As the US enters 2025, traders face a landscape shaped by slowing growth, persistent inflation, and evolving policy risks. Understanding the key trends is essential for navigating the year's opportunities and challenges.

5 Key Trends for US Economic Outlook 2025

1. Slower GDP Growth: Navigating a Decelerating Economy

The US economy is forecast to grow at just 1.4% in 2025, according to the latest Federal Reserve and World Bank estimates—a notable slowdown from the robust 2.8% expansion seen in 2024. This downward revision, from the 1.8% projected in March, reflects the impact of tighter monetary policy, new US tariffs, and ongoing global economic headwinds. The Organisation for Economic Co-operation and Development (OECD) projects a similar slowdown, with growth dipping to 1.6% in 2025.

For traders, this signals a more cautious environment for equities, especially in cyclical sectors that are sensitive to economic momentum. A slower growth environment often favours defensive sectors and increases the importance of careful sector allocation. Keep an eye on GDP releases and leading indicators such as manufacturing PMIs and retail sales, which can provide early signals of economic turning points.

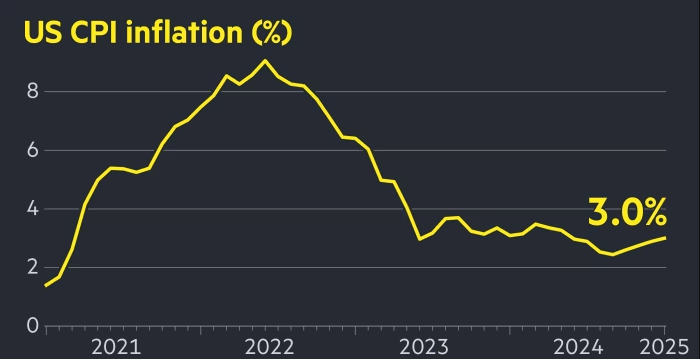

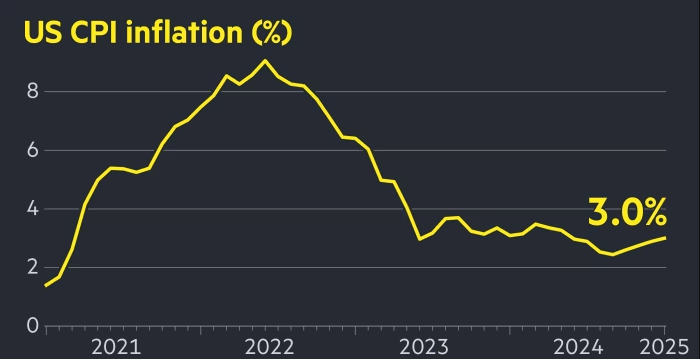

2. Inflation Remains Stubborn: Stagflation Concerns

Inflation is expected to remain above the Fed's 2% target throughout 2025. The central bank's preferred inflation gauge, the core personal consumption expenditures (PCE) price index, is now projected to rise 3.1% in 2025, up from the 2.8% estimate made in March. Headline PCE inflation is also forecast to hit 3%, a significant jump from the 2.1% annual rate seen in April 2025. The OECD projects inflation could approach 4% if tariffs are prolonged or expanded.

This combination of high inflation and slow growth has revived stagflation concerns. According to a recent JPMorgan survey, over half of institutional respondents see stagflation as a greater risk than recession in the US this year. For traders, this environment can lead to increased volatility across asset classes. Commodities, inflation-protected securities, and select defensive stocks may offer relative safety, while growth stocks could face renewed pressure if inflation expectations remain elevated.

3. Labour Market Weakens: Unemployment on the Rise

The US labour market, which showed remarkable resilience in recent years, is now showing signs of strain. The unemployment rate is forecast to climb to 4.5% by the end of 2025, up from 4.2% in May and higher than the 4.4% previously expected. The Philadelphia Fed's latest survey also predicts higher unemployment rates over the next several years, with job gains moderating to an average of 140,900 per month in 2025, down from previous estimates.

A weakening labour market could dampen consumer spending and corporate earnings, particularly in sectors reliant on discretionary income. For traders, this may mean a shift towards defensive sectors such as healthcare and utilities, as well as companies with stable demand profiles. Monitoring weekly jobless claims, nonfarm payrolls, and wage growth data will be crucial for anticipating market moves.

4. Policy and Geopolitical Risks

Policy uncertainty remains a defining feature of the US economic outlook 2025. The impact of new US tariffs—currently averaging over 15%, the highest since the 1930s—ongoing trade disputes, and the potential for further policy shifts under the Trump administration are all contributing to market volatility. The recent round of tariffs, including a 10% baseline on most imports and 25% on autos, is expected to push core inflation as high as 3.7% by year-end if maintained.

Geopolitical tensions, particularly between Israel and Iran, have also led to sharp moves in oil prices, which surged more than 4% in the past 24 hours.

These developments can have rapid and significant effects on inflation, consumer confidence, and risk sentiment. For traders, staying alert to policy announcements, central bank communications, and geopolitical headlines is essential for managing risk and identifying new opportunities.

5. Trading Opportunities: Sector Rotation and Risk Management

Despite the challenges, 2025 presents opportunities for traders who can adapt to the evolving environment. Sector rotation is likely to be a key theme, with experts highlighting financials, information technology, communication services, utilities, and energy as sectors to watch.

Defensive sectors such as healthcare and utilities may outperform if economic growth remains subdued, while energy could benefit from higher oil prices and increased demand for infrastructure tied to AI and data centres.

The strong US dollar and higher yields may also favour financials, while elevated volatility creates opportunities in options and derivatives markets for those with robust risk management strategies.

Traders should remain nimble, diversify their portfolios, and use technical analysis alongside macroeconomic data to identify entry and exit points. Additionally, cash is expected to remain a top-performing asset class in 2025, according to institutional surveys, due to persistent uncertainty and elevated yields.

What to Watch: Key Data and Signals for Traders

GDP and inflation releases: These will drive market sentiment and influence Fed policy.

Labour market trends: Watch for shifts in jobless claims, nonfarm payrolls, and wage growth.

Fed policy updates: The central bank's stance on rates and inflation remains pivotal. The Fed's “dot plot” still points to two rate cuts in 2025, but there is growing division among policymakers, and the timing remains uncertain.

Geopolitical developments: Tariffs, trade policy, and global tensions can move markets rapidly.

Sector performance: Monitor rotation between defensive and cyclical sectors for trading signals.

Closing Statement

As 2025 unfolds, the US economic outlook is marked by slower growth, persistent inflation, and heightened policy risk. For traders, success will depend on staying informed, managing risk proactively, and seizing opportunities as market conditions evolve.

The interplay between monetary policy, inflation, and global events will continue to shape market dynamics, making flexibility and vigilance more important than ever.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.