The U.S. Producer Price Index (PPI) report is due today, Friday, January 30, 2026, and it arrives at a moment when markets are particularly susceptible to any signal about inflation persistence.

The Federal Reserve maintained interest rates on January 28, 2026, keeping the federal funds target range at 3.50%–3.75%. It indicated that any future changes will depend on incoming data rather than a predetermined path.

At the same time, risk appetite is not quiet. U.S. equities have been approaching new highs as investors rotate between "growth optimism" and "policy anxiety," depending on the latest macroeconomic data and headlines.

What Time Is the US PPI Report Today?

| Location |

Local time |

| New York (ET) |

8:30 a.m. |

| London (GMT) |

1:30 p.m. |

The Bureau of Labor Statistics will release the December 2025 PPI today at 8:30 a.m. ET.

Key Note:

This release is not just another monthly datapoint, because the federal government shutdown in October and November delayed data collection and shifted the release schedule.

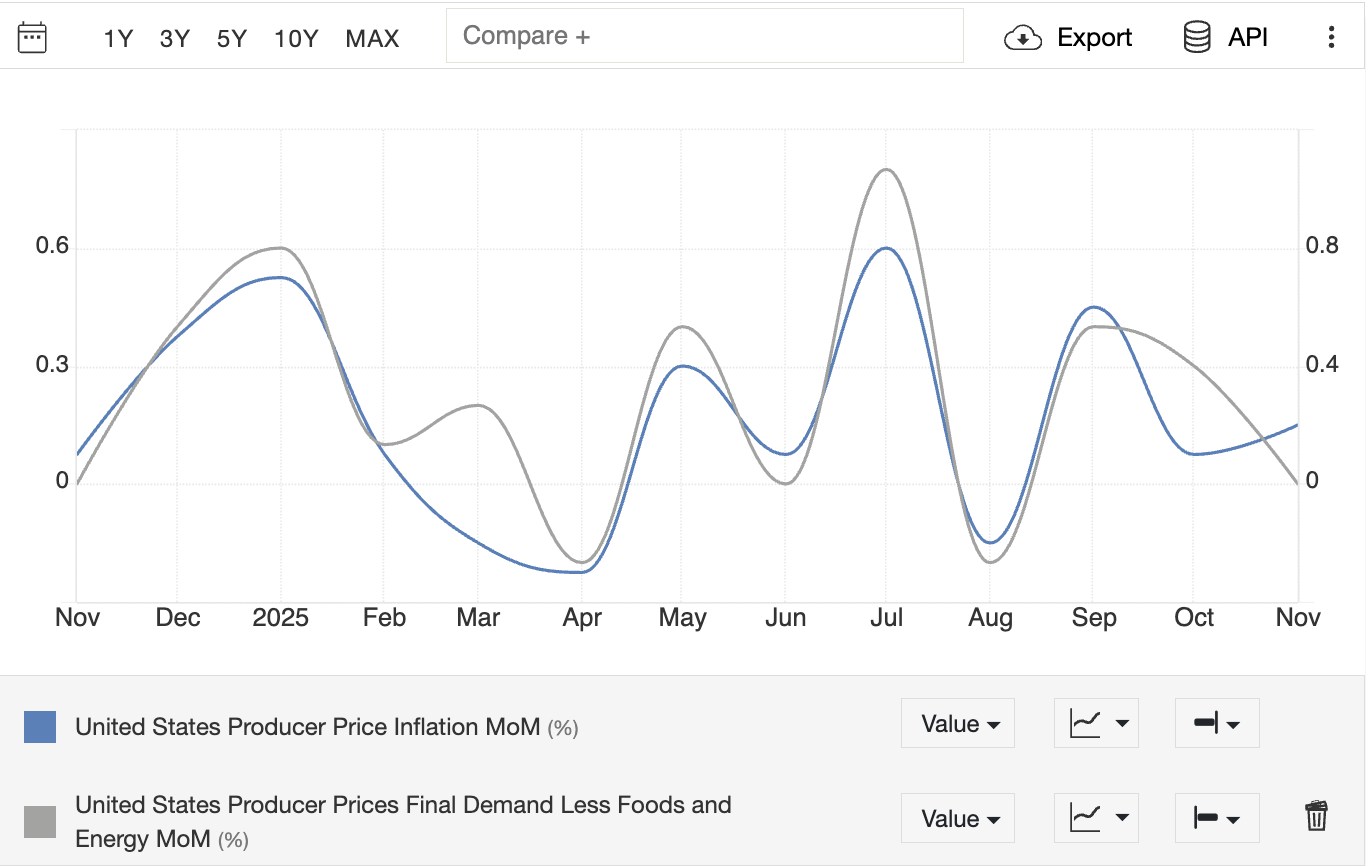

Market Forecast for Today's US PPI Report

| Measure |

Forecast |

Previous |

| Headline PPI (m/m) |

0.2% |

0.2% |

| Headline PPI (y/y) |

2.7% |

3.0% |

| Core PPI (m/m) |

0.3% |

0.0% |

| Core PPI (y/y) |

2.9% |

3.0% |

What the Forecast Mix Implies:

It points to a steady headline print and a firmer core monthly pace. If the core number runs hotter than expected, markets typically treat it as the more durable inflation signal.

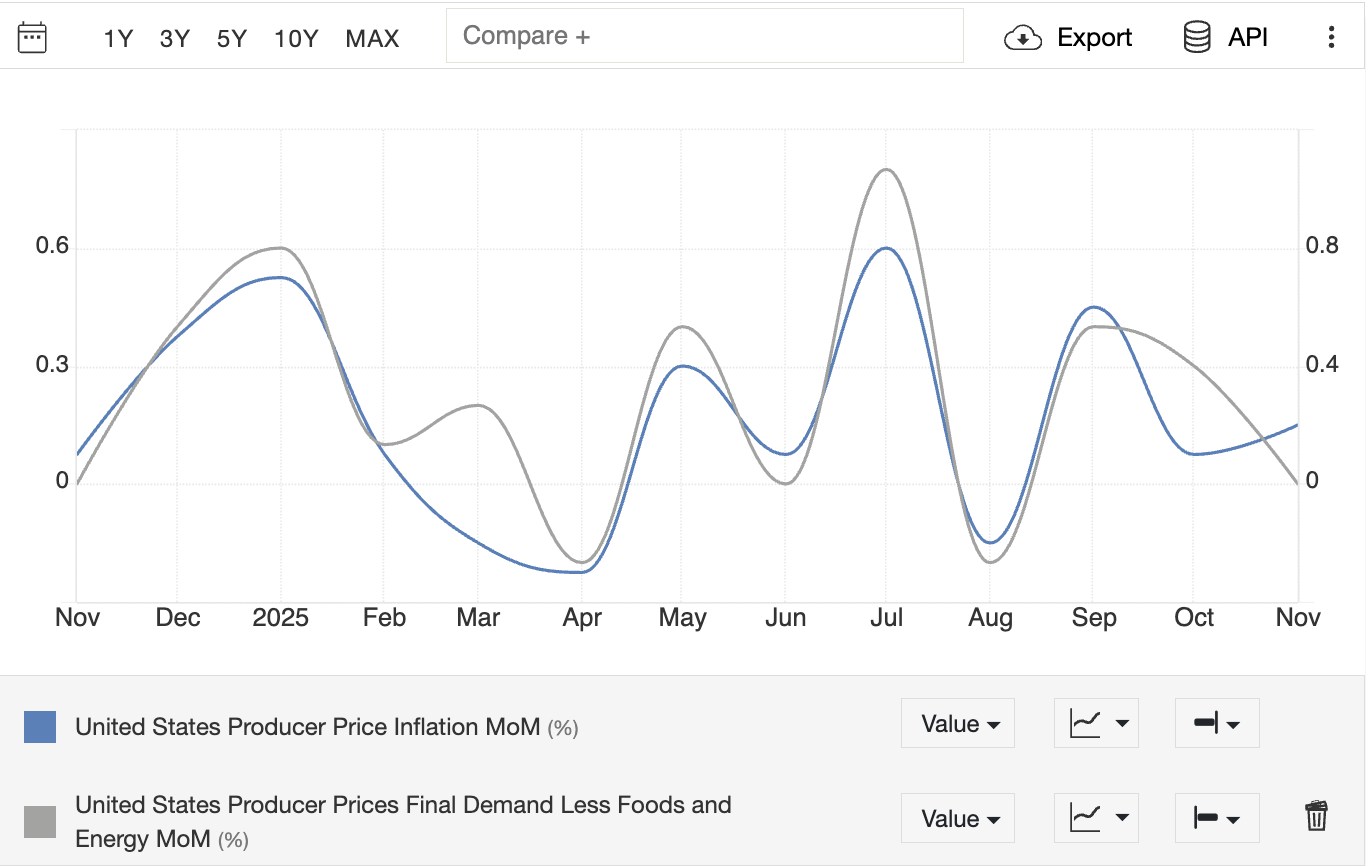

Quick Recap: What the Last US PPI Report Told the Market

The most recent official PPI report (for November 2025) showed headline final demand prices rising 0.2% on the month, with 0.9% coming from goods while services were flat. On a 12-month basis, final demand prices were up 3.0%.

Two details stood out:

1) Energy Did the Heavy Lifting in Goods

Final demand energy increased by 4.6%, while gasoline prices surged by 10.5%.

2) Trade Services Margins Fell

The BLS noted that margins for final demand trade services declined by 0.8%, a reminder that PPI is not only about commodity inflation. It also captures margin dynamics across the supply chain.

The BLS also highlighted that "final demand excluding foods, energy, and trade services" increased by 0.2% for the month and rose 3.5% over the year, indicating a persistent "underlying" pressure that makes the Fed cautious.

What to Watch Inside Today's US PPI Report

The market's first reaction will be to determine whether the data runs hot or cool relative to consensus. The second reaction will focus on where the pressure is showing up, because that determines whether inflation is likely to spill over into consumer prices.

1) Energy-Linked Volatility

If energy-driven categories push the headline PPI above expectations, the market often sees it as less "sticky" than a broad services acceleration. The problem is that energy can still quickly influence inflation psychology, especially when it hits transport and logistics costs.

2) Trade Services and Margin Pressure

Trade services in PPI measure margin changes at wholesalers and retailers. When margins compress, it can look disinflationary in the data, but it can also signal stress for parts of the corporate sector if it persists.

The November report's decline in trade margins is a valuable reference point for what to monitor again today.

3) Services That Matter for the Fed's PCE Inflation Lens

Some PPI categories help shape the inflation picture that ultimately matters most for policy expectations, because PCE inflation is central to the Fed's reaction function.

The BEA has explained that market-based PCE components are deflated using detailed CPI or PPI measures, and the BLS has noted that healthcare PPIs are used to deflate the PCE healthcare components.

That is why traders should listen closely for areas like:

Healthcare-related service prices.

Transportation and warehousing service prices.

Financial and portfolio-management related service prices.

Scenario Map: How Markets Often React to PPI Reports

| Outcome vs forecast |

Likely rates reaction |

Likely USD reaction |

Likely equities reaction |

Likely gold reaction |

| Hot PPI (headline and core above) |

Yields tend to rise. |

USD tends to strengthen. |

Stocks often dip at first. |

Gold often softens. |

| Hot core, soft headline |

Yields can still rise. |

USD can firm. |

Mixed, because traders debate "stickiness." |

Mixed to lower. |

| In-line PPI |

Smaller moves. |

Smaller moves. |

Focus shifts to earnings and risk mood. |

Range trading is common. |

| Cool PPI (headline and core below) |

Yields tend to fall. |

USD tends to soften. |

Stocks often catch a bid. |

Gold often benefits. |

No two inflation days trade the same, but the first reaction usually follows the same logic: inflation surprises change the expected path of policy.

Key Warning:

If markets are heavily positioned in one direction before the print, even a slight miss can trigger a violent reaction as traders are forced to unwind their positions.

Key Levels to Watch After the Print

Listed below is a trader-friendly set of reference zones using liquid proxies. These are not predictions. They are practical checkpoints where price movement frequently accelerates or slows down.

| Market proxy |

Current reference |

First resistance area |

First support area |

| SPY (S&P 500 ETF) |

~694 |

700 (psychological) |

685 (recent swing area) |

| UUP (Dollar Index bull fund) |

~26.59 |

26.70 |

26.50 |

| TLT (20+ year Treasury ETF) |

~87.62 |

88.00 |

87.00 |

Key Takeaway

If PPI is hotter and yields jump, TLT is the first place to watch for a clean directional break.

If PPI is cooler and the dollar slips, UUP often shows that shift quickly. If rates fall on a cool print, SPY may attempt another push through round-number resistance.

What to Watch After Today's US PPI Report?

1) Revisions

PPI data can be revised for up to four months after its initial publication.

That means a "clean" inflation trend can become less clean later, and the Fed will notice.

2) The Fed's Reaction

With policy already paused and the Fed openly data-dependent, inflation prints have extra weight.

3) PPI will be Judged Against PCE, not CPI headlines

The Fed's preferred inflation gauge is PCE, and the market will immediately translate today's result into "what it might mean for PCE services.

Frequently Asked Questions

1. What Time Is the US PPI Report Today?

The December 2025 US PPI report is scheduled for 8:30 a.m. ET on Friday, January 30, 2026.

2. What Is the Market Expecting for PPI Today?

Consensus expects headline PPI at 0.2% m/m and 2.7% y/y, and core PPI at 0.3% m/m and 2.9% y/y for December.

3. Which Number Matters More, Headline PPI or Core PPI?

Core PPI is often more significant for market pricing because it excludes the volatility of food and energy, which can fluctuate sharply from month to month.

Conclusion

In conclusion, the US PPI report today is not just a routine inflation update. It is a direct test of whether pipeline inflation is cooling fast enough to support future rate cuts after the Fed's January pause.

If you are planning around macro volatility, focus on preparation rather than prediction.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.