On September 22, 2025, Kenvue Inc. (NYSE: KVUE), maker of Tylenol, saw its stock drop over 7% following a White House announcement that linked acetaminophen (Tylenol's active ingredient) use during pregnancy to a potential increased risk of autism.

The company swiftly rebutted these claims, citing "sound and independent science" showing no causal relationship. Major medical groups, including the CDC and the American Academy of Paediatrics (AAP), continue to stress that no proven causal link has been established.

Simultaneously, Kenvue faces challenges such as slow revenue growth, legal risks, changes in leadership, and a robust U.S. dollar, which are impacting its projections. So, should investors buy the dip, hold, or avoid Kenvue stock altogether?

What Triggered Kenvue Stock Dipping to Its 52-Week Low?

In September 2025, President Trump, alongside Health Secretary Robert F. Kennedy Jr., announced that acetaminophen use during pregnancy "may be linked to autism in children." [1]

The statement triggered media attention, regulatory concern, and market shock. Despite medical groups contesting the claim, Kenvue's business, especially Tylenol, became a focal point.

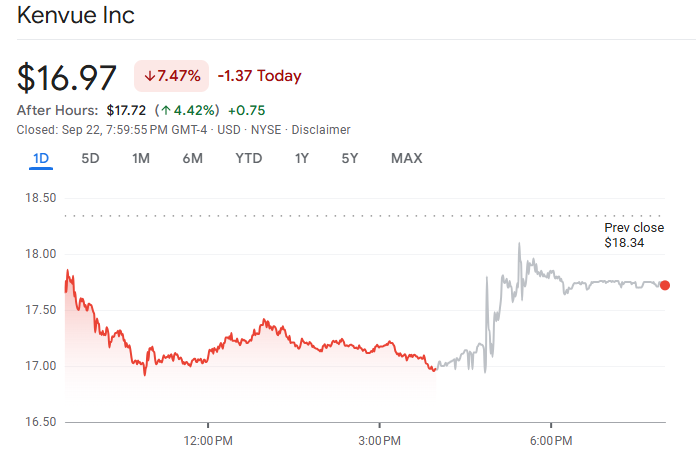

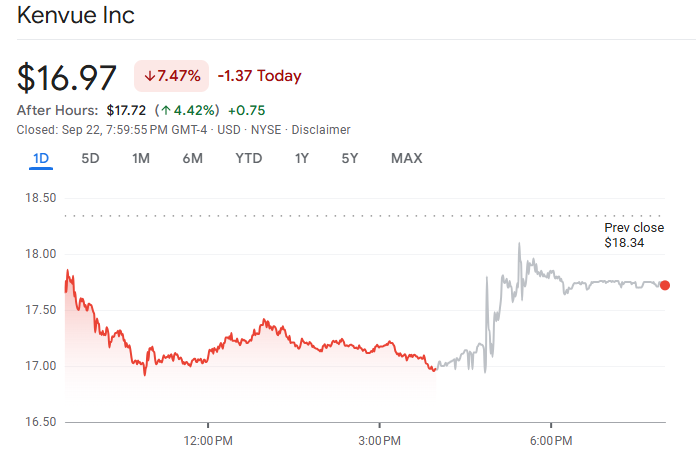

The Immediate Stock Market Reaction

Kenvue shares plunged about 7–8% in regular trading on the day the claim became public. In after-hours or extended trading, the stock recovered somewhat (~4–5%) but remained well below recent highs.

The decline happened even as Kenvue asserted the safety of its product. Year-to-date, the stock had already decreased by approximately 20-25% before this event, indicating growing apprehensions.

Risks Amplified by the Tylenol-Autism Claim

This issue compounds existing risks for Kenvue. Key risks include:

1. Regulatory Risk & Product Liability

If authorities issue warnings or labelling requirements change, demand for Tylenol and other acetaminophen products could decline sharply. Existing lawsuits might gain momentum. [2]

2. Consumer Trust & Brand Reputation

Tylenol is central to Kenvue's business. Even if the science disproves causation, consumer fear can drive substitution toward alternatives such as ibuprofen-based pain relievers.

3. Financial Drag

Higher litigation costs, marketing expenses to restore trust, and slower sales growth will likely weigh on margins and EPS through late 2025 and 2026.

4. Currency Headwinds & Macro

The strong USD, inflationary pressures, and potential supply chain or tax/regulatory changes add complexity.

5. Valuation Pressure

Kenvue currently trades at ~17x forward earnings, slightly below its sector median (~19x). Its dividend yield sits near 3.2%, making it attractive for income investors, but valuation pressure remains if EPS growth stalls.

Kenvue Q2 2025 Revenue, Earnings Report and Performance

| Metric |

Value / Recent Data |

| Q2 2025 Revenue |

$3.84 B (−4% YoY) |

| Organic Sales Growth |

−4.2% |

| Adjusted EPS Q2 2025 |

$0.29 (beat est. $0.28) |

| TTM Revenue |

~$15.14 B |

| Year-ahead EPS growth estimate |

~8.8% (analyst consensus) |

| Recent stock drop |

~7-8% on autism claim, ~20-25% YTD drop |

Revenue & Earnings

In Q2 2025, Kenvue reported:

Revenue: $3.84 billion, down 4.0% year-over-year.

Organic Sales decline: about 4.2%.

Adjusted diluted EPS: $0.29, beating consensus predictions of ~$0.28.

Kenvue's trailing twelve-month revenue is ~ $15.14 billion, slightly down from 2024 levels (approx. $15.45 billion in 2024), indicating stagnation in growth.

Margin, Profit & Forecasts

Kenvue's profit forecast for 2025 is below some analyst estimates, mainly due to:

A strong U.S. dollar is making exports and international operations more expensive or less profitable.

Weak demand in specific product lines (e.g., cough & cold, certain self-care products).

Expense pressures from ongoing litigation risk (autism-related lawsuits), marketing, and structural changes. [3]

Corporate Governance & Strategy Shifts

CEO Thibaut Mongon stepped down mid-2025 amid pressure from activists to improve profitability. Interim CEO appointed.

A strategic evaluation is in progress, focusing on optimising the brand portfolio, potential divestitures, and reducing costs.

Why Are Some Investors and Analyst Still Investing in KVUE?

Despite the risks, some investors believe the stock is worth monitoring or possibly investing in. For example, BofA Securities reiterated a Buy rating on Kenvue with a price target of $25.00, even though the stock had dropped (~10%) amid the Tylenol safety concerns.

Evercore ISI kept an In Line rating with a $25 target, despite recent fluctuations and worries regarding the forthcoming report on acetaminophen and pregnancy.

Reasons Investors Are Favouring the Dip as an Opportunity

Firstly, the market often overreacts to headline risk. If scientific and regulatory bodies do not find strong evidence, the impact will be limited and the stock could rebound.

Moreover, the company's Q2 2025 earnings surpassed estimates with EPS of $0.29 compared to predictions of $0.28, indicating a degree of resilience. Its strong cash flow also gives flexibility for legal defence, marketing, R&D, and possibly acquisitions.

Lastly, Tylenol and other established brands in the Kenvue portfolio have long-standing industry trust. Thus, its brand strength will not drop immediately, as disruption often takes time even if claims are proven true.

Should You Buy, Hold, or Avoid Kenvue Stock?

1. Short-Term Traders:

The dip offers volatility and potentially oversold conditions; it might be worth taking a small speculative position, but only with tight risk controls.

2. Long-Term Investors:

It depends on risk tolerance. If you believe in credible data, regulatory restraint, and Kenvue's ability to defend its brand (and financial cushion), a cautious buy or hold with monitoring could make sense.

If you are more risk-averse, it may be better to wait for clarity, especially from regulators or scientific studies, before committing significant capital.

3. Avoid Stance:

This is reasonable if you believe the autism claims will translate into regulatory or consumer demand damage, or if litigation risk is material and undervalued.

What Investors Should Monitor Next?

1) FDA and regulatory actions about the autism claim

2) Sales trends in the acetaminophen and Tylenol line

3) Kenvue Q3/Q4 2025 guidance

4) Legal case outcomes

5) Currency trends

6) Leadership actions

Frequently Asked Questions

1. What Caused Kenvue's Recent Sharp Drop in Stock Price?

Kenvue's stock fell after reports that the White House planned to link acetaminophen (Tylenol's active ingredient) use during pregnancy with a higher risk of autism.

2. Is the Tylenol-Autism Claim Backed by Solid Science?

As of late 2025, the CDC and AAP confirm no causal link has been proven. Kenvue maintains that its products are safe.

3. Given Current Risks and Valuation, Should One Buy Kenvue Now, Wait, or Avoid?

Purchase for the opportunistic investor, retain for numerous investors needing clarity, and steer clear for cautious investors.

Conclusion

In conclusion, Kenvue's stock dip following President Trump's remarks was dramatic but not entirely unexpected, given existing sensitivity around product safety, lawsuits, and weak sales trends.

For many investors, holding off until clearer evidence (or a more defensive balance sheet/earnings guidance) emerges might be the prudent path.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.businessinsider.com/tylenol-autism-link-white-house-kenvue-stock-price-hhs-kennedy-2025-9

[2] https://www.reuters.com/business/healthcare-pharmaceuticals/trump-expected-link-autism-with-tylenol-experts-say-more-research-needed-2025-09-22/

[3] https://investors.kenvue.com/financials-reports/quarterly-results/default.aspx