The Jackson Hole Fed Meeting revealed renewed hopes for monetary easing, driving rallies in global stocks and shifting investor sentiment on inflation and trade risks.

How Did the Jackson Hole Fed Meeting Influence Market Sentiment?

Federal Reserve Chair Jerome Powell's keynote at the Jackson Hole Economic Policy Symposium on 22 August 2025 signalled a cautiously accommodative stance amid persistent inflation and a cooling labour market. Powell suggested a possible interest rate cut in September, highlighting risks in the job market alongside inflation pressures. His remarks sparked rallies in major US indices—the S&P 500 and Dow Jones hitting new highs—with strong gains in small-cap and value stocks despite volatility in tech sectors.

What Were the Major Market Highlights This Week?

-

Australia's S&P/ASX 200 broke the 9,000-point barrier for the first time, supported by recent rate cuts and strong bank earnings.

-

Canada's S&P/TSX climbed on positive economic data and central bank guidance.

-

The US dollar strengthened on Fed policy expectations, while the New Zealand dollar gained despite geopolitical concerns.

-

Commodity markets were mixed: crude oil prices were little changed after a two-week decline, pressured by uncertain Russia-Ukraine peace talks and supply-demand worries.

Metals and energy sectors showed varied performance as investors balanced optimism with caution.

Which Economic Indicators and Data Releases Shaped Markets?

-

Markets priced in an increased probability of a US Federal Reserve rate cut in September, with futures markets reflecting this shift strongly.

-

Recent headlines and core CPI inflation data, along with retail sales figures, influenced economic outlooks.

Key upcoming data include US housing starts, central bank meeting minutes, PMIs, UK unemployment and GDP figures, US retail sales, and China's July CPI.

How Did Different Sectors and Regions Perform?

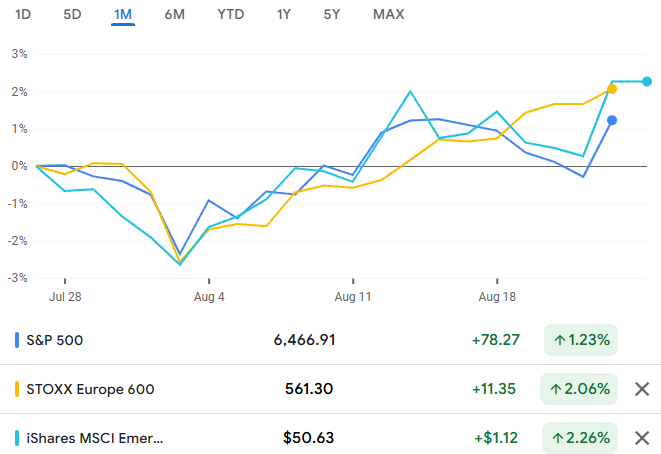

US energy, real estate, financials, and materials sectors led gains amid expectations of easier monetary policy. European equities remained resilient, buoyed by optimism regarding the Ukraine conflict and strong financial stocks. Asian and emerging market equities posted broad rallies, including China, India, Taiwan, South Korea, and Brazil, reflecting widespread risk appetite.

What Were the Key Market Movers and Investor Themes?

-

Renewed US-China tariff pause alleviated trade uncertainties and supported asset prices.

-

US, German, and UK government bond yield curves indicated mixed inflation and growth expectations.

-

Powell's Jackson Hole speech clarified Fed policy stance, acting as a market catalyst.

Inflation trends, labour market dynamics, and policy shifts drove sector rotation and risk sentiment.

What Should Investors Expect in the Coming Week?

Investors will focus on critical economic data and corporate earnings that could shape the Fed's September 16-17 meeting decision on interest rates. Key dates include:

-

Monday, 25 August: US new home sales and Fed officials' speeches can offer insight into housing and policy views.

-

Tuesday, 26 August: Reserve Bank of Australia meeting minutes, US durable goods orders, and Case-Shiller home prices.

-

Wednesday, 27 August: Australia's July CPI, Germany's GfK consumer confidence, and China's industrial profits.

-

Thursday, 28 August: Central bank decisions in South Korea and the Philippines, Eurozone economic sentiment, and US Q2 GDP estimate.

Friday, 29 August: Japan's retail sales and unemployment, UK housing prices, Germany's preliminary inflation, and the US July core PCE price index—Fed's preferred inflation gauge.

On the corporate front, significant earnings reports from companies like Hewlett-Packard and Williams-Sonoma will be under scrutiny, potentially impacting market confidence amid geopolitical and economic uncertainties.

Conclusion

The Jackson Hole Fed Meeting marked a key moment for markets in late August 2025. Powell's speech lifted optimism for a potential easing but underscored ongoing inflation and geopolitical risks. With the labour market softening and inflation pressures persisting, a delicate balance remains. Investors should closely monitor upcoming data and earnings as these will influence the Fed's policy path and market dynamics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.