Forex trading in India is gaining popularity, but it operates under a unique set of rules and restrictions that every trader must understand. The global appeal of currency trading is strong, yet Indian residents face a regulatory landscape unlike many other markets.

If you're considering entering the world of forex trading in India, here are the top five things you should know before you start.

1. Forex Trading Is Legal—But Only for Certain Pairs

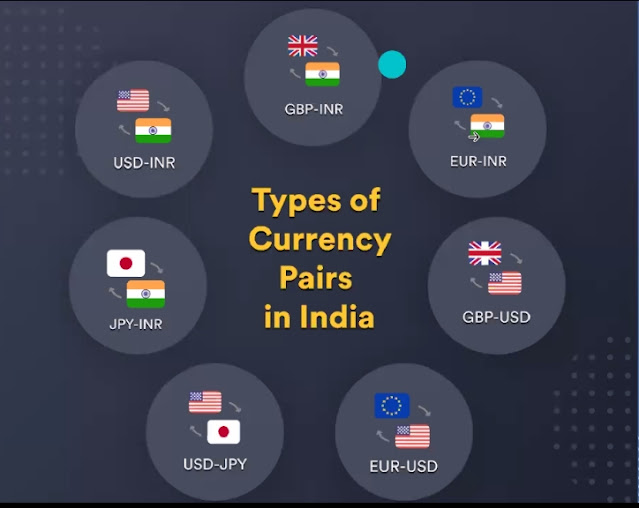

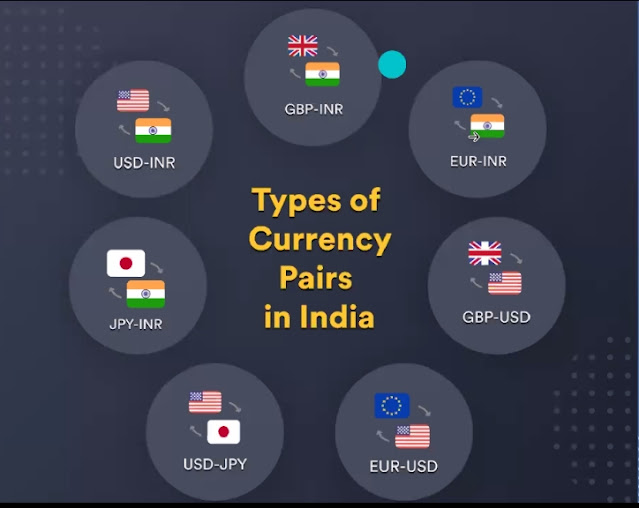

Forex trading is legal in India, but only under strict regulations. Indian residents are permitted to trade currency pairs that involve the Indian Rupee (INR) against major global currencies. The allowed pairs are:

-

USD/INR

-

EUR/INR

-

GBP/INR

JPY/INR

Recently, select cross-currency pairs such as EUR/USD, GBP/USD, and USD/JPY have also been permitted for trading on recognised Indian exchanges.

2. Only Trade Through Regulated Indian Exchanges

All legal forex trading in India must occur through regulated exchanges such as the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE). These platforms operate under the oversight of the Reserve Bank of India (RBI) and other regulatory authorities.

3. Understand the Regulatory Framework and Restrictions

The Foreign Exchange Management Act (FEMA) of 1999 is the primary law governing forex trading in India. FEMA, enforced by the RBI, sets out the rules for all foreign exchange transactions.

The RBI and other authorities impose limits on the maximum amount of foreign exchange individuals and firms can buy or sell, as well as restrictions on the types of permissible trades. These measures are designed to prevent currency speculation, protect the rupee’s stability, and avoid capital flight.

4. Risk Management Is Essential

Forex trading offers significant opportunities but also comes with substantial risks. In India, leverage is capped at 1:50 for major currency pairs and 1:20 for minor pairs, which helps limit exposure but does not eliminate risk. Volatility, interest rate changes, and global events can all impact currency prices.

Traders should always use stop-loss orders, manage their position sizes, and never risk more than they can afford to lose. Developing a solid Trading plan and practising on demo accounts before trading with real money is highly recommended.

5. Stay Informed

Some online trading platforms offer a wide range of global financial instruments, including currency pairs and other products.To ensure a smooth and secure trading experience, it's important to choose a broker that is authorised to operate and complies with regulations.

Staying informed about regulatory updates and market developments helps traders make confident, compliant decisions in a dynamic financial landscape.

Conclusion

Forex trading in India can be a rewarding pursuit if approached with knowledge, discipline, and compliance in mind. By focusing on legal currency pairs, using regulated exchanges, understanding the rules, managing risk, and avoiding unauthorised platforms, traders can navigate the Indian forex market safely and effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.