The US dollar has fallen 8.9% so far in 2025, more than erasing its 2024

gains. The White House suggested Trump and Xi Jinping could have a conversation

about trade as soon as this week.

Wall Street banks are reinforcing their calls that the dollar will weaken

further, hit by interest-rate cuts, slowing economic growth and Donald Trump's

fickle trade and tax policies.

The greenback will fall to hit 91 by around this time next year and the

10-year Treasury yield will reach 4% by the end of this year before staging a

much larger decline next year, according to Morgan Stanley.

The bank listed the euro and the yen among the biggest winners from the

greenback's slide, along with the Swiss franc. Similarly, JP Morgan recommended

long bets on the yen, euro and Australian dollar last week.

Goldman Sachs noted a potential change to US tax rates on foreign individuals

and companies is expected to exacerbate concerns about risks of US investments

which have already come under pressure.

In a separate report, it said their models suggest the dollar is about 15%

overvalued and therefore it has further to fall. The decline will likely be

driven by reallocation and repricing of global assets.

Wells Fargo also said "a medium-term narrative around a weaker dollar is

building." Traders are looking to a slew of employment data this week to

determine the next shifts in Fed policy and its implications for the dollar.

Fundamental shift

The close relationship between Treasury yields and the dollar has broken

down. They have tended to move in step with each other in recent years as higher

yields typically appeal to foreign capitals.

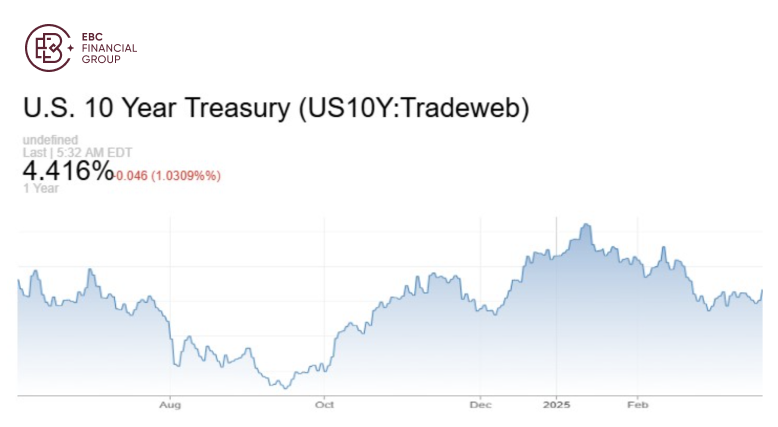

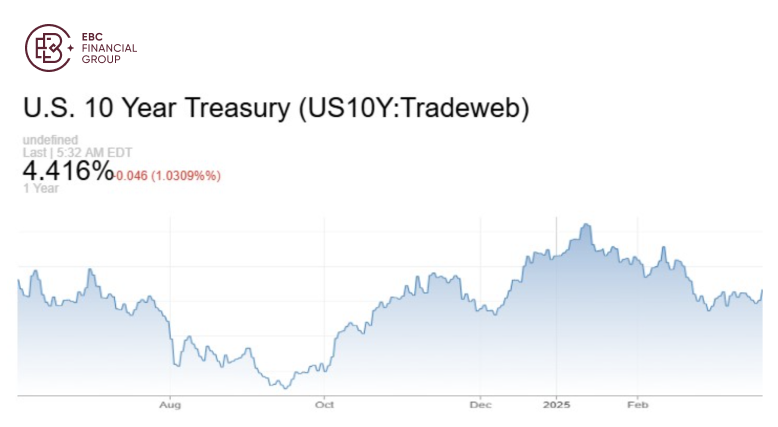

Since Trump's "liberation day" tariffs were announced, the 10-year yield has

risen around 250 bps, while the dollar suffered great losses. The correlation

hit its lowest level in nearly three years this month.

Debt selloff resulted from unsustainable fiscal deficits and unpredictable

trade policies, rather than strong economic outlook, which happens more

frequently in EM markets, said UBS analyst Shahab Jalinoos.

The Fed has refrained from monetary easing since December 2024. However,

higher for longer borrowing costs loom large for the federal government that aim

to spur growth and balance budget.

That is not an unprecedented case though. During the European debt crisis

that began in 2009, Greek10-year bonds yielding nearly 4000 bps more than French

government bonds at their peak.

The new pattern could increase risks for investors seeking haven assets, said

Andreas Koenig, head of global FX at Amundi. Gold is growing popular as a tool

to hedge dollar-denominated portfolio.

The ultra-wealthy are increasingly moving their gold offshore increasingly

opting for physical gold bars instead of paper, according to a CNBC report in

May.

BNPP forecasts the 10-year yield to finish 2025 around 4.25%. It does not

expect any Fed rate cuts this year, citing inflationary concerns, multiple

policy uncertainties, and a still-solid growth backdrop.

Emerging menace

Trump's erratic policies offer a "prime opportunity" to strengthen the euro's

international role and allow the currency bloc to enjoy more of the privileges

so far reserved for the US, ECB President Christine Lagarde said.

She repeated calls to complete the single market, trim regulation and build

the savings and investment union. The bloc's capital market is highly

fragmented, undermining its competitiveness.

Russia aggression and US protectionism appear to be a "double-edged sword"

for Europe. While the events deal a blow to economy, solidarity across the

continent has enhanced, including reconciliation between the EU and UK.

Lagarde reiterated that there should be more joint financing on the European

level for measures including defence as progress on that front would mean

investors would have a deeper pool of securities to tap into.

George Buckley, chief European economist at Nomura, sees upside ahead for the

euro to some extent. "The euro is still a distant second, but it's gaining in

momentum quite significantly with all the things going on."

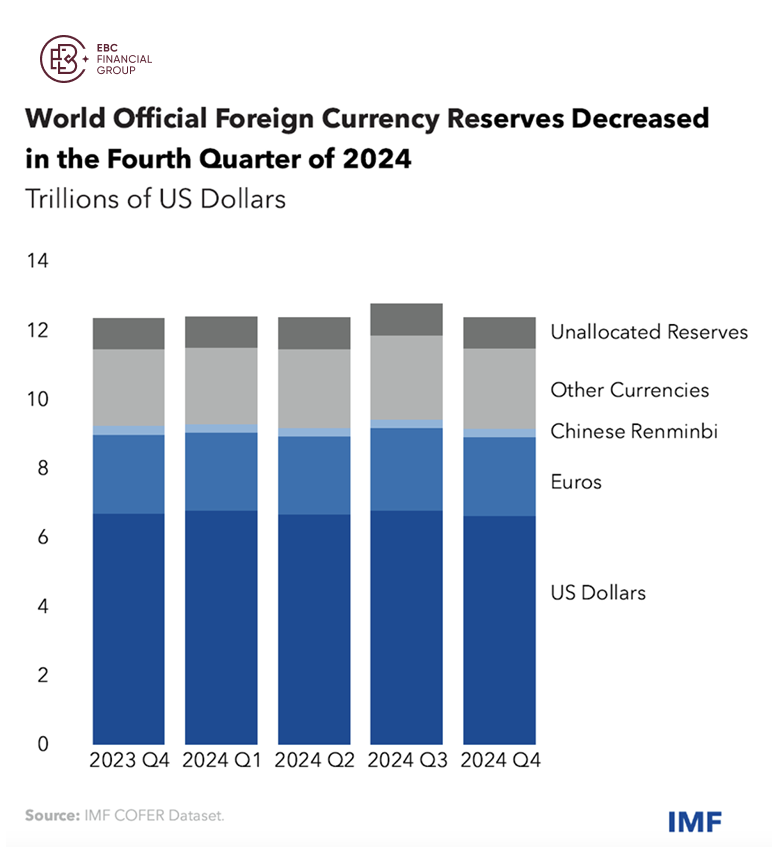

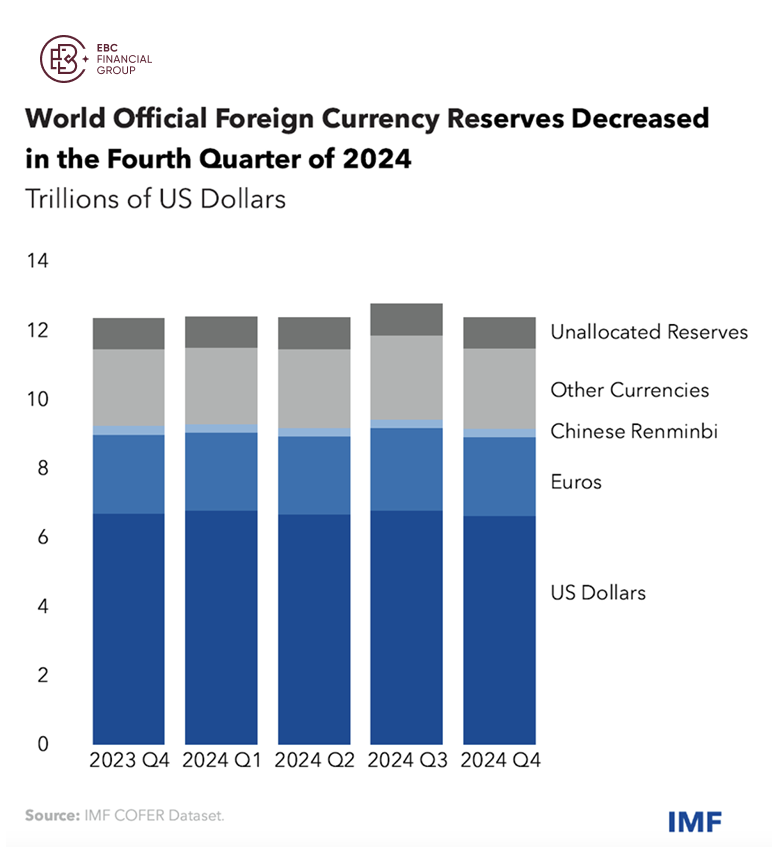

The euro's 20% share of world reserves has remained fairly constant at this

level for the past 10 years. During that period, the dollar's share has fallen

by seven percentage points.

A paper from Fed Board economist Colin Weiss shows homed in on the fact that

roughly three-quarters of foreign official holdings of US assets are with

countries that have military ties to Washington.

Military spending boom raises questions about how Europe will view their

dollar reserve holdings going forward. And potentially deeper crack within the

transatlantic alliance would likely affect the rest of the world.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.