As of 2025, India has a dozen stocks with per-share prices that exceed tens or even hundreds of thousands of rupees, which attract investors' attention. "Highest share price" does not always mean "highest valuation," but it implies rare combinations of consistency, scarcity, and investor perception.

As of September 2025, MRF Ltd has reclaimed the crown of India's highest-priced stock. Elcid Investments follows, along with others like Page Industries, Honeywell Automation India, and Bosch Ltd.

This article covers the stocks mentioned above, explains what drives their high share prices, examines whether they are good buys, and highlights risks.

Highest Share Price in India (2025): Who's at the Top?

| Rank |

Company |

Approx. Share Price (₹) |

Key Sector |

Why So Expensive? |

| 1 |

MRF Ltd (Madras Rubber Factory) |

₹150,000 |

Tyres & Rubber |

Low equity float, consistent earnings, strong brand legacy. |

| 2 |

Elcid Investments Ltd |

₹133,200 |

Investment Holding |

Extremely low free float, holding value in Asian Paints shares. |

| 3 |

Page Industries Ltd |

₹45,400 - ₹45,700 |

Textiles & Apparel (Jockey India) |

Premium consumer brand, high margins, niche leadership. |

| 4 |

Bosch Ltd |

₹39,600 - ₹39,900 |

Auto Components |

German multinational’s Indian arm, strong auto tech & engineering demand. |

| 5 |

Honeywell Automation India Ltd |

₹37,000 - ₹37,300 |

Industrial Automation |

Global tech giant’s Indian operations, high-end automation demand. |

Listed above are five of the most expensive (by per share price) public companies in India as of September 2025, with prices and their reasoning.

What Made MRF Reclaim Its #1 Spot as the Most Expensive Stock in India?

| Metric |

MRF Ltd |

Elcid Investments Ltd |

| Approx Share Price (2025) |

₹150,000 |

~ ₹1,33,220-₹1,33,266 |

| Liquidity / Trading Volume |

Relatively higher; active among high-price stocks |

Very low volume; fewer trades, investor interest more niche |

| Business Model |

Tyre manufacturer; global exports, consumer sectors |

Investment company / NBFC style; holding/finance assets heavy in investments |

| Growth & Brand |

Strong brand recognition, product demand, stable earnings |

Less growth oriented; more passive investment exposure |

MRF has had this highest-priced share title in past years, lost it to Elcid briefly, but regained it. For context, MRF's price recovered strongly from its 52-week low (~₹1,02,124 in early 2025) to reclaim the highest-priced crown. Key reasons:

Strong recovery in the tyre and rubber sector demand, export orders, and input price stability.

Minimal stock splits → price per share keeps climbing.

Investor preference: Many consider MRF a "blue chip" luxury brand in tyres, so even small investors hold these high-value stocks for prestige or capital appreciation.

In contrast, Elcid's valuation is distorted by low float and thin volumes, making MRF the more stable benchmark. [1]

Other Noteworthy Expensive Stocks in India

Beyond the top 5, there are many with high share prices that deserve attention. Some examples:

3M India Ltd: It is often among the top-ranked expensive shares.

Shree Cement Ltd: It is well-known in the cement sector, with consistently high stock prices.

Global Context: How India Compares

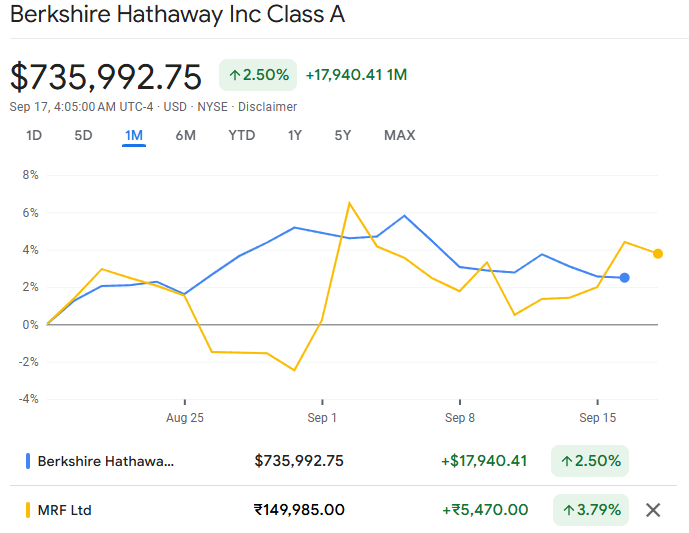

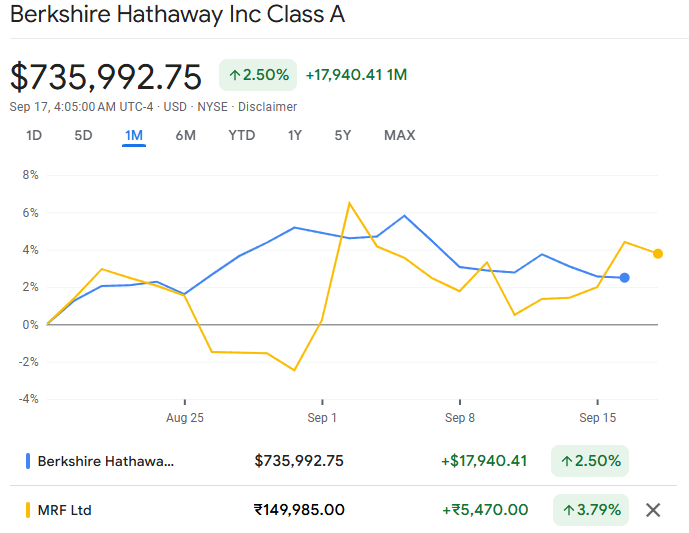

While India's highest share price belongs to MRF, globally, Berkshire Hathaway Class A (NYSE: BRK.A) holds the record, trading above $735,000 per share in 2025.

What Drives These High Share Prices?

1. Minimal Stock Splits / Bonus Issues

Companies like MRF rarely split shares. If you do not split the shares, the price per share continues to increase over time due to compounding.

2. Strong Financial Performance, Stable Earnings

High margins, consistent profitability, limited debt, and trusted brands contribute to investor trust.

3. Brand, Domain Niche and Competitiveness

Premium brands or companies with niche positions, such as MRF in the rubber/tyre industry and Page Industries in premium garments, allow for premium pricing, with investors willing to pay more.

4. Investor Perception & Demand

The stock price plays a significant role in establishing "status" among investors. Also, institutional and promoter holdings affect float & supply.

5. Low Float / Low Supply of Shares

When fewer shares are traded (high promoter shareholding, infrequent trading), scarcity can push the per-share price up.

Should You Buy These Expensive Stocks?

If you're considering investing in high-priced stocks, here's how to evaluate:

1) Check Valuation Metrics

Evaluate P/E, ROE/ROCE, debt, and growth. A high price doesn't always mean overvaluation, but some do trade at stretched multiples.

2) Assess Price History

Is the stock climbing due to fundamentals or scarcity?

3) Risk Tolerance

Can you afford one share? Would a fall in value materially impact your portfolio?

4) Diversification

Don't put all your money into high-priced stocks. Balance with mid and small caps.

5) Alternatives

Retail investors may also consider mutual funds or ETFs, such as Nifty Next 50 ETFs. These provide exposure to these companies without the need to purchase an expensive share.

What Are the Pros and Cons of Buying High-Priced Stocks?

Advantages

Prestige & psychological barrier: Many retail investors believe a high price equals high quality. Although it's not always the case, many high-priced stocks are typically associated with well-established companies that have strong governance.

Lower volatility of absolute movement: A ₹1000 movement in a ₹150,000 stock is a much smaller % change; sometimes less volatile in ₹ terms.

Scarcity value: Many high-price stocks have low free float (fewer shares in market) → supply constraints can help price stability.

Risks

Less liquidity: Many high-priced, low-float stocks often experience low trading volumes; entering or exiting large positions can significantly affect the price.

Valuation risk: Price alone doesn't capture fundamentals, as a high-price stock could be overvalued relative to its earnings growth.

Psychological bias: Investors may focus too much on stock price rather than key company metrics, such as P/E, ROCE, debt, and growth.

Capital requirement: Buying one share of a ₹1,40,000 stock demands capital and limits participation for small investors unless fractional shares or similar tools exist (which often they don't in Indian markets).

Frequently Asked Questions

1. Does a High Share Price Mean the Stock Is Overvalued?

Not necessarily. High prices arise from a lack of splits, strong earnings, niche branding, and low supply. However, many high-priced stocks also have high P/E ratios, so it's vital to check their valuation.

2. Are High-Price Stocks Good for Small Investors?

It can be difficult because the cost per share is high; small investors may prefer fractional shares (if available) or ETFs/investment vehicles that include them. Risk vs capital balance is key.

3. How Does Liquidity Affect Expensive Stocks?

Stocks with very high prices and low float often have lower trading volumes. That raises bid-ask spreads, slippage risk, and potential for sharp moves if heavy buying or selling happens.

4. Is It Better to Own Expensive Stocks or Diversify?

Diversification usually wins. Putting too much into a few expensive stocks exposes you to brand risk, sector risk, and market re-ratings. Balanced portfolios help reduce downside risk.

Conclusion

In conclusion, the crown for India's highest stock price remains with MRF Ltd, followed by Elcid Investments at ₹133,200, and consumer leader Page Industries near ₹45,500.

Over the next few years, whether MRF and Elcid maintain their crown depends not just on brand power, but also on policy changes, sector cycles, and investor appetite for prestige stocks.

For investors, the lesson is clear: stock price ≠ value. The best way forward is to analyse fundamentals rather than chasing the most expensive names.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://economictimes.indiatimes.com/markets/stocks/news/mrf-snatches-indias-highest-priced-stock-crown-back-from-elcid-investments/articleshow/121593384.cms