Opening a Contract for Difference (CFD) account remains one of the most accessible ways for investors and traders to gain exposure to global markets—without owning the underlying asset.

With the arrival of 2025, emerging platforms, stricter regulations, and enhanced trading experiences simplify the initiation process more than ever.

In this guide, we'll walk you through step-by-step how to open and fund a CFD account—with a spotlight on EBC Financial Group, a well-established CFD broker.

What Are CFDs and Their Benefits

Contracts for Difference (CFDs) are derivatives that mirror the price fluctuations of underlying assets, such as indices, foreign exchange, stocks, and commodities without ownership.

With a CFD, you profit (or lose) based on the price difference between when you open and close the position.

Benefits of cfd trading include:

Access to global markets while staying local

Leverage, letting you control larger positions with less capital

Ability to go long or short, enabling strategies for both rising and falling markets

No physical ownership, meaning no storage or custody expenses

Flexible portfolio diversification across multiple asset types

Is CFD Trading Right for You?

While powerful, CFDs carry significant risks:

Leverage magnifies both profits and losses—you can lose more than your initial deposit.

Complicated products, indicating a lack of comprehension, can result in swift losses

Financial charges, such as overnight swaps, affect holding costs.

Market risk due to sudden price swings, liquidity issues, or gaps.

CFDs best suit traders with:

A clear understanding of market mechanics

Defined risk management strategies

Capital that you're willing to risk

Emotional discipline under pressure

For those who prefer long-term investing, shares or ETFs may be more suitable.

Why Choose EBC Financial Group

EBC Financial Group is a global CFD broker regulated in multiple jurisdictions, offering competitive tools and execution.

Regulation & Safeguards:

EBC (UK) Ltd is FCA-regulated

EBC Cayman and SVG are also regulated via CIMA and SVGFSA, respectively.

Offers segregated client funds and private insurance from Lloyd's of London & AON

Negative-balance protection via SVG entity

Trading Infrastructure:

Supports MT4 and MT5, with one-click trading and Level 2 data

Ultra-fast execution (~20 ms) and tight spreads via DMA/STP model

Offers raw-spread Professional accounts and Standard accounts

Access to 100+ U.S. ETF CFDs with zero management fees

Market Access & Support:

Trading instruments include forex, commodities, indices, shares, and ETF CFDs.

Demo accounts, micro-lots, and educational resources for beginners.

Dedicated account managers, multi-lingual support, and copy trading are available.

Step-by-Step Guide to Opening a CFD Account

Step 1: Prepare Your Documentation

Before you start, ensure you have:

Proof of identity (passport or driver's license)

Proof of address (utility bill, bank statement dated within last 3 months)

Step 2: Register and Verify

Step 3: Select Account Type

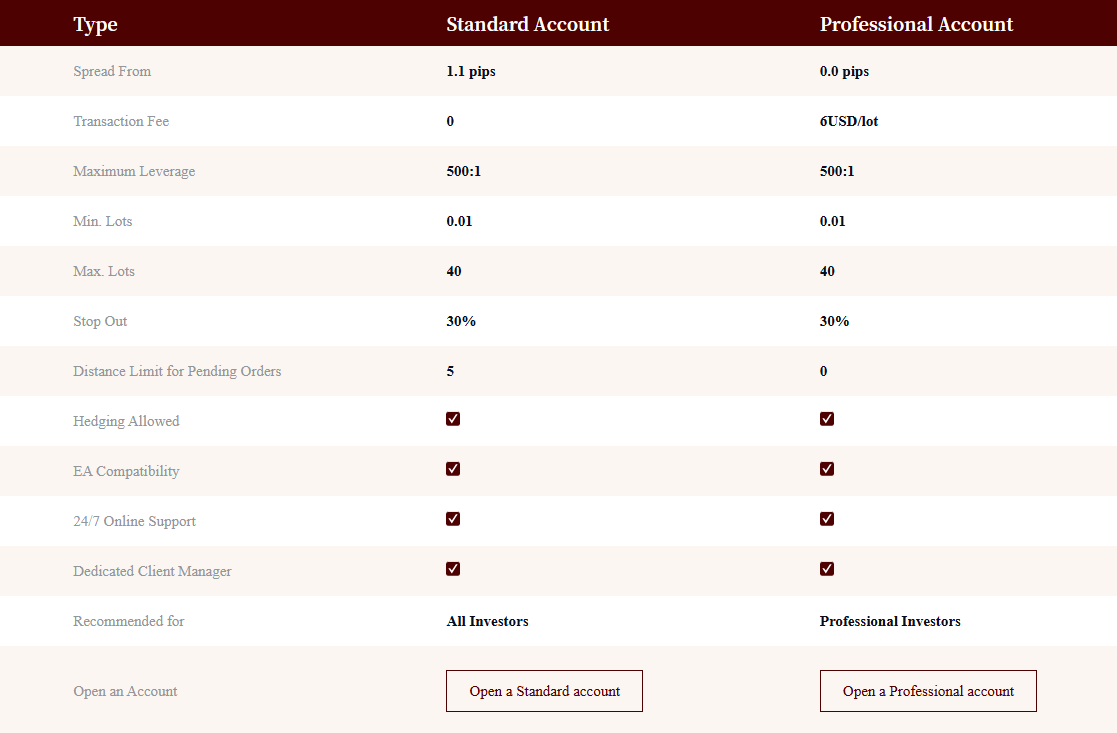

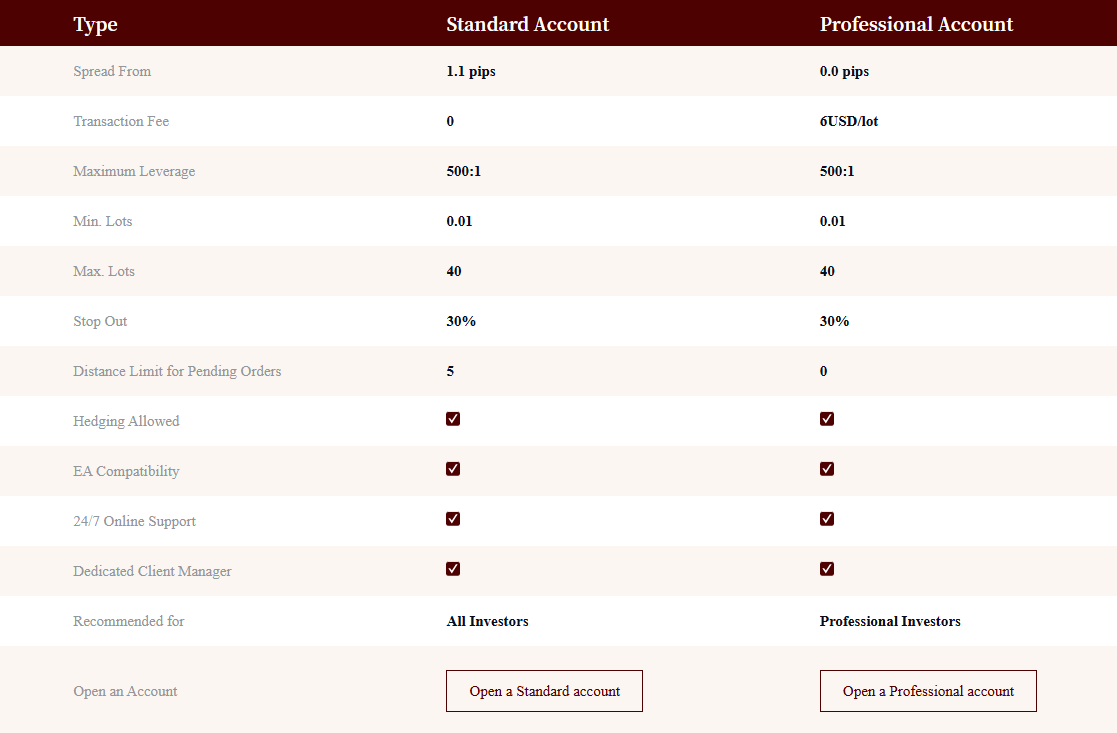

EBC offers:

Standard Account: from ~$100 deposit, standard spreads, no commissions

Professional Account: from ~$5,000 deposit, raw spreads from 0.0 with $6 round-turn commission

Both support swap-free versions, micro-lots, demo access, and copy trading.

Choose based on:

Step 4: Deposit Funds

EBC supports multiple payment methods:

Processing time: Typically 1 business day, with 0% deposit and withdrawal fees

Step 5: Download Trading Platform

EBC offers MT4 and MT5, which are compatible with desktops.

Download, log in using your credentials, and explore:

Real-time quotes

Charting indicators

Order types (market, limit, stop loss, take profit)

Copy trading and automated strategy capabilities

Step 6: Place Your First CFD Trade

To execute a trade:

Select your market (e.g., EUR/USD)

Choose a position (Buy/Sell)

Enter lot size (minimum is 0.01)

Set leverage, stop-loss, and take-profit

Click execute

Monitor your trade—EBC's MT platforms allow chart-based modifications and one-click actions.

Step 7: Learn and Manage Risk

Use stop-loss orders to limit losses

Avoid maximum leverage from day one—start conservatively

Use micro-lots for testing strategies

Maintain a trading journal recording trades and emotions

Use EBC's educational materials, webinars, and research

Tips for Beginners

Try the demo account until you're consistently profitable

Start small and increase position size after gaining experience

Trade when Volatility Is High —e.g. during active hours for forex or news-driven events

Study market analysis: use Trading Central research available from EBC

Stay disciplined—define daily risk limits and stick to them

Use copy trading to learn from experienced traders on EBC's proprietary platform

Conclusion

In conclusion, opening a CFD account in 2025 involves more than clicking "Open Account." Select a trustworthy broker, confirm your documents, deposit money into your account and engage in responsible trading.

EBC Financial Group stands out with its fast execution, global regulatory coverage, low fees, and robust platform offerings. Whether you're a total beginner or an experienced trader seeking liquidity and tight spreads, they offer account options to match your needs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.