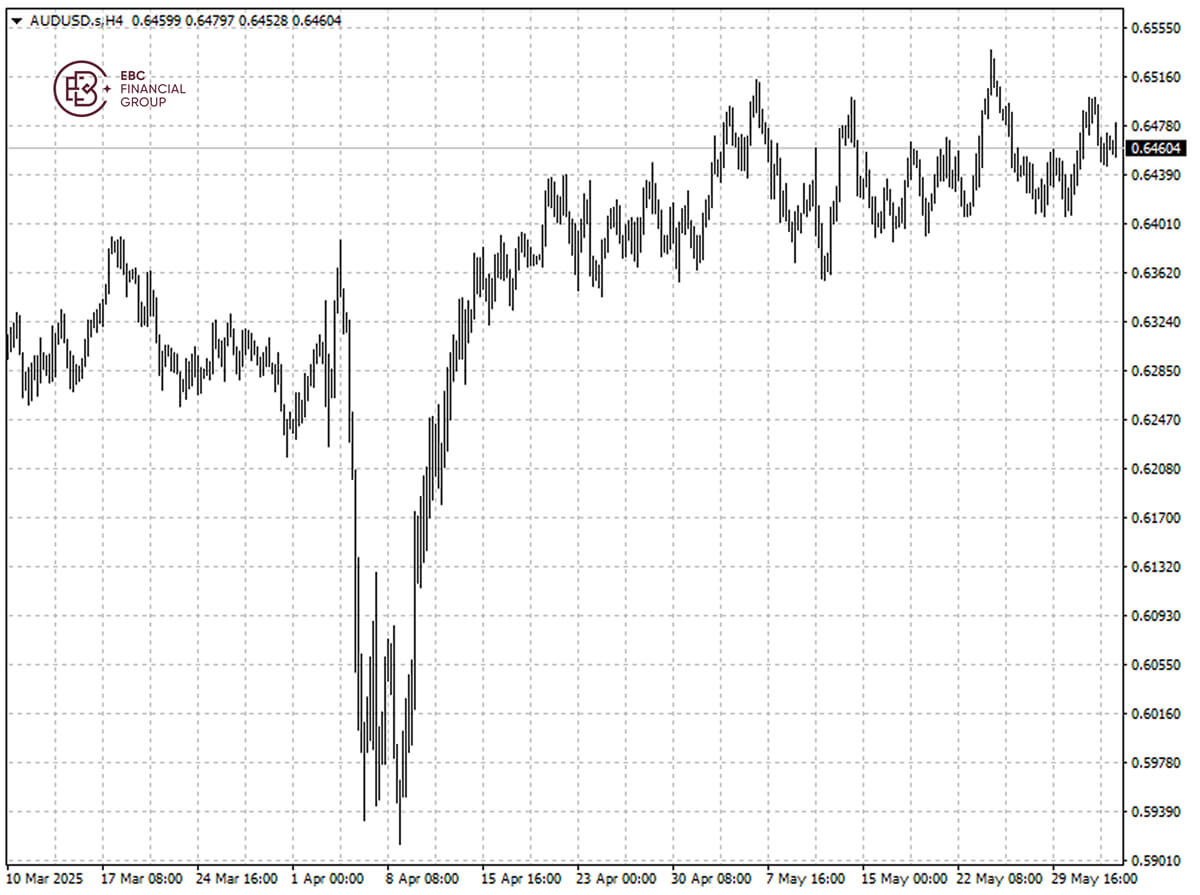

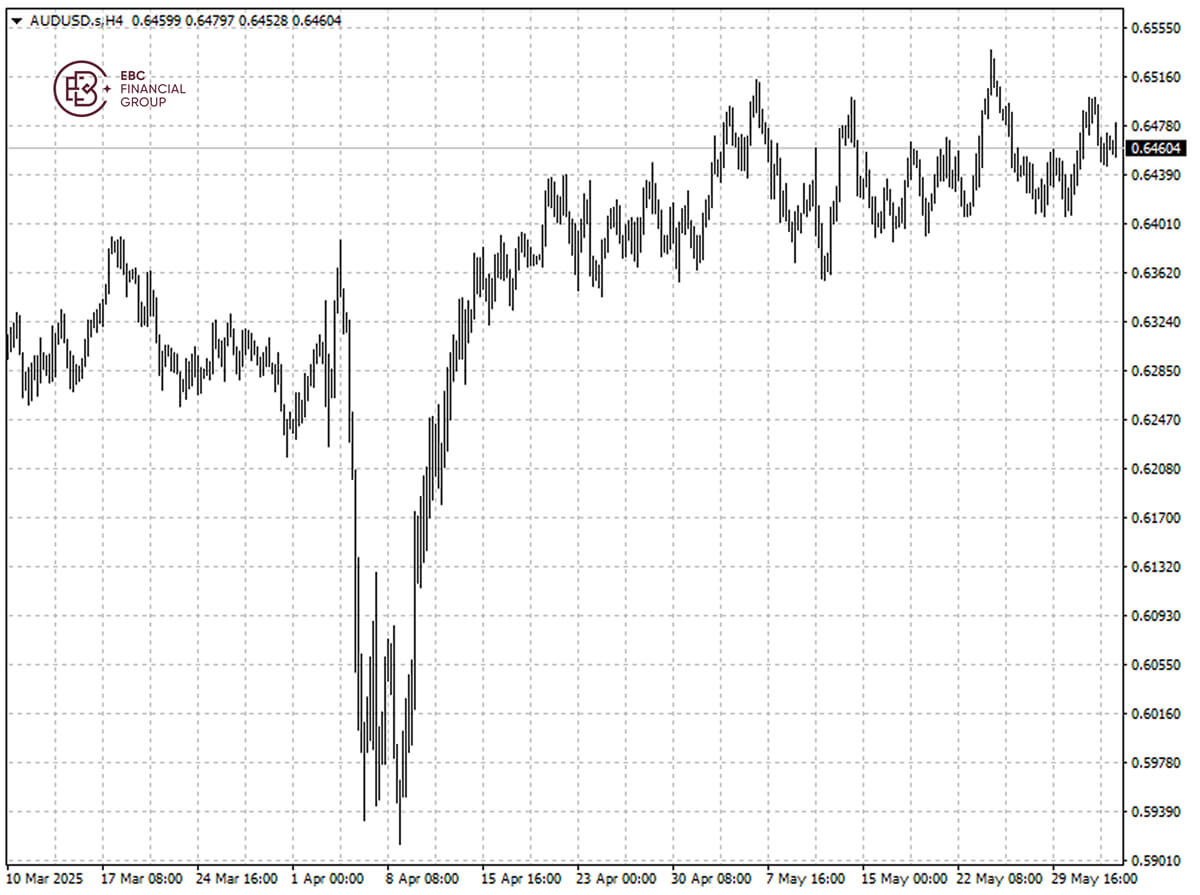

The Australian dollar was little changed on Wednesday following the release

of GDP figures. Markets await developments in Trump's tariff negotiations with

key trading partners.

Australia's economy barely grew in Q1 as consumers stayed frugal and

government spending sputtered to a standstill. The weakness calls for the RBA to

ramp up policy stimulus.

The central bank has already cut interest rates twice since February. Swaps

imply an 80% probability of a rate cut in July, with a total easing of almost

100 bps priced in by early next year.

Governor Sarah Hunter said on Tuesday that higher US tariffs would drag on

the global economy and put near-term downward pressures on prices of traded

goods, though the exact impact is hard to asses.

Chinese producers are trying to redirect their products to other markets

where tariffs are lower, making products cheaper and lowering inflation, he

added.

The country's independent wage-setting body raised the national minimum wage

by 3.5% effective July 1 as headline consumer price inflation held at a level in

line with the 2%-3% target in Q1.

The Australian dollar has been directionless for almost a month. Therefore,

the base scenario is that it continues to move between 0.64 and 0.65 in the

short term.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.