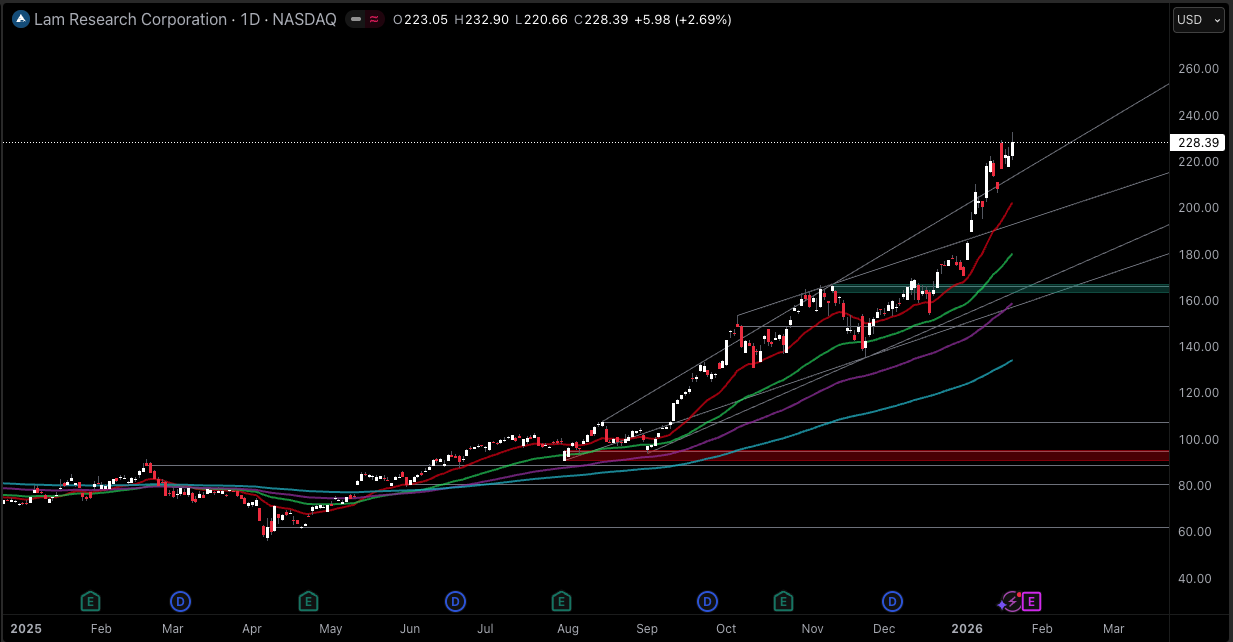

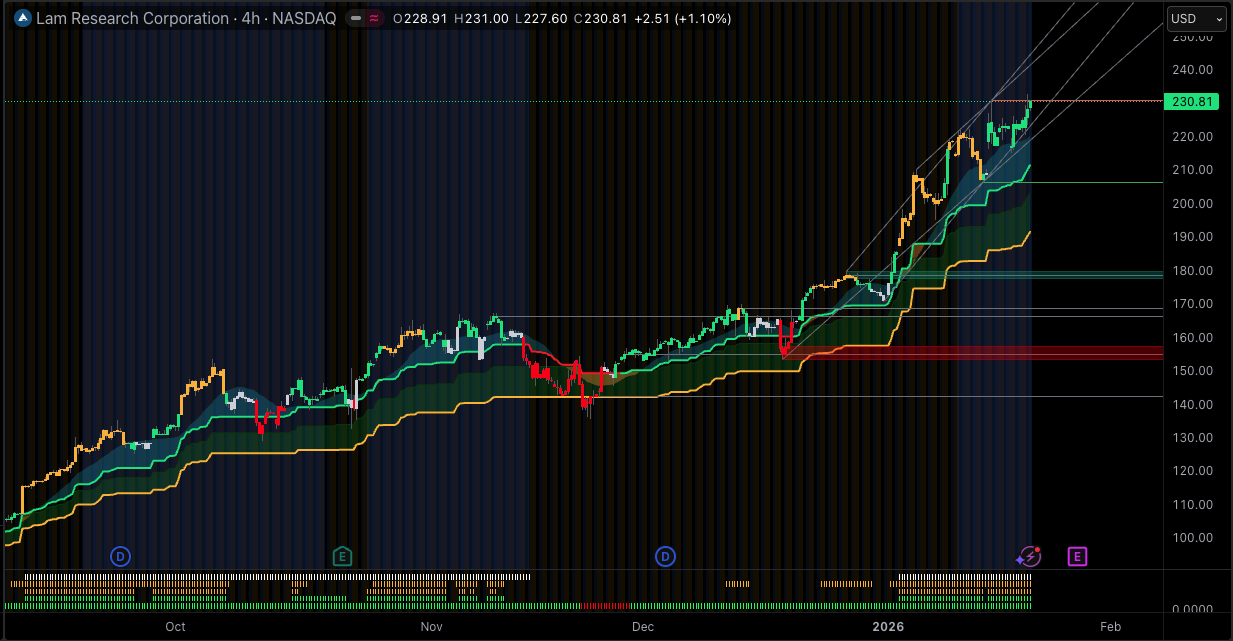

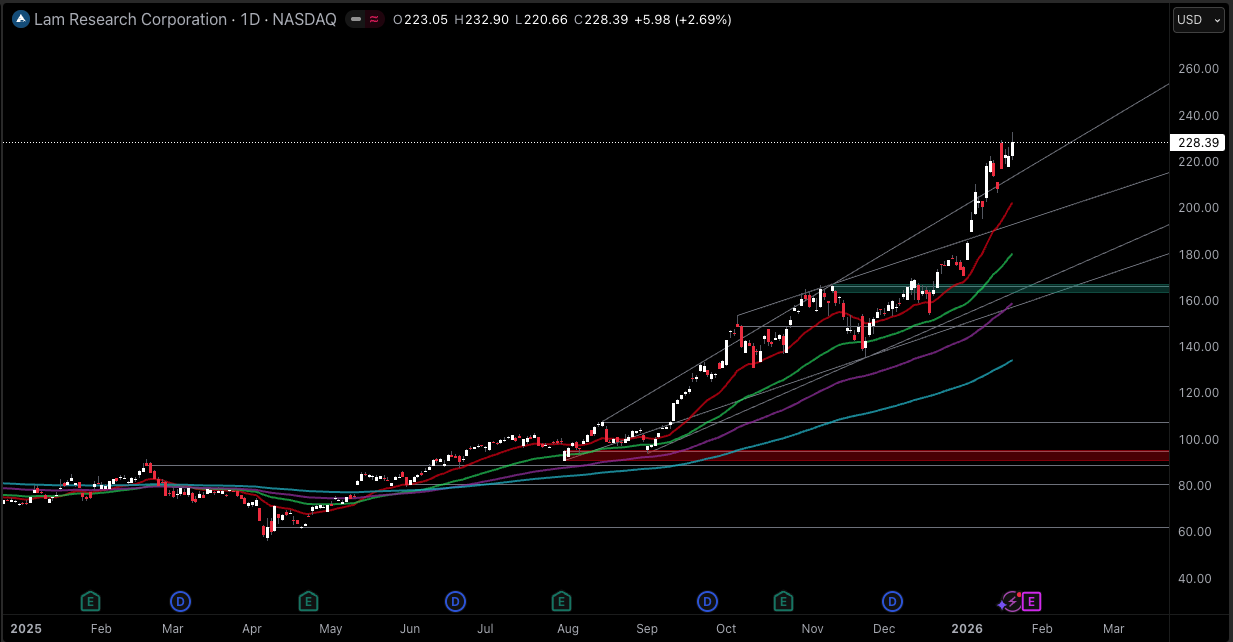

On Jan 21, 2026, Lam Research (NASDAQ: LRCX) Stock closed at $228.39 with a market cap of $162B. On Jan 22, 2026, the pre-market price is around $232.90.

Lam Research stock approaches 2026 with a unique combination of favorable industry cycles and strong company execution. The wafer fabrication equipment cycle is accelerating due to AI infrastructure investments; however, the primary catalyst is the increasing number of process steps per wafer. This trend is driven by taller memory stacks, more complex logic transitions, and packaging emerging as a key performance constraint.

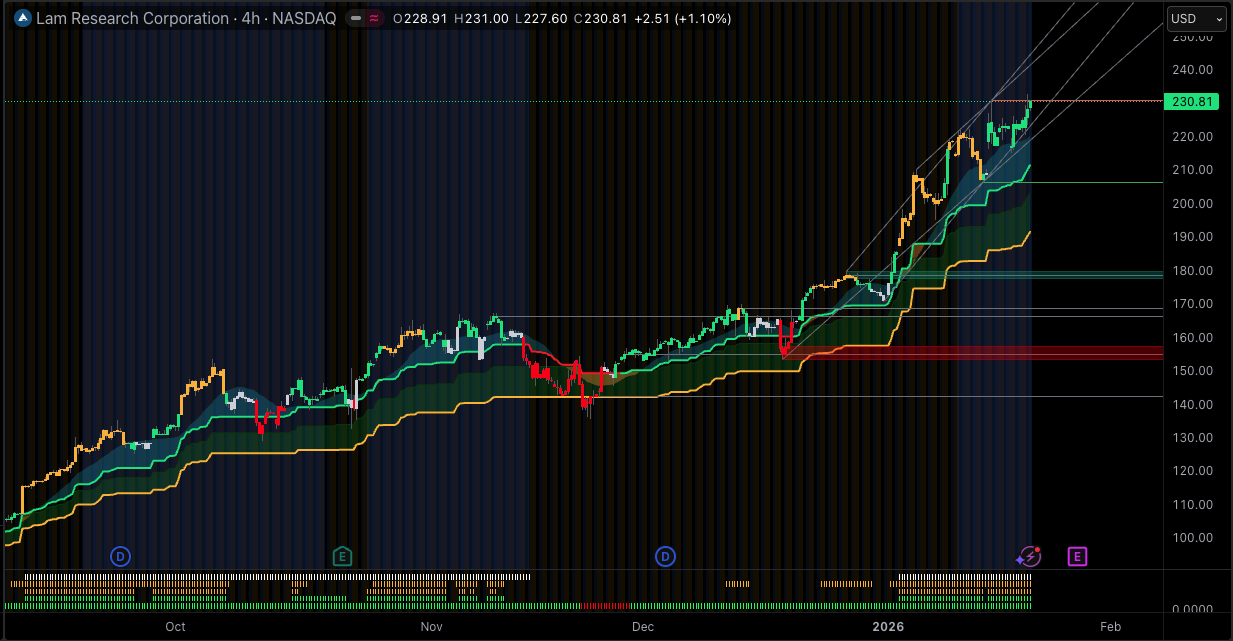

LRCX stock has exhibited a sustained uptrend through late January, underpinned by margin expansion and significant capital returns. The central consideration for 2026 is whether AI-driven expenditures will remain broad enough to offset slower segments, particularly as policy risk and exposure to China continue to influence earnings.

Lam Research Stock Outlook 2026: Key Takeaways In The AI WFE Cycle

AI is fundamentally altering the landscape of wafer fabrication equipment (WFE). The 2026 cycle emphasizes process intensity and time-to-yield rather than simple capacity expansion. This environment directly benefits leaders in etch and deposition, as each new device architecture introduces additional layers, films, and patterning complexity.

Memory is no longer a simple boom-bust lever. High-bandwidth memory demand is pushing sustained DRAM tool spending growth into 2026, while 3D NAND continues to move toward higher stacks, both of which expand etch and deposition content per wafer.

A strong services base is an underappreciated stabilizer. Customer support-related revenue accounted for about 38% of fiscal 2025 sales, helping dampen earnings volatility when system shipments fluctuate.

Margins are already operating at “good cycle” levels. Gross margin held near 50% in the September 2025 quarter, indicating that factory efficiency and mix are providing operating leverage even before a full peak-capex environment.

Capital return remains a material part of the equity story. Fiscal 2025 operating cash flow was $6.2 billion, with $3.4 billion deployed into repurchases and $1.1 billion into dividends.

China is the swing factor. China accounted for 43% of the September 2025 quarter revenue, which can amplify upside in strong demand periods but also magnifies policy and compliance risks if controls tighten or acceptance timing shifts.

Technical indicators support a bullish outlook, although the stock is approaching a significant resistance level. The price remains above key moving averages, and the relative strength index (RSI) is in bullish territory. However, the proximity to recent highs suggests that further upward momentum may require new catalysts.

The AI WFE Cycle In 2026: Why “Process Intensity” Matters More Than Wafer Starts

AI workloads are initiating an upgrade cycle that affects both logic and memory segments. Leading-edge logic capacity is expanding to meet accelerator demand, while memory manufacturers are investing to alleviate bandwidth constraints. This capital expenditure mix is particularly advantageous for equipment categories in which Lam Research has maintained a significant market share, including etch, deposition, and cleaning tools.

Industry equipment sales are projected to rise again in 2026, with wafer fab equipment expanding from 2025 levels and continuing higher into 2027. Within that, memory equipment is forecast to keep growing in 2026, supported by DRAM and HBM buildouts and continued 3D NAND migration.

Industry equipment sales are projected to rise again in 2026, with wafer fab equipment expanding from 2025 levels and continuing higher into 2027. Within that, memory equipment is forecast to keep growing in 2026, supported by DRAM and HBM buildouts and continued 3D NAND migration.

A second distinguishing aspect of this cycle is that investors should focus on finished die at yield rather than wafer starts. As feature sizes decrease and stack heights increase, process windows become more constrained, leading to greater tool time, more metrology cycles, and heightened sensitivity to rework. Consequently, fabrication facilities allocate more resources to steps that control film quality, sidewall profiles, and defectivity. In this context, etch and deposition processes serve as critical yield enablers rather than mere capital expenditures.

A third feature is that advanced packaging is pulling forward demand for adjacent tools. As chiplets, interposers, and high-density memory integration scale, front-end process requirements increasingly reflect back-end constraints. Even for vendors with limited direct back-end exposure, the knock-on effect is more investment in leading-edge wafer processes that improve yield and thermals upstream.

Fundamental Drivers for LRCX Shares In 2026

Revenue mix that can hold up through mini-cycles

Fiscal 2025 revenue was $18.44 billion, with systems revenue at $11.49 billion and customer support-related revenue and other revenue at $6.94 billion. That mix matters. Systems shipments are the cycle amplifier, while services, spares, upgrades, and mature-node solutions tend to monetize the installed base even when new capacity pauses.

In the September 2025 quarter, revenue was $5.32 billion, with systems at $3.55 billion and customer support-related revenue at $1.78 billion. This is a healthy balance for an equipment vendor, especially in a cycle where memory and leading-edge logic can be strong while select segments digest.

Margins and operating leverage are already visible

In fiscal 2025, gross margin was 48.7%, up from 47.3% in fiscal 2024, and net income was $5.36 billion. Those figures imply strong incremental profitability in an improving demand environment.

In the September 2025 quarter, gross margin reached 50.4% on a GAAP basis and 50.6% on a non-GAAP basis. For 2026, this indicates that Lam Research is not dependent on a peak capital expenditure surge to achieve high margins. The current business model is already delivering near-peak gross margins, which enhances the likelihood that additional revenue will translate efficiently into earnings if wafer fabrication equipment spending increases as anticipated.

Cash generation and balance-sheet flexibility support shareholder returns

Operating cash flow was $6.2 billion in fiscal 2025, with $759 million of capex, implying roughly $5.4 billion of cash generation after capex. That funded $3.4 billion of share repurchases and $1.15 billion of dividends in the year.

At fiscal year-end, the balance sheet reported cash and cash equivalents of $6.39 billion. Total debt and finance lease obligations were about $4.48 billion when combining current and long-term portions, leaving the company with net cash flexibility that matters in a volatile capex cycle.

A key point for 2026 is that capital return is not incidental. The company has explicitly tied buybacks and dividends to free cash flow generation via large authorizations, which can dampen drawdowns if the cycle softens and can amplify upside if earnings accelerate.

Geopolitics and China Exposure: The Swing Factor Investors Cannot Ignore

Lam’s geographic revenue concentration is not a headline risk; it is an earnings model input. In fiscal 2025, China's revenue was $6.21 billion, around one-third of total revenue. In the September 2025 quarter, China represented 43% of revenue.

Two dynamics matter in 2026:

Policy and compliance risk can change the timing of tool demand and acceptance. Even when demand exists, restrictions and customer qualification processes can delay revenue recognition or shift mix toward services and upgrades.

China's capacity buildouts can support WFE even when other regions pause. The same exposure that raises risk can also extend the cycle, particularly in mature nodes and certain memory segments where local investment remains strategically prioritized.

The market typically reflects this risk through a higher discount rate. In 2026, it is more appropriate to view China's exposure as increasing the range of potential outcomes between optimistic and pessimistic scenarios, rather than determining a single appropriate valuation multiple.

Valuation: What The Market Is Pricing Into 2026

At about $228 per share, the equity is priced at roughly 28 times trailing earnings with a market capitalization of $162 billion.

That multiple is not cheap in a vacuum, but it is not extreme for an equipment franchise that is already delivering high gross margins and strong cash generation into an AI-led capex upswing. The key valuation debate for 2026 is whether the cycle looks like a multi-year buildout with steady memory and leading-edge logic spend, or a front-loaded surge that normalizes quickly.

Dividend yield is modest, with a quarterly dividend of $0.26 per share paid in early January 2026, but the combination of dividends and repurchases is the more relevant shareholder-return signal.

Technical Analysis: Trend Structure And The Levels That Matter

LRCX stock remains in a bullish technical regime:

Momentum: RSI(14) is 61.684, which is constructive and not in the classic overbought zone.

Trend: Price is above MA50 at 219.79 and MA200 at 188.23, a setup that typically signals sustained institutional bid support.

Immediate structure: The pivot zone is around 230.27. Resistance levels cluster above that area, while nearby supports sit in the mid-220s and low-220s.

From a market structure perspective, the stock currently presents a 'buy-the-dip' profile as long as the price remains above the 50-day moving average. The primary technical risk for 2026 is not a trend reversal, but rather the potential for momentum exhaustion near recent highs if earnings catalysts do not continue to support the growth narrative.

2026 Scenarios: A ractical framework

The most disciplined way to think about 2026 is to anchor on WFE's direction and map it to Lam’s operating leverage and mix.

| 2026 scenario |

What has to happen in WFE |

Business impact |

Likely market behavior |

| Bull case: AI buildout stays broad |

Memory and leading-edge logic remain strong, and advanced packaging keeps pulling spend forward |

Systems growth accelerates, services stay firm, margins hold near recent highs |

Multiple can hold, upside led by earnings revisions |

| Base case: AI strong, pockets digest |

AI-related capex offsets softer spending in select segments |

Revenue growth moderates, services buffers volatility, margins remain healthy |

Stock trades as “quality cyclicals,” rewarding consistency |

| Bear case: capex pause and policy shock |

Spending delays, acceptance timing issues, or restrictions hit the order-to-revenue bridge |

Systems decline, services slows with utilization, margin compresses |

Multiple de-rates and price seeks long-term averages |

The base case remains constructive if WFE expands in 2026 as projected and if large foundries continue raising capital budgets to support advanced nodes and packaging capacity.

Frequently Asked Questions (FAQ)

1. Is Lam Research stock a direct AI play?

Yes, but indirectly. AI demand drives leading-edge logic and HBM memory investment, which increases etch and deposition intensity per wafer. The revenue link runs through customer capex decisions rather than AI chip unit sales.

2. What matters more in 2026: memory or logic spending?

Both, but memory quality matters more than memory quantity. HBM-related DRAM investments tend to be higher-value and more process-intensive than classic commodity DRAM expansions, which can improve the tool mix and margins.

3. How important is service revenue for stability?

Customer support-related revenue was about $6.94 billion in fiscal 2025, roughly 38% of total revenue. That recurring stream can cushion earnings when new-tool demand pauses and can rise when utilization is high.

4. Why is China's exposure so central to the outlook?

Because it is large enough to move quarterly results. China accounted for 43% of revenue in the September 2025 quarter, so any shift in policy, shipment timing, or customer qualification can materially change the revenue mix and volatility.

5. What are the most useful technical levels to watch?

MA50 near 219.79 is the key trend support, with MA200 near 188.23 as the long-term “cycle line.” On the upside, the 230 area is a near-term decision zone that requires strong volume and catalysts.

6. Does the dividend meaningfully change total return?

The dividend is modest at $0.26 per quarter, but it signals durability and discipline. The larger driver of total shareholder return has been repurchases funded by strong operating cash flow.

Conclusion

Lam Research stock should be viewed as a high-quality cyclical investment benefiting from structural AI-driven demand. The 2026 opportunity is rooted in increasing process complexity rather than simply the number of fabrication facilities, which favors etch, deposition, and installed-base monetization. The company begins the year with strong margins, substantial cash generation, and continued capacity for capital returns.

The primary risks are not abstract. They sit in capex timing, policy friction, and China-linked revenue concentration. If AI capex remains resilient and memory spending stays focused on HBM-driven upgrades, the earnings framework supports a constructive 2026 outlook with volatility that can create tactical entry points rather than thesis breaks.

Sources:

Lam Research Investor Relations, SEC

Industry equipment sales are projected to rise again in 2026, with wafer fab equipment expanding from 2025 levels and continuing higher into 2027. Within that, memory equipment is forecast to keep growing in 2026, supported by DRAM and HBM buildouts and continued 3D NAND migration.

Industry equipment sales are projected to rise again in 2026, with wafer fab equipment expanding from 2025 levels and continuing higher into 2027. Within that, memory equipment is forecast to keep growing in 2026, supported by DRAM and HBM buildouts and continued 3D NAND migration.