Derivatives trading has become a cornerstone of modern financial markets, offering traders and institutions a range of sophisticated tools to manage risk and capitalise on price movements. By allowing exposure to assets without direct ownership, derivatives provide flexibility that is unmatched by traditional investment methods. Understanding the fundamentals of derivatives, what they are, how they work, and who uses them, is essential for anyone seeking to participate in these markets effectively and responsibly.

What Are Derivatives?

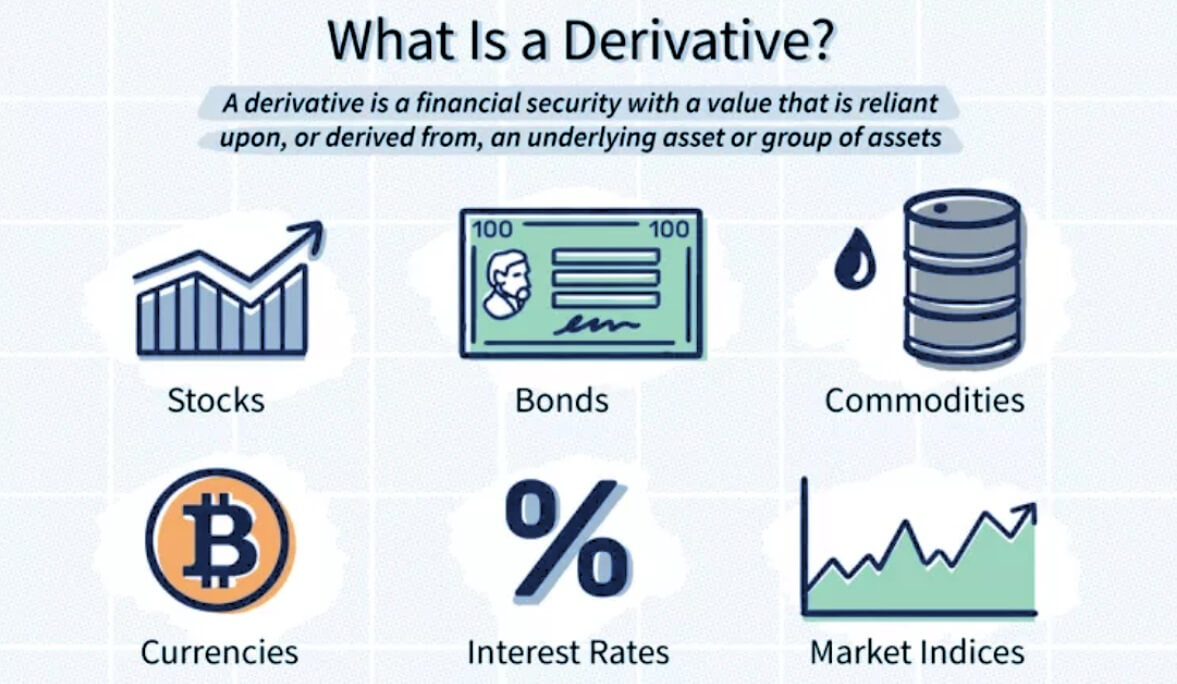

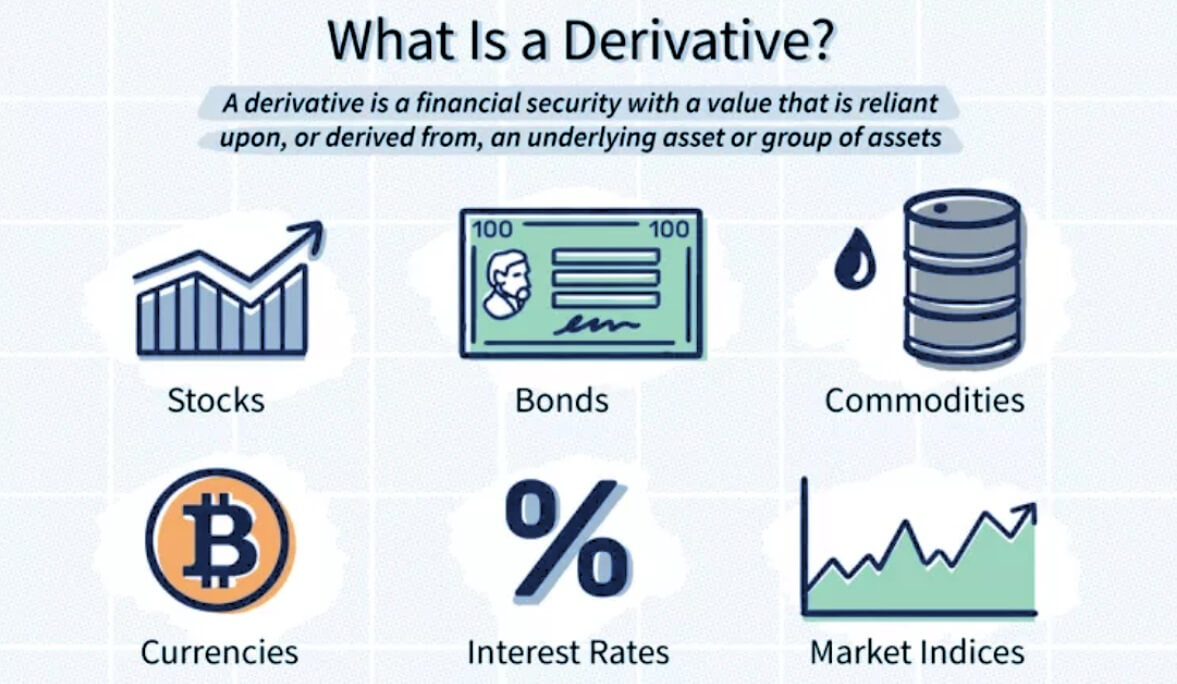

Derivatives are financial contracts whose value is derived from an underlying asset or group of assets. These assets could include stocks, bonds, commodities, currencies, interest rates, or market indices. Rather than owning the actual asset, the trader enters into a contract that reflects the expected movement in its price.

The purpose of a derivative is to either hedge against price fluctuations or speculate on price changes. For instance, a farmer might use derivatives to lock in a future selling price for their crops, while a trader might use them to bet on rising oil prices.

Some of the most actively traded derivatives are based on highly liquid markets, such as equity indices (like the FTSE 100 or S&P 500), foreign exchange pairs (EUR/USD), and commodities (such as gold or crude oil).

Types of Derivatives Explained

There are four main types of derivatives, each with its own characteristics and use cases:

1. Futures Contracts

Futures are standardised contracts traded on exchanges. They obligate the buyer to purchase, and the seller to deliver, a specific quantity of an asset at a predetermined price on a future date. They're widely used in commodities and financial markets alike.

2. Options Contracts

Options give the buyer the right, but not the obligation, to buy or sell an asset at a fixed price before or at a certain date. There are two types:

Unlike futures, options can expire worthless, limiting the risk to the premium paid.

3. Forwards Contracts

Forwards are similar to futures but are traded over the counter (OTC), meaning they are privately negotiated between parties. They are customisable but carry more counterparty risk as they are not traded on a centralised exchange.

4. Swaps

Swaps involve exchanging cash flows or liabilities, typically in interest rates or currencies. A common example is an interest rate swap, where one party exchanges a fixed-rate interest payment for a floating-rate one.

Each of these instruments serves specific purposes in hedging or speculating, with varying levels of complexity and risk.

How Derivative Pricing Works

The price of a derivative is closely linked to the price of its underlying asset, but there are other key factors that influence its valuation:

For options, the pricing is more complex and often calculated using models such as Black-Scholes or Binomial Trees. These models consider both intrinsic value (the difference between the strike price and market price) and time value (how much time is left until expiry).

In the case of futures, the pricing also includes a cost of carry, which accounts for storage, insurance, and interest costs associated with holding the underlying asset.

Understanding these pricing mechanisms is essential for making informed trading decisions and assessing risk.

Role of Derivatives in Hedging and Speculation

One of the most important functions of derivatives is their use in hedging. This means reducing the risk of adverse price movements in an asset. For example:

On the other hand, speculation involves taking a view on the direction of an asset's price in order to profit. Since derivatives allow for leveraged positions, they are popular among traders seeking short-term gains. However, this leverage also increases potential losses, making proper risk management essential.

Additionally, derivatives improve market liquidity and price discovery, offering more efficient pricing across asset classes. They also allow for portfolio diversification, giving traders exposure to markets they may not otherwise access directly.

Key Market Participants

The derivatives market includes a wide range of participants, each with their own objectives and strategies:

1. Hedgers

These include businesses, fund managers, and financial institutions looking to protect their portfolios or income streams from market volatility.

2. Speculators

Retail traders, proprietary trading firms, and hedge funds fall into this category. They seek to profit from price movements, often using technical or fundamental analysis.

3. Arbitrageurs

These participants look for pricing inefficiencies between different markets or instruments. They aim to make low-risk profits by buying and selling similar derivatives in different markets.

4. Market Makers

Usually large financial institutions or brokers, market makers provide liquidity by continuously quoting buy and sell prices, ensuring the smooth functioning of the market.

5. Clearing Houses and Exchanges

These centralised platforms, such as the Chicago Mercantile Exchange (CME) or Intercontinental Exchange (ICE), manage settlement and reduce counterparty risk. Clearing houses guarantee the performance of contracts traded on their platforms, enhancing market stability.

Final Thoughts

Derivatives trading is a powerful tool for both risk management and speculative purposes. By understanding what derivatives are, how they're priced, and who uses them, new investors and traders can better navigate this complex but highly influential area of financial markets.

For beginners, it's important to build a solid foundation before diving into more advanced strategies. Whether you're looking to hedge your portfolio, explore options strategies, or simply understand the mechanics of futures trading, mastering the fundamentals is the first step toward becoming a more informed and confident market participant.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.