Gold stands at the core of global market stability, economic security, and remains a top safe haven asset in times of uncertainty. Central banks and governments have long accumulated gold to diversify reserves and preserve value during volatile economic cycles.

In this article, we explore who holds the most gold in 2025, analyzing the top 10 countries by gold reserves, how their positions have changed, and what these holdings signify for the global financial system.

Top 10 Gold Reserves by Country in 2025

Gold’s resurgence since the early 2020s, driven by inflation concerns, geopolitical shifts, and dollar diversification, has made it a cornerstone of monetary strategy once again.

According to data from the World Gold Council (WGC) and International Monetary Fund (IMF), central bank gold buying in 2024 reached near-record levels, with emerging economies notably increasing their reserves.

| Rank |

Country |

Gold Reserves (Tonnes) |

| 1 |

United States |

8,133 t |

| 2 |

Germany |

3,352 t |

| 3 |

Italy |

2,452 t |

| 4 |

France |

2,437 t |

| 5 |

Russia |

2,333 t |

| 6 |

China |

2,304 t |

| 7 |

Switzerland |

1,040 t |

| 8 |

India |

880 t |

| 9 |

Japan |

846 t |

| 10 |

Netherlands |

612 t |

1. The United States Remains Dominant

The United States still holds more than 8,100 tonnes of gold, a position unchanged even as global gold demand has surged in 2025. With prices hitting repeated record highs this year, the stability of U.S. reserves has contrasted sharply with the active buying and selling seen in other major economies.

These holdings remain concentrated at Fort Knox, the Denver Mint, and the Federal Reserve Bank of New York. Their consistency continues to support confidence in the dollar during a period of heightened geopolitical and commodity-market volatility.

2. Europe’s Enduring Faith In Gold

Germany, Italy, and France maintain large stockpiles as a hedge against euro-area instability. Germany’s Bundesbank restored much of its gold from New York and Paris between 2013-2017, signaling long-term trust in physical possession.

3. Asia’s Accelerating Accumulation

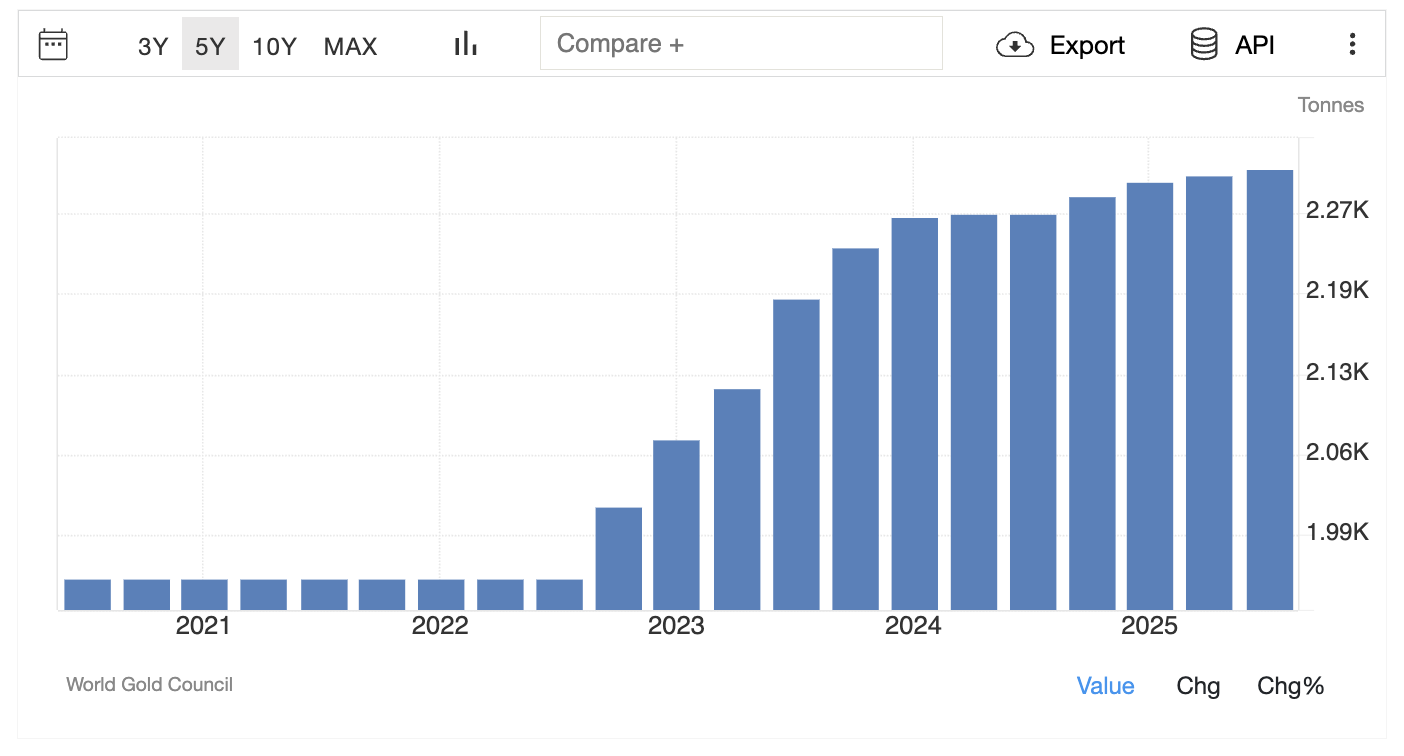

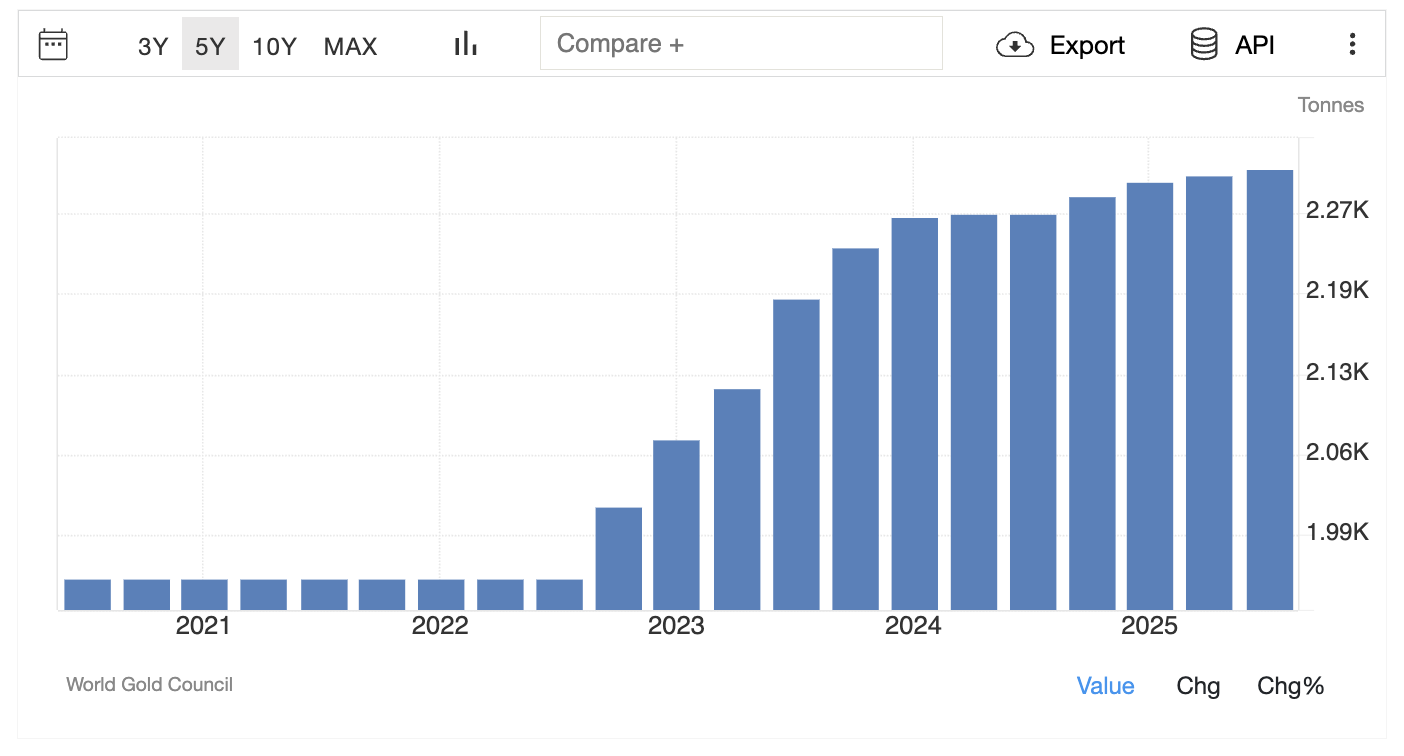

China has quietly but consistently grown its official gold reserves through 2025, reaching about 2,304 tonnes by year end of 2025. This continued build-up underscores Beijing’s push for reserve diversification and a gradual move away from dependence on the U.S. treasury assets.

Below is the growth rate of China’s gold reserve throughout the years.

Meanwhile, the Reserve Bank of India (RBI) has lifted India’s gold reserves to roughly 880 tonnes by late 2025, strengthening its currency buffer in light of import price pressures and global economic uncertainty.

4. Russia’s Strategic Diversification

Russia has reversed course, rather than stockpiling gold, it is now selling physical gold from its reserves for the first time. The sales are intended to support the budget, prop up the ruble, and provide liquidity amid shrinking oil revenues and frozen foreign assets.

This marks a major shift from using gold as a shield against sanctions to using it as a cash source to sustain government spending.

5. Emerging Nations Joining The Trend

Several emerging-market central banks, including National Bank of Kazakhstan, Central Bank of Turkey, and Central Bank of Uzbekistan, have ramped up gold purchases in 2025.

The purchases reflect growing concern over currency stability and regional economic uncertainty, prompting these nations to build bullion buffers against volatility.

Why Central Banks Accumulate Gold

Central banks hold gold for several reasons:

Monetary Stability: Gold provides insurance against currency depreciation and global financial crises.

Portfolio Diversification: It reduces dependency on the U.S. dollar and other fiat assets.

Confidence and Credibility: A strong gold position reinforces investor trust in a nation’s financial resilience.

Inflation Hedge: Gold retains its purchasing power during periods of rising consumer prices.

These strategic motives explain the steady increase in global gold reserves across both developed and developing nations.

How Gold Reserves Influence National Policy

The size of a country’s gold holdings influences its monetary flexibility and sovereign credit confidence. Nations with significant reserves can leverage gold for foreign exchange support or liquidity during crises.

For instance, during inflationary pressures, countries with higher gold reserves can maintain investor confidence without heavily depleting currency reserves.

Furthermore, gold acts as a psychological anchor in times of uncertainty. When central banks signal higher gold holdings, it often bolsters domestic and foreign investor trust, mitigating capital flight.

What This Means for Investors and Market Watchers

Safe-Haven Appeal: The fact that sovereigns continue to accumulate gold underscores its enduring role as a “safe-haven” asset. For private investors, this may reinforce gold's appeal as a hedge in portfolios especially during macroeconomic uncertainty or rising inflation.

Geopolitical Risk Premium: As geopolitical tensions rise and de-dollarization gains traction, gold’s strategic value may increase. Countries with rising geopolitical tensions may benefit from holding bullion rather than assets tied to global banking systems or foreign currencies.

Long-Term Store of Value: Gold remains a store of value for institutions that prioritize long-term stability over short-term yield. For investors with similar risk profiles such as conservative, long horizon, low correlation needs, gold continues to make sense.

Caution on Liquidity & Opportunity Cost: Holding large gold reserves offers stability, but gold does not yield interest or dividends. For central banks or investors needing active cash flow, over-reliance on gold potentially limits flexibility.

How Traders Can Interpret Gold Reserve Data

For traders and market analysts, gold reserve updates offer actionable insights into macroeconomic trends:

Monitoring reports from the World Gold Council or central bank disclosures can help traders align strategies with underlying macro shifts.

The Global Context: Beyond Monetary Reserves

Gold reserves are part of a broader geopolitical narrative. As global debt levels rise and fiat currencies face inflationary pressure, gold reasserts itself as a store of value. The 2020s have seen a paradigm shift from purely financial optimization to strategic resource holding.

China’s consistent accumulation of gold reflects a long-term goal: building confidence in the yuan as a competing reserve currency. Likewise, Western economies’ stable holdings reflect their commitment to traditional monetary frameworks.

The East-West divergence in gold strategy reveals the evolving balance of financial power.

Risks and Limitations

Valuation Risk: The market value of gold can fluctuate widely. While its non-correlation benefits diversification, swings in price may impact the perceived value of gold reserves or investments.

Opportunity Cost: Money tied up in gold earns no yield. In periods when interest rates or productive investments outperform gold, reliance on bullion can underperform.

Liquidity Constraints: Selling gold quickly, especially large quantities, can be challenging and may send negative market signals, making it difficult for central banks to liquidate in dire circumstances.

Frequently Asked Questions (FAQ)

1. Why is gold important for central banks?

Gold provides stability during inflation or crisis, diversifies reserves, and strengthens investor confidence in a country’s economy.

2. How often are gold reserve rankings updated?

The World Gold Council updates official central bank data quarterly, though some countries revise their figures less frequently.

3. Does more gold mean a stronger economy?

Not necessarily. While gold contributes to financial strength, economic growth depends on broader factors like production, trade, and fiscal policy.

Summary

As of 2025, the United States, Germany, and Italy lead the world in gold holdings, with China and India rapidly expanding their reserves. This global accumulation trend underscores gold’s role as both a monetary safeguard and a strategic asset in a shifting financial landscape.

For traders and investors, understanding which nations are increasing their holdings provides insight into long-term market confidence and inflation expectations.

In the modern economy, gold remains not only a relic of history but a powerful instrument of stability and trust.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.