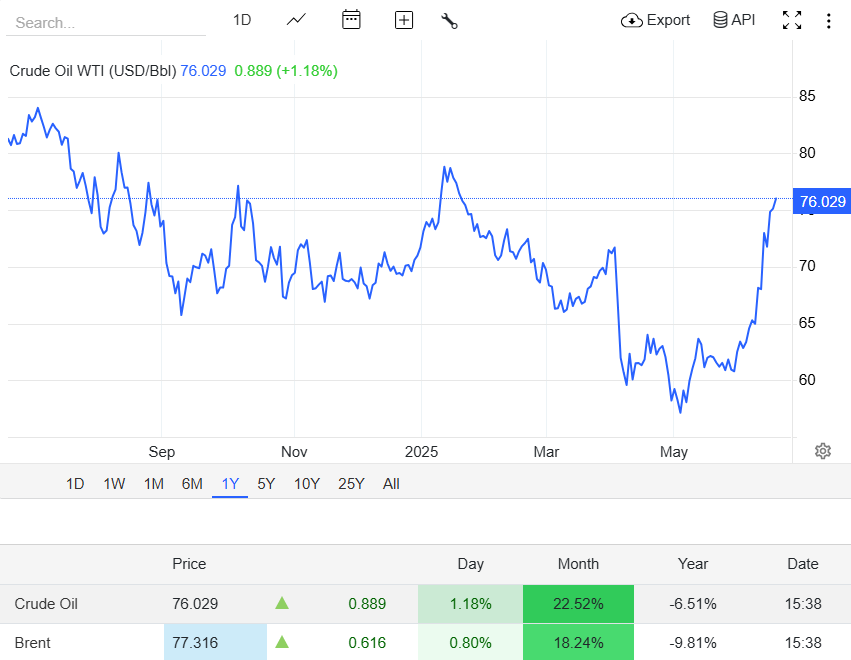

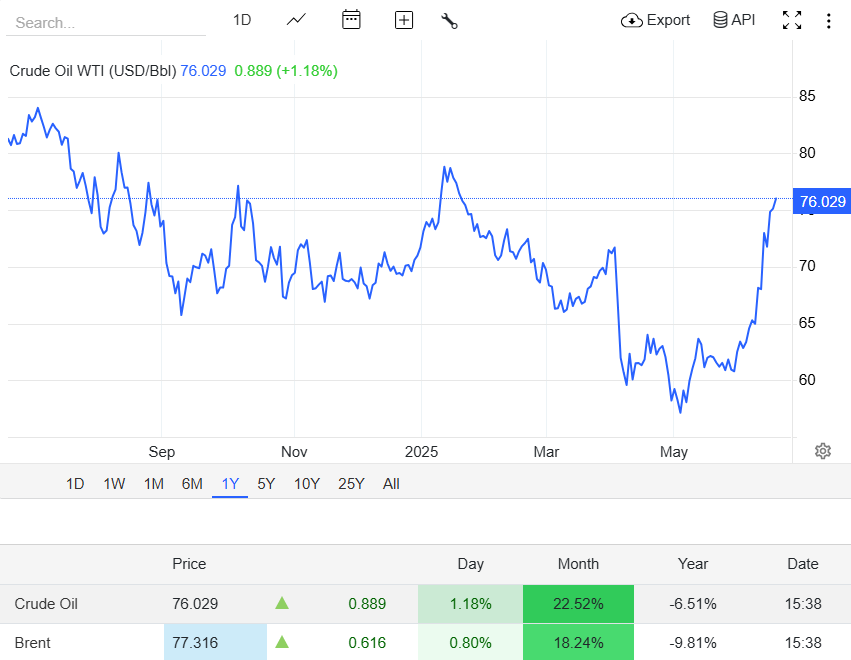

The price of crude oil, often quoted as XTIUSD (U.S. Dollar per West Texas Intermediate barrel), has surged this June 2025 amid escalating geopolitical tensions. Currently trading around $76 per barrel, oil has seen volatile swings of 4–11% in recent days.

Given the risks of conflict in the Middle East, threats to crucial chokepoints such as the Strait of Hormuz, and various global macroeconomic factors, it is essential for investors, consumers, and policymakers to understand how far XTIUSD prices may rise.

XTIUSD Price Today and Recent Movements

On June 19, Brent crude spiked to $76–77 per barrel, driven by escalating Iran–Israel hostilities. U.S. West Texas Intermediate (WTI) traded slightly lower, around $74–75, after recent jitters.

For additional context:

On June 16, a $1 drop in WTI to $71.77 reflected hopes of de-escalation.

On June 17, Brent climbed 4.4%, settling at $76.45, following Iranian retaliatory strikes and threats to cut access through the Hormuz Strait—though no physical disruptions have occurred.

On June 18, prices were around $76.70 for Brent and $75.14 for WTI as concerns about U.S. involvement elevated.

Still, the general trend has been upward, with Brent climbing 4–11% after Iranian energy infrastructure was targeted.

For example, traders are aggressively placing $80 call options on WTI—volumes hit the highest level this year, signalling expectations of further volatility.

Inventory and Production Data

U.S. crude stocks dropped by 11.5 million barrels last week, the largest draw in a year, despite refinery slowdowns.

Global supply and demand: The IEA's June report indicates that supply is exceeding demand by approximately 1 million barrels per day, supported by a 93 million-barrel increase in May.

This excess supply should anchor prices near $60–65, assuming geopolitical stress eases.

Geopolitical Drivers Behind the Surge

1. Middle East Conflict & Infrastructure Attacks

Airstrikes on Iran's energy assets—like South Pars gas fields and Kharg Island—reignited fears around supply vulnerability.

2. Strait of Hormuz Risk

As a transit route for nearly 20% of seaborne oil, any military escalation could trigger sharp price spikes. Goldman notes worst-case scenarios, pushing Brent past $100–120/bbl.

3. U.S. Involvement & Reaction Risk

Markets currently price in a 7% to 9% chance of U.S. military escalation. A Reuters report notes that renewed U.S. action could bump prices to $85–100/bbl.

XTIUSD Forecast: Will Prices Continue Up?

Base Case: $60–65 by Q4

Goldman and J.P. Morgan align on maintaining oil in the low-to-mid $60s, assuming no further disruptions and balanced OPEC+ output.

Upside from Short-Term Risk

If conflict intensifies and the Strait of Hormuz is threatened, an additional $10–20 premium could push Brent temporarily into the $90–120 range.

Structural Equilibrium to 2030

The IEA predicts a gradual increase in demand of 2.5 million barrels per day by 2030, while supply is expected to grow by approximately 5 million barrels per day. Absent consistent disruptions, oil prices are likely to stabilise in the $60 to $70 range over the next five years.

Market Implications

1. Inflationary Impact

Rising oil prices feed into consumer inflation—potentially elevating CPI back toward 5% in the U.S., jeopardising central banks' inflation goals.

2. Fed and Rate Policy

The U.S. Federal Reserve has paused at 4.25% to 4.5%. However, it may reconsider this decision if oil prices fluctuate significantly, which could affect broader financial markets.

3. Risk Asset Volatility

Equity and currency markets are sensitive to movements. Safe-haven demand boosts the U.S. dollar and gold when turmoil strikes.

Trading Insights and Key Risk Triggers

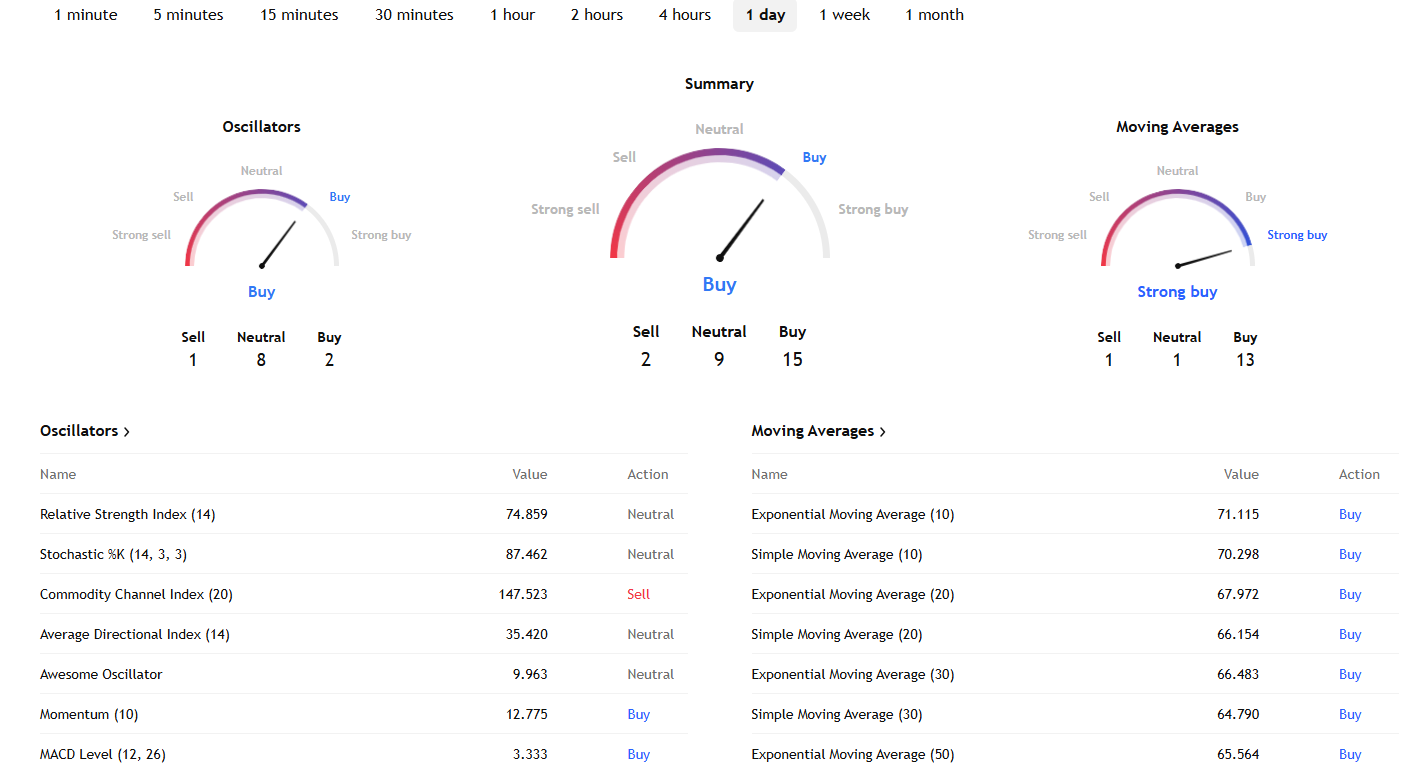

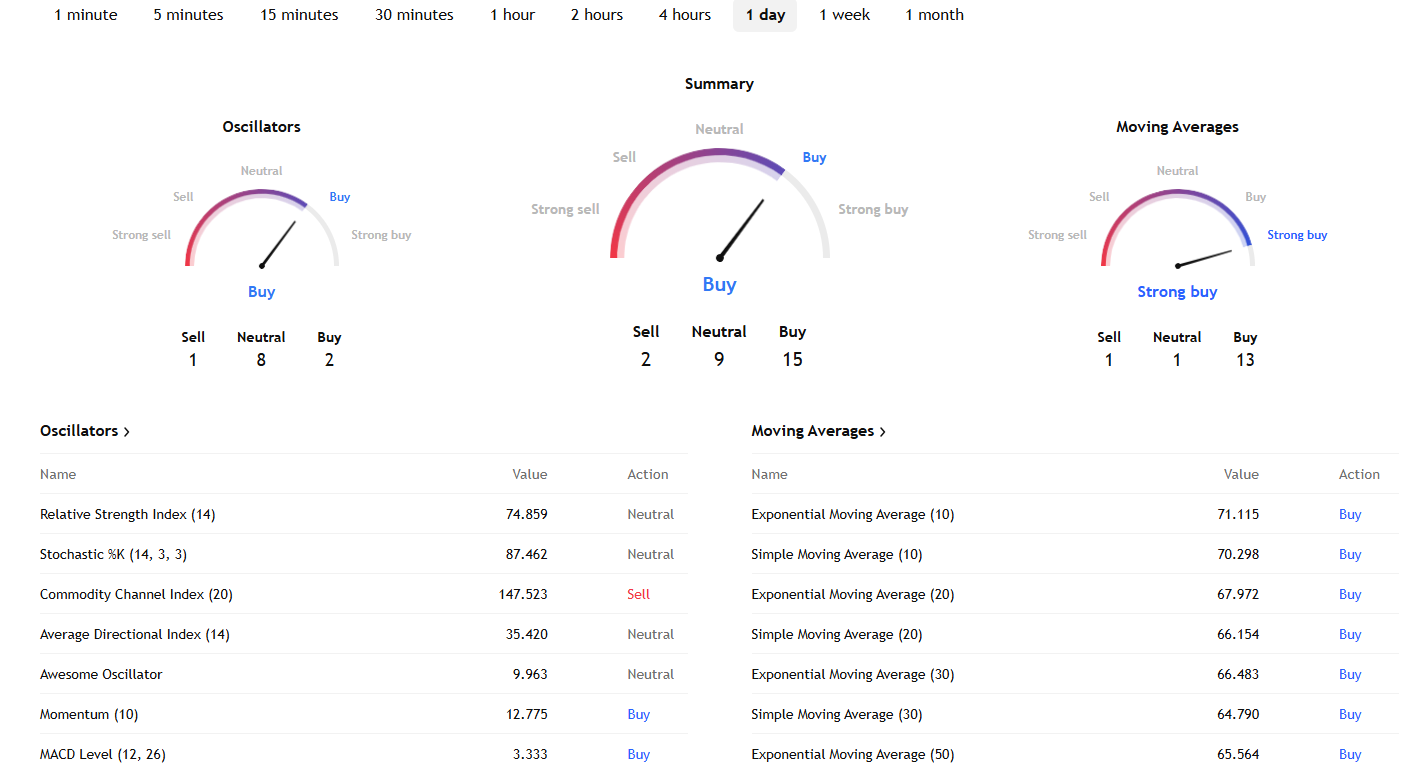

Short-term technical charts indicate XTIUSD is overbought, setting up for corrections around 5–10%. Still, momentum remains strong amid heightened volatility and tight fundamentals. Yet, option flows—particularly in $80 WTI calls—indicate strong speculative betting on further upside.

Regardless, there are four key risks traders and investors must monitor, in which are:

De-escalation in the Middle East that reverses oil gains.

U.S. policy shifts, intervention or sanctions escalation.

OPEC+ response: increased output could ease prices.

The global economic slowdown weakening demand, especially in China.

Conclusion

In conclusion, geopolitical risk remains the dominant force shaping XTIUSD in the near term—adding up to $10/bbl in price premium. If no significant disruptions occur, a structural supply surplus is likely to cap prices near $60–65 by Q4 2025.

However, a serious spike, for example, testimony to a blocked Hormuz—could push Brent beyond $90–120, with ripple effects on global inflation, markets, and energy policy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.