In today's dynamic financial markets, retail traders are becoming increasingly aware of the subtle tactics used by institutional players to manipulate price action. One of the most popular Smart Money Concepts (SMC)-based methods to decode this behaviour is the PO3 trading strategy.

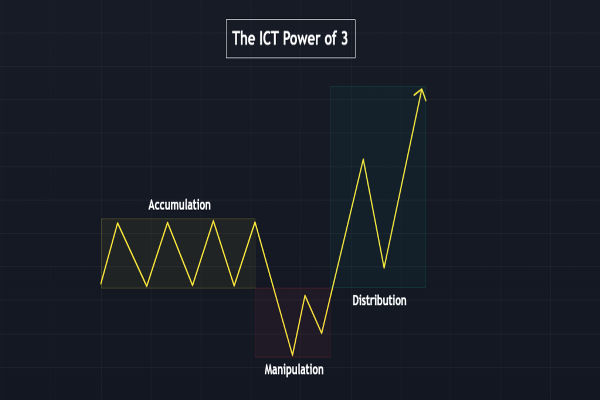

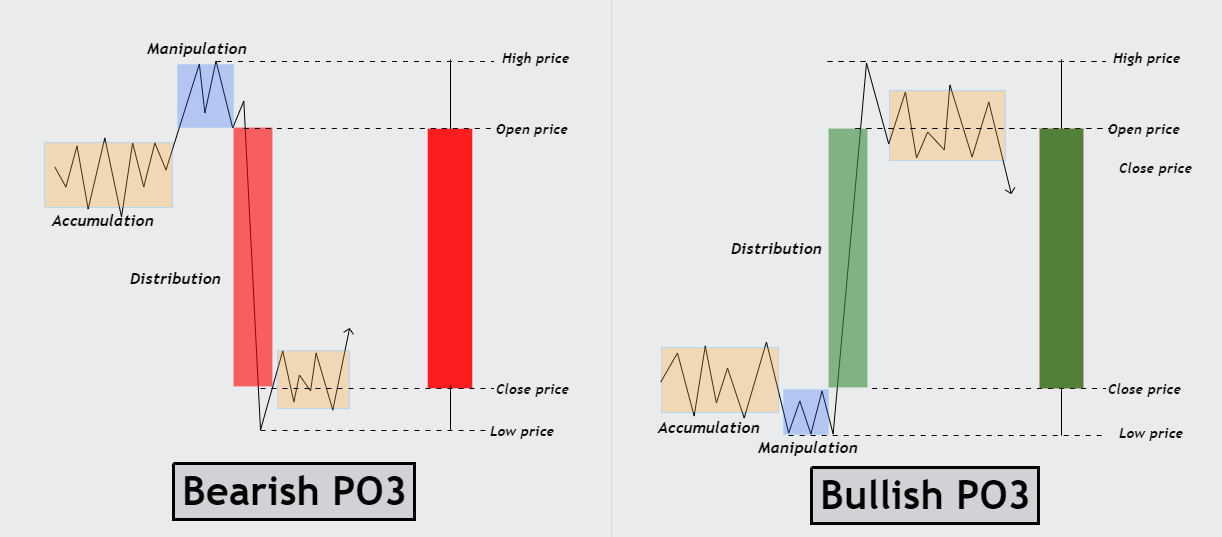

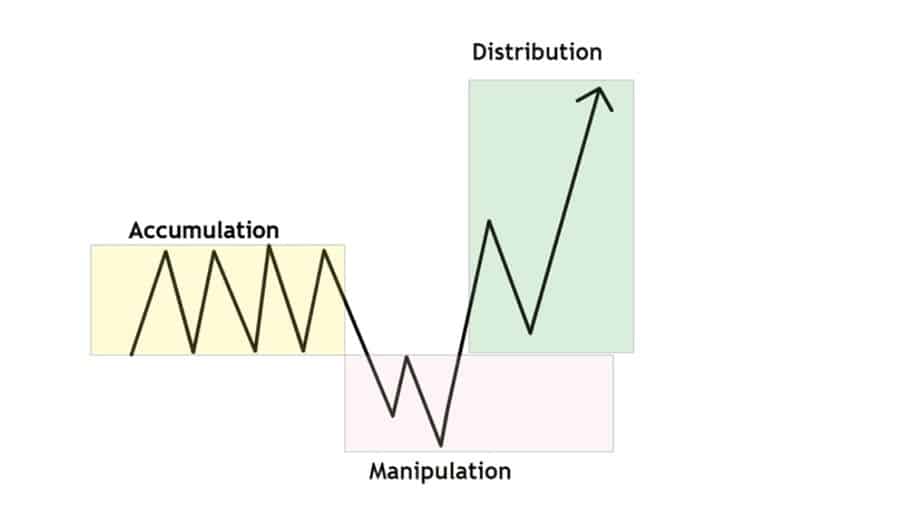

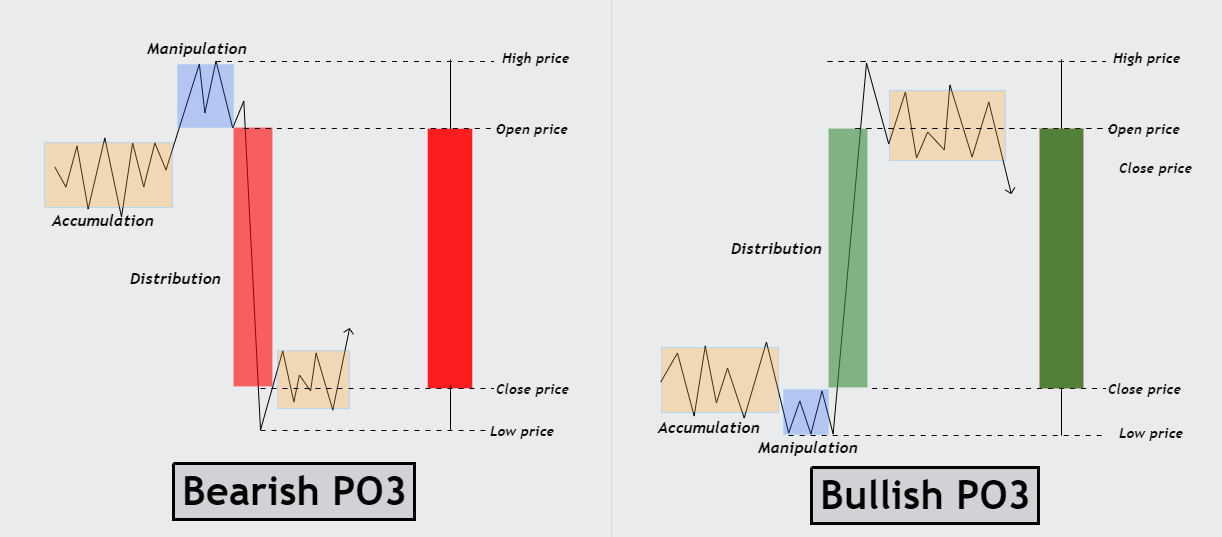

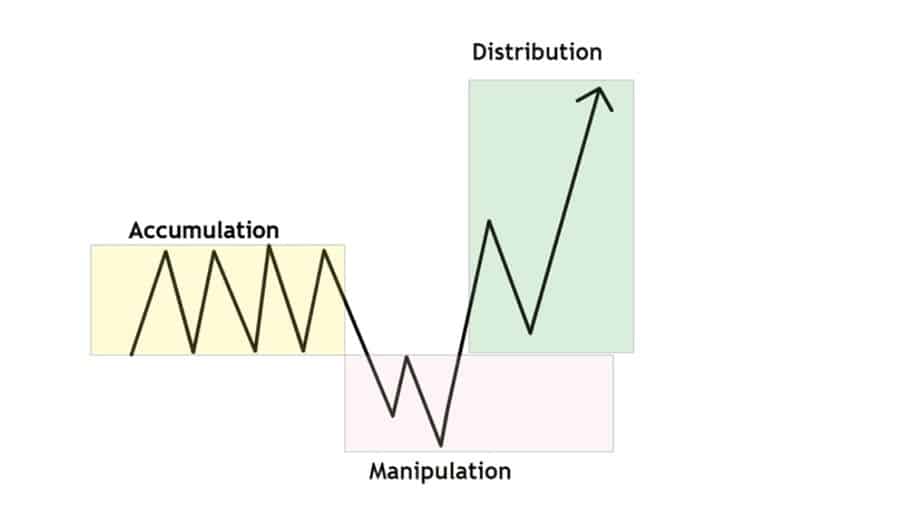

Short for "Power of Three," PO3 breaks the market down into three distinct phases—accumulation, manipulation, and distribution.

This article provides a detailed guide on recognising and utilising the PO3 trading strategy to detect market manipulation, implement it in actual trading settings, and minimise false signals.

What Is PO3 Trading?

PO3 Trading—Power of Three—is based on the concept that institutional traders, often referred to as "Smart Money," follow a three-step sequence when moving markets: accumulation, manipulation, and distribution. Unlike traditional technical indicators, PO3 focuses on price behaviour and liquidity to determine market intention.

This method originated from price action studies and has been widely adopted by traders who focus on the underlying intent of market movement, rather than surface-level technical patterns.

The Three Phases of PO3: Accumulation, Manipulation, Distribution

Accumulation Phase

During this initial phase, major entities start to discreetly establish their holdings without noticeably affecting the price. The market frequently moves laterally during accumulation, deceiving retail traders into believing the market is uncertain or confined to a range.

During this phase, price tends to consolidate near key support or resistance levels. It's an essential moment for Smart Money to accumulate orders discreetly. Retail traders frequently find themselves trapped in deceptive breakouts or hasty entries during this phase.

Manipulation Phase

Once enough liquidity has been gathered, the market enters the manipulation phase. Here, Smart Money intentionally pushes the price in the opposite direction of its intended move to trigger stop losses and trap traders.

This phase creates fake breakouts or breakdowns, often known as "liquidity grabs." Retail traders believe a breakout is happening, take positions, and swiftly get stopped out. In the meantime, Smart Money gathers additional liquidity at superior prices.

Manipulation is the most deceptive part of PO3, but recognising it can give traders an edge. The key is to observe price behaviour around session highs and lows or around previous support and resistance zones.

Distribution Phase

After clearing out liquidity and collecting stop orders, institutions begin to move the price in the actual intended direction. This is the real move, and it's where experienced PO3 traders execute high-probability trades.

The distribution phase exhibits a clear trend and heightened momentum, frequently backed by volume. This occurs when the price aligns with the original intent displayed during the accumulation phase, swiftly changing as trapped participants exit their positions.

Identifying Market Manipulation with PO3

PO3 is primarily designed to identify manipulation before it happens. By learning to spot accumulation and anticipating manipulation, traders can wait for the actual move and avoid fake breakouts.

Manipulation often occurs during specific times of the trading day, typically at the London Open or New York Open. Price may spike one way (manipulation) before sharply reversing in the true direction (distribution).

This behaviour shows how institutions "engineer" liquidity. The goal isn't necessarily to beat the retail trader but to fill large orders efficiently. Thus, PO3 assists traders to align with these institutional trends rather than opposing them.

Step-by-Step Guide to PO3 Trading Strategy

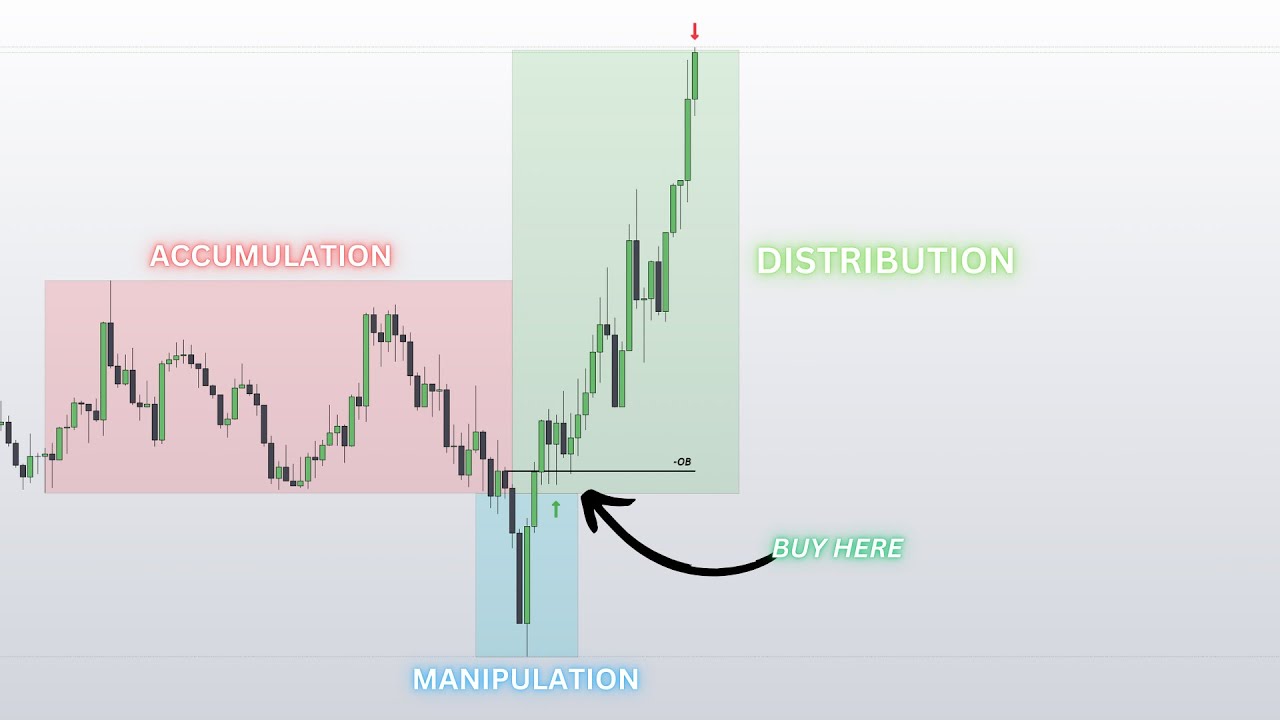

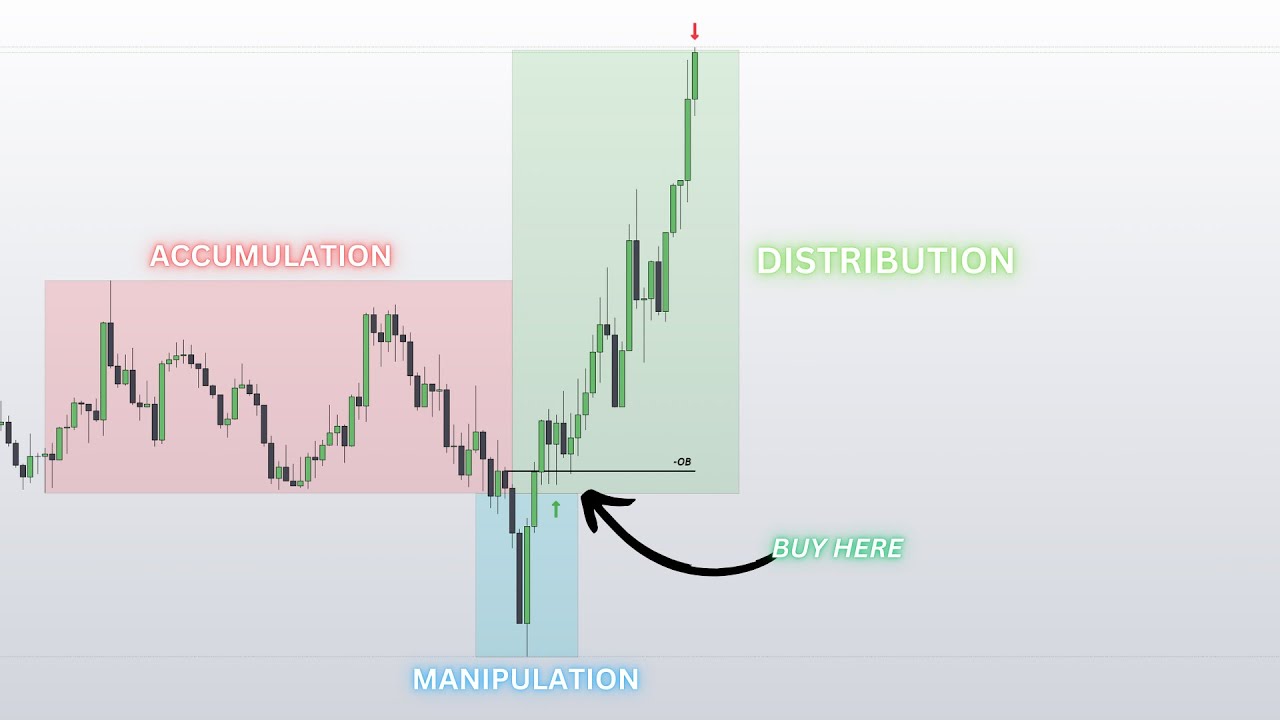

Step 1: Identify the Accumulation Zone

Look for a sideways consolidation period before a major session (e.g., London or New York). The price usually fluctuates within a set range of high and low. Designate these limits as your "accumulation range."

This range signals that large orders are being placed. The longer the accumulation, the bigger the move is likely to be.

Step 2: Watch for the Manipulation Move

Next, observe a breakout beyond the accumulation range—either above resistance or below support. This move is often sharp and fast, designed to trigger stop losses and attract breakout traders.

Here's where patience is key. Refrain from entering the breakout, and instead seek indications of a reversal, like a change of character (CHOCH) or a structural shift.

Step 3: Trade the Distribution

After the manipulation spike, the price returns to the accumulation range or breaks through it in the opposite direction. It is your cue that the distribution phase has started.

Now is the optimal time to enter a trade in the direction of the real move. Use confirmation such as:

Market structure shift (e.g., break of previous high/low)

Fair Value Gaps (FVG) aligning with entry zones

Volume confirmation or price rejection candles

Set your stop-loss just beyond the manipulation wick and aim for a risk-reward ratio of 2:1 or higher.

Key Tools to Enhance PO3 Trading

Time of Day

Market manipulation often occurs during key sessions:

Traders should mark session opens and monitor how the price behaves around them.

Volume Analysis

Increased volume during the manipulation and distribution phases can confirm institutional involvement. Look for high-volume spikes coinciding with price reversals.

Liquidity Pools

Liquidity often sits above recent highs and below recent lows. When price spikes into these zones only to reverse, it indicates the manipulation phase. Mark these areas to anticipate potential PO3 setups.

Advantages and Tips for Beginners

The PO3 strategy offers several advantages to traders:

Clear Framework: It provides a simple, three-phase structure for analysing market moves.

Improved Entries: By steering clear of trades during manipulation, traders minimise false breakouts.

Higher Trades: The distribution phase frequently results in significant trends, providing enhanced profits.

Insight into Institutional Behaviour: It trains you to think like Smart Money.

Because PO3 is grounded in how markets actually move, it can be applied across timeframes and asset classes, from forex to indices, even crypto.

To use PO3 effectively in live markets, follow these steps:

Backtest rigorously using historical charts during major sessions.

Mark daily highs, lows and session opens to visualise potential manipulation zones.

Track win/loss ratios and setups in a journal for pattern recognition.

Combine with CHOCH and liquidity concepts for stronger confirmation.

Stay disciplined—only trade once all three phases are confirmed.

Remember, PO3 isn't about guessing tops or bottoms—it's about recognising the intentional moves of large players and positioning accordingly.

Conclusion

In conclusion, PO3, accumulation, manipulation, and distribution, provides a robust framework for comprehending market manipulation and aligning your trades with institutional movements.

By learning to observe structure, liquidity grabs, and time-based behaviour, traders can stop reacting emotionally and start trading intentionally.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.