USD/CNY: A Currency Pair Entering a Structural Repricing Phase

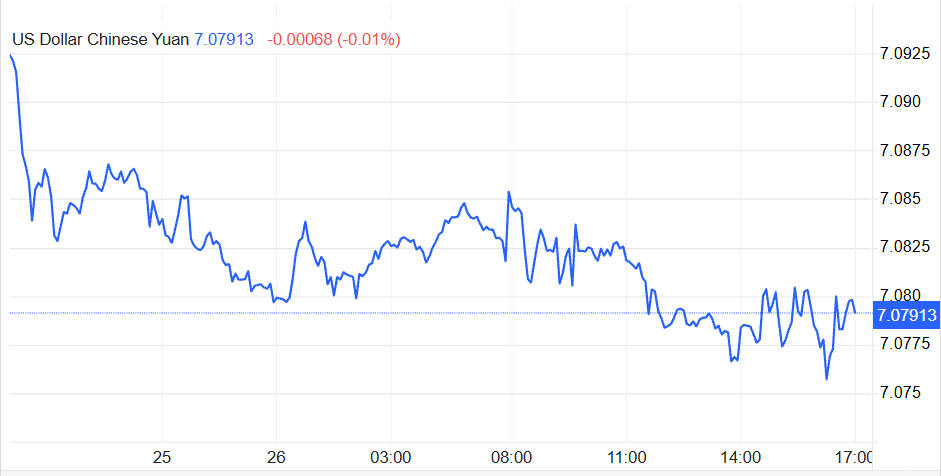

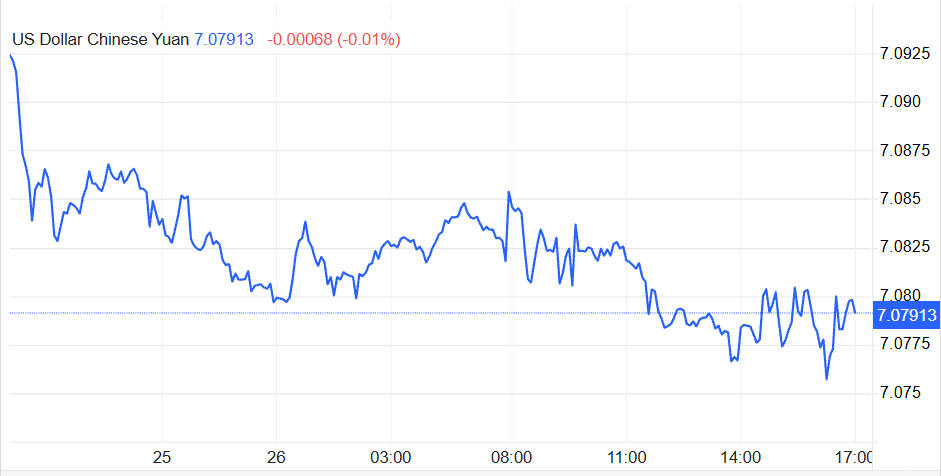

USD/CNY is no longer moving only on short-term sentiment. By late November 2025. the onshore pair traded near 7.08. marking one of the most stable and sustained periods of renminbi appreciation since early 2023.

At the same time, the CFETS RMB Index rose to 98.22. the highest since April. This confirms that the RMB's strength is broad-based, not simply a reaction to dollar weakness.

Together, these moves show a currency entering a structural repricing cycle, supported by both macro conditions and deliberate domestic policy engineering.

The Federal Reserve's Pivot and Its Direct Impact on USD/CNY

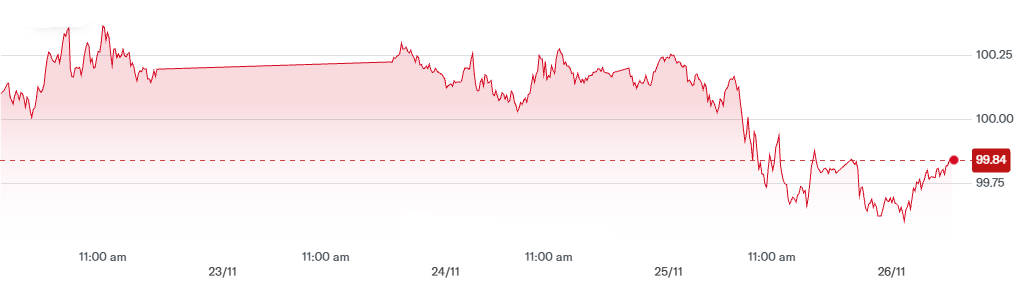

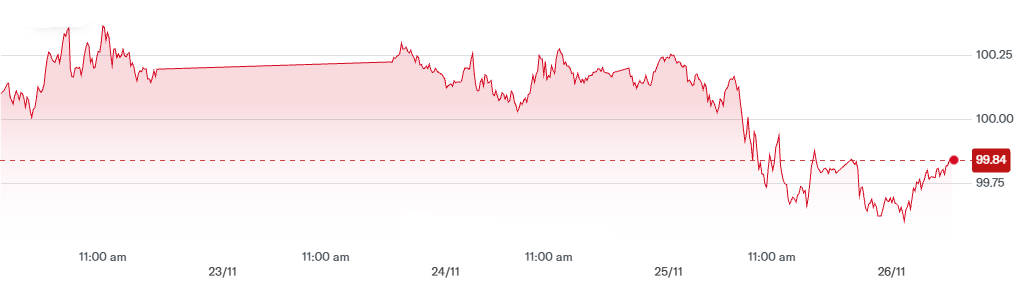

The Fed's transition from restrictive policy to gradual rate cuts is a central driver of the USD/CNY move.

As US rates fall and yield differentials narrow, the dollar's carry advantage erodes.

This reduces global demand for USD assets and naturally shifts flows toward undervalued or policy-supported currencies — including the RMB.

USD/CNY has historically been highly sensitive to narrowing yield gaps. In 2025 the effect is amplified because China is simultaneously guiding the RMB higher.

PBOC's Subtle but Effective Guidance Toward a Stronger RMB

The People's Bank of China has actively shaped the trajectory of USD/CNY.

Key features of the current policy stance:

Midpoints set consistently stronger than market estimates

State-bank operations to smooth intraday volatility

A visible commitment to orderly appreciation, avoiding disruptive swings

Use of the ±2% trading band around the midpoint as a stabilising anchor

This does not amount to aggressive intervention. Rather, it is a controlled appreciation strategy, signalling confidence and reinforcing China's intention to present the RMB as a stable, reliable currency.

Why China Wants a Stronger Renminbi in This Cycle

A firmer RMB aligns with several structural priorities.

1. Rebuilding global credibility

China is echoing its strategy during the 1998 Asian Financial Crisis, when it refused to devalue alongside regional peers.

Displaying stability now reinforces the RMB's anchor-currency image.

2. Supporting the internationalisation agenda

A strong and predictable RMB encourages its use in:

cross-border settlements,

corporate invoicing,

regional lending arrangements, and

central-bank reserve allocation.

3. Strengthening foreign investor confidence

Stability encourages inflows into onshore bonds, which remain attractive even with narrowed yield spreads.

4. Responding constructively to global uncertainty

With markets volatile, presenting the RMB as a steady currency differentiates China from other emerging markets.

In short, a stronger RMB is not just an economic signal — it is a strategic narrative.

USD/CNY and the Surge in Renminbi Liquidity Worldwide

One of the most important, and underappreciated, structural drivers is the sharp rise in RMB turnover.

According to the latest BIS FX turnover survey, RMB trading volumes have surged nearly 60% since 2022. now accounting for over 8% of global daily FX transactions.

Higher liquidity means:

As USD/CNY becomes one of the world's most traded currency pairs, market microstructure itself reinforces RMB stability.

This improving FX ecosystem makes RMB appreciation more sustainable than in previous cycles.

2018 vs. 2025: A Tale of Two Currency Regimes

The contrast highlights how much has changed.

2018:

2025:

Fed easing rather than tightening

China guiding stable appreciation

RMB gained nearly 3% YTD

Rising global demand for RMB-denominated assets

The structural difference is not only macroeconomic — it is policy-driven, reflecting China's broader internationalisation objectives.

Analyst Forecasts: Where USD/CNY Is Headed Next

Most major banks now expect continued RMB appreciation.

Goldman Sachs Forecast

3 months: ~6.95

6 months: ~6.90

12 months: ~6.85

The bullish case for RMB is anchored by:

declining US yields,

China's stable midpoint guidance,

improving domestic credit conditions, and

rising RMB usage in trade settlement.

However, the bank also emphasises the move will be gradual, not explosive.

Who Benefits and Who Must Adjust as USD/CNY Falls

1. Exporters

A stronger RMB narrows profit margins for exporters, particularly for low-margin manufacturers. Some may shift production or renegotiate contract terms.

2. Importers

Importers benefit immediately from lower costs for commodities, machinery, and technology inputs.

3. Multinationals Operating in China

A more predictable USD/CNY reduces hedging costs and FX uncertainty, supporting long-term planning.

4. Investors and Asset Managers

A credible appreciation cycle encourages:

inflows into Chinese government bonds,

more stable participation in onshore equities,

broader allocation into RMB assets for reserve managers.

5. Consumers

A firmer RMB reduces imported inflation, potentially lowering prices for overseas travel, luxury goods, and foreign services.

Risks That Could Reverse the USD/CNY Trend

Despite the strong momentum, key risks remain.

1. A resurgence of US economic strength

If US inflation re-accelerates, the Fed may slow or halt easing, which could strengthen the dollar.

2. Geopolitical shocks

Tensions in Asia or global instability could trigger flight-to-safety flows into USD assets.

3. Domestic growth concerns

Weakening Chinese data — especially in property or employment — could limit RMB appreciation.

4. Liquidity tightening

A sudden rise in global yields could shift capital back into USD assets.

For now, none of these risks dominate the baseline scenario, but they remain important to monitor.

Is USD/CNY Signalling a Structural Shift in Global FX Power?

All signs point to a longer-term story. USD/CNY is no longer merely reflecting short-term market moves.

It is reflecting:

China's internationalisation strategy,

rising RMB liquidity,

coordinated policy communication, and

a global environment that favours currency diversification.

If the momentum continues, the RMB could steadily increase its share in:

global trade settlement,

central-bank reserves,

regional financing systems, and

capital-market flows.

This does not mean the RMB will rival the USD imminently. But it does suggest a slow structural rebalancing — with USD/CNY acting as the front-line indicator of that transition.

Conclusion: Reading USD/CNY as a Strategic Signal

USD/CNY is no longer just a reflection of short-term market sentiment—it has become a clear indicator of broader structural shifts in global FX dynamics.

Supported by China's deliberate policy guidance, rising RMB liquidity, and the Federal Reserve's pivot toward easing, the yuan's steady appreciation signals a new phase of currency credibility and internationalisation.

For investors, exporters, and multinational firms, this means reassessing hedging strategies, planning for gradual RMB strength, and recognising USD/CNY as a key metric of long-term global monetary realignment.

As the cycle unfolds, the renminbi's stability and policy-backed trajectory will likely play an increasingly influential role in shaping global capital flows and trade settlement patterns.

Frequently Asked Questions

1. Why is USD/CNY falling in 2025?

USD/CNY is dropping due to the Federal Reserve's rate cuts, China's stronger midpoint guidance, and rising global demand for RMB assets. These forces narrow yield spreads, support capital inflows, and reinforce confidence in the yuan's stability and policy direction.

2. How does the Fed's policy affect USD/CNY?

Fed easing reduces US yields, weakening the dollar's carry advantage and encouraging flows into higher-stability currencies like the RMB. This narrows yield differentials, makes USD assets less attractive, and creates sustained downward pressure on USD/CNY throughout the cycle.

3. Why is China guiding the RMB stronger?

China aims to signal monetary confidence, promote RMB internationalisation, attract foreign investment, and stabilise domestic markets. A stronger RMB supports credibility, reduces imported inflation, and enhances China's position as a reliable regional anchor currency during global uncertainty.

4. What risks could reverse the USD/CNY appreciation?

Key risks include renewed US economic strength, geopolitical shocks, weaker Chinese data, and tightening global liquidity. Any of these could revive dollar demand, shift capital flows, or prompt more cautious midpoint settings from the PBOC, slowing RMB appreciation momentum.

5. Will RMB internationalisation accelerate because of USD/CNY?

Yes. A stable, appreciating RMB encourages wider use in trade settlements, reserve diversification, and regional financing. Rising liquidity, deeper offshore markets, and stronger policy signals create favourable structural conditions that support faster RMB internationalisation in the coming years.

6. What does a stronger RMB mean for exporters?

A stronger RMB reduces export price competitiveness and narrows profit margins, especially for low-margin manufacturers. Exporters may adjust pricing, upgrade product value, or hedge more actively to manage currency risk and remain competitive in overseas markets.

7. How will multinational firms in China be affected?

Multinationals benefit from reduced FX volatility, lower hedging costs, and greater pricing visibility. A steadier USD/CNY improves long-term planning, stabilises cash flows, and supports investment decisions by providing a more predictable operating and financial environment.

8. What are analysts forecasting for USD/CNY in 2026?

Most analysts expect continued RMB strength, projecting USD/CNY toward 6.90 or lower if Fed easing persists and domestic conditions stabilise. Appreciation should remain gradual, supported by policy guidance, rising RMB liquidity, and improving international confidence in Chinese markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.