Offerpad Solutions (NYSE: OPAD) shocked the markets with an astonishing leap from its 52-week lows, surging more than 180% intraday. Once deeply distressed, the stock's dramatic turnaround has left investors and analysts asking: What's driving this recovery?

As of late August 2025, the intraday spike raised the stock to $3.64, up ~136% from the previous day's close, but you shouldn't use that surge to calculate YTD performance. According to the latest research, OPAD stock is up ~26.12% year-to-date. It vastly outpaces the S&P 500's ~15% YTD gain, fueling headlines about its reward potential.

This article explains the various factors contributing to OPAD's resurgence, including financial recovery, strategic shifts, liquidity enhancements, technical advancements, and broader industry support.

Why OPAD Stock Is Rebounding in 2025? 4 Main Driving Factors Explained

| Driver |

Contribution to Recovery |

| Q2 Operational Improvement |

Demonstrates execution and improved margins |

| Capital Raise & Liquidity |

Reduces solvency concerns |

| HomePro & Auction.com Partnership |

Scales tech-enabled real estate model |

| Meme-stock/ Retail Interest |

Short-term trading momentum |

1) Offerpad Solutions Q2 2025 Results Signal Operational Progress

Offerpad's Q2 2025 earnings, released on August 4, 2025, revealed tangible improvements in its business:

Revenue: $160.3 million, driven by 452 homes sold.

Gross margin: 8.9%, with Adjusted EBITDA loss narrowing sequentially by 39%.

Liquidity: Raised $21 million in July, raising total cash reserves to over $75 million.

Notable initiatives included:

Expansion of its HomePro platform across all markets.

Recorded $6.4 million in revenue from the Offerpad Renovate segment.

Enhancements to the Direct+ service platform.

These developments underscore Offerpad's shift toward asset-light, technology-driven services, boosting market confidence.

2) Capital Raise Strengthens Financial Position

Amid market volatility, Offerpad's $21 million capital raise in July 2025 was a vote of confidence that helped stabilise its balance sheet. The infusion pushed liquidity to over $75 million, essential for navigating real estate market volatility.

The message: Offerpad has a financial runway to sustain operations and invest in high-growth areas.

3) Technological and Strategic Innovation: HomePro & Partnerships

Offerpad's strategic investments are core to its recovery:

HomePro deployment: Launched across markets mid-2025 to provide in-home consultations for sellers. This move brought Offerpad closer to consumers and improved user engagement.

Partnership with Auction.com: Integrates Renovate services and expands Offerpad's visibility among property investors via Auction.com's platform.

These initiatives signal a shift toward scalable, tech-enabled services that can drive future growth while reducing reliance on inventory-heavy models.

4) Meme-Stock Momentum and Sector Tailwinds

Part of OPAD's rally aligns with the broader real estate tech meme-stock narrative, where traders who chased Opendoor (OPEN) extended the momentum to Offerpad.

Analysis platforms flagged OPAD as a retail-driven stock riding this wave.

Intra-day volumes surged in late August, with over 139 million shares traded, a 800% increase from the norm and options volatility soared to 292%.

The stock's rise to $3.64 from around $2, despite fundamental shortcomings, indicates speculative money supporting the rebound, although essential business enhancements still serve as the core motivators.

Will OPAD Stock Continue to Surge or Drop? Analytics & Forecasts

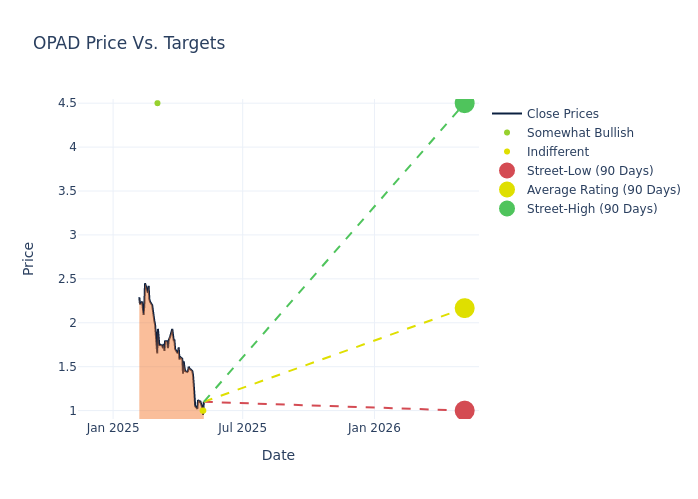

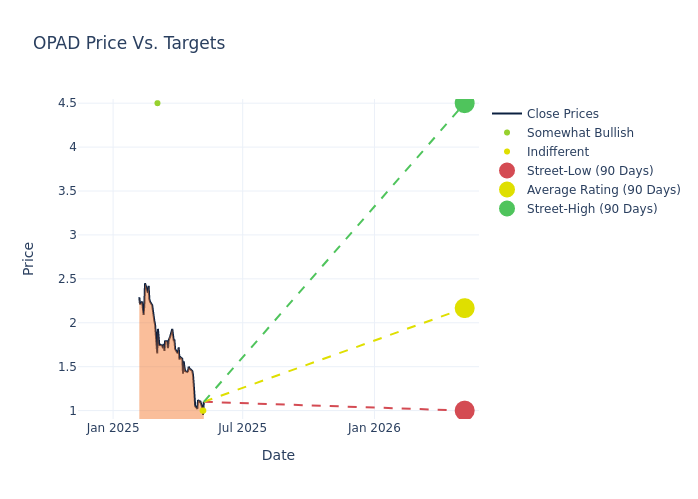

Forecast models show bullish trends, with key buy signals from moving averages and momentum indicators. Resistance lies near $4.89, while support lies around $0.30.

Analysts' consensus: Hold rating, 12-month target of $2.22 (approx. 44% upside from current ~$1.54).

These forecasts reflect both enthusiasm for the recent rally and caution given past losses and uncertain fundamentals.

Should You Buy OPAD Stock Now?

For opportunistic investors:

Catalysts exist, from operational momentum to expanded platform reach.

Timing is critical as entry near technical support levels ($2-3) may offer upside while containing risk.

Long-term-minded investors should monitor:

Whether Offerpad can continue improving margins and sales volume.

Ability to generate positive cash flow and further reduce losses.

Execution risks related to scaling HomePro and Renovate services.

Speaking of risks, while OPAD's comeback is striking, several risks remain:

Ongoing losses: The company continues to report negative earnings and has a thin cash runway despite recent funding.

Speculative volatility: Meme-stock dynamics often have quick reversals. Withdrawal of retail interest could cause abrupt sell-offs.

Macro headwinds: A slowdown in the real estate market, increased interest rates, or reduced home sales might weaken the operational argument.

Valuation uncertainty: The Price-to-Sales ratio stays low, indicating doubts about ongoing revenue growth.

Frequently Asked Questions

1. Why Is OPAD Stock Going up in 2025?

OPAD stock has surged in 2025 due to improving Q2 financial results, a $21 million capital raise boosting liquidity, expansion of its HomePro and Renovate services, and strong retail investor momentum.

2. Is OPAD Stock a Good Buy Right Now?

OPAD stock has shown signs of recovery, but it remains a speculative investment. Analysts currently rate it a "Hold" with a 12-month price target around $2.20–$2.50, suggesting moderate upside.

3. How High Could OPAD Stock Go In 2025?

Prediction models indicate resistance at $4.80 to $5.00 based on technical signals. Nevertheless, the analysts' consensus is more cautious, forecasting approximately $2.20 within 12 months.

4. Should Long-Term Investors Hold OPAD Stock?

Long-term investors should be cautious. While OPAD's strategic shifts and liquidity boost are positives, the company has yet to prove sustainable profitability.

Conclusion

In conclusion, Offerpad Solutions' recovery in 2025 is rooted in a mix of tangible growth indicators and speculative exuberance. Key drivers include Q2 performance gains, enhanced liquidity, strategic rollout of new service models, and strong retail-driven momentum.

The rally offers early signs of a turnaround, but investors must weigh execution risk, the sustainability of innovation gains, and whether valuations justify the move.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.