U.S. inflation softened in May, with key CPI data falling below expectations.

The latest CPI Report May 2025 has prompted traders to increase bets on rate

cuts, with the market now broadly expecting two reductions by the Federal

Reserve before year-end.

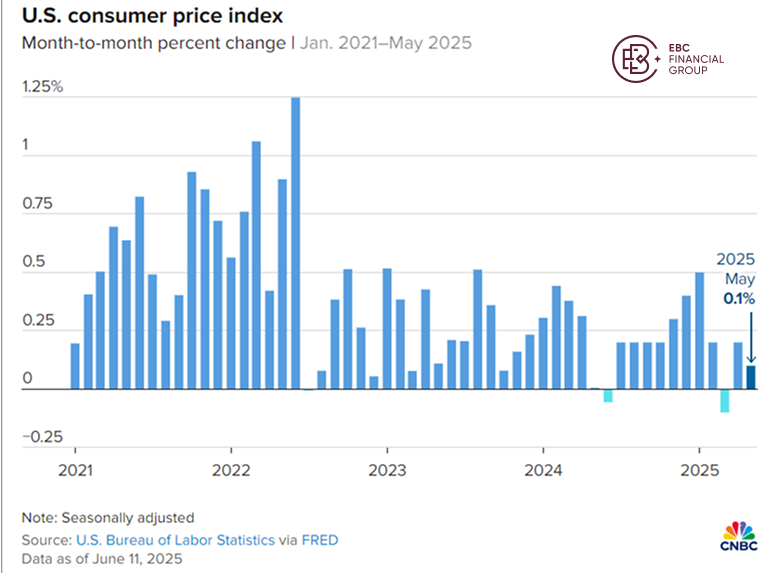

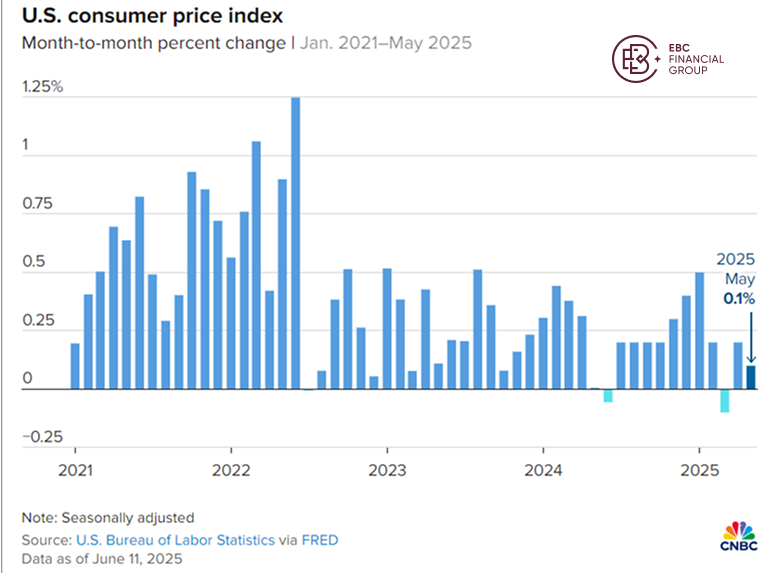

The U.S. Department of Labor reported a 2.4% year-on-year rise in CPI, under

the forecasted 2.5%. On a monthly basis, inflation ticked up just 0.1%, also

below expectations. Core CPI, excluding food and energy, rose 2.8% from a year

earlier and just 0.1% from April—both weaker than consensus.

CPI Report May 2025 Highlights Cooled Categories

The report showed clear disinflation across several components. Energy prices

dropped 1%, while new and used vehicles saw declines of 0.3% and 0.5%

respectively. Clothing prices fell 0.4%, offsetting a 0.3% rise in both food and

shelter costs. The U.S. Bureau of Labor Statistics highlighted housing as the

main driver behind the modest monthly increase.

According to CNBC, falling energy and service prices helped limit broader

price gains. Some analysts had anticipated a rise in tariffs would impact

categories like automobiles and apparel. However, both segments saw price

declines, contradicting earlier predictions.

Rate Cut Bets Rise as Market Reacts to Softer CPI

Following the data release, market expectations for rate cuts intensified.

Fed futures now imply 77 basis points of easing over the next 12 months, up from

67 previously. Projections for December rose to 48 basis points from an earlier

42. Financial markets reacted swiftly: U.S. equity futures turned higher and

spot gold broke through the $3,360 level.

Tariff Pressures Yet to Hit Consumers

May marked the fourth consecutive month of lower-than-expected core

inflation, raising questions over why tariffs have not translated into higher

consumer prices. Analysts suggest that firms may still be absorbing extra costs,

or that the temporary suspension of some tariffs has muted the impact so

far.

Looking forward, that protection may wane. If the tariff pause expires and

further duties are imposed, firms could be forced to pass on more costs to

consumers, fuelling future inflation.

Fed Stance in Focus Amid Political Pressure

The Federal Reserve is expected to keep rates unchanged at its next meeting.

Still, political pressure is mounting. President Trump has openly urged Fed

Chair Jerome Powell to mirror rate cuts by the ECB and Bank of England, calling

for a full percentage point cut.

Nick Timiraos, often seen as a reliable guide to Fed thinking, attributed the

weaker CPI to lower prices in cars and clothing, sectors expected to reflect

early tariff effects. The CPI Report May 2025 was released as the White House

continues trade negotiations, adding further weight to upcoming Fed

decisions.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.