Stock sectors are essential building blocks of the stock market, grouping companies based on their business activities or industries. These sectors help investors understand how different parts of the economy are performing and how various industries influence overall market movements.

By analysing stock sectors, traders and investors can make more informed decisions, diversify their portfolios, and manage risk more effectively. This article explores what stock sectors are, their importance in the market, and how they shape market movements.

What Are Stock Sectors?

Stock sectors categorise companies into broad industry groups. Common stock sectors include technology, healthcare, financials, energy, consumer discretionary, consumer staples, industrials, materials, utilities and real estate. Each sector consists of companies that operate in related fields and face similar economic factors.

These sectors allow investors to quickly assess which parts of the economy are thriving and which may be struggling. For example, a boom in the technology sector often signals strong innovation and growth, while weakness in the energy sector might reflect falling oil prices or reduced demand.

Why Do Stock Sectors Matter?

Stock sectors matter because they reveal trends and cycles within the economy that impact individual stocks and the broader market. Market movements rarely affect all sectors equally. Some sectors perform well during economic expansions, while others tend to be more resilient during downturns.

For instance, consumer staples and utilities are considered defensive sectors because their demand remains relatively stable regardless of the economic climate. Conversely, sectors like consumer discretionary and technology are more sensitive to economic cycles and often outperform during periods of growth.

Understanding these differences helps investors allocate their capital more wisely. By diversifying across various stock sectors, investors can reduce exposure to risks concentrated in any one industry.

How Stock Sectors Influence Market Movements

Market movements are shaped significantly by the performance of different stock sectors. When leading sectors experience gains or losses, they often drive the broader market index up or down. For example, the technology sector's strong performance can lift major indices, given its substantial weighting.

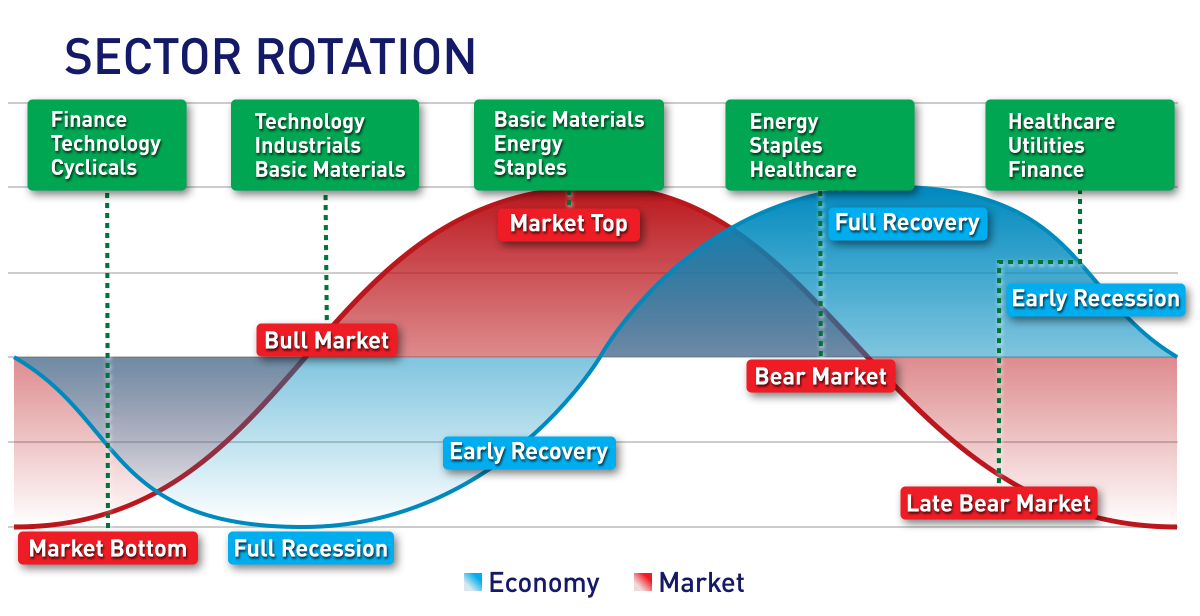

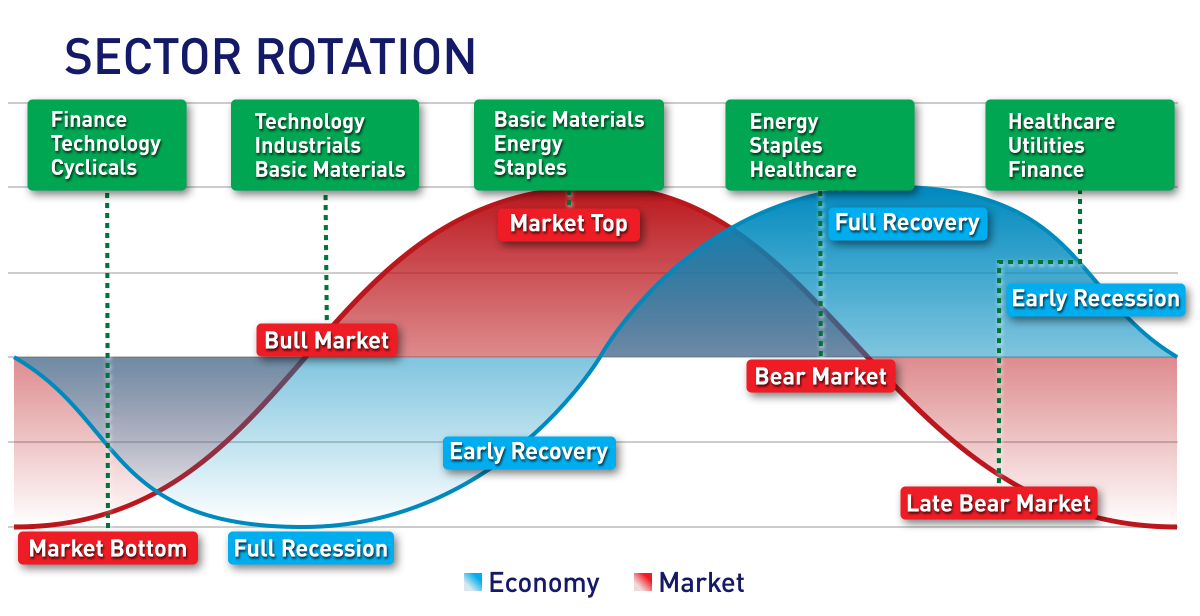

Sector rotation is a common phenomenon where investors shift funds between sectors based on expected economic changes. During early economic recovery, cyclical sectors such as industrials and consumer discretionary might gain favour. Later in the cycle, defensive sectors could attract more investment as investors seek safety.

This rotation impacts Stock Prices and overall market sentiment. Recognising which stock sectors are leading or lagging can help investors anticipate market trends and adjust their portfolios accordingly.

Sector Performance During Different Economic Cycles

Economic cycles play a critical role in how stock sectors perform. During periods of expansion, sectors tied to consumer spending, technology, and industrial growth tend to do well. These sectors benefit from increased business activity, consumer confidence, and capital investments.

In contrast, during recessions or slowdowns, investors often flock to more defensive stock sectors like healthcare, utilities and consumer staples. These sectors provide essential goods and services that remain in demand even in tough economic times, offering relative stability.

Energy and materials sectors may also fluctuate with commodity prices, making them sensitive to global economic conditions and geopolitical events.

Using Stock Sectors to Build Investment Strategies

Incorporating stock sectors into investment strategies allows for better portfolio diversification and risk management. Investors may choose to overweight sectors expected to outperform or reduce exposure to sectors facing headwinds.

For example, growth-oriented investors might focus on technology and consumer discretionary sectors, which offer high potential returns but also carry higher volatility. Income-focused investors might prefer utilities and real estate sectors, which often pay consistent dividends.

Sector analysis is also useful for tactical asset allocation. By monitoring economic indicators and sector trends, investors can rotate holdings to capture gains during different phases of the economic cycle.

Tools to Analyse Stock Sectors

Several tools and resources help investors analyse stock sectors effectively. Sector ETFs (Exchange Traded Funds) track specific sectors and allow investors to gain exposure without picking individual stocks. Market indices, such as the S&P 500 sector breakdown, show sector weightings and performance.

Technical and fundamental analysis of sector performance provides insights into momentum, valuation and potential opportunities. News and economic data releases related to industries within sectors also influence sector trends.

Conclusion

Stock sectors play a crucial role in influencing market movements and guiding investment decisions. By understanding how sectors respond to economic changes and market dynamics, investors can better position themselves to capture opportunities and mitigate risks.

Tracking stock sectors enables investors to adapt to market cycles, diversify portfolios effectively and achieve more consistent long-term returns. Whether you are a beginner or an experienced trader, incorporating sector analysis into your strategy can enhance your market insight and improve investment outcomes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.