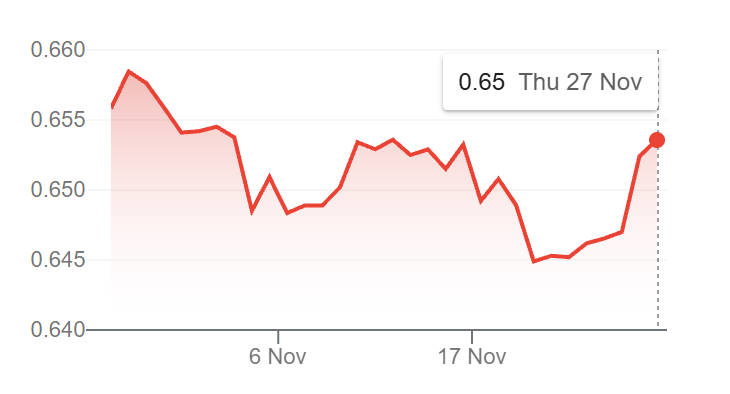

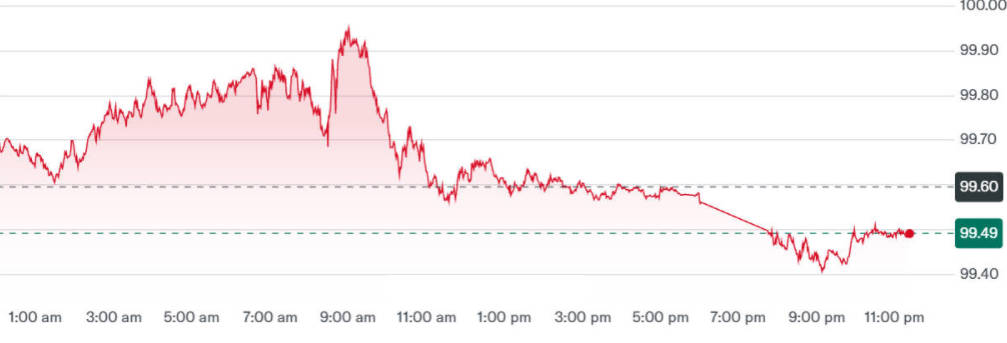

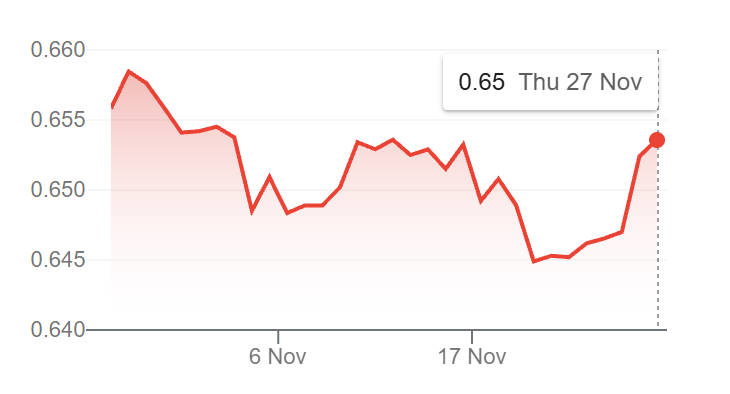

AUDUSD hovered near 0.6500 on 27 November, trading within a tight 0.6485–0.6512 range as markets weighed softer US inflation against firmer Australian data. The pair extended its rebound after Australia's October CPI beat expectations, prompting traders to rethink the RBA's easing path and boosting bets on an earlier Fed cut.

The move marks a clear shift from the autumn downturn and sets AUDUSD on a data-driven trajectory ahead of upcoming central-bank meetings and a busy US economic calendar.

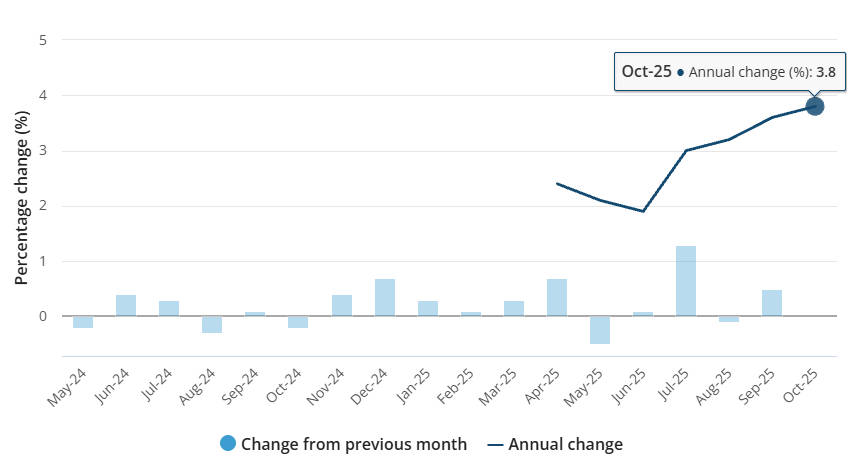

Inflation Shock Repositions AUDUSD Momentum

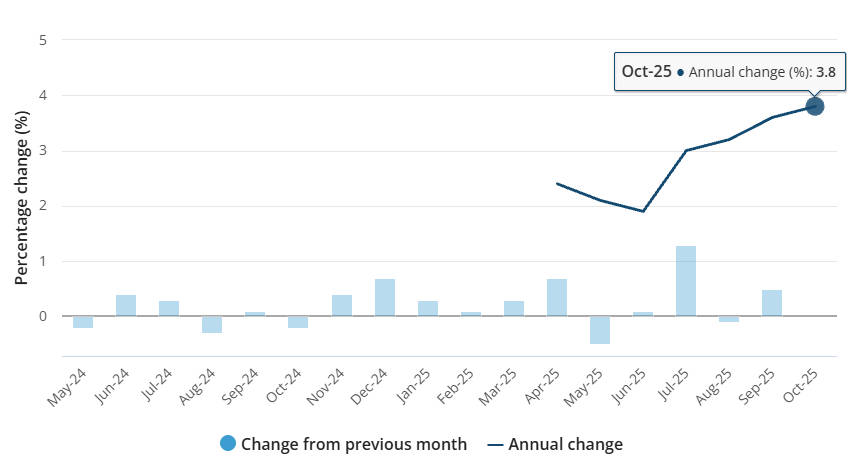

Australia's October CPI surprised at 3.8% year-on-year, higher than forecasts and the prior reading. The result lifted Australian yields, narrowed yield differentials with the US and underpinned demand for the Australian dollar. Markets immediately trimmed the probability of near-term RBA rate cuts.[1]

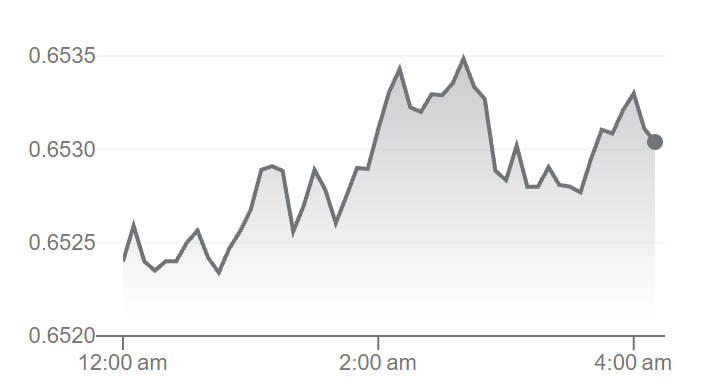

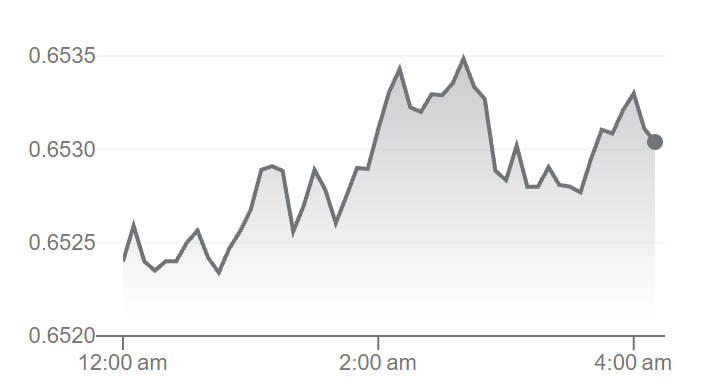

AUDUSD Intraday High: 0.6535

Australia CPI (Oct): 3.8% y/y (surprise)

Key date: RBA board meeting — 9 December.

Dollar Dynamics: Fed Cuts, DXY Softness and AUDUSD Tailwinds

Concurrently, a sequence of softer U.S. data has intensified market pricing for a Federal Reserve cut in December, weighing on the dollar and offering a tailwind for commodity currencies such as the AUD.

Concurrently, a sequence of softer U.S. data has intensified market pricing for a Federal Reserve cut in December, weighing on the dollar and offering a tailwind for commodity currencies such as the AUD.

The interplay of a weakening USD and firmer Australian yields has proved decisive in pushing AUDUSD above the 0.65 psychological mark in recent sessions.

Technical Profile: Resistance Cluster and Support Map for AUDUSD

Technicians point to a resistance cluster in the 0.6525–0.6550 band — a zone that coincides with key moving averages and prior swing highs. A sustained close above this area would suggest a run at 0.6650. while failure to breach resistance would likely invite a retest of support at 0.6420 and the November low near 0.6345.

Key technical levels

Commodities, China and Risk Sentiment: External Drivers for AUDUSD

Australia's currency remains commodity-linked. Stabilising iron ore and base-metal markets, together with tentative policy support in China, provide structural backing for AUD demand.

Conversely, a material slowdown in China or a sharp commodity slump would quickly reverse gains. Global equity sentiment continues to amplify moves: risk-on flows favour AUD, risk-off hurts it.

Short-Term Market Drivers: Events That Will Move AUDUSD

RBA meeting (9 December):

Watch guidance on inflation and "higher-for-longer" language.

US macro cluster:

Core PCE, non-farm payrolls and other prints that shape Fed expectations.

FX options expiries:

Round-number strikes (e.g. 0.6500) may exert short-term gravitational pull.

Commodity headlines / China news:

Iron ore, copper and stimulus signals remain influential.

A decisive break above 0.6550 could signal a medium-term trend reversal for AUDUSD; until then, the pair remains data-sensitive.

Medium-Term Scenarios: Probabilities and Strategy Implications

Base case:

RBA resists cuts while the Fed moves gradually toward easing — AUDUSD trades higher in a re-priced range.

Bull case:

Break above 0.6550 plus sustained USD weakness and robust commodity prices push the pair toward 0.6650–0.6700.

Bear case:

China slowdown, commodity shock or a resurgent USD force AUDUSD back below 0.63. Institutional players may favour buying dips with tight stops rather than aggressively chasing rallies.

Trading Risk and Liquidity Considerations

Expect thinner liquidity around holiday windows and option expiries; sudden spikes are possible. Traders should use disciplined risk controls, mind leverage and avoid oversized directional bets into major data or policy events.

Conclusion: AUDUSD Enters a Data-Driven Phase

Australia's inflation surprise has reset market expectations and given AUDUSD fresh impetus. The pair's next directional move will be determined by an interplay of RBA commentary, US data and commodity flows. Until clear technical confirmation, the market's tone will remain reactive and event dependent.

Frequently Asked Questions

Q1: What immediate impact did Australia's 3.8% CPI have on AUDUSD?

The 3.8% October CPI unexpectedly pushed yields higher and lowered the odds of near-term RBA cuts. This boosted AUD demand and helped AUDUSD climb back toward and briefly above the 0.65 mark.

Q2: Will the Fed's expected December cut weaken AUDUSD?

A Fed cut typically weakens USD and can benefit AUDUSD. However, if the RBA resists cuts, relative yields may limit AUDUSD's upside; the net effect depends on timing and magnitude of both central banks' moves.

Q3: Which technical levels should traders monitor for AUDUSD?

Watch resistance at 0.6525–0.6550 and support at 0.6420 and 0.6345. A clean close above resistance would open 0.6650; failure to hold support warns of deeper retracements toward 0.6270.

Q4: How important is China for AUDUSD's outlook?

China's demand for commodities meaningfully affects Australia's export revenues and thus AUD. Positive Chinese stimulus or stabilisation supports AUDUSD; a slowdown would transmit downside risk via lower commodity prices and weaker external demand.

Q5: What's the safest trading approach now?

Adopt cautious, data-responsive strategies: buy dips near reliable support with tight stops, avoid over-leveraging around expiries and major macro events, and monitor both RBA commentary and US data releases.

Sources:

[1] https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/oct-2025

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Concurrently, a sequence of softer U.S. data has intensified market pricing for a

Concurrently, a sequence of softer U.S. data has intensified market pricing for a