In the age of technology, all of our lifestyles change with the advancement of technology. In particular, the speed at which social media platforms are replacing each other is just mind-boggling. As the leader in the social media space, Facebook is also slowly becoming the front wave being lapped on the beach. Perhaps because of this, in 2021. Facebook decided to focus on virtual currencies and augmented reality technology and renamed the company META. And now we'll take a look at Meta's stock analysis and investment insights.

What is META?

What is META?

It was originally called Facebook, Inc. (Facebook) and is an American technology company founded in 2004 by Mark Zuckerberg and others. The company initially focused on the Facebook social networking platform and later acquired companies such as Instagram and WhatsApp to become one of the largest social networks in the world.

The company's founder, Mark Zukerberg, created the social media platform at Harvard University in 2004. initially as an on-campus social networking site for Harvard students. However, its clean design and powerful social features attracted more and more users, quickly becoming a hit at Harvard and soon expanding to other US universities.

With the introduction of new features, such as graffiti walls and clubs sharing photos, Facebook attracted more and more users and became one of the largest social platforms in the world. This expansion has allowed Facebook to go beyond the campus and become an important part of people's daily lives.

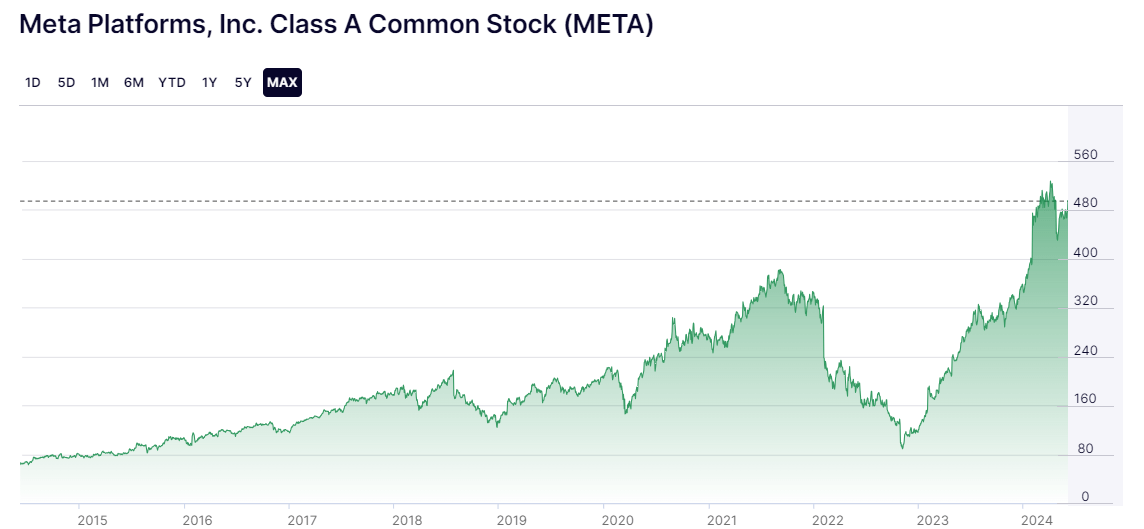

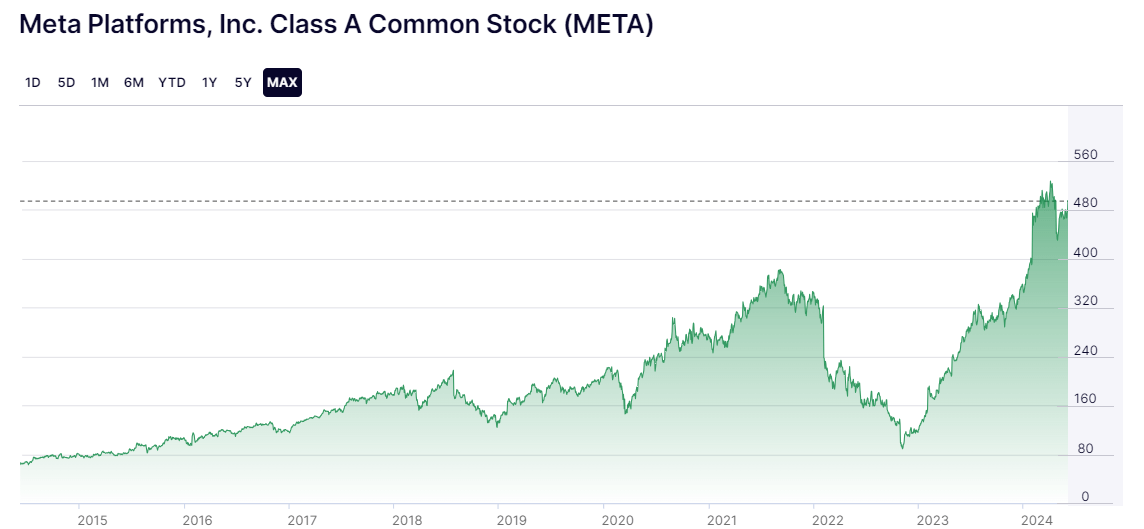

Just two years later, Facebook had a rapid global reach and became one of the top five tech giants alongside Microsoft, Amazon, Apple, and Google. In 2012. Facebook went public on the NASDAQ, making its founders super-rich and worth tens of billions of dollars. By 2021. its share price had soared tenfold, making it one of the five largest companies in the world by market capitalization.

But as the size of its user base continues to grow, Facebook is facing more and more challenges. One of the most prominent issues is privacy. Facebook has caused user dissatisfaction with features such as dynamic messaging and has even been accused of broadcasting false information in the U.S. presidential election. In addition, the review and management of content have also been one of the challenges that Facebook has been facing.

In order to cope with market competition and future development trends, Facebook's parent company decided to move into the meta-universe and announced in October 2021 that it had changed its name to Meta Platforms, Inc. Mark Zuckerberg announced the move, meaning that Facebook will become one of the company's subsidiaries and no longer an overarching brand name.

The Significance of the Name "Meta"

The name "Meta" signifies the company's commitment to being at the forefront of artificial intelligence and transitioning its focus from solely being a social platform to pioneering developments in metaverse technologies. Since the name change, the company's stock price has experienced significant fluctuations, dropping from a high point to a low before gradually recovering. This volatility reflects the strong interest and enthusiasm of stock market investors for the concept of the metaverse.

And nowadays, Meta's main revenue segment is divided into two major blocks: first, advertising revenue, mainly from digital advertisements on its various social platforms; and second, the meta-universe business, i.e., the layout and development of the meta-universe field. Steady growth in advertising revenue as well as investment and development in the proto-universe business are both important components of the company's future outlook.

Although Meta's layout and investment in the meta-universe field have faced many challenges, its performance has gradually stabilized, and its share price has continued to recover. And the company has also adjusted its strategic focus in the midst of the difficulties, shifting more attention to the development of artificial intelligence technology in response to changing market demands and competitive environments.

To summarize, Meta's journey has been one full of challenges and opportunities. Despite many difficulties and pressures, it has opened up new paths for its development by continuously adjusting its strategy, innovating its products and services, and making timely investments and layouts.

Reasons for the Meta Stock Price Crash

Reasons for the Meta Stock Price Crash

Facebook, one of the world's largest social media platforms, has been in the spotlight since its transformation into a meta-universe company. Recently, the company released its earnings report, which showed a significant increase in earnings. But despite the company's stellar earnings performance, with both revenue and profit exceeding expectations, the stock price fell somewhat after the release of the earnings report.

One of the reasons for this could be that the market has some concerns about the company's future capital expenditures and revenue expectations. Despite the excellent results shown in the earnings report, investors may be concerned that the company's future investment plans, especially the high investments in the fields of artificial intelligence and meta-universe, may put some pressure on the company's profitability.

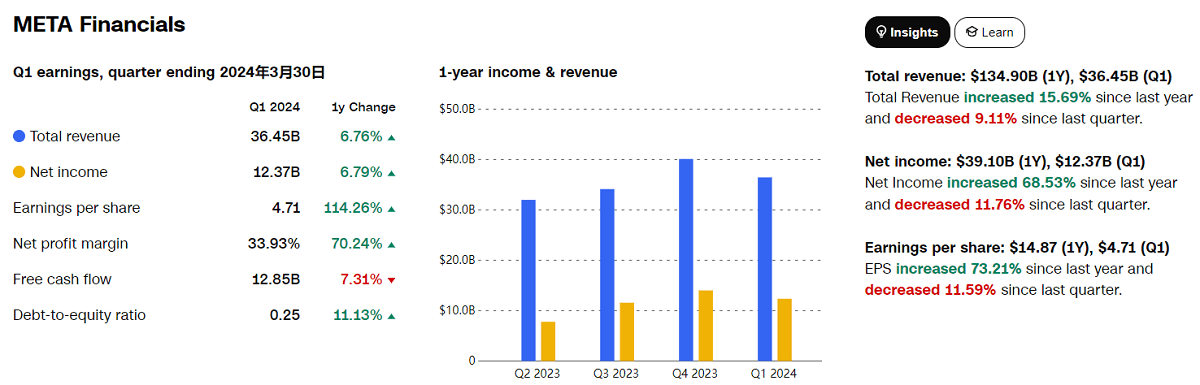

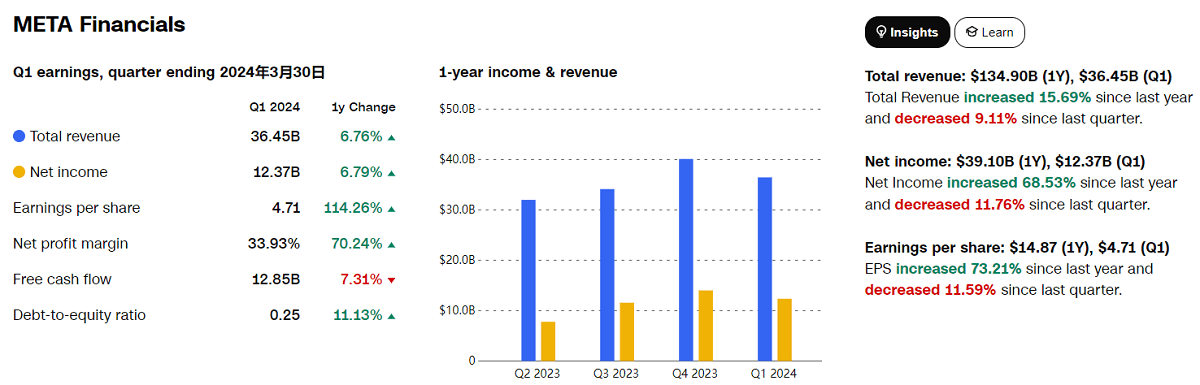

According to the latest data, the company's earnings report for the first quarter of 2024 showed a bright performance. Total revenue was $36.46 billion, up 27% year-over-year, while net profit was $12.37 billion, up 117%. This was largely due to the strong performance of its core business, Family of Applications (FOA), which contributed 98% of revenue, while Reality Labs, which represents the meta-universe, saw a 50% year-over-year increase in revenue.

And, despite the significant revenue growth, Meta realized a decline in costs and expenses, bringing operating and net margins back to the high levels seen during the 20-year New Crown Pandemic. Free cash flow margins also grew significantly, to nearly 30%.

Meanwhile, the company's FOA (Family of Apps) active user base continues to grow, exceeding 3 billion, demonstrating solid growth in user size. At the same time, the revenue contributed per user is also increasing, which could mean that the company is implementing a more effective advertising strategy or launching more paid features, thus increasing users' willingness to pay and ad click-through rates.

In addition to FOA, the company's other apps, such as Reals and Strides, are also showing good growth in terms of user base and activity. This shows that the company is expanding its user base by diversifying its product layout and has achieved some success in different areas of application, providing a broader scope for the company's future growth.

While the main revenue business is in good shape, investors also note that Meta plans to raise its capex range to $30–$37 billion, mainly for server investments and hardware construction as well as data center expansion. This means that the company will increase its investment in infrastructure to support the growing size and demands of its business. The company also expects to continue to increase its investments in AI, and these increases in capital expenditures are quite worrying for investors.

The growing competition in the digital advertising industry is a major source of uncertainty for investors about the company's future. In the tech sector, it is facing competitive pressure from rivals such as Google, Microsoft, and TikTok, which have a strong presence and resource advantage in areas such as digital advertising, cloud computing, and artificial intelligence.

For example, Google, the world's largest search engine and digital advertising giant, competes with it in the digital advertising market and has invested heavily in AI and cloud computing. Microsoft, on the other hand, has shown strong growth through its cloud computing service Azure and AI technologies (e.g., Copilot), posing a challenge to Meta. In addition, TikTok has risen rapidly in the social media and short-form video space, putting competitive pressure on the company's Instagram reels, which attract a large number of young users.

Apple's privacy policy update, newly restricting app tracking and data collection, has created challenges for the digital advertising industry, so Meta is looking for alternative advertising models and solutions to compensate for this impact. Meanwhile, the rise of TikTok poses a threat to its user growth and advertising business.

As a result, despite Meta's stellar earnings results, investors may still be wary of the company's growth prospects in the short term, leading to some declines in the stock price. But in the long term, if the company can effectively utilize these investments and grow its business and profits, the stock price is expected to return to an upward trajectory.

And it's also possible that Meta's share price decline in the face of good earnings results is due to the fact that the market has been informed of the company's growth prospects in advance, hence the sell-off after the earnings report. Additionally, some investors may be taking advantage of the share price volatility after the earnings announcement to make short-term trades and take profits, which could also lead to a short-term drop in the share price.

Because the financial market is a zero-sum game, investors need to have more trading skills and patience in order to achieve sustainable profits in the market. Therefore, it is important for long-term investors to remain calm and patient and not be influenced by short-term fluctuations, but rather focus on the long-term growth potential and fundamentals of a company.

Meta's Stock Investment Analysis

Meta's Stock Investment Analysis

The company's stock price has risen 42% since the beginning of 2024. which shows the market's optimism about its future growth prospects. Although the stock price fell right after the earnings report, it quickly recovered and is now priced at around $493. This shows investors' view that the company still holds a very high investment value, probably based on its strong financial performance, diversified business layout, and confidence in its future growth potential.

This is because Meta's investment opportunity in the digital advertising space is clear. As the global advertising market transforms digitally, the company has significant strengths in precision ad delivery and user data. Its strong position in this space offers investors the prospect of steady growth. As more brands and marketers shift their focus to digital platforms, the company, as one of the leading digital advertising platforms, will continue to benefit from this trend, delivering substantial long-term returns to investors.

In addition to the digital advertising space, its investments in AI also present long-term growth opportunities. With the continuous advancement of AI technology, the company is expected to make breakthroughs in ad delivery and user experience, further consolidating its market position. As one of the world's leading technology companies, its investments in these emerging areas will bring considerable future returns to investors and lay a solid foundation for the company's long-term growth.

Moreover, Meta has demonstrated its strong adaptability by successfully addressing market challenges on several occasions, such as responding effectively to Apple's privacy policy update and the rise of TikTok. This ability to successfully respond to challenges adds confidence to the company's future growth, demonstrating its resilience and ability to innovate in response to industry changes and competitive pressures. This adaptability not only brings stability to the company but also provides investors with a positive outlook on future prospects.

Some investors will look at the stock ownership of executives within a company as one of the key indicators in assessing a company's prospects. While some executives selling stock may raise doubts, it does not necessarily mean that the company's outlook is poor. The continued increase in stock holdings by large institutions shows confidence and optimism in the company's future, reflecting recognition of its long-term growth potential and value. Investors should consider the company's overall situation and the market environment rather than relying solely on the trading behavior of individual executives.

And not only do the company's financial statements show that earnings have exceeded expectations, but the declaration of a dividend of $0.50 per share does show that the company's financial position is sound and healthy. Such a performance may appeal to some investors, especially those looking for steady income and dividends.

However, some investors may be concerned about the company's dividend declaration because they fear that the company's future earnings growth may not be sufficient to justify a sustained dividend distribution or that it may signal a lack of confidence in the company's pursuit of new growth opportunities. This concern is legitimate, as dividend distributions typically require a company to have stable cash flow and profitability.

At the same time, the 15% rise in Meta's stock price to an all-time high has raised doubts among some investors. On the one hand, they may be concerned about missing out on the share price increase, especially given the company's future growth potential. On the other hand, they may also be concerned that the share price has become overheated and there is a risk of a pullback.

For long-term investors, even if the stock price rises to all-time highs, now may still be a good time to buy if they believe in Meta's long-term growth potential and plan to hold the stock for a long time. With the company's strong business and strategic footprint in areas such as digital advertising, AI, and the metaverse, as well as its good financial performance, a long-term hold could lead to sizable returns.

However, for short-term investors, the fact that the stock has risen to all-time highs could mean higher risk. And given Meta's potential, waiting for the stock price to pull back before entering the market is a sound strategy. This reduces investment risk and allows for higher returns when better entry opportunities are available.

In addition, buying in tranches is also an option to reduce risk by cost-averaging. By spreading out the timing of investments, investors can better capture market fluctuations and avoid over-concentration of investments at one point in time. This strategy not only helps to smooth out the impact of price fluctuations on investments but also maintains a more stable position when market movements are uncertain.

In conclusion, investors should decide whether and when to buy Meta stocks based on their investment objectives, risk tolerance, and market conditions. Before making a decision, it is advisable to conduct thorough research and evaluation in order to make an informed investment decision.

Meta's stock analysis and investment insights

| Strengths |

Disadvantages |

Risks |

| Strong financial performance |

Competitive digital advertising market |

Competitor Pressure |

| Diversified business portfolio |

High capital expenditure program |

Impact of Apple's privacy policy update |

| Resilient and innovative |

Stock price at an all-time high |

Increased short-term investment risk |

| Long-term growth potential |

|

Increased likelihood of share price volatility |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is META?

What is META? Reasons for the

Reasons for the  Meta's Stock Investment Analysis

Meta's Stock Investment Analysis