USD/CAD is falling even though the U.S. still offers meaningfully higher front-end yields than Canada. That disconnect is the story heading into the CPI double-header: positioning has flipped in favor of the Canadian dollar, volatility remains relatively contained, and the next two inflation prints are likely to decide whether this move extends or snaps back.

The order of releases is significant: the U.S. CPI will be published on February 13, 2026, followed by Canada’s CPI on February 17, 2026. With USD/CAD trading near the key psychological level of 1.3500, the upcoming period presents a scenario where macroeconomic catalysts intersect with technical support.

USDCAD Trade Setup Before US CPI and Canada CPI: Key Takeaways

Market sentiment currently favors a stronger Canadian dollar, though not decisively. As of February 3, 2026, speculators held a modest net-long position in the Canadian dollar (+2,130 contracts), which limits the potential for further USD/CAD declines unless new data introduces a significant surprise.

Interest rates remain favorable to the United States. The Federal Reserve’s target range is 3.50% to 3.75%, while the Bank of Canada’s policy rate remains at 2.25%. This differential maintains structural support for the U.S. dollar through carry and front-end spreads, unless U.S. inflation moderates further.

Interpreting Canada’s CPI is complicated by tax-related base effects. A temporary GST/HST holiday reduced certain prices last year, causing year-over-year inflation readings to appear elevated even if underlying momentum remains subdued. Relying solely on headline figures may lead to misinterpretation of the data.

USD/CAD is nearing a critical support area. The pair closed at approximately 1.3557 on February 10, following earlier trades near 1.372 in the month, positioning the 1.3500 to 1.3540 range as near-term support.

Volatility remains moderate. CME’s CAD/USD CVOL has hovered around 6% for 30-day implied volatility, indicating event-driven risk rather than crisis conditions. In such environments, price breakouts often reverse unless new data significantly alters rate expectations.

The Macro Backdrop: Inflation Prints That Can Move Rate Differentials

USD/CAD typically reflects the relative performance of both economies rather than one in isolation. The currency pair expresses growth and inflation differentials through policy expectations, while also incorporating commodity sensitivity and global risk sentiment.

On policy, the Fed is still running a clearly tighter stance than the Bank of Canada. The Fed held its target range at 3.50% to 3.75% in late January, and the Bank of Canada maintained its policy rate at 2.25%. That gap is large enough that USD/CAD does not need a strong bullish story to stay supported on dips. It only needs Canada to look “good but not good enough” to force a repricing of the BoC path.

On market rates, the U.S. 2-year Treasury constant-maturity yield was around the mid-3.5% area in early February, while Canada’s benchmark 2-year yield reference sits materially lower, reinforcing the structural USD yield advantage. If CPI surprises change where traders expect the next 50 to 100 basis points of policy to go, USD/CAD can reprice quickly.

Event calendar that matters for USD/CAD

| Release |

Date |

Why it matters for USD/CAD |

| U.S. CPI (January 2026) |

Feb 13, 2026 |

Sets the tone for front-end U.S. yields and Fed timing |

| Canada CPI (January 2026) |

Feb 17, 2026 |

Tests whether CAD strength is supported by “real” inflation momentum or base effects |

| Positioning (COT, Canadian dollar futures) |

Latest: Feb 3, 2026 |

Confirms the market is no longer heavily short CAD |

What The Last Inflation Data Is Really Saying

U.S. Inflation: Calmer Headline, Sticky Pockets

The December 2025 U.S. CPI report is consistent with inflation easing but not “done.” Headline CPI rose 0.3% month over month (seasonally adjusted) and 2.7% year over year. Core CPI rose 0.2% month over month and 2.6% year over year.

For USD/CAD, the most actionable information lies beyond the headline figure. The key consideration is whether components of core inflation linked to domestic demand continue to moderate. Even with a 0.2% monthly increase in core inflation, the market may react negatively if the distribution reflects persistent services inflation and weaker goods prices, as this combination often leads the Federal Reserve to maintain a cautious stance.

Current Inflation And Policy

| Metric (Latest) |

United States |

Canada |

| Headline CPI (YoY) |

2.7% (Dec 2025) |

2.4% (Dec 2025) |

| Core CPI (YoY) |

2.6% (Dec 2025) |

CPI-trim 2.7% (Dec 2025) |

| Shelter CPI (YoY) |

3.2% |

2.1% |

| Policy rate |

3.50–3.75% |

2.25% |

| 2-year gov’t yield |

3.50% |

2.55% |

| 10-year gov’t yield |

4.22% |

3.40% |

| USDCAD spot (Feb 6, 2026) |

1.3644 |

1.3644 |

What matters most in the January U.S. CPI print (for trading):

Core services persistence: If services inflation re-accelerates, front-end yields typically move first, and USD/CAD often follows.

Shelter signal: Shelter tends to move slowly, but unexpected strength can keep the core elevated.

Goods deflation durability: If goods stop disinflating, it changes the feel of the whole core trend.

Canada Inflation: Headline Can Mislead Because Of Tax Base Effects

Canada’s December 2025 CPI rose 2.4% year over year. Monthly CPI fell 0.2% on a not seasonally adjusted basis, while the seasonally adjusted measure increased 0.3%. The key nuance is that the GST/HST holiday temporarily lowered certain prices last year, and that can mechanically push year-over-year inflation higher as those months roll out of the comparison window.

This distinction is important because USD/CAD responds to central bank reaction functions rather than headline figures. If Canada’s CPI appears elevated primarily due to base effects, the Bank of Canada is unlikely to adjust policy. While the currency may initially appreciate, such moves are often reversed once market participants recognize that the policy outlook remains unchanged.

What matters most in Canada’s January CPI (for trading):

Broadening vs. narrow spikes: A one-off category jump is less useful than breadth across core components.

Inflation momentum vs. base effects: Watch whether shorter-run momentum looks calm even if year-over-year rises.

Housing-sensitive components: Canada’s housing channels can feed inflation expectations quickly if they reheat.

Positioning And Volatility: Why The First Move May Not Be The Real Move

Two data points frame the risk profile.

First, speculative positioning is no longer significantly short on the Canadian dollar. According to the latest CFTC data, non-commercial traders held a net long position of 2,130 contracts as of February 3, 2026. Although this is a modest figure, it reduces the likelihood of a substantial CAD rally driven solely by short covering. Further appreciation now depends on supportive economic data.

Second, implied volatility remains moderate. CME’s CAD/USD CVOL has been approximately 6% on a 30-day basis, suggesting that markets anticipate movement but not a fundamental shift. In such conditions, CPI-driven price breakouts may be pronounced intraday but often reverse if subsequent rate changes do not confirm the move.

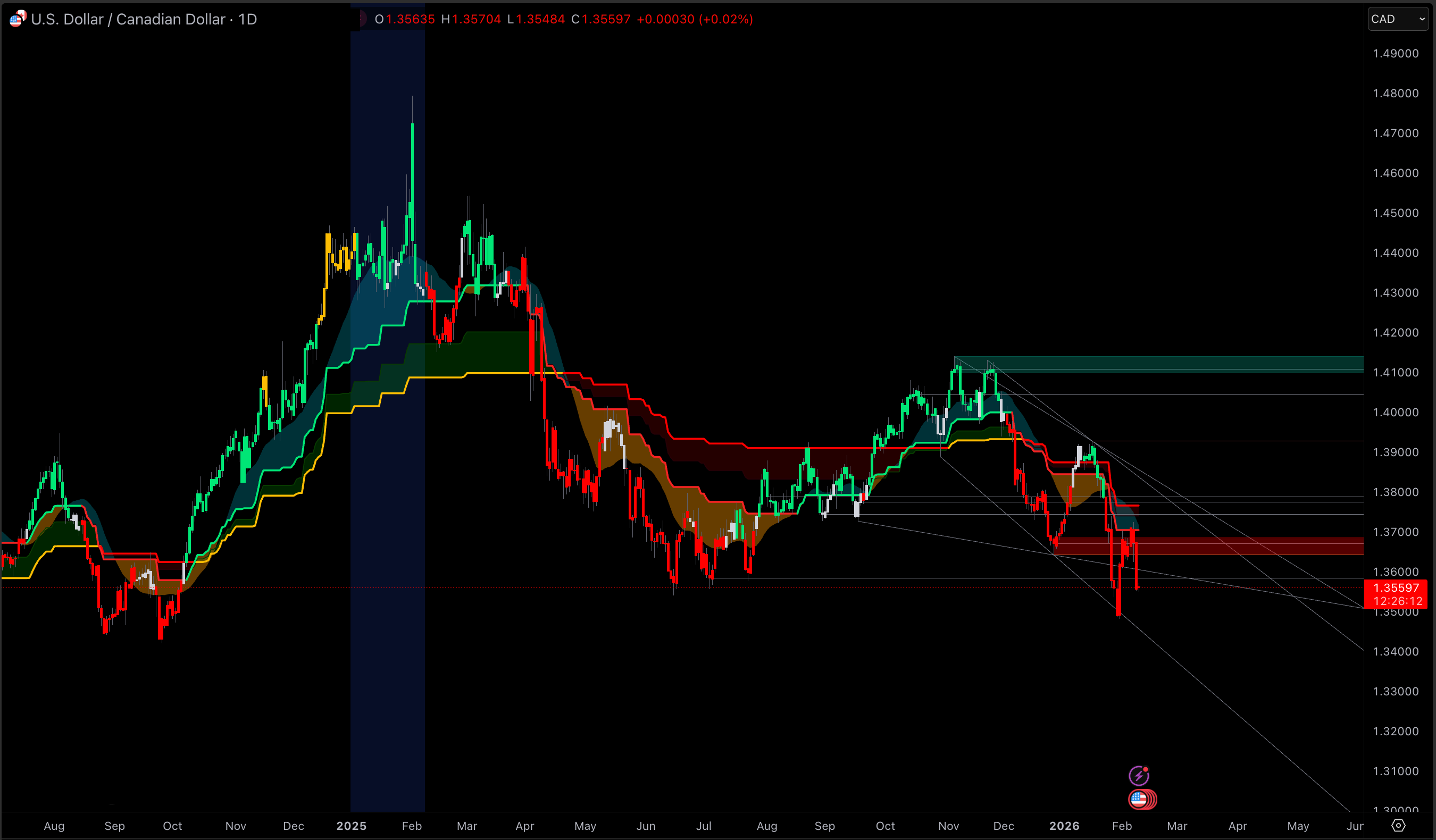

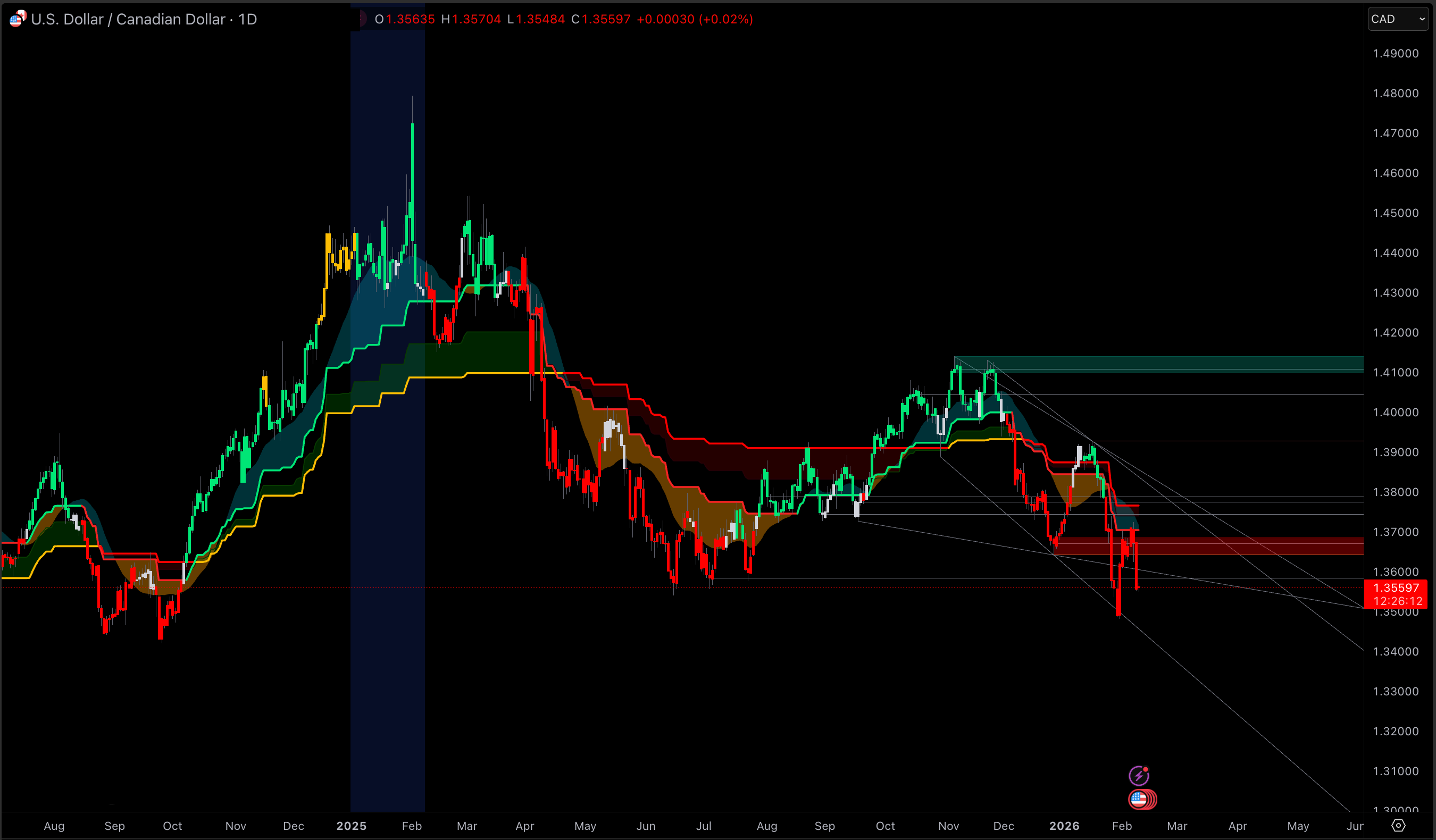

USDCAD Technical Analysis: The Map Before CPI

USD/CAD closed around 1.3557 on February 10, 2026, after trading near 1.372 earlier in February. That drop matters because it drags the pair back into a zone where flows tend to cluster: psychological support (1.3500) plus recent swing structure.

Key USD/CAD levels into CPI week

-

Support zone: 1.3500 to 1.3540

A clean break below 1.3500 increases the odds of continuation toward the next support band.

-

Near-term pivot: 1.3565 to 1.3600

If price reclaims and holds this area after the U.S. CPI release, the downside thesis weakens.

-

Resistance zone: 1.3660 to 1.3725

This is where the recent selloff accelerated. A break and hold above it usually signals that CPI repriced the rates story in favour of USD.

Technical Dashboard

| Indicator |

Reading |

Signal |

| RSI (14) |

28.6 |

Oversold, reversal risk rising |

| MACD (12,26,9) |

-0.0050 |

Bearish, but weakening momentum |

| EMA 20 |

1.3699 |

Price below, near-term downtrend |

| EMA 50 |

1.3775 |

Price below, medium-term bearish |

| EMA 200 |

1.3881 |

Price below, long-term bearish bias |

| Trend |

Down |

Lower highs, lower lows |

| Momentum |

Bearish but stretched |

CPI can trigger sharp snapback |

Three Trade Setups For USD/CAD Before US CPI And Canada CPI

These strategies are event-driven and emphasize confirmation. CPI releases can result in slippage, wider spreads, and initial false moves, making the setup as important as directional bias.

1) The “Two-Sided Breakout” Plan For CPI Volatility

Use when: A directional edge is unclear, but the market is compressed near support.

Buy stop: Above 1.3660

Sell stop: Below 1.3490

Initial stop: 35 to 55 pips from entry (tight enough to control risk, wide enough to survive noise)

First target: 70 to 110 pips

Management: If triggered, reduce risk quickly after the first impulse. CPI trends that lack a second leg often reverse hard.

This approach acknowledges that the U.S. CPI release may set the initial market direction, while Canada’s CPI has the potential to either confirm or reverse that movement.

2) The “Sell Rallies” Plan If U.S. CPI Is Soft And Canada CPI Is Resilient

Macro logic: A softer U.S. CPI usually pressures front-end U.S. yields. If Canada’s inflation momentum remains steady, the policy differential narrative becomes marginally less USD-positive.

Trigger: U.S. CPI drives a drop, then USD/CAD retests 1.3620 to 1.3660 and fails to reclaim the highs

Entry: On rejection signals near the retest zone

Stop: Above 1.3730 (beyond the recent swing highs)

Targets: 1.3500 first, then 1.3420 if momentum holds

Invalidation: A daily close back above 1.3660 increases the chance of a squeeze higher into Canada CPI.

3) The “Trend Reversal” Plan If U.S. CPI Is Hot And Yields Jump

Macro logic: A hot CPI can quickly reprice the Fed's path, pushing U.S. yields higher and reviving USD carry demand. If that happens while CAD is already modestly crowded long, the reversal can be fast.

Trigger: Break and hold above 1.3725 after the U.S. CPI release

Entry: On a successful retest of 1.3700 to 1.3725, holding as support

Stop: Below 1.3630

Targets: 1.3860, then 1.3950 if momentum and rates confirm

Risk consideration: The release of Canada’s CPI may disrupt the prevailing trend. It is advisable to reduce risk exposure ahead of the second data release unless the initial move demonstrates strong trend consistency.

Frequently Asked Questions (FAQ)

What time are the US CPI and Canada CPI releases?

The U.S. CPI for January 2026 is scheduled for February 13, 2026, and Canada’s CPI for January 2026 is scheduled for February 17, 2026. Both releases typically hit at 8:30 a.m. Eastern Time, when liquidity is deep but spreads can still widen sharply.

Why does USD/CAD react so strongly to inflation data?

Inflation drives interest-rate expectations. USD/CAD is highly sensitive to changes in the U.S.-Canada rate differential, especially at the front end. When CPI alters the expected path for the Fed or the Bank of Canada, bond yields move first, and the currency often follows within minutes.

What is the biggest mistake traders make during CPI week?

Treating the first spike as the final direction. CPI often produces an initial impulse, then a reversal once rates markets digest the details. Waiting for confirmation, such as a retest of a broken level or follow-through in yields, improves risk-adjusted outcomes.

How does the GST/HST holiday affect Canada CPI interpretation?

Tax-related price distortions can create base effects that push year-over-year CPI higher even if current inflation momentum is not accelerating. That can generate a short-term CAD reaction that fades if traders conclude the BoC does not need to respond to a “headline-only” surprise.

Is positioning important for USD/CAD right now?

Yes, because it changes the asymmetry. With non-commercial CAD positioning only modestly net long (+2,130 contracts), the market is not stretched, but it is no longer set up for a large CAD rally driven purely by shorts covering. Data now matters more than flow.

How can traders control risk during CPI releases?

Reduce leverage, use predefined invalidation levels, and avoid chasing the first 30-60 seconds. Consider scaling out quickly if the trade moves in your favor, since CPI volatility can reverse abruptly. Always plan for wider spreads and potential slippage around the release.

Conclusion

USD/CAD approaches the U.S. and Canada CPI releases with a unique combination of factors: a structural yield advantage for the United States, a tactical shift toward Canadian dollar strength, and price action near a key technical level conducive to breakout trading. The most effective strategy is to observe the sequence of events, allowing the U.S. CPI to establish the initial direction and then using Canada’s CPI to assess whether the move is fundamentally supported or likely to reverse.

Practically, the 1.3500 to 1.3540 range delineates a controlled downtrend from a more significant USD/CAD decline. A break below this support, driven by interest rate developments, could extend downward momentum. Conversely, if this level holds and the pair recovers to 1.3660 following the data releases, a mean-reversion scenario toward the previous trading range is likely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

(Bureau of Labor Statistics)(cftc.gov)(federalreserve.gov) (www150.statcan.gc.ca)(federalreserve.gov)