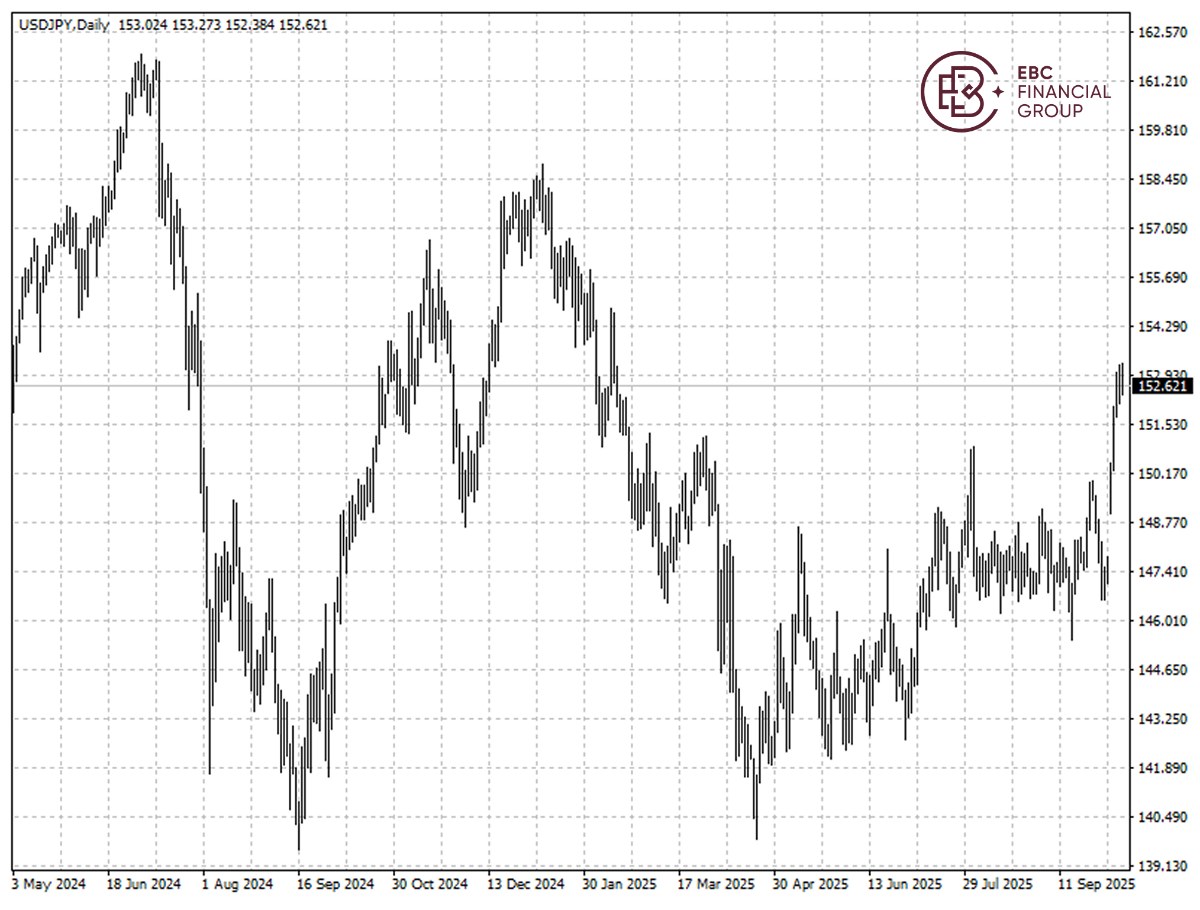

The yen was set for its steepest weekly drop in a year due to fast-receding

chances of a near-term rate hike. A once-popular currency trade betting against

the yen looks set to make a comeback.

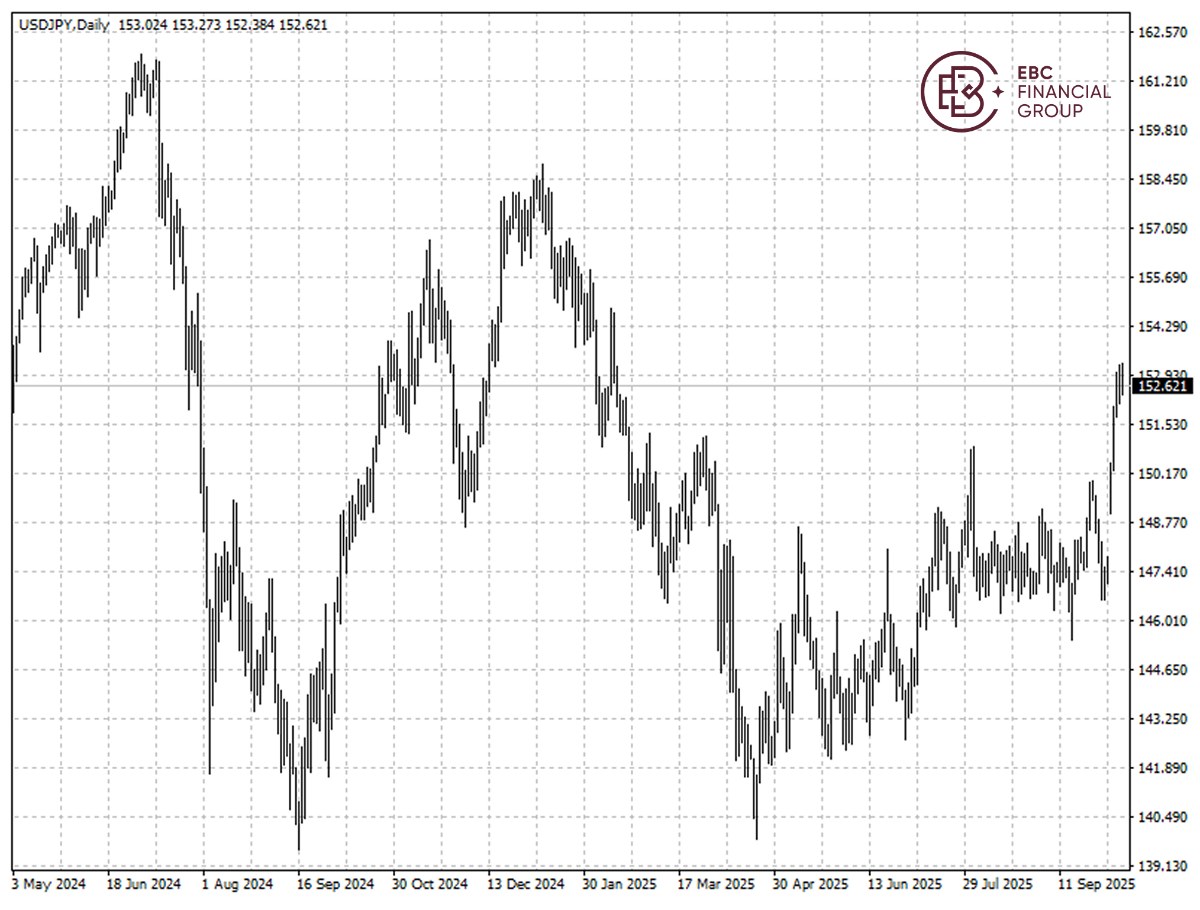

The strategy turned out to be highly profitable in recent weeks. One-month

implied volatility in dollar-yen has fallen over 40% from the year's high and

reached the lowest level in over 12 months in September.

Meanwhile, the premium paid to hedge against the yen falling relative to

gains against the greenback over the next month has risen to the highest level

in more than three years.

Traders are seeing a 25% chance of BOJ move later this month. Takaichi's

closet economic adviser Takuji Aida said the yen's current depreciation is

beneficial on the grounds of the bullish stock market.

"At 140 or 150 yen to the dollar, it becomes viable to manufacture goods

domestically. This exchange rate level is helping drive the capital investment

cycle upward and also serves as a buffer against US tariffs," he said.

The BofA expects the currency to end this year at 155 per dollar, while

strategists at Deutsche Bank said they had decided to close their bullish yen

position, as "positive catalysts seem to be lacking right now."

Masayuki Nakajima, senior currency strategist at Mizuho Bank in London, is

among those who see a good chance that yen selling will accelerate. The currency

may well drop toward 180 per euro.

Limits of Abenomics

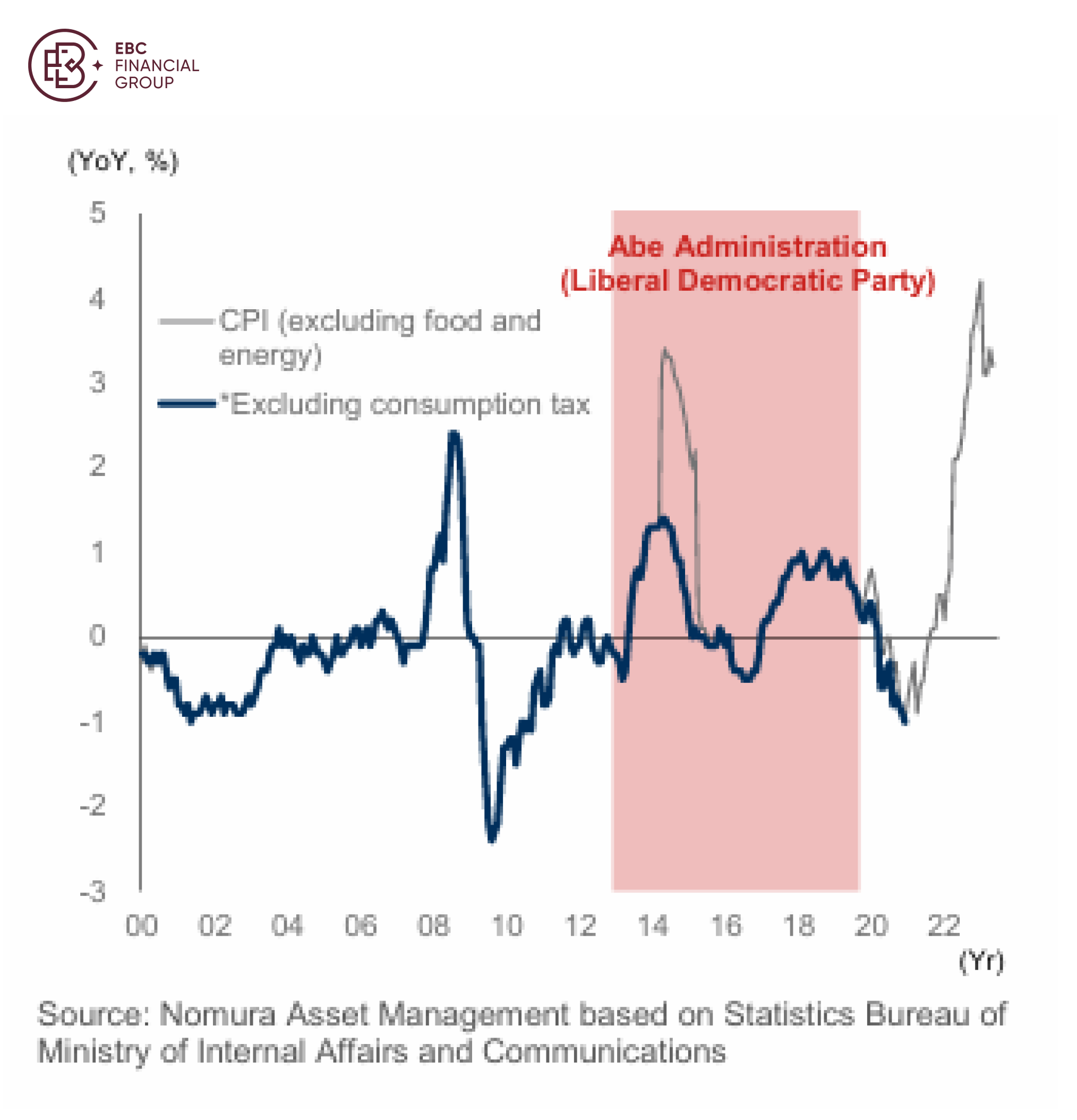

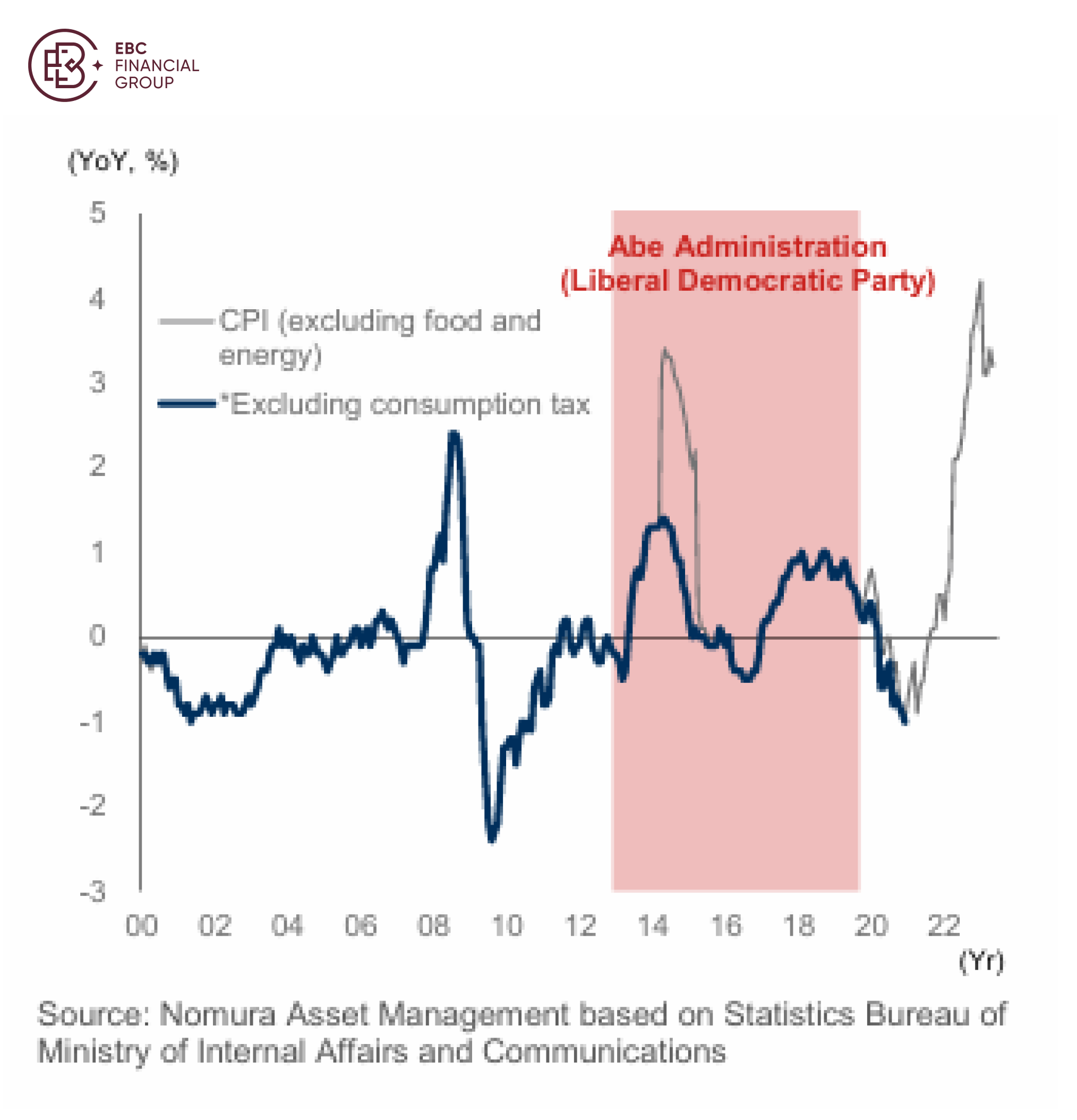

Abenomics fell short of fully reviving Japan's economy due to inconsistent

implementation, structural challenges, and unmet policy targets. While it

achieved some progress, overall impact was mixed.

The pillar of Abenomics was the "Three Arrows" of monetary easing, fiscal

stimulus and growth strategy. Several numerical targets were set, such as

inflation rate of 2% and GDP expansion of 2% on an annual basis.

According to Nomura Asset Management, the package proved to be effective

against stagnation that had persisted for ages. The number of employed persons

also increased significantly.

Though headline CPI is on track to meet target durably, the trend is largely

driven by supply shortage rather than higher demand. A rapid upswing in prices

rippled across the globe after the COVID-19 pandemic ended.

The side effects of negative interest rates were clear, including decreased

profitability for banking industry, market distortions and capital outflow. The

BOJ has the largest balance sheet relative to GDP among major central banks.

For Takaichii, fiscal spending will be severely constrained by exceptionally

high public debt. Unlike the US, Japan does not have the financial clout to pass

most of the burden to the rest of the world.

Demographic challenges remain. The number of births in Japan fell below

700,000 for the first time in 2024, marking a record low for the ninth year

running, casting doubts on her tougher stance on immigration.

Policy tightrope

Traders will now listen carefully to rate-setters' speeches in the coming

weeks for any hint of a slowdown in the policy tightening path. The upcoming

administration could complicate monetary decision.

The most extreme case of intervention came in 2013, when Abe hand-picked

Kuroda to overhaul the BOJ's caution over ramping up stimulus under then

governor Masaaki Shirakawa.

The extent of Takaichi's influence, however, is likely to be tempered by the

risks of inflation, a sharp yen decline and her own party's weak standing -

problems the former PM never faced.

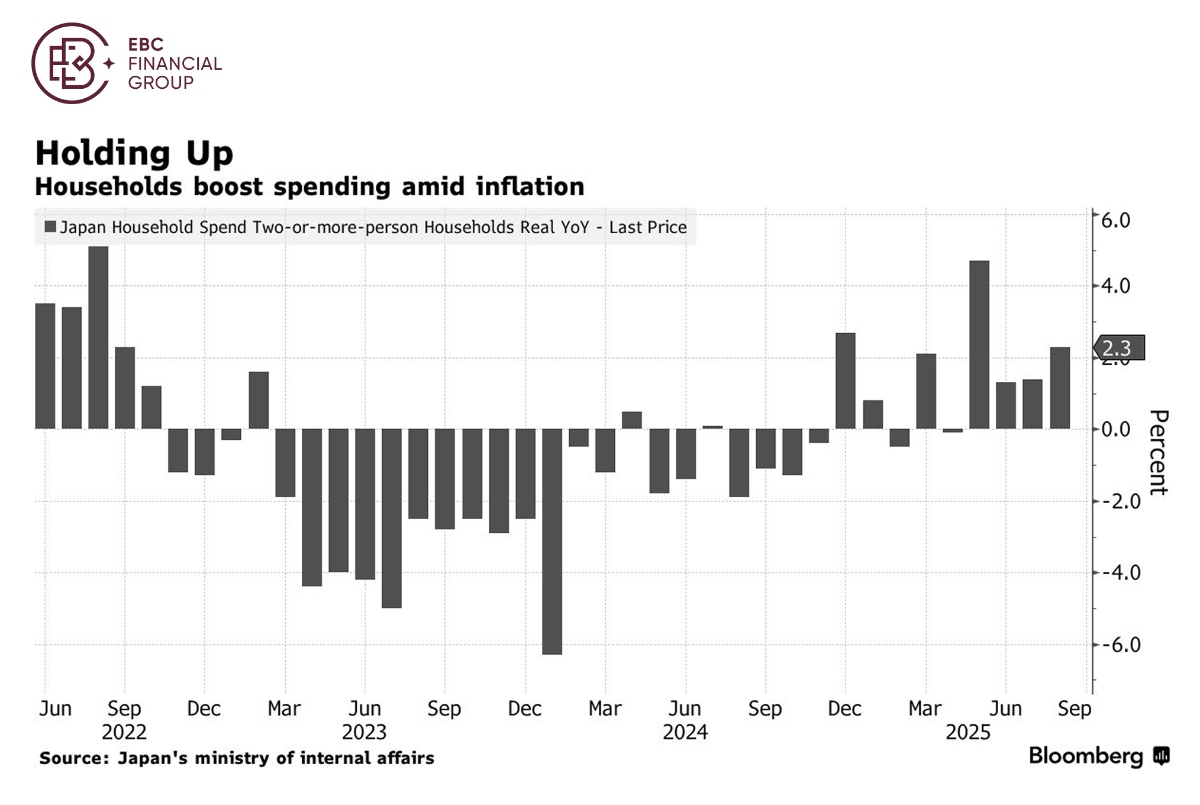

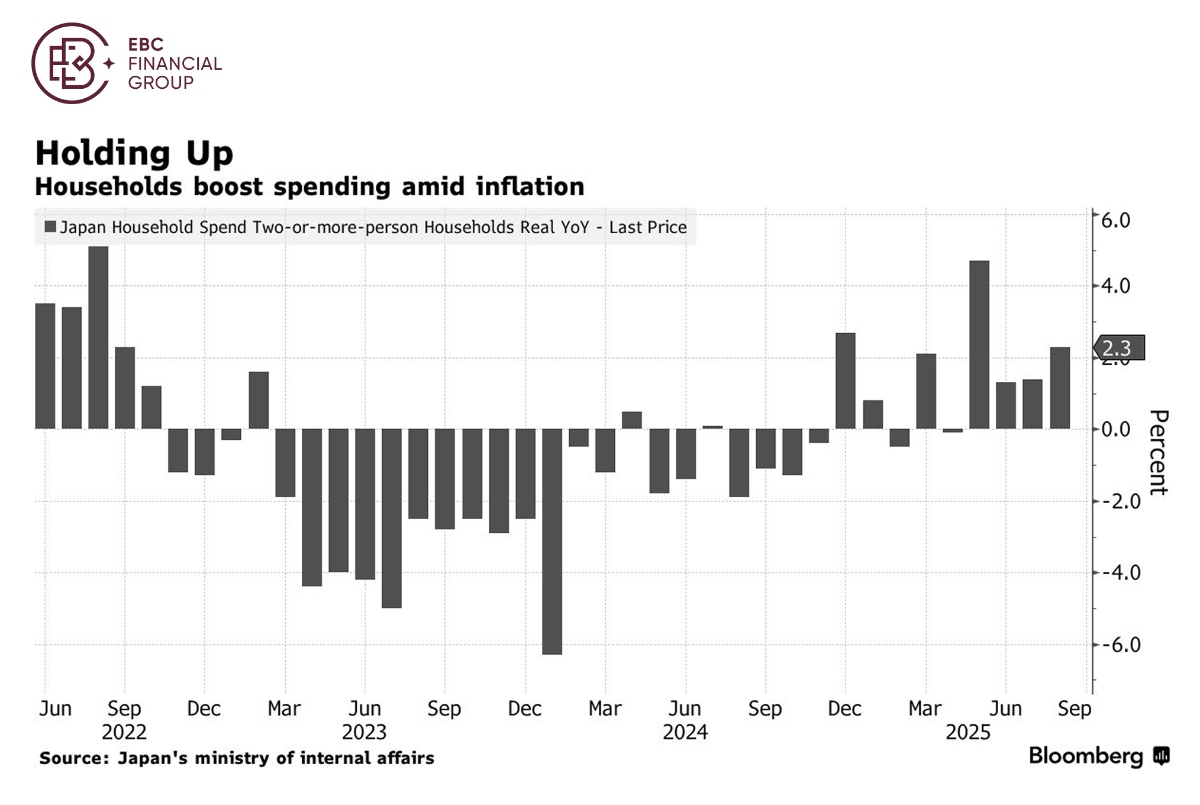

Rising living costs are seen as a key factor that led to the LDP's huge loss

in an upper house election in July. Delayed rate hikes are to worsen consumer

inflation and dent household spending which has risen for 4 months.

Erik Nelson, macro strategist at Wells Fargo Bank in London, reckons the it

is unlikely to change course. "The BOJ knew this election was coming and still

delivered fairly resolute guidance that more hikes were coming."

Finance Minister Katsunobu Kato said on Friday that the government was

concerned about excessive volatility in the forex market as the yen came under

pressure due to fiscal concerns.

Japanese authorities may tolerate moderate yen declines but could intervene

if the currency sharply depreciates towards 160 per dollar, said Atsushi

Takeuchi, a former central bank official.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.