In August 2025. U.S. technology stocks, particularly the "Magnificent Seven" — Apple (AAPL), Amazon (AMZN), Tesla (TSLA), Alphabet (GOOGL), Microsoft (MSFT), Nvidia (NVDA), and Meta Platforms — have experienced notable declines. This downturn has raised concerns about potential overvaluation and the sustainability of the AI-driven rally. Investors are increasingly cautious, with some turning to protective strategies like purchasing "disaster" put options to hedge against further losses.

Recent Performance and Market Dynamics

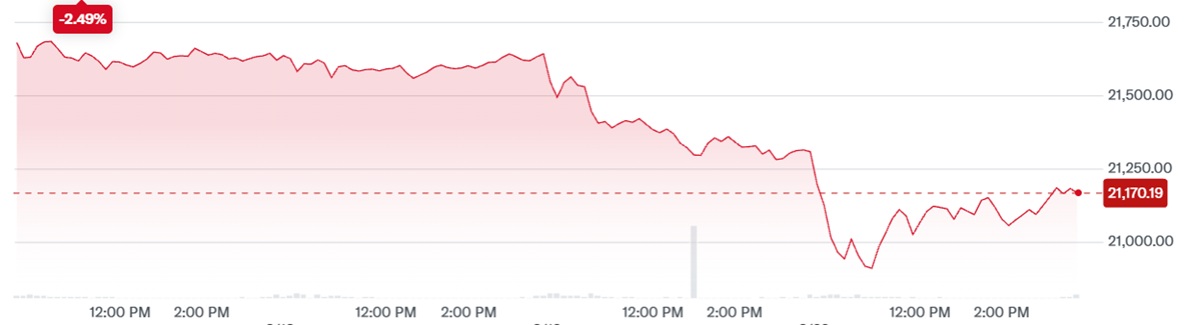

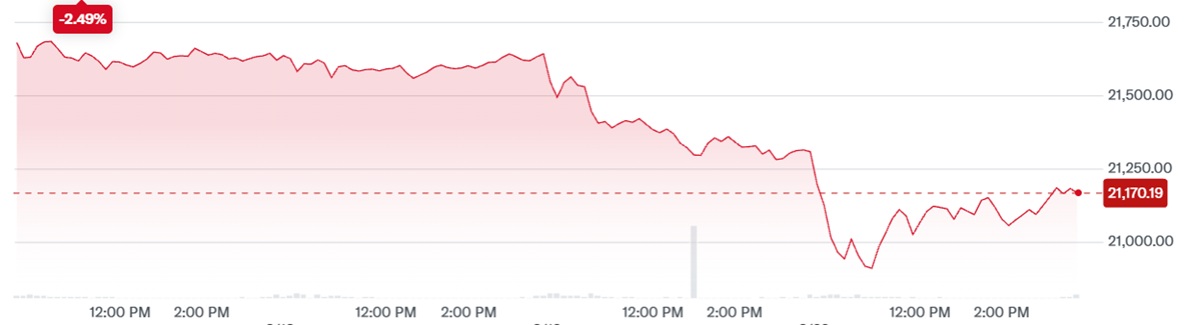

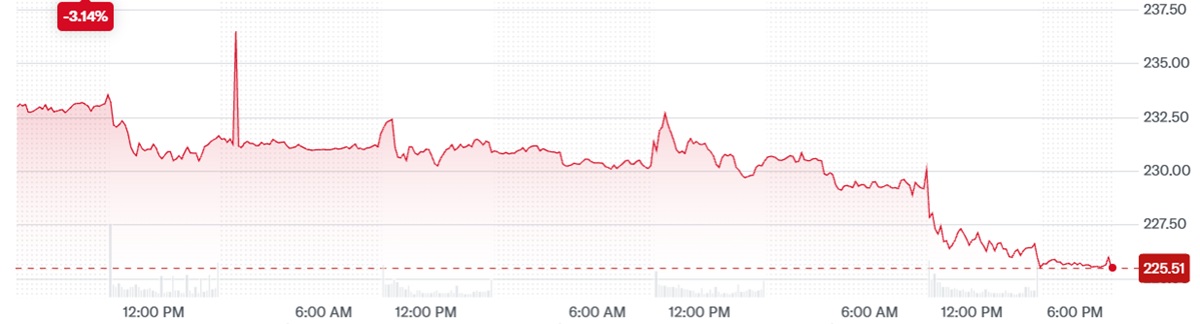

As of August 20. 2025. the Nasdaq Composite dropped 0.7%, extending its two-day loss to 2.1%. The S&P 500 technology sector index also declined, reflecting a broader market retreat from high-growth tech stocks. Notably, Nvidia's stock fell 5%, while Palantir's shares plummeted 16%, signaling investor apprehension over the sustainability of AI-related gains.

This pullback is attributed to several factors:

Valuation Concerns: The rapid surge in tech stock prices, fueled by AI optimism, has led to questions about whether valuations have outpaced fundamental growth.

Monetary Policy Uncertainty: Anticipation of Federal Reserve Chair Jerome Powell's upcoming speech at the Jackson Hole symposium has added to market volatility, as investors seek clarity on future interest rate policies.

Sector Rotation: Investors are rotating out of tech stocks into more defensive sectors like healthcare and consumer staples, which are perceived as undervalued and less susceptible to interest rate fluctuations.

Analyzing the Magnificent Seven

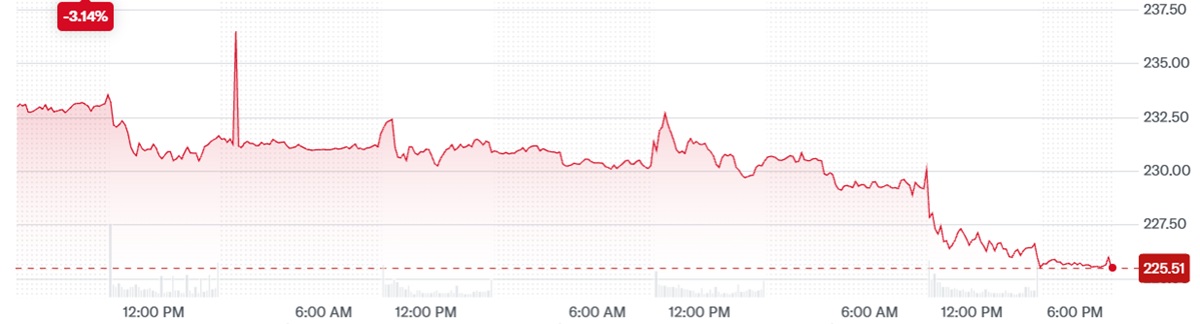

Amazon (AMZN): With a price of $223.81. Amazon's stock has also dipped about 1.8%. The company's diverse revenue streams, including e-commerce, cloud computing, and advertising, provide resilience against market fluctuations.

Alphabet (GOOGL): Trading at $199.32. Alphabet's shares have fallen 1.1%. The company's dominance in search and advertising, along with ventures into AI and cloud services, underpin its long-term growth prospects.

Investment Strategies Amidst Volatility

In light of the recent market volatility, investors are adopting various strategies:

Diversification: Spreading investments across different sectors and asset classes to mitigate risk.

Hedging: Utilizing options and other financial instruments to protect against potential downturns.

Focus on Fundamentals: Emphasizing companies with strong financials, consistent earnings, and a clear growth trajectory.

Conclusion

The recent pullback in U.S. tech stocks serves as a reminder of the inherent volatility in high-growth sectors. While the AI-driven rally has propelled these stocks to new heights, it's essential for investors to assess valuations critically and consider broader economic factors. By maintaining a diversified portfolio and focusing on companies with solid fundamentals, investors can navigate the current market landscape with greater confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.