Oil prices pulled back on Friday though there was no sign of an Exit Strategy

from Israel and Iran. Israel defence minister Israel Katz said that Ayatollah

Ali Khamenei "cannot continue to exist."

Trump concluded a meeting Wednesday with top advisers as he weighed whether

to plunge the US into the ongoing war between Israel and Iran, but the White

House offered few clues about his decision.

The US is seen as being able to provide military firepower necessary to

destroy Iran's underground enrichment facility at Fordow, which analysts say

Israel is unable to do alone.

Adding to the encouraging headlines, US crude oil stockpiles posted their

largest decline in a year in the week ending 13 June, while gasoline and

distillate inventories rose, according to the EIA.

But the IEA forecast in its latest report China's oil demand will stop

growing in 2027 - earlier than previously expected, reinforcing the outlook for

a global peak and prolonged supply surplus this decade.

US output will keep growing, complemented by Brazil, Canada and Guyana. About

5.1 million barrels of production capacity will be added this decade, double the

increase in oil demand, according to the report.

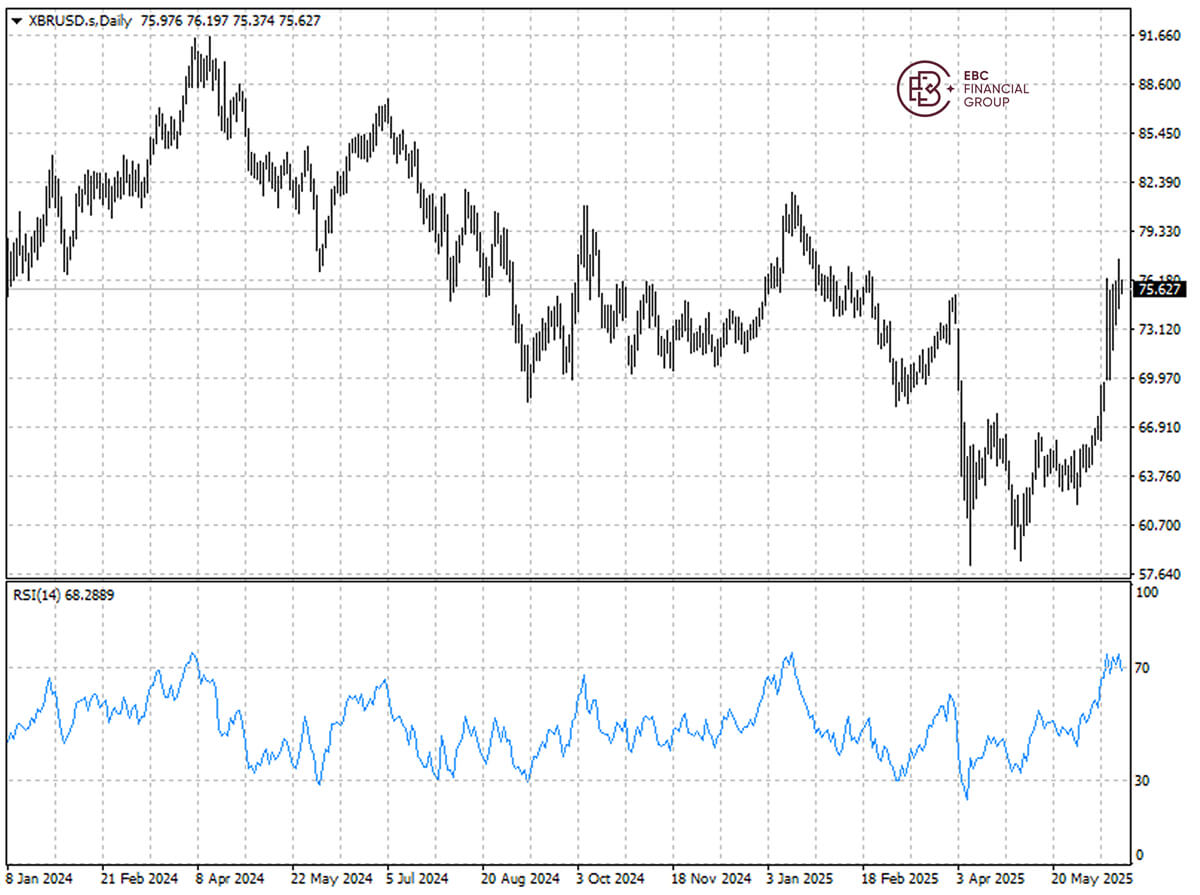

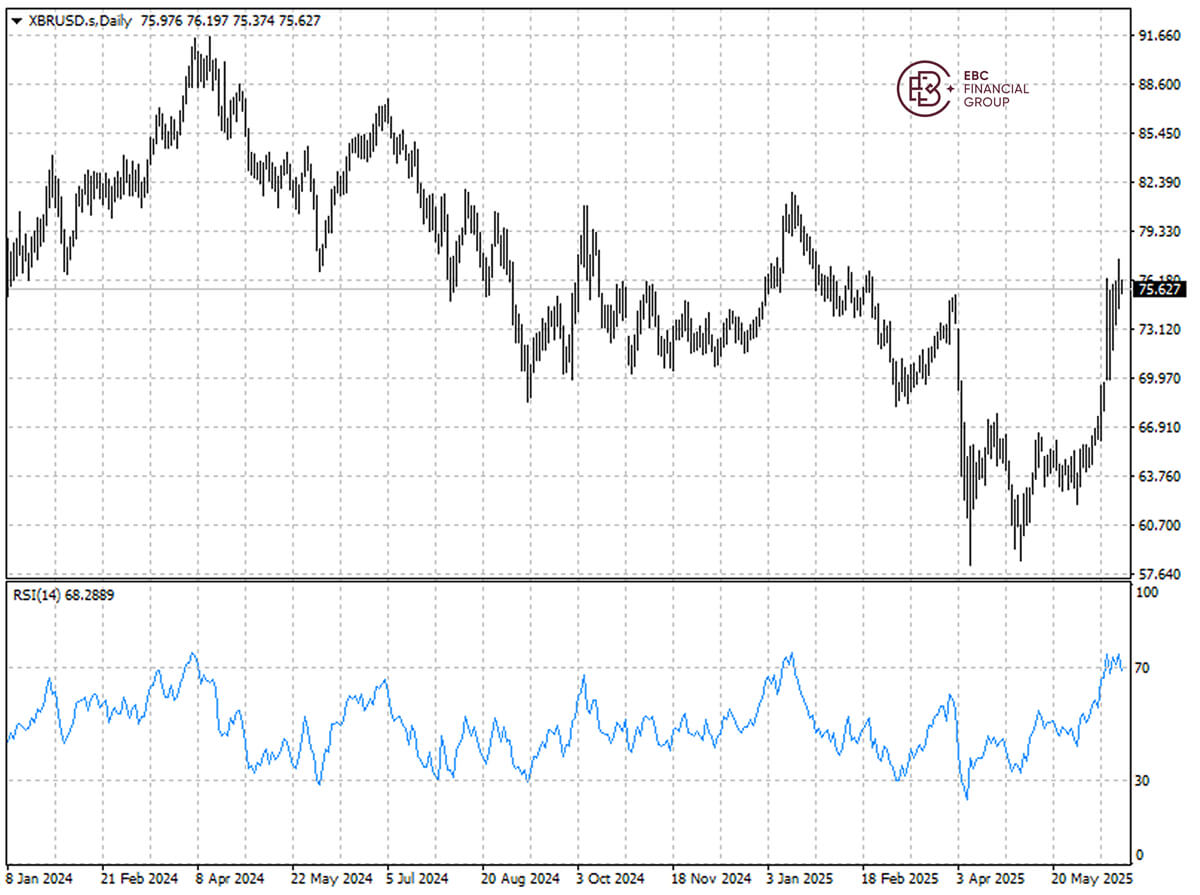

Brent crude is heading for a third straight substantial weekly gains. The

price has come off the overbought territory. The uptrend remains intact but a

temporary decline towards $74 cannot be ruled out.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.