The Nikkei 225 index weakened on Thursday as the US could join Israel's air

strike on Iran. Oil prices and the yen benefited from geopolitical

uncertainties, adding to headwinds for Japanese firms.

PM Ishiba and Trump failed to reach an agreement on a trade package on the

sidelines of the G7 summit, an outcome that leaves the Asian nation inching

closer to a possible recession.

Tokyo is subject to a 25% levy on cars and auto parts and a 50% tariff on

steel and aluminium. A 10% across-the-board levy on other goods is set to rise

to 24% in early July.

Manufacturers grew less confident about business conditions in June and

expressed caution about the outlook for the next three months, according to the

BOJ's monthly poll, though the service sector stayed calm.

Exports in May declined 1.7% year over year, marking the sharpest decline

since September 2024. Notably shipment of motor vehicles to the US plummeted

24.7%, which is particularly disturbing.

BOJ Governor Kazuo Ueda said on Tuesday near-term focus was on downside risks

to economy with the hit from tariffs seen intensifying in the second half of

this year despite of sticky inflation.

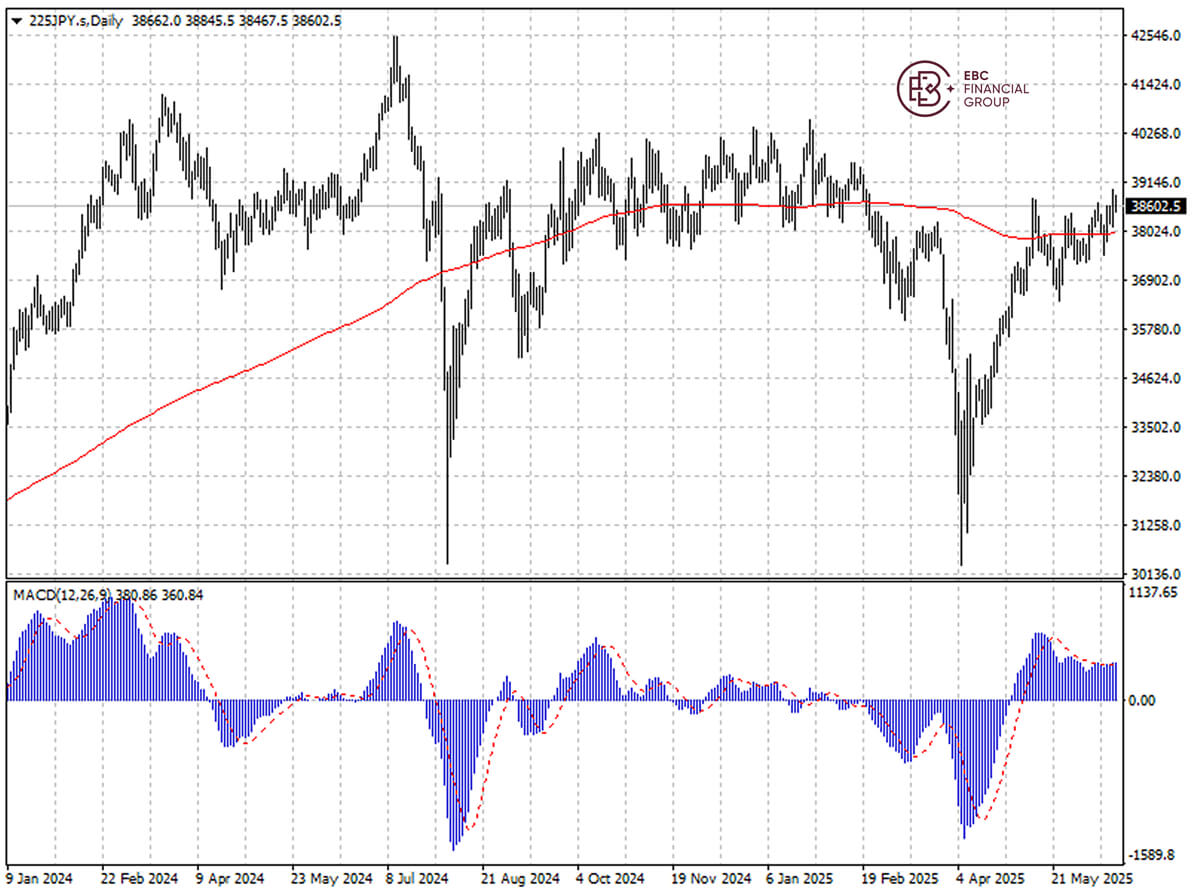

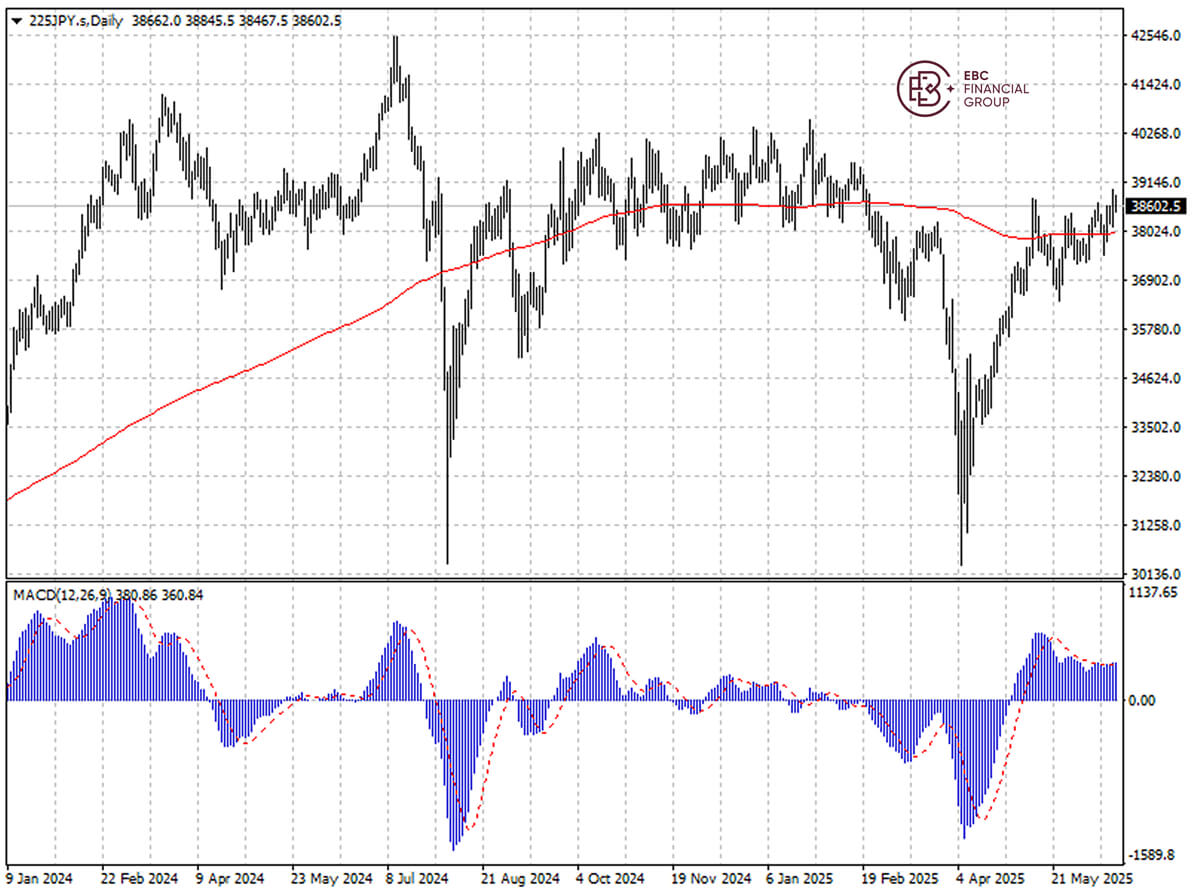

The Nikkei index stays comfortably above 200 SMA, but bearish MACD divergence

indicates the uptrend could stall soon A push below 38,000 is on the cards.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.