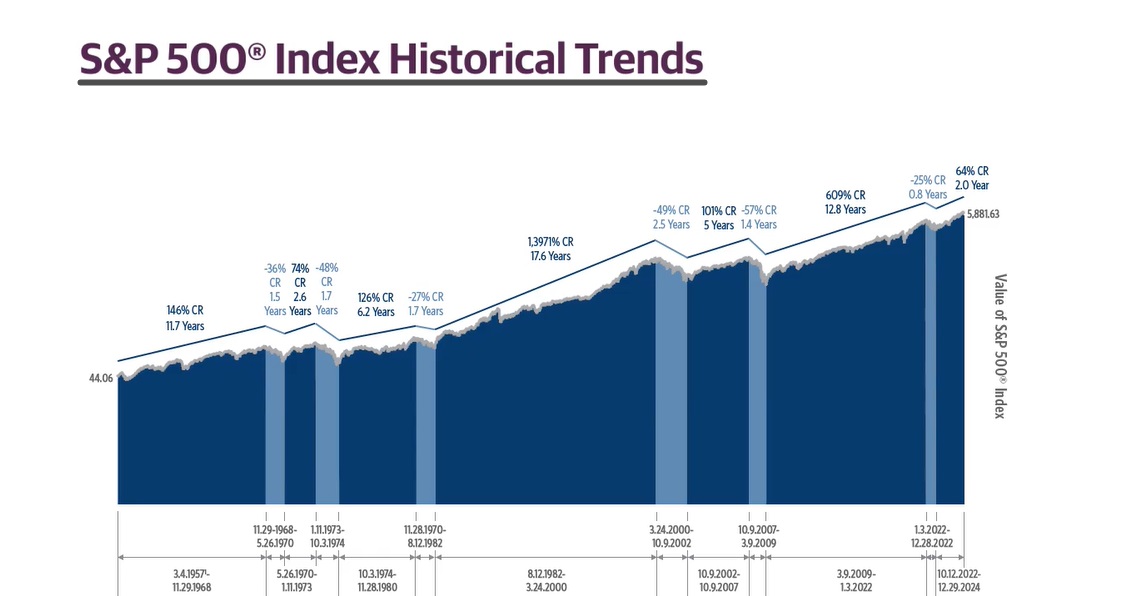

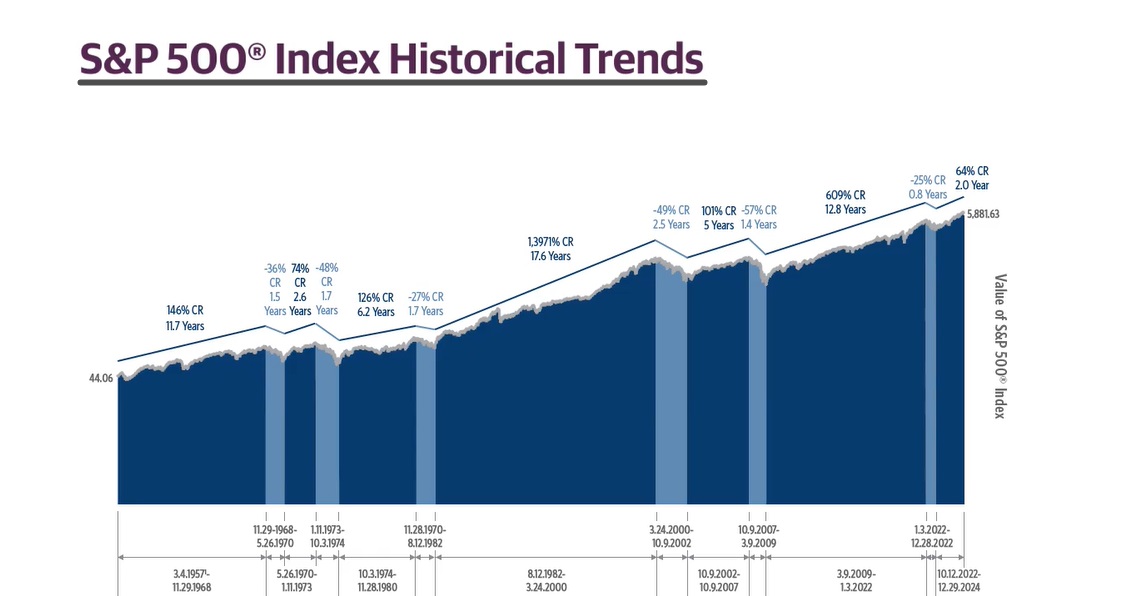

As the S&P 500 index edges closer to its all-time highs, attention is shifting away from earnings and economic growth toward a less visible yet powerful force: the dynamics of US Treasury issuance. Recent analysis suggests that the composition and pace of government bond issuance may play a more critical role in shaping equity performance than previously acknowledged.

A Hidden Indicator: Treasury Issuance vs Fiscal Deficit

Bloomberg strategist Simon White highlights a recurring pattern: when the net issuance of medium- to long-term US Treasuries (i.e. newly issued minus matured bonds) reaches 100% of the fiscal deficit, the stock market tends to stagnate or decline. This trend has held true during previous periods of financial strain, including 2008. 2015. 2018. and the current environment.

Bloomberg strategist Simon White highlights a recurring pattern: when the net issuance of medium- to long-term US Treasuries (i.e. newly issued minus matured bonds) reaches 100% of the fiscal deficit, the stock market tends to stagnate or decline. This trend has held true during previous periods of financial strain, including 2008. 2015. 2018. and the current environment.

At present, medium- and long-dated Treasury issuance accounts for the entirety of the fiscal deficit, with long-term bonds alone making up 80%. Yet, total debt issuance is actually slowing. This combination—aggressive long-term borrowing and an overall deceleration in issuance—exerts dual pressure on the S&P 500 index. On one hand, long-dated bonds absorb a significant portion of market liquidity. On the other, diminished fiscal stimulus is insufficient to offset the impact of that liquidity drain.

Historical data supports this concern. When medium- and long-term Treasuries account for over 85% of the deficit and total issuance growth weakens, the S&P 500 consistently underperforms relative to trend.

Lessons from 2023: The Role of Short-Term Debt

The year 2023 offers a contrasting case study. At that time, the US Federal Reserve held over $2 trillion in idle liquidity through its reverse repurchase (RRP) facility. Then-Treasury Secretary Janet Yellen opted to ramp up short-term debt issuance instead of long-dated bonds. This move encouraged money market funds to shift capital from RRP to short-term Treasuries, effectively filling the fiscal gap while injecting liquidity into markets.

The strategy worked. Short-term debt, often referred to as providing "low-velocity liquidity", had a far less disruptive effect on risk assets. As a result, equity markets, including the S&P 500 index, entered a two-year bull run. This experience underlines the importance of debt maturity composition—short-term Treasuries support liquidity and help equities, while long-term debt can suppress market momentum.

Repo Market Evolution Strengthens the Link

Another critical development is the evolving structure of the repo market. Improvements in collateral valuation and clearing mechanisms have transformed Treasuries into high-quality, highly liquid collateral. This means that total debt issuance now has a closer positive correlation with equity performance—when supply increases under the right conditions, the S&P 500 index often follows.

However, the current environment lacks the favourable ingredients of 2023. The US Treasury is issuing fewer short-term bills, limiting the availability of "safe" collateral that boosts market liquidity. Instead, long-term issuance is crowding out private capital and tightening financial conditions, leaving the equity market vulnerable despite its strong recent gains.

The Risk of Shifting Back to Short-Term Debt

While increasing short-term issuance may appear to be a solution, it is not without drawbacks. Current Treasury Secretary Janet Yellen has previously warned that a short-duration strategy could elevate borrowing costs and heighten inflation risks. With annual interest payments already exceeding $1 trillion, shortening the average maturity of US debt could amplify fiscal and inflationary pressures.

Additionally, a sudden increase in short-term supply might destabilise fixed-income markets, leading to steeper yield curves and more volatility—factors that can weigh heavily on equities, including the S&P 500 index.

Conclusion: Bond Market Dynamics Could Shape the S&P 500's Path

As the S&P 500 index flirts with record highs, investors would do well to look beyond traditional market drivers. Treasury issuance patterns—particularly the balance between short- and long-term debt—are exerting increasing influence on equity performance. Without sufficient short-term supply to ease liquidity conditions, and with long-term borrowing crowding out private capital, the stock market could face renewed headwinds.

As the S&P 500 index flirts with record highs, investors would do well to look beyond traditional market drivers. Treasury issuance patterns—particularly the balance between short- and long-term debt—are exerting increasing influence on equity performance. Without sufficient short-term supply to ease liquidity conditions, and with long-term borrowing crowding out private capital, the stock market could face renewed headwinds.

If policymakers fail to strike the right balance, the historical pattern may repeat—strong equity rallies may give way to stagnation or reversal. For investors watching the S&P 500. monitoring Treasury issuance could be just as critical as tracking earnings or economic data.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.