Stock prices are often seen as the heartbeat of financial markets. But how are stock prices determined in the market? This question is central to investors, traders, and anyone interested in finance.

Stock prices represent the current value assigned by buyers and sellers in an exchange, reflecting their collective view of a company's worth. Unlike fixed prices in retail, stock prices fluctuate constantly due to various forces that drive supply and demand.

At its core, stock price determination is a dynamic process involving multiple participants, information flows, and market conditions. In this article, we will break down the main factors that determine stock prices and explain how this fascinating mechanism works.

How Are Stock Prices Determined in the Market?

1) Supply and Demand: The Fundamental Drivers

The most basic principle behind how stock prices are determined in the market is supply and demand. When more investors want to buy a stock than sell it, demand outpaces supply, pushing prices higher. Conversely, if more investors want to sell than buy, supply exceeds demand, causing prices to fall.

This balance is never static. News about a company's earnings, economic data, political events, or even market sentiment can shift investors' willingness to buy or sell, impacting supply and demand in real time. For example, if a company announces a breakthrough product, buyers may rush in, increasing demand and raising the stock price.

2) Market Participants

Stock price determination involves a variety of market participants, each with different motivations and strategies. Retail investors, institutional investors, hedge funds, market makers, and high-frequency traders all contribute to price discovery.

Market makers play a crucial role by providing liquidity. They continuously quote bid and ask prices, ensuring that there is always a buyer or seller available. Their actions help narrow the spread between buying and selling prices, making the market more efficient.

Institutional investors, managing large portfolios, can influence stock prices significantly when making big trades. Meanwhile, high-frequency traders use algorithms to exploit tiny price differences, adding another layer of complexity to price formation.

3) Impact of Company Performance and Fundamentals

While supply and demand set the immediate price, the underlying fundamentals of a company influence how investors value its stock. Fundamentals include earnings, revenue growth, profit margins, debt levels, and management quality.

Strong financial performance typically attracts buyers, driving prices up. On the other hand, poor earnings reports or increasing debt can trigger selling pressure. Investors analyse quarterly earnings reports and other disclosures to assess whether the stock is fairly valued or not.

This fundamental analysis is a cornerstone of value investing, where traders seek stocks trading below their intrinsic value, expecting the price to rise as the market corrects itself.

4) Market Sentiment and Psychological Factors

Stock prices are also affected by market sentiment—how investors collectively feel about the market or a particular stock. Sentiment can be influenced by news headlines, analyst opinions, economic outlook, or even rumours.

Fear and greed are powerful emotions that can drive prices away from their fundamental values temporarily. For instance, during market bubbles, prices soar well beyond intrinsic values due to overly optimistic sentiment. Conversely, panic selling during downturns can depress prices excessively.

Sentiment-driven price moves are often short-term but can create opportunities or risks for traders and investors.

5) Technical Factors

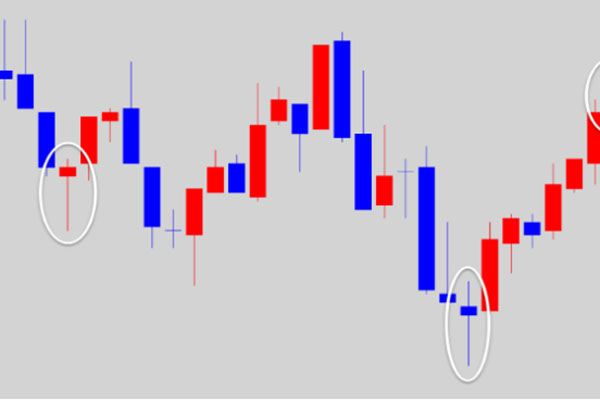

In addition to fundamental factors, many traders rely on technical analysis to predict stock price movements. Technical analysis focuses on historical price data, Chart Patterns, volume, and other market statistics to gauge future trends.

Technical traders believe that price movements reflect all available information and tend to follow patterns. Support and resistance levels, moving averages, and momentum indicators help traders decide when to buy or sell.

While technical analysis does not directly determine stock prices, it influences trading decisions that affect supply and demand, indirectly shaping prices.

6) External Economic and Political Influences

Stock prices do not exist in a vacuum. Broader economic conditions such as interest rates, inflation, employment figures, and geopolitical events affect investor confidence and risk appetite.

For example, an interest rate hike by a central bank may increase borrowing costs, potentially slowing economic growth and impacting corporate profits. This may lead to a sell-off in stocks, lowering prices.

Similarly, political stability or instability can influence markets. Elections, trade negotiations, or conflicts can cause uncertainty, making investors cautious and affecting prices.

The Continuous Process of Price Discovery

Stock price determination is a continuous process of price discovery. Every trade executed on the exchange contributes information about what buyers are willing to pay and what sellers are willing to accept.

The order book, which lists buy and sell orders at different prices, constantly updates. As new information becomes available, prices adjust, reflecting the latest consensus of value.

This dynamic process ensures that stock prices remain fluid and responsive to changes in market conditions and investor expectations.

Conclusion

In summary, stock prices are determined by a complex interplay of supply and demand, market participants, company fundamentals, investor sentiment, technical analysis, and external economic factors. Each of these elements influences how buyers and sellers perceive value and make trading decisions.

Understanding these factors helps traders and investors make informed choices, navigate market volatility, and identify potential opportunities. While no single factor alone determines stock prices, together they create the ever-changing picture we see on financial screens every day.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.