The Japanese yen tumbled below 154 per dollar on Tuesday, weighed down by the

dollar’s strength after the latest batch of economic data in the US came in

better than expected in general.

The currency was the worst-performing G10 currency for three years

consecutively. It has already weakened beyond levels that prompted authorities

to enter the market in 2022.

That is fuelling speculation over possible fresh intervention in Tokyo’s

currency markets. Long-yen positions held by Japanese retail investors were

close to a record level on 2 April, Tokyo Financial Exchange showed.

That stands in stark contrast to financial professionals. Hedge funds have

built up their biggest bet against the yen in 17 years in the week through 9

April, according to the data from CFTC.

The BOJ failed to stem the slide in the yen with its first interest rate hike

since 2007. Many analysts had been bullish at the turn of 2024 on the grounds of

narrowing policy divergence.

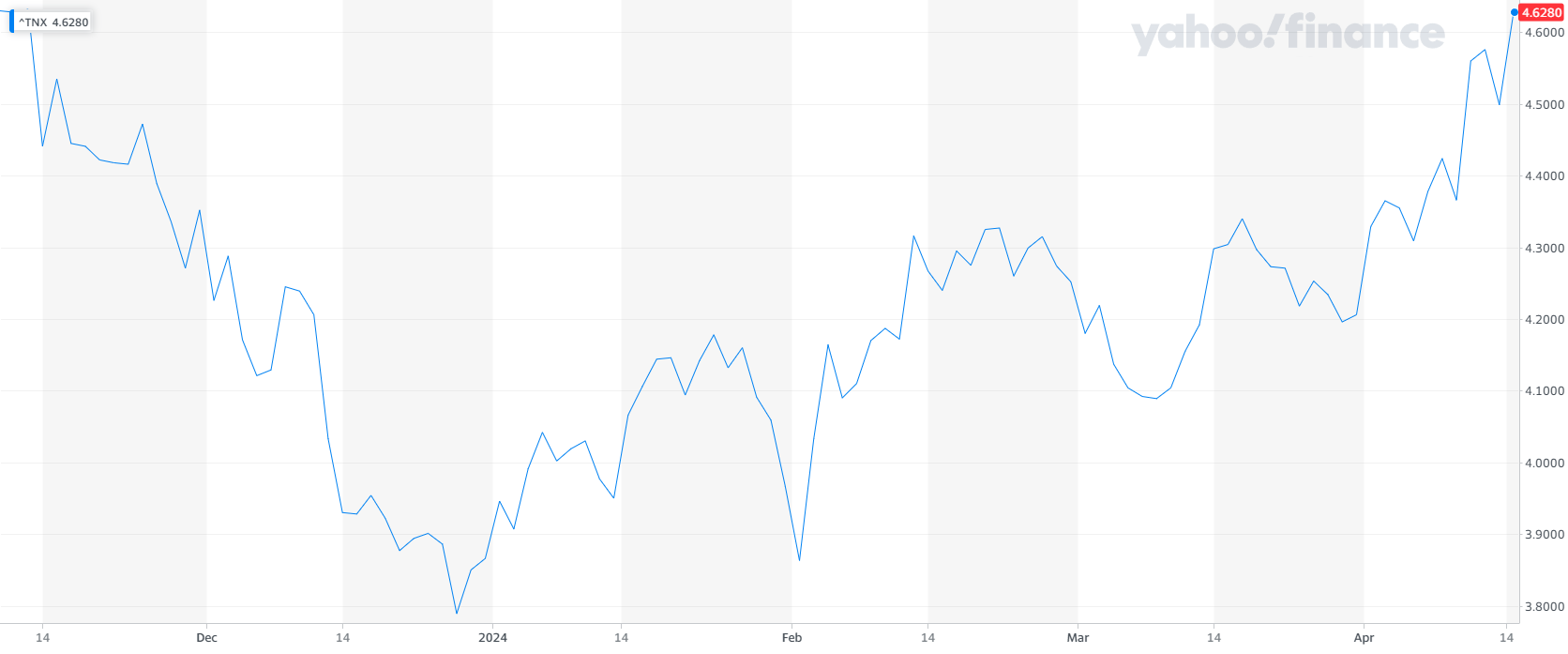

The Fed now seems unlikely to act in H1. Futures traders have reduced bets on

how much the central bank will cut rates this year to the lowest level since

October, LSEG showed last week.

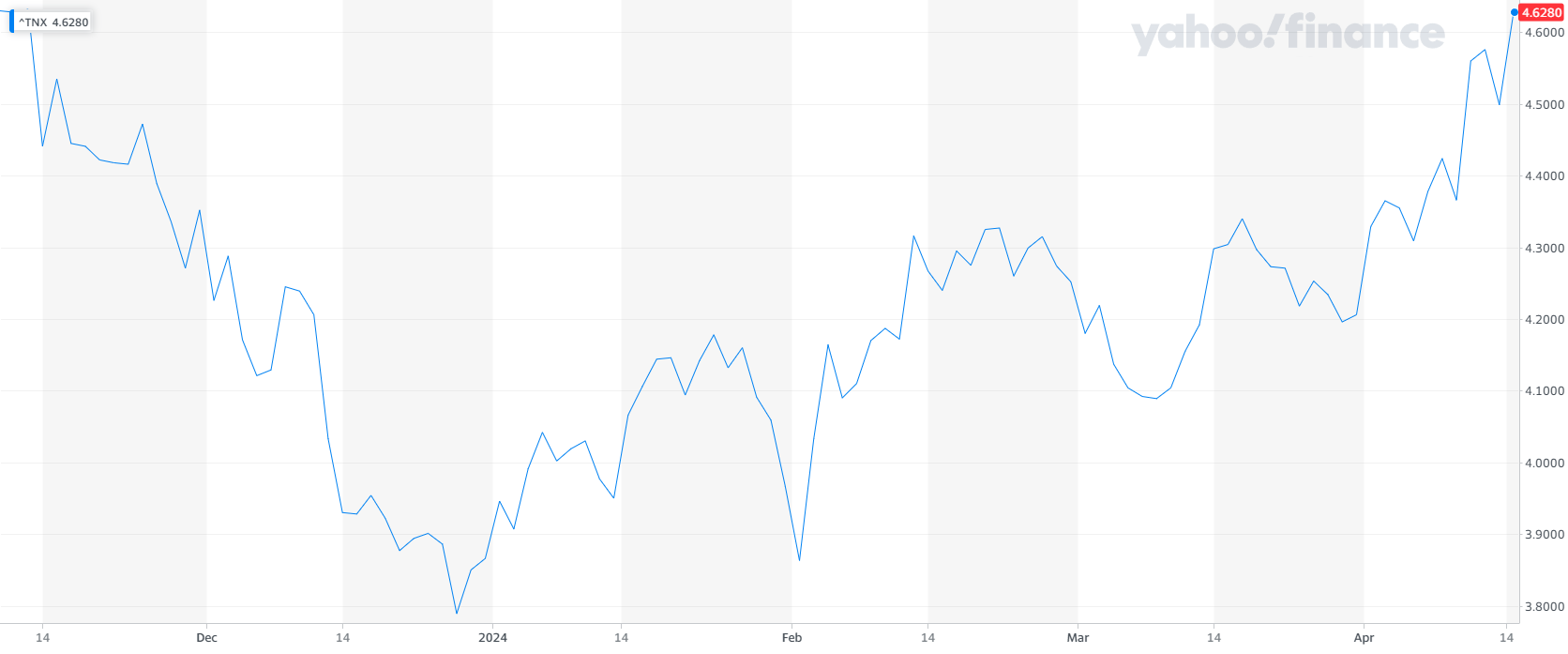

Most US Treasury yields climbed to new year-to-date highs. Bond investors are

still shunning the bond market, reflected in the lacklustre demand for 30-year

bonds Thursday.

Big short

The BOJ is shifting to a more discretionary approach in setting policy, with

less emphasis on inflation, sources said. That may require more attention to

subtle changes in its narratives.

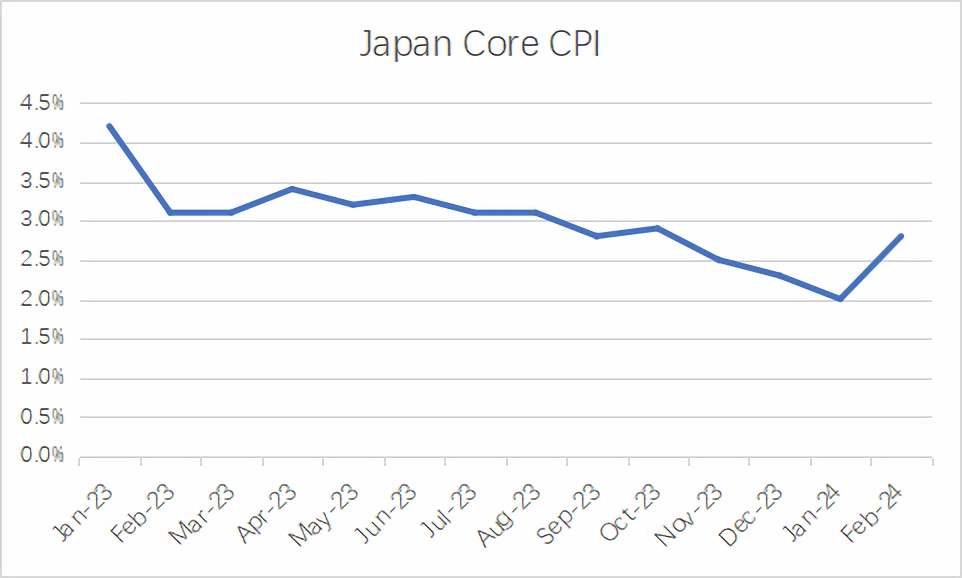

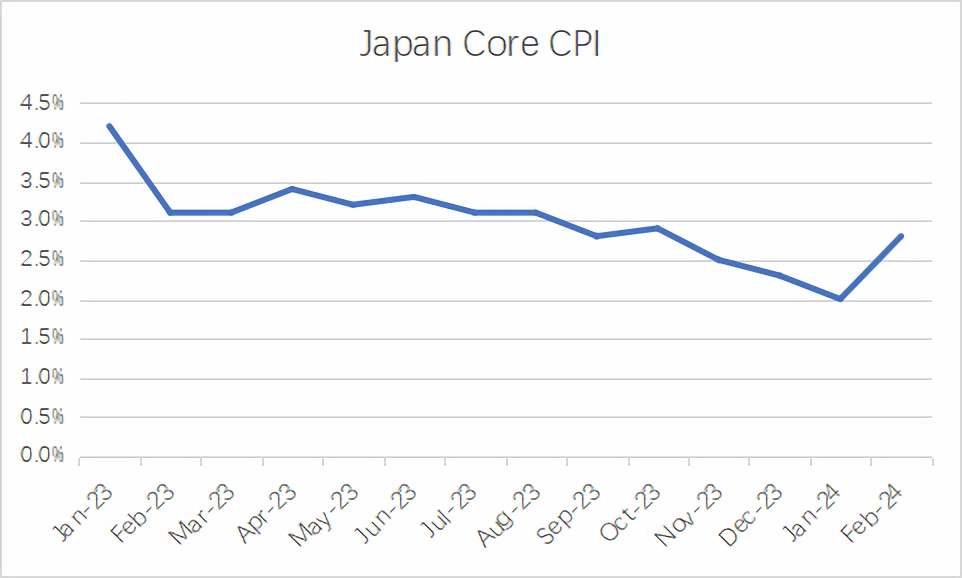

They added that while the central bank is expected to project inflation to

stay around its 2% target through early 2027 in April, such forecasts alone

won't serve as strong hints of a near-term rate hike.

BofA is among the most bearish forecaster in Wall Street banks, saying the

currency could slide to hit 160 per dollar unless the Fed cuts interest rates

this year.

Intervention “is very likely but it would be more like leaning against the

wind,” says the bank’s currency strategy Thanos Vamvakidis. He sees the yen

rallying to 142 if the rate cut takes place.

“Without intervention, the yen could fall as low as 160.20,” said Daisaku

Ueno at MUFJ Morgan Stanley Securities. “Intervention is likely to occur once

the yen exceeds 155 against the dollar.”

Japan’s top currency official, Masato Kanda, has previously said a 10 yen

change within one month is rapid. A gauge measuring the pair’s low-to-high move

over a rolling 28-day window stood at 7 yen.

The yen will continue its drop and could slide another 10% to levels not seen

since the 1980s because of the Bank of Japan’s reluctance to raise interest

rates significantly, said T. Rowe Price.

King dollar

The dollar index has gained nearly 5% this year, pulling out of its slump

last year, as the Fed’s loosening cycle is very likely to be delayed and as the

war has escalated in the Middle East.

Even before the CPI report, Fed officials had begun worrying that

disinflation progress might have stalled and a longer period of tight monetary

policy could be needed to tame the pace of price increases.

Some officials even raised the possibility that the current policy rate was

"less restrictive than desired,” which may be used to defend more rate hikes,

according to minutes of the March’s meeting.

Atlanta Fed president Raphael Bostic still expects one rate cut in 2024, but

is not ruling out the possibility of two or zero depending on the direction of

the US economy and inflation.

The distribution of price increases now, he said, shows too many areas far

above the level of 5% than what are typically seen in normal times. He added

that the economy has been “incredibly resilient.”

Fed Governor Michelle Bowman said the Fed may need to raise rates at a future

meeting if progress on inflation stalls or reverses. Her baseline outlook,

however, is in favour of lower rates this year.

Meanwhile, expectations were widespread that the 10-year Treasury yield

higher than 4.5% would attract buyers. A bond rally came in the wake of Iran’s

bombardment on Friday bore it out.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.