In 2025, growth stocks are once again under the spotlight. With AI, cloud computing, cybersecurity, semiconductors, and digital transformation driving global capital flows, enthusiastic investors are seeking companies that can genuinely meet high expectations.

That said, valuations are elevated across many growth equities, so picking the right ones matters more than ever.

Below are several leading U.S. growth stocks that many analysts and market observers are highlighting for 2025 and later, including significant risks, valuation insights, and crucial factors to monitor. These also serve as some of the best AI stocks 2025, cybersecurity stocks to buy, and semiconductor growth stocks.

7 Growth Stocks to Buy Now With Big Upside Potential

1. NVIDIA Corporation (NVDA)

One of the most discussed growth names, NVIDIA, sits at the core of AI infrastructure. In its latest Q2 FY2026, NVIDIA delivered revenue of $46.7 billion, up 56% YoY, with data centre revenue hitting $41.1 billion. Guidance for Q3 suggests continued strength in next-gen compute deployments.

Current Price: ~$186.58 USD (as of 1st October 2025)

Why it's compelling: As demand for GPUs, accelerators, and AI compute soars, NVIDIA's combined hardware/software stack and ecosystem lead give it a structural advantage.

Risks: High valuation, export controls (especially to China), competition from custom silicon projects.

What to watch: Architecture roadmap updates, order backlogs, margin trajectories in GPU segments, and capacity expansion plans.

2. Microsoft (MSFT)

In Q4 FY2025, Microsoft reported ~18% revenue growth to $76.4 billion, with Microsoft Cloud revenue around $46.7 billion (+27%). Its Azure business, Copilot integrations, and AI-infused productivity stack strengthen its growth thesis.

Current Price: ~$517.95 USD

Strengths: Massive scale, high free cash flow, ability to invest aggressively, diversified AI + cloud + software exposure.

Risks: Regulatory demands in the U.S. and EU, increasing AI operational expenses, and lower profit margins.

Key signals: Azure growth rates, AI subscription trends, margin expansion or compression in the cloud, and regulatory developments.

3. Advanced Micro Devices (AMD)

AMD remains a major player in the semiconductor industry and AI-related computing.

Current Price: ~$161.79 USD

Strengths: Diversified exposure across CPUs, GPUs, and AI accelerators; potential upside if it captures more data centre share.

Risks: Fierce competition (Intel, Nvidia, ARM-based architectures), margin pressure, dependency on foundry execution.

Catalysts: Adoption of AI chips, data centre growth, and expansion in edge computing.

4. CrowdStrike Holdings (CRWD)

Cybersecurity remains a mission-critical domain, and CrowdStrike is among the top cybersecurity stocks to buy for growth exposure. [1]

In Q2 FY2026, CrowdStrike reported revenue of $1.17 billion, a 21% YoY increase, with net new ARR of $221 million.

Current Price: ~$490.38 USD

Why it's compelling: Their Falcon platform stickiness, modular upselling, and vertical expansion (cloud, identity, SIEM) support a strong growth outlook.

Risks: High valuation (forward P/S near 20×), cyclical nature of macro IT expenditures, execution risk in scaling new modules.

What to watch: ARR growth, adoption of next-gen modules (Flex, identity, SIEM), margin expansion, competing threats.

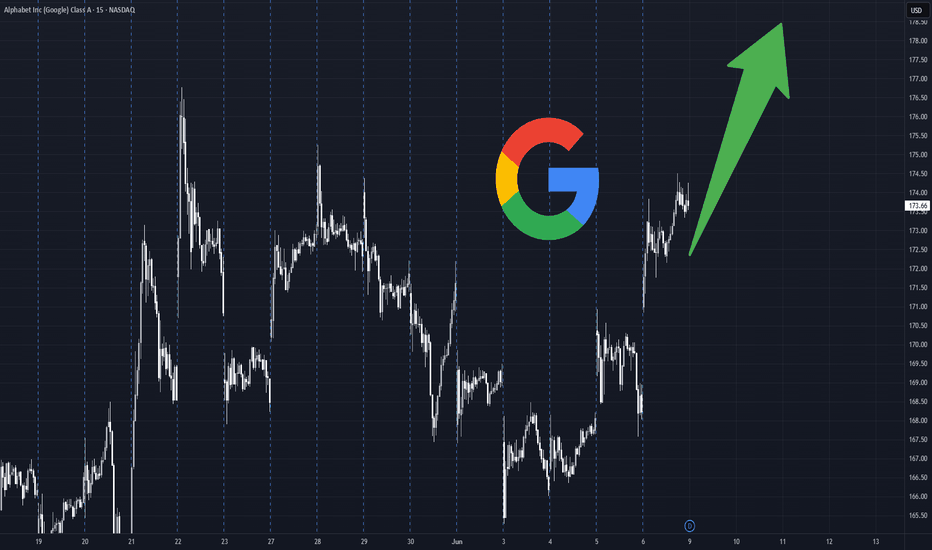

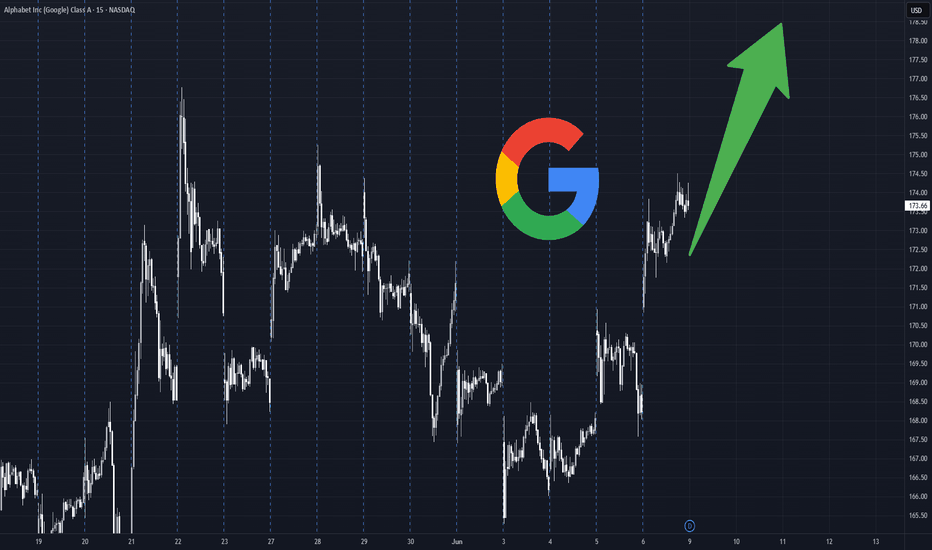

5. Alphabet (GOOGL / GOOG)

Alphabet remains a foundational growth name, integrating search advertising, cloud, and AI.

In Q2 2025, Alphabet reported revenue of $96.4 billion, up ~14% YoY, with Google Cloud revenue rising ~32%. [2]

Current Price: ~$243.55 USD

Why it's compelling: The AI stack (Gemini, AI Mode in Search), deep moat in data/machine learning, and wide enterprise integration keep its flywheel strong.

Risks: Regulatory and antitrust challenges, delayed monetisation of AI investments, and variations in advertising cycles.

Key signals: Cloud margins, AI monetisation KPIs, regulatory decisions, ad spend trends.

6. Broadcom (AVGO)

Broadcom pairs semiconductor strength with infrastructure software to deliver a unique hybrid growth model.

Current Price: ~$329.91 USD

Why it's compelling: Its AI networking, licensing, and software stack give it leverage beyond pure hardware.

Risks: Integration of acquisitions, fluctuations in module, and changes in technology architecture.

What to watch: Growth in software recurring revenue, cross-platform synergies, and margin trends.

7. Palantir Technologies (PLTR)

More speculative, but often cited among long-term growth stocks for 2025 because of its AI analytics involvement.

Current Price: ~$182.42 USD

Why it's compelling: Palantir's edge lies in its government and commercial AI-data contracts and engineering deployment model (FDE).

Risks: Execution risk, contract concentration, and valuation sensitivity.

Key signals: Growth in commercial revenue share, new contract wins, and margin trends.

Other Mentioned Names Worth Watching

These aren't core recommendations here, but are on many lists of top growth names:

Meta Platforms (META): Pushing into AI, immersive tech, and ad monetisation.

Apple (AAPL), Amazon (AMZN): Mature growth names that are still showing revenue expansion and optionality.

Tesla (TSLA): Often debated, with a strong narrative around EVs, autonomy, energy, but with high volatility.

Howmet Aerospace (HWM): A growth pick in the industrial and aerospace space. [3]

How to Build a Growth Portfolio in 2025: Strategy & Tips

Diversify across verticals (AI compute, cloud, cybersecurity, infrastructure, consumer tech).

Employ position sizing and avoid overcommitting to a singular high-volatility stock.

Use hedges / protective options / trailing stops to limit downside.

Layer entries over time (dollar-cost averaging) rather than in one large amount.

Monitor catalysts such as earnings surprises, macro data, regulation shifts, and competitive moves.

Sample Growth Portfolio for 2025

| Name |

Allocation (%) |

Thesis Focus |

| NVIDIA |

15% |

AI infrastructure leadership |

| AMD |

10% |

Diversified AI + compute exposure |

| CrowdStrike |

10% |

Cybersecurity + SaaS growth |

| Alphabet |

15% |

Platform + AI monetisation |

| Broadcom |

10% |

Infrastructure + software leverage |

| Palantir |

5% |

Speculative AI / data-play |

| Others (Meta, Amazon, Apple) |

25% |

Stable, large-cap growth names |

| Cash / Hedge Buffer |

10% |

Optionality & risk management |

It is illustrative. Thus, you should tailor to your risk appetite and capital.

Frequently Asked Questions

Q1: Are Growth Stocks Still Worth Buying in 2025?

Yes, but it's riskier. The best picks will combine strong execution, durable moats, and realistic valuations.

Q2: Which Sectors Will Drive Growth Stocks Beyond 2025?

AI infrastructure, cybersecurity, quantum computing, cloud and edge, and vertical software are top candidates.

Q3: How Risky Are AI Stocks Compared to Traditional Tech?

They carry higher upside but also greater execution and regulatory risk. Volatility tends to be higher.

Conclusion

In conclusion, Growth investing in 2025 is not for the faint of heart. The narratives are likely to drive multi-year gains. However, the margin for error is thin and unpredictable.

Among the names discussed, NVIDIA arguably leads thanks to its embedded role in AI infrastructure. As we move toward 2026, the balance between AI-driven optimism and macro risks will determine which of today's growth darlings become tomorrow's market leaders.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.nasdaq.com/articles/crowdstrike-q2-revenue-tops-11-billion

[2] https://abc.xyz/assets/cc/27/3ada14014efbadd7a58472f1f3f4/2025q2-alphabet-earnings-release.pdf

[3] https://www.forbes.com/sites/investor-hub/article/6-best-growth-stocks-to-buy-august-2025/