Gold rose above above $3,700 earlier this week, supported by expectations of

Fed rate cut. Global stocks hit a fresh record high as US and Chinese officials

discussed trade in Madrid.

A deal has been reached for social media platform TikTok, said Treasury

Secretary Scott Bessent. Trump told CNBC in an interview last year that he

believed the Chinese app was a national security threat.

China's market regulator on Monday said that Nvidia violated anti-monopoly

law, according to a preliminary probe, adding that Beijing would continue its

investigation into the chip giant.

That signals a tech war between Beijing and Washington may well drag on,

though the world's two largest economies are both prioritising financial

stability and therefore steering away from an all-out trade war.

What also supports animal spirits is that Europe will impose high secondary

tariffs on China immediately as requested by Washington given the bloc's

dependency on Chinese imports.

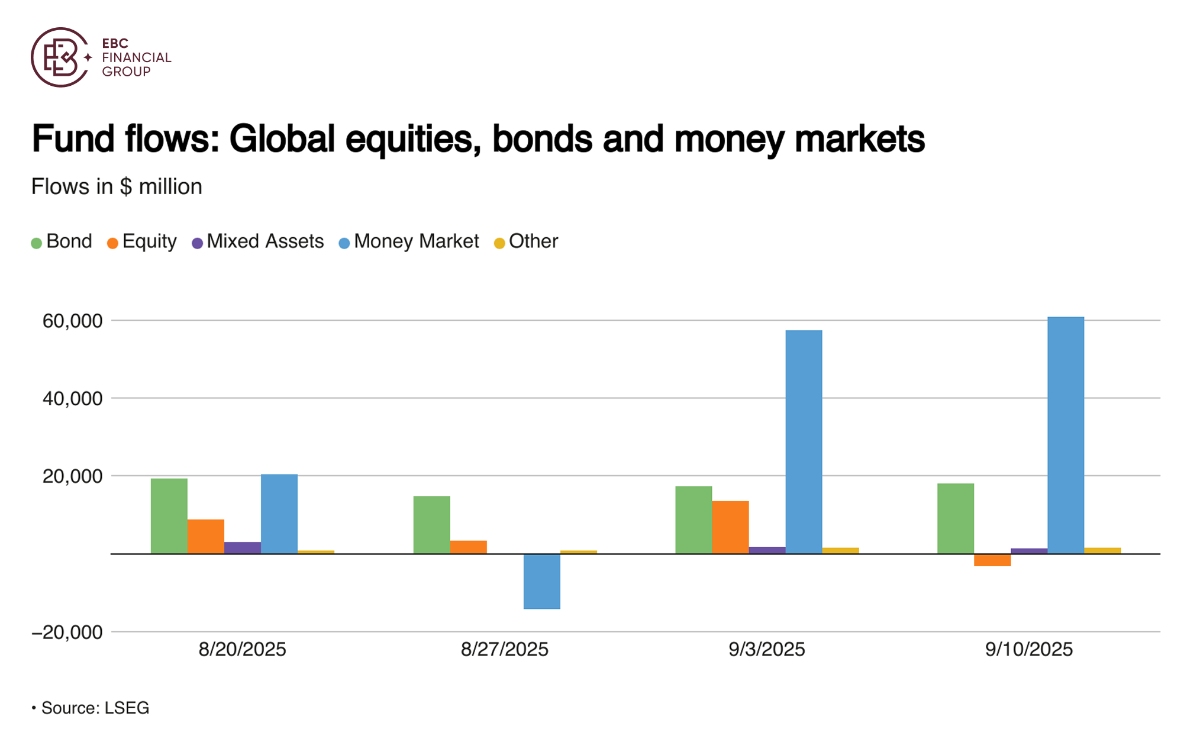

Global equity funds drew net outflows in the week by 10 September, while bond

funds posted a 21st straight week of net inflows and money markets remained in

favour, data from LSEG Lipper showed.

The federal government's budget deficit reached $2 trillion for the current

fiscal year, according to CBO. Even so, benchmark 10-year Treasury yield is

within a whisker of 4%, the lowest level in more than 5 months.

Out of the woods

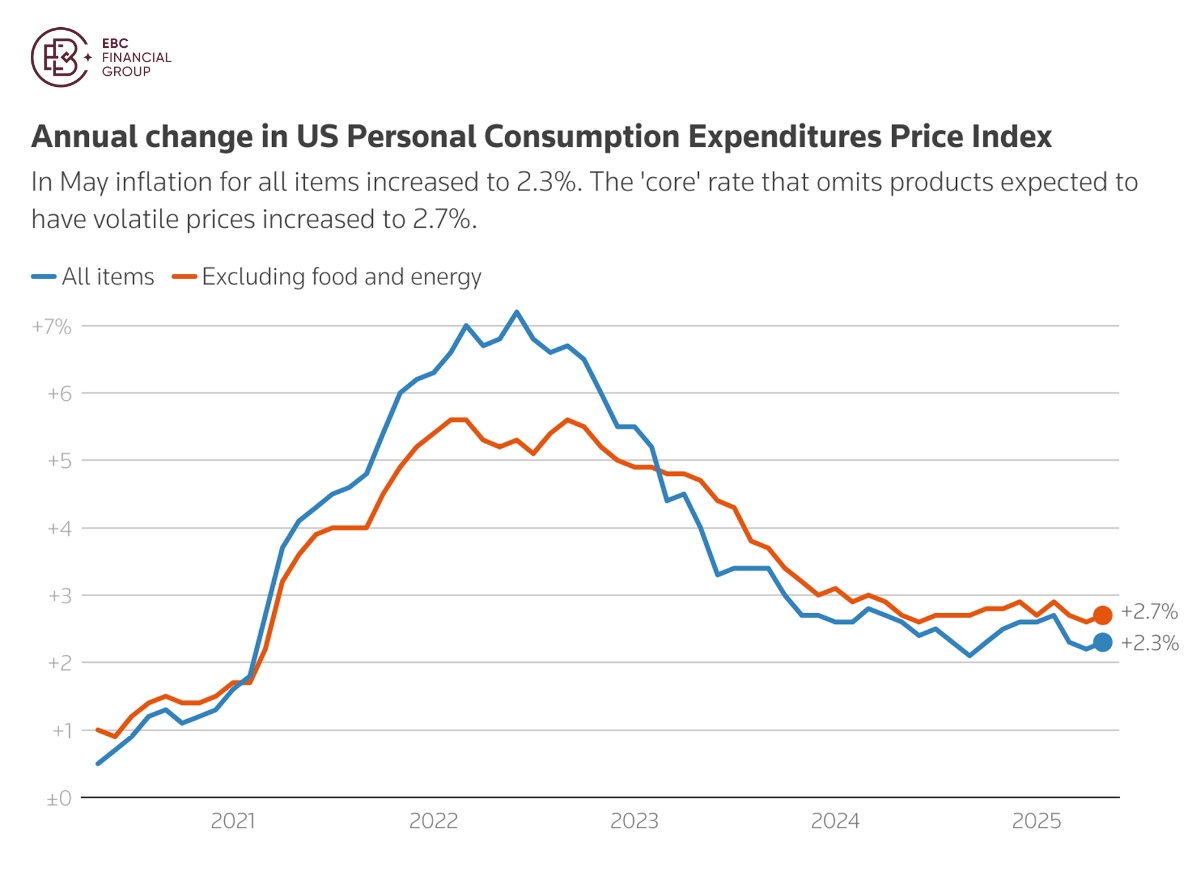

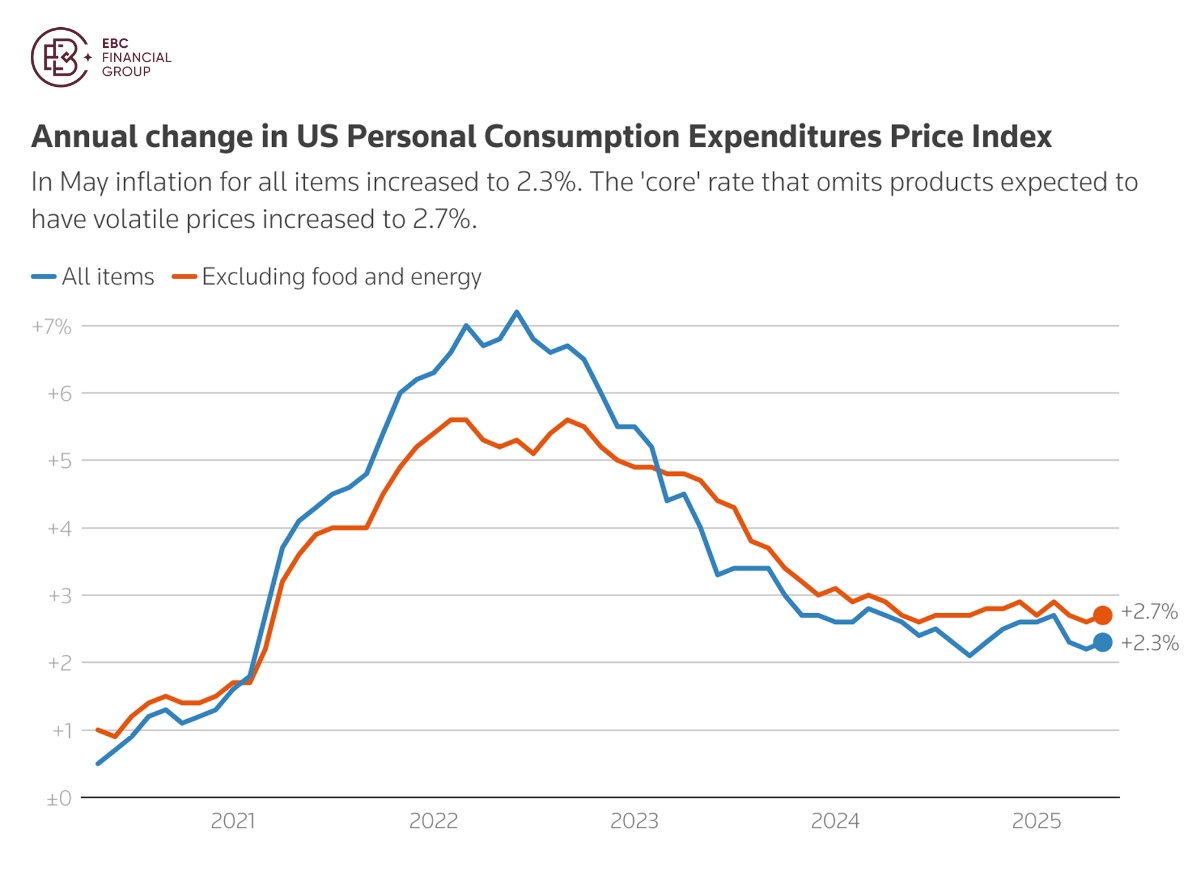

JP Morgan Global Research sees global core inflation increasing to 3.4% in

the second half of 2025. It expects a synchronized downshift in global growth to

1.4% and central bank easing across the board.

Tariffs' impact on consumer prices will finally kick in, which could push US

core inflation higher. Elsewhere, there could be a slide in European core

inflation as wage pressures seem abating.

That means US real interest rate will likely continue to outstrip that of

Europe by the year end, setting the dollar up for a rebound after the US Dollar

Index declined more than 10% so far.

Trade deficit in goods widened sharply in July as imports surged on

frontloading in the run-up to new trade policy. Market will zero in on if more

balanced trade can be delivered as promised afterwards.

Pass-through from the tariffs to consumer prices has started to show up, but

has been limited as many companies absorb at least part of the duties for now.

As such consumer spending is not particularly a concern.

While demand for labour is softening, supply is also disappearing amid the

Trump administration's immigration crackdown. The complication means

policymakers will remain cautious on more cuts.

The GDPNow model estimate for Q3 growth is 3.1%, compared to the final

reading of 3.3% for the previous quarter. An economy on solid footing

technically bolsters demand for its currency.

Worse scenario

A stronger dollar bodes ill for bullion, especially with the metal deep in

the overbought territory. The exception is that the two tend to rise in tandem

if geopolitical strain increases.

The anomaly occurred in 2023 and 2024 as the conflicts in Europe and the

Middle East drove safe-haven demand for both gold and the dollar. Traders now

largely shrug off the related headlines.

Russia's oil pipeline monopoly Transneft warned in August producers they may

have to cut output following Ukraine's drone attacks on critical export ports

and refineries, according to industry sources.

The country's central bank cut its benchmark interest rate by 100 bps on

Friday to prop up a cooling wartime economy. Crude oil sentiment has swung to

lower prices, probably one of the reasons of larger-scale Russia attacks.

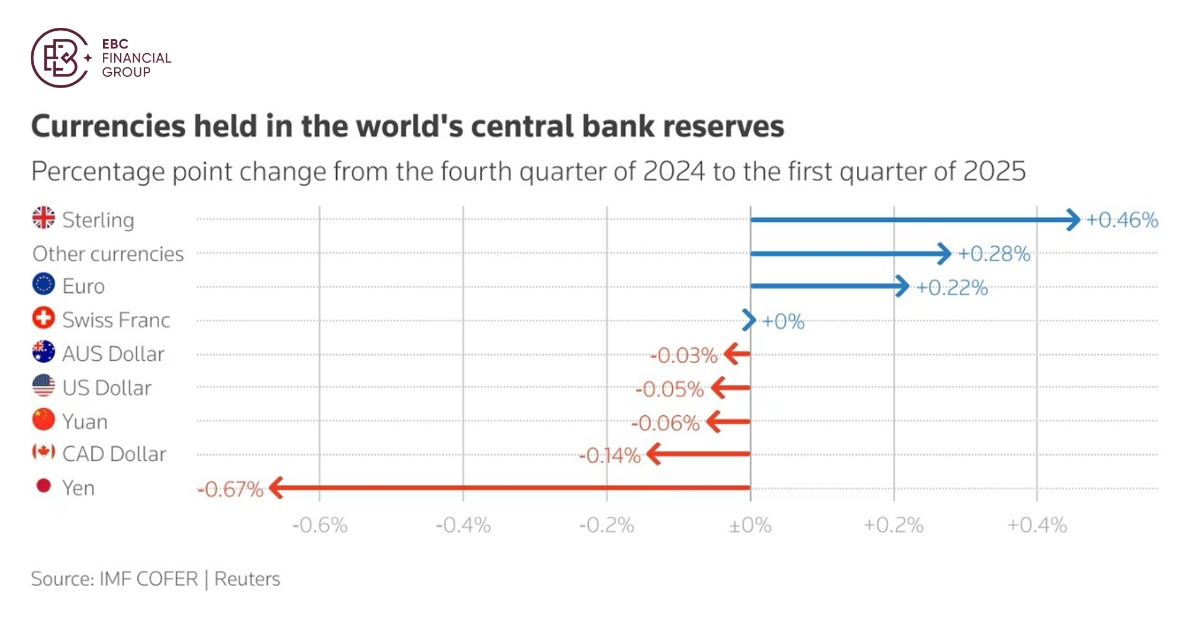

Besides ongoing deglobalisation could cap bullion's anticipated retreat. In

recent years, emerging market countries have significantly increased the use of

their local currencies in international transactions.

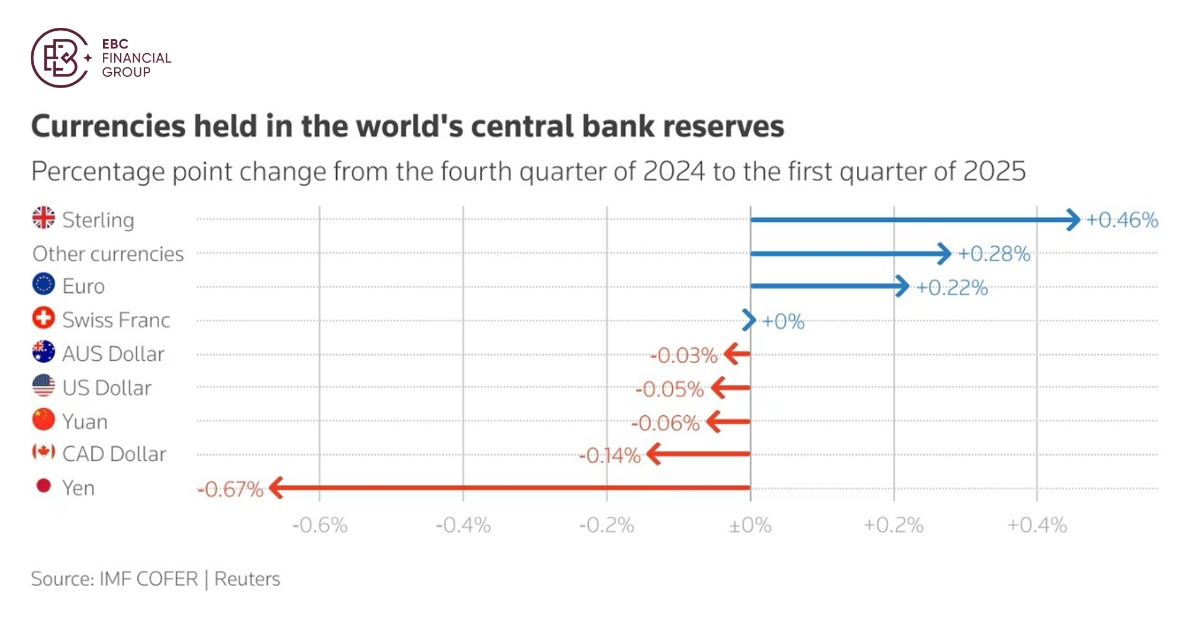

The greenback's share of global currency reserves reported to the IMF nudged

lower to 57.7% in Q1 while the share of euro-denominated reserves gained.

Global central banks bought net 10 tons of gold in July based on reported

data. Despite slower pace of buying, they remain positive even in the current

price range amid signs of another Cold War.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.