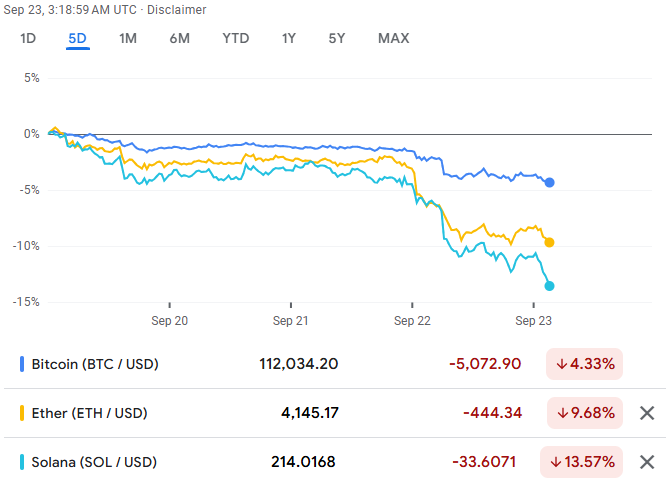

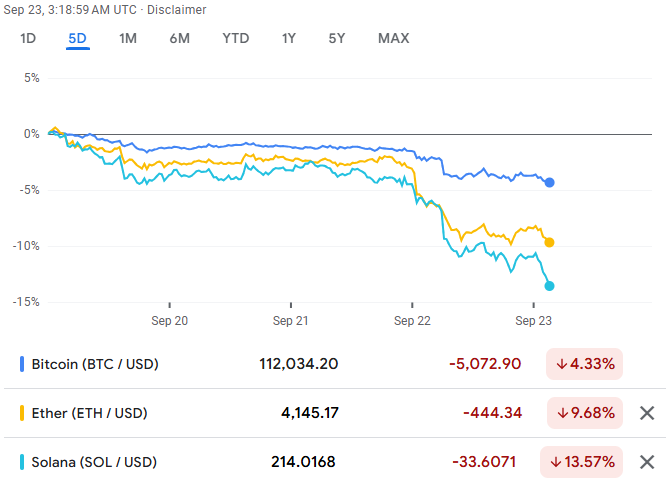

Bitcoin fell intraday to about $111,998 at the lows, while Ether declined by roughly 9% to near $4,075, with losses spilling over into higher‑beta altcoins as liquidity thinned.

Coverage also pointed to an estimated $200 billion drop in aggregate crypto market value during the window, highlighting the outsized price impact when leverage unwinds quickly. [1]

Key Numbers

| Metric |

Value |

Window |

| Total Liquidations |

$1.5–$1.7 billion |

~24 hours |

| Traders Liquidated |

>407,000 |

~24 hours |

| Bitcoin Intraday Low |

~$111,998 |

Day of the move |

| Ether Intraday Low |

~$4,075 |

Day of the move |

| Market Cap Change |

~−$200 billion |

Hours during flush |

Drivers Of The Drop

Breaks below widely watched supports set off stop‑losses and margin calls, turning initial selling into a forced deleveraging spiral via market orders.

Heavy long positioning in perpetual futures amplified spot declines, deepening liquidity gaps and accelerating price discovery to the downside.

Headlines around exchange‑traded fund developments and rules added uncertainty that discouraged dip‑buying and contributed to one‑way flows.

Derivatives And Leverage

The sell‑off aligned with a classic liquidation cascade: equity on leveraged longs fell below maintenance margin, triggering automatic closures that sold into a falling market and fuelled further price declines until leverage reset.

Same‑day tallies indicated that ETH‑linked positions bore a larger share of losses within the total liquidation pool, consistent with higher beta and thinner conditions during stress.

Altcoins And Flows

Altcoins underperformed majors during the heaviest part of the move, a common pattern when liquidity narrows and risk reductions concentrate first in higher‑volatility tokens.

Reports highlighted that Ether and other large altcoins led the drop, consistent with the observed liquidation mix and the higher sensitivity of these tokens to rapid shifts in derivatives positioning. [2]

Levels To Watch

| Asset |

Level |

Why It Matters |

Scenario If Broken |

| BTC |

~$112,000 |

Intraday low zone from the flush |

A clean break risks another wave of stops in thin liquidity |

| ETH |

~$4,100 |

Pivot area near the day's rebound attempts |

Failure invites a retest of the prior low |

| ETH |

~$4,000 |

Round-number support referenced in market coverage |

Loss increases downside momentum and volatility |

Timeline Of Events

Prices slipped through support, prompting initial stop‑loss selling across majors.

Margin thresholds were breached on leveraged longs; forced liquidations accelerated the decline.

Ether and larger altcoins underperformed as liquidation volumes clustered in ETH‑linked exposure.

Aggregated estimates showed $1.5–$1.7 billion in liquidations and a market cap drawdown near $200 billion during the window.

Policy And Regulatory Watch

ETF‑related headlines were cited as a volatility amplifier by several reports, contributing to one‑way positioning during the flush.

Absent a fresh rule surprise, stabilising derivatives metrics and two‑way liquidity usually matter more to short‑term direction after a deleveraging day.

Risk Radar

A renewed spike in liquidations toward the $1.5–$1.7 billion range could reignite forced selling and widen spreads intraday.

Failure to hold the BTC ~$112,000 and ETH ~$4,100 zones risks another sweep of stops before any durable base forms.

Additional ETF or market‑structure headlines could suppress liquidity and keep basis volatile into the next sessions. [3]

Next 24 Hours

Monitor 24‑hour liquidation totals and the split between longs and shorts for signs that leverage is clearing decisively.

Watch BTC near ~$112,000 and ETH near ~$4,100 for confirmation of higher lows or a fresh push to prior troughs.

Track Ether's relative performance versus Bitcoin, as ETH leadership often signals whether altcoin beta is stabilising or still under pressure.

Bottom Line

The market fell as support breaks tripped margin calls, triggering $1.5–$1.7 billion in liquidations that pushed Bitcoin to about $111,998 and Ether down roughly 9%, with ETF‑linked headlines amplifying risk‑off sentiment.

Stabilisation now depends on a cooling in liquidation tallies and holds above the immediate low zones, with ETH's relative performance a useful gauge of whether altcoin risk is resetting or remains fragile.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://finance.yahoo.com/news/crypto-market-liquidation-shoots-1-092212522.html

[2] https://blockchain.news/flashnews/ethereum-eth-leads-500m-of-1-7b-crypto-liquidations-outpacing-btc-and-signaling-altcoin-season

[3] https://www.forbes.com/sites/digital-assets/2025/09/22/open-up-the-floodgates-a-blackrock-price-bombshell-is-suddenly-hurtling-toward-bitcoin-and-crypto/