Oil prices jumped on Thursday, extending gains from the previous session,

after the US imposed sanctions on Russian oil companies Rosneft and Lukoil over

the Ukraine war.

The new sanctions aiming to imperil a war machine were unveiled one day after

plans for a summit between Trump and Putin were put on hold –a turnaround for

the White House.

EU countries on Wednesday approved a 19th package of sanctions on Moscow that

included a ban on Russian LNG imports. Trump reiterated India has agreed to

reduce purchase of Russian crude.

US oil inventories unexpectedly decreased in the week ending 17 October, said

the EIA, which implies that analysts may have underestimated the resilience of

energy markets.

Fuel oil imports to the Gulf Coast surged to a two-and-a-half-year high in

September, driven by a jump in cargoes from the Middle East, as refiners seek

alternatives to dwindling Venezuelan crude supplies, according to preliminary

data.

China has significantly increased crude stockpiling this year. The crude

import volumes going into the worlds biggest importer have held relatively

strong despite an imminent peak in demand for road transportation fuels.

Crude prices pushed above $63.70, a bullish sign for its trajectory going

forward. We expect it to overcome $64 soon, before testing the resistance around

$64.10.

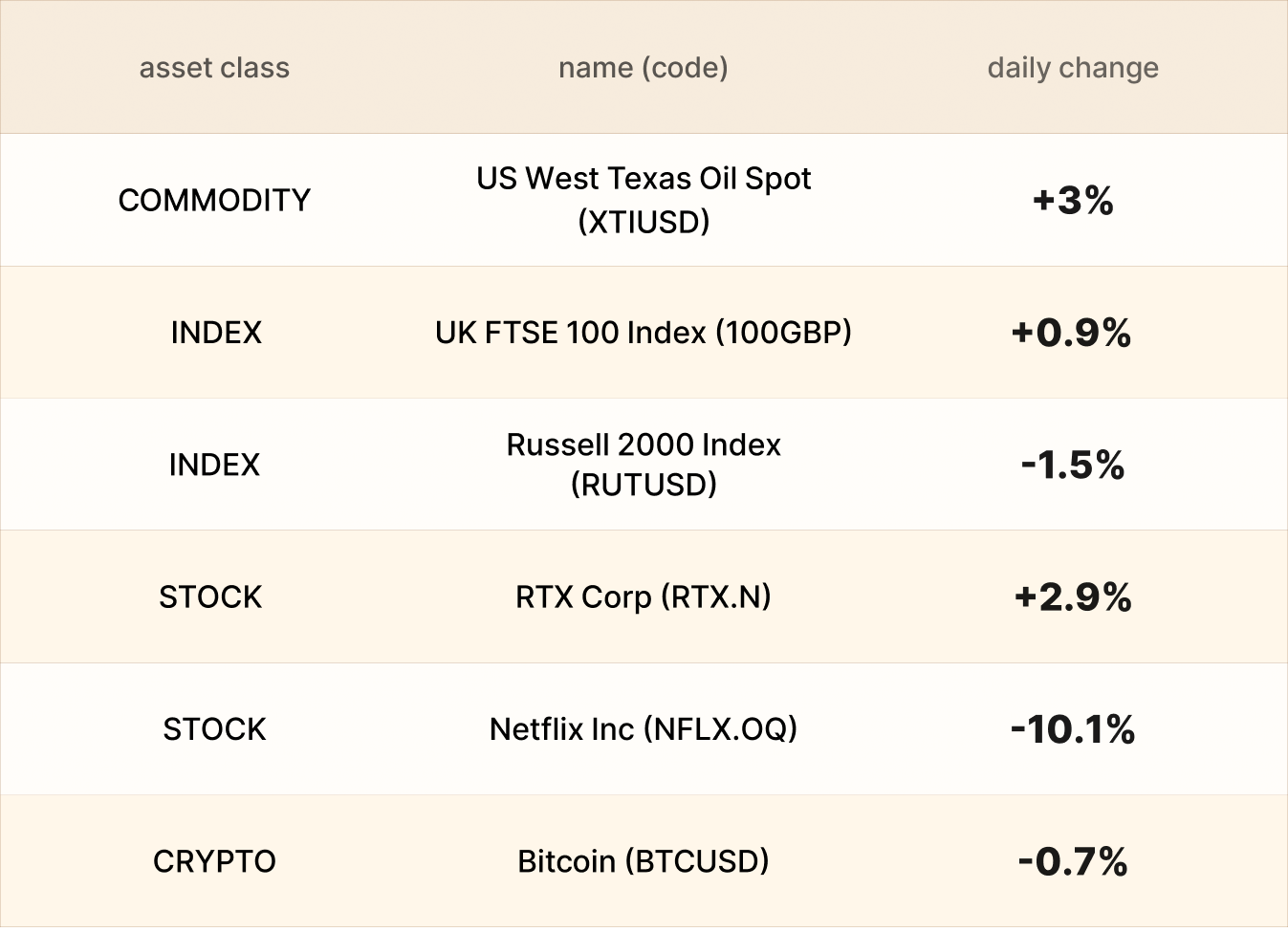

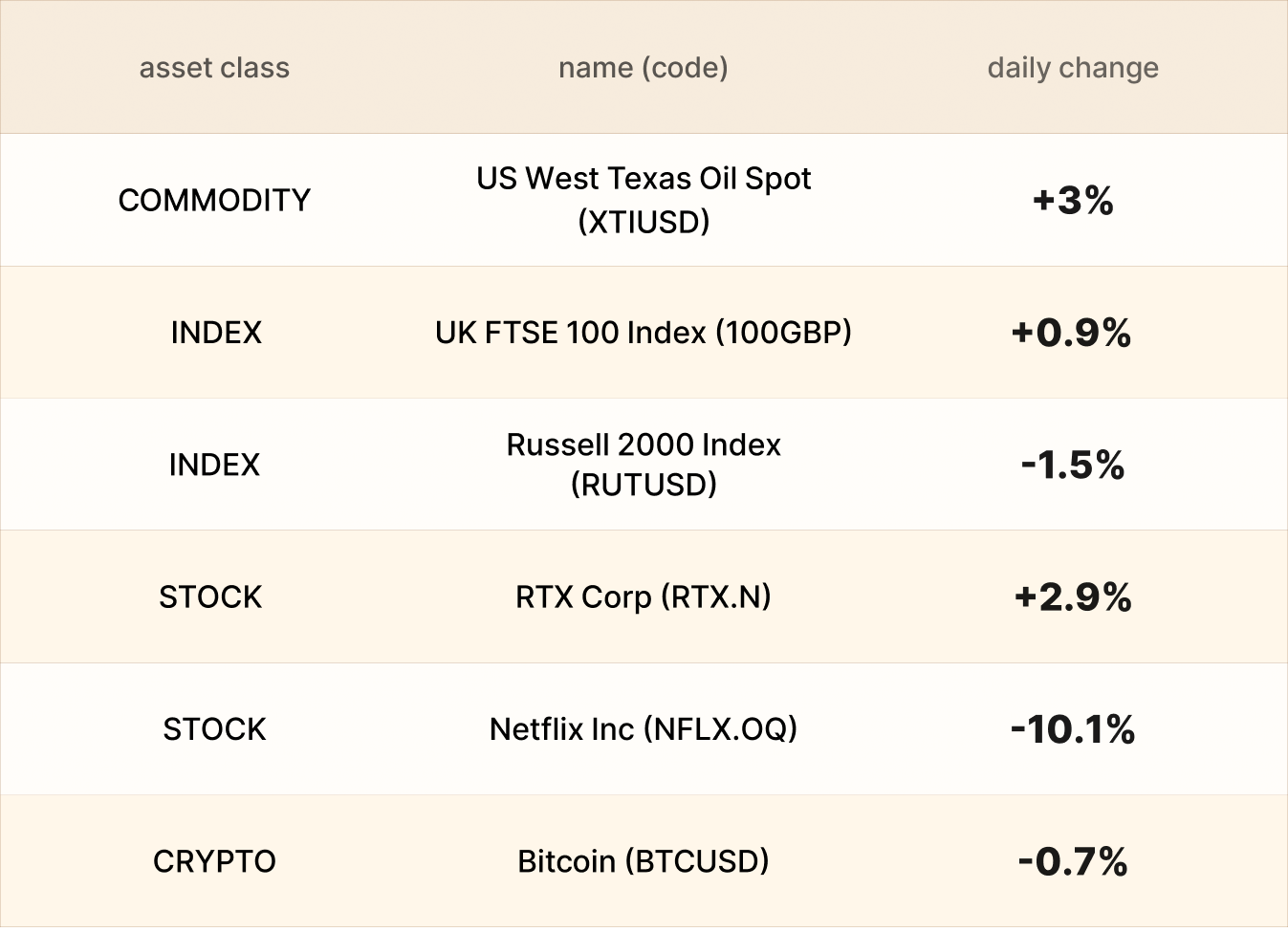

Asset recap

As of market close on 22 October, among EBC products, WTI crude and RTX group

led gains, though global markets showed signs of fatigue.

The FTSE 100 was an outlier, benefiting from the latest inflation report and

earnings from major companies. CPI came in lower than expected, reinforcing the

case for more rate cuts.

Netflix was thrashed as it missed big on profit. The company attributed the

earnings miss to an unexpected $619 million charge related to the Brazilian tax

dispute.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.