Representing 500 of America’s largest publicly traded companies, S&P 500 captures roughly 80% of total U.S. market capitalisation. Investors worldwide track it as a measure of economic health and market sentiment.

In 2025, the S&P 500 reached new highs again, leaving investors asking: Is it too late to get in?Here's how you can invest confidently.

What Is the S&P 500?

The S&P 500, or Standard & Poor’s 500 Index, is the foundation of U.S. equity investing.

The S&P 500, or Standard & Poor’s 500 Index, is the foundation of U.S. equity investing.

It tracks the performance of 500 of the largest publicly traded companies across sectors such as technology, healthcare, energy, and finance, representing nearly 80% of the U.S. stock market’s total value.

For investors, the S&P 500 serves as both a benchmark and a barometer of economic strength. It reflects the collective performance of corporate America and helps guide strategic asset allocation, risk assessment, and long-term portfolio growth.

Current S&P 500 Market Value

The S&P 500 is more than just a number scrolling across a ticker. It’s a snapshot of the U.S. economy.

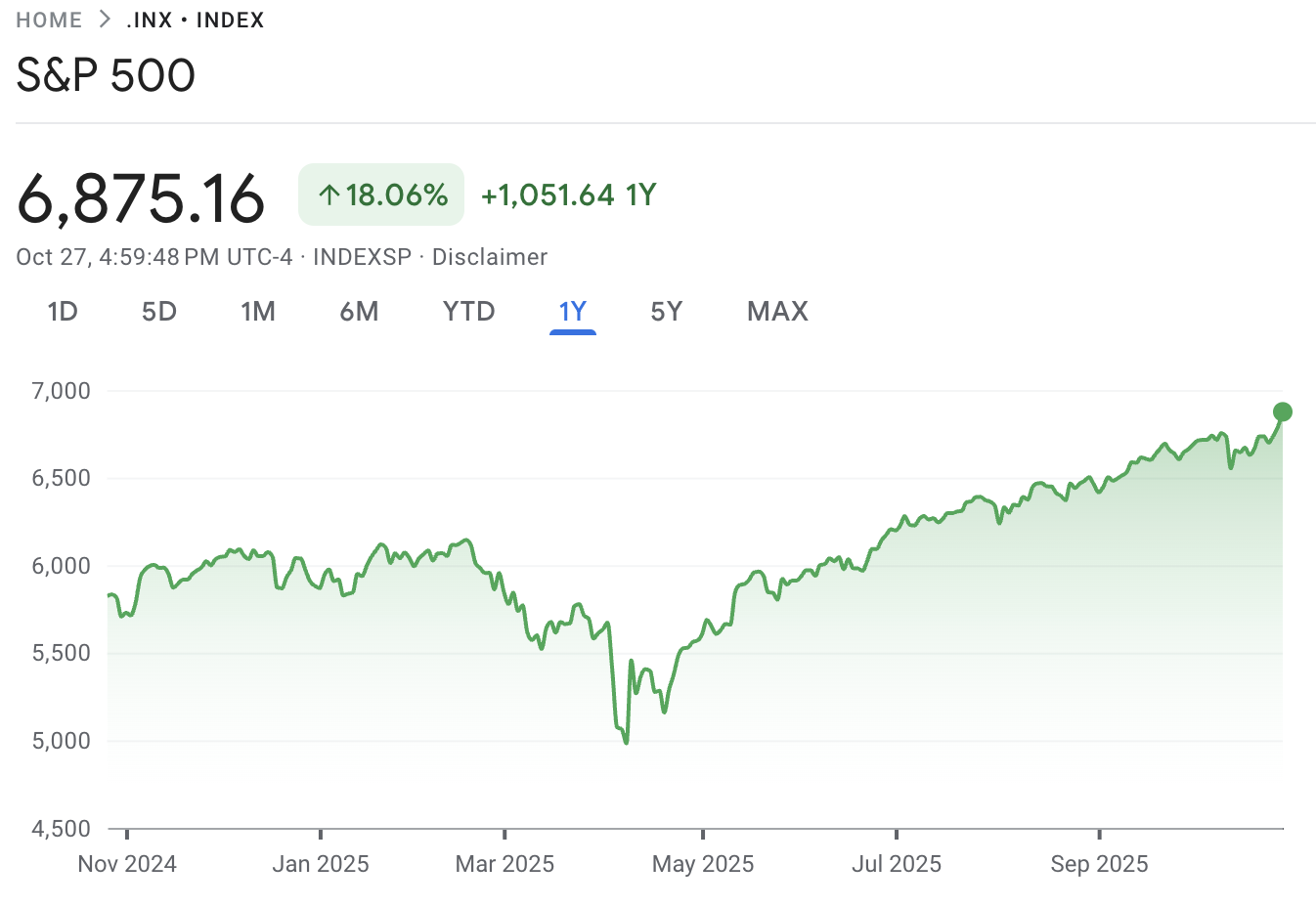

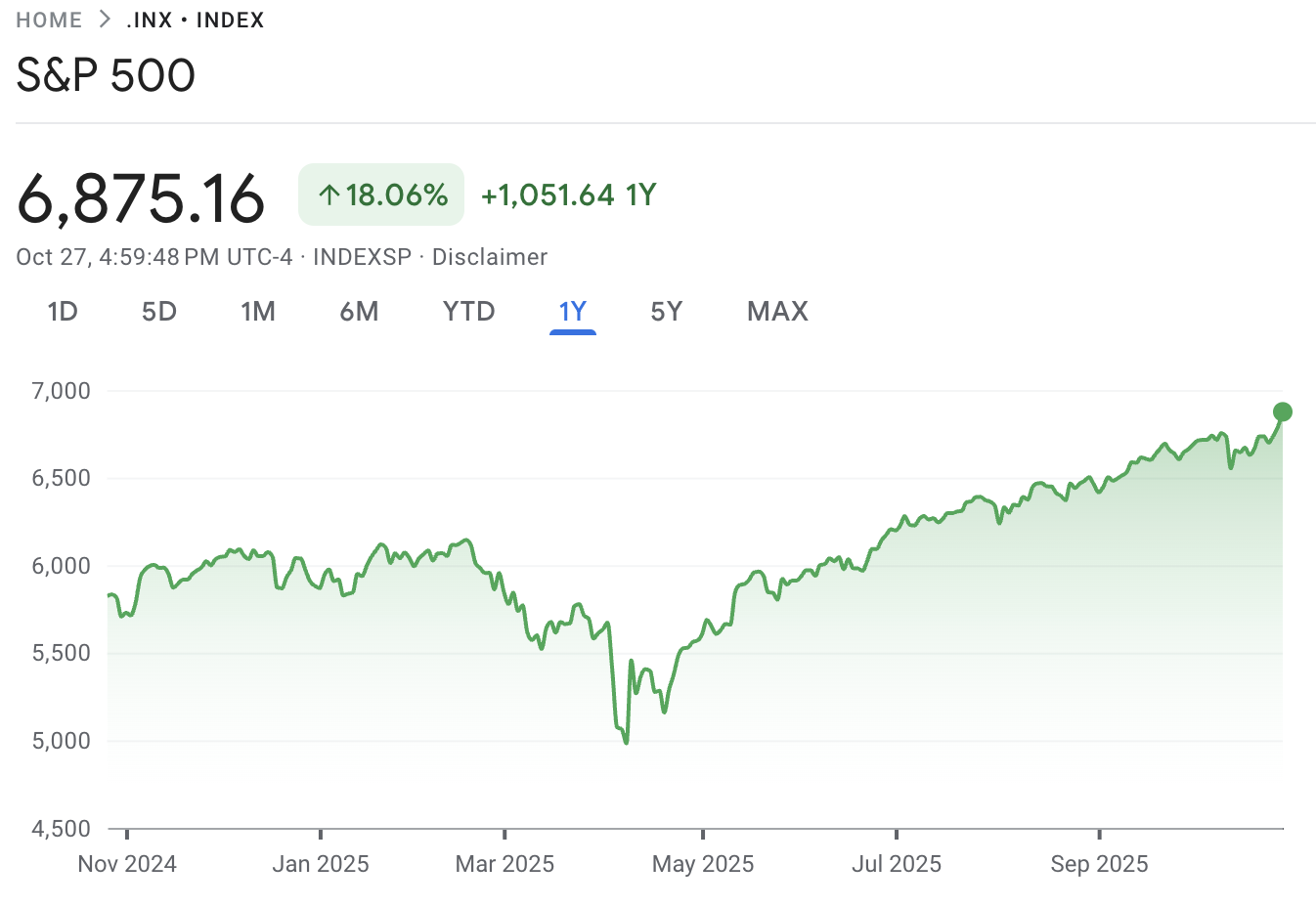

As of late 2025, the S&P 500 has shown solid growth, rising to around 6,791 points, a gain of roughly 12% year-to-date.

This upward trend highlights the continued strength of major U.S. companies despite persistent inflation, shifting interest rate expectations, and global market uncertainty.

Despite short-term swings, the S&P 500 continues to be a key gateway for investors seeking long-term growth, stability, and exposure to U.S. industry leaders.

S&P 500 Short-Term Outlook 2025

The market is currently showing bullish momentum due to several positive factors:

Record Highs: Major indices like the S&P 500 closed at new record highs recently (as of October 27, 2025).

Key Events this Week: Markets are highly focused on: The Federal Reserve's interest rate decision (expected to be a cut), Major Tech Earnings reports (Alphabet, Meta, Microsoft, Amazon, Apple, etc.), and US-China trade deal optimism.

Technical Outlook: The overall trend is bullish, with some analysts seeing potential for an extension toward the 7,000 level for the S&P 500.

The S&P 500 as an Economic Barometer

The S&P 500 isn’t just a stock index but a pulse check on the U.S. economy. Each movement reflects how investors collectively interpret growth, risk, and future potential.

When the index trends upward, it typically signals optimism: companies are reporting strong earnings, consumer spending is healthy, and business confidence is high.

Conversely, when the S&P 500 declines, it often suggests growing caution in the market. Investors may be bracing for slower growth, rising interest rates, or external pressures like geopolitical instability.

In essence, the S&P 500 acts as an early indicator of broader economic shifts, often moving before changes in employment data, consumer sentiment, or GDP growth become visible.

Why Invest in the S&P 500?

The S&P 500 offers investors a simple yet powerful way to build long-term wealth.

The S&P 500 offers investors a simple yet powerful way to build long-term wealth.

It represents the performance of 500 leading U.S. companies, giving exposure to the nation’s most dynamic sectors from technology and healthcare to finance and energy.

Here’s why it remains a core portfolio choice in 2025:

Broad Diversification: Investing in the S&P 500 means owning a slice of 500 companies across multiple industries, reducing the risk of relying on any single stock or sector.

Strong Long-Term Returns: The index has historically delivered around 10% average annual returns, reflecting steady growth over decades of market cycles.

Low Costs: S&P 500 ETFs and index funds typically come with minimal fees, helping investors keep more of their earnings.

Ease of Access: It’s a passive investment, once you’re in, it tracks the market automatically without the need for active trading or constant monitoring.

How to Invest in the S&P 500: Step-by-Step Guide

Investing in the S&P 500 is straightforward and accessible to both new and seasoned investors. It can be done through index funds or ETFs (exchange-traded funds) that mirror the performance of the index. Here’s how to get started:

1.Choose Your Investment Type

Decide between an S&P 500 index fund or an ETF.

Index funds are mutual funds that track the S&P 500 and are traded once daily at their net asset value (NAV).

ETFs trade throughout the day like individual stocks and often have slightly lower fees.

Popular options:

SPDR S&P 500 ETF Trust (SPY) - the most widely traded ETF.

Vanguard S&P 500 ETF (VOO) - known for its low expense ratio.

iShares Core S&P 500 ETF (IVV) - offers similar exposure with competitive costs.

2. Open a Brokerage Account

You’ll need a brokerage account to purchase an ETF or index fund. Reputable platforms like Fidelity, Charles Schwab, Vanguard, and E*TRADE provides easy access with low or no account minimums.

3. Fund Your Account

Transfer money into your brokerage account via bank transfer or direct deposit. Make sure you have enough to cover the cost of your investment and any transaction fees.

4. Place Your Order

Search for your chosen S&P 500 fund’s ticker (like SPY, VOO, or IVV) and place a market order to buy immediately at the current price, or a limit order if you want to set a specific buy price.

Strategies to Know When Investing In S&P 500

Successful investing in the S&P 500 isn’t about predicting every market move, it’s about consistency and patience. These proven strategies help investors manage risk while building long-term growth:

1. Dollar-Cost Averaging

Invest a fixed amount at regular intervals, regardless of market highs or lows. This smooths out volatility and removes the pressure of trying to “time” the market.

2. Long-Term Holding

The S&P 500 performs best when held over years, not weeks. Staying invested through market cycles allows compounding returns to work in your favor and helps you recover from short-term downturns.

3. Dividend Reinvestment

Choose to reinvest dividends automatically to buy more shares. This steady reinvestment accelerates portfolio growth and enhances long-term returns without additional capital.

Together, these strategies form the foundation of disciplined, goal-oriented investing in the S&P 500.

Risks and Limitations

Even the most diversified index has its vulnerabilities.

Sector Concentration: Tech giants make up a large portion, meaning downturns in that sector can drag the index down.

Market Volatility: Economic shocks or policy shifts can cause short-term fluctuations.

Inflation & Interest Rates: Rising rates can pressure equity valuations and investor sentiment.

Diversification across regions and asset classes can help offset these risks while keeping exposure to the U.S. market.

S&P 500 vs Other Indexes

The S&P 500 is often compared with other major stock indexes to understand how it fits into an investor’s broader strategy. While all indexes track segments of the U.S. market, their composition and risk profiles vary significantly.

| Index |

Description |

Key Difference |

| S&P 500 |

Tracks 500 large U.S. companies across all major sectors. |

Broad diversification and balanced exposure to growth and stability. |

| Dow Jones Industrial Average (DJIA) |

Follows 30 major blue-chip companies and is price-weighted. |

Higher-priced stocks have greater influence on the index. |

| Nasdaq 100 |

Focuses on large-cap technology and growth-oriented companies. |

More volatile due to heavy tech concentration. |

| Russell 2000 |

Represents 2,000 small-cap companies in the U.S. market. |

Reflects higher risk and potential for stronger growth. |

By comparison, the S&P 500 offers a balanced view of the economy, broad enough to capture long-term growth trends while avoiding the concentration risks found in smaller or more sector-focused indexes.

Future Outlook: Is the S&P 500 Still Worth Investing In?

Despite near-term volatility, the long-term case for the S&P 500 remains strong. U.S. corporations continue to innovate in technology, healthcare, and clean energy, while resilient consumer demand supports growth.

Analysts project steady but moderate gains through 2026, assuming inflation cools and corporate earnings stabilize. For investors with a long horizon, the index still represents one of the most reliable pathways to compounding wealth.

Short-term noise will come and go, but the S&P 500’s long-term story is one of resilience and reinvention.

Frequently Asked Questions (FAQ)

1. Is the S&P 500 a good investment for beginners?

Yes. The S&P 500 offers instant diversification across 500 major U.S. companies, making it one of the simplest and most stable entry points for new investors.

2. What are the risks of investing in the S&P 500?

While the S&P 500 is diversified, it’s still exposed to market volatility, interest rate changes, and heavy weighting in tech stocks. Short-term declines can occur, so it’s best suited for long-term investors.

3. Is the S&P 500 still a good investment in 2025?

Yes. As of late 2025, the S&P 500 remains a strong long-term investment option, supported by solid corporate earnings, steady innovation in technology and healthcare, and resilient consumer spending.

4. Can international investors invest in the S&P 500?

Yes, through global brokers such as EBC or ETFs that track the index (like VOO or SPY).

Conclusion

As of late October 2025, the S&P 500 is trading near 6,875, reflecting robust investor confidence and broad-market strength. Recent data show the index up about 15–16% year-to-date, highlighting its continued relevance as the heartbeat of U.S. large-cap equities.

For investors, this makes the S&P 500 both a core investment vehicle and a benchmark for portfolio performance. Selecting low-cost index funds or ETFs tied to the index remains one of the most efficient ways to gain diversified exposure to the U.S. economy.

Even so, it’s crucial to align your strategy with your time horizon, risk tolerance, and financial goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.