Unusual options activity (UOA) has become a buzzword among traders looking to gain an edge in the markets. It often acts as a signal that something significant may be brewing beneath the surface of a stock's price chart.

Whether you're a seasoned options trader or a beginner trying to decode market sentiment, understanding UOA can help you spot trading opportunities early and manage risk more efficiently.

This comprehensive guide explains what unusual options activity is, why it matters, and how you can use it to enhance your trading strategy in 2025 and beyond.

Understanding Options Activity

Before diving into what makes options activity "unusual," it's crucial to understand what normal options activity looks like. Every day, traders buy and sell millions of options contracts across thousands of stocks and indexes. These transactions reflect traders' expectations about future price movements, volatility, or events such as earnings or news.

Normal options activity aligns with historical trends, volume, and open interest. For example, if Apple typically trades 50,000 call options per day and suddenly sees 500,000, that deviation is considered "unusual." Similarly, if there's a large, out-of-the-money put option trade on a stock with no recent news, traders may take note.

What Is Unusual Options Activity?

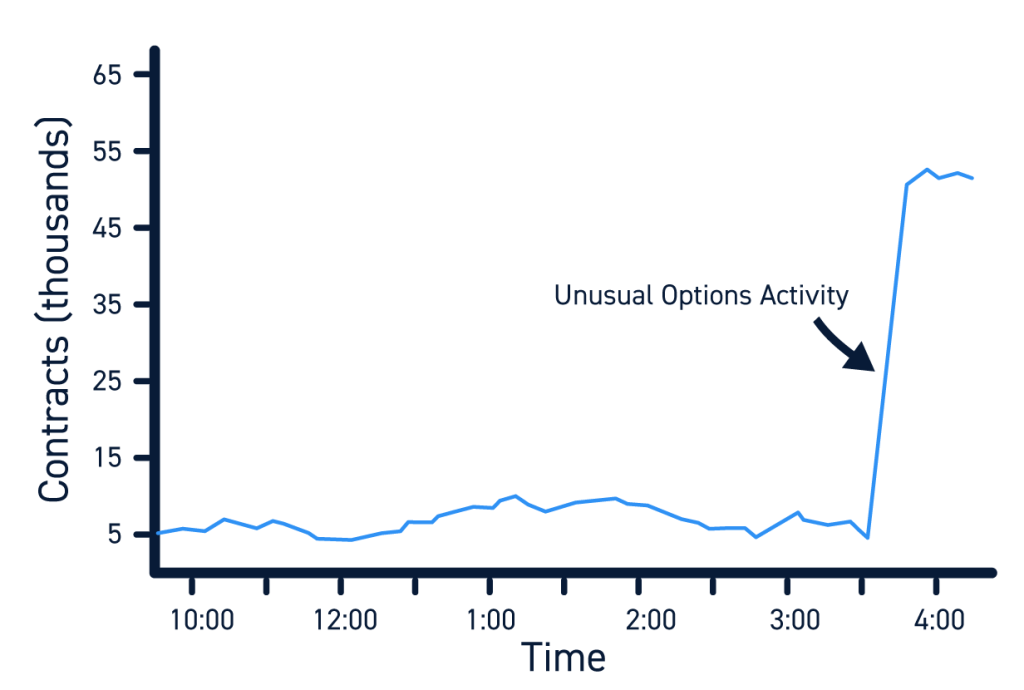

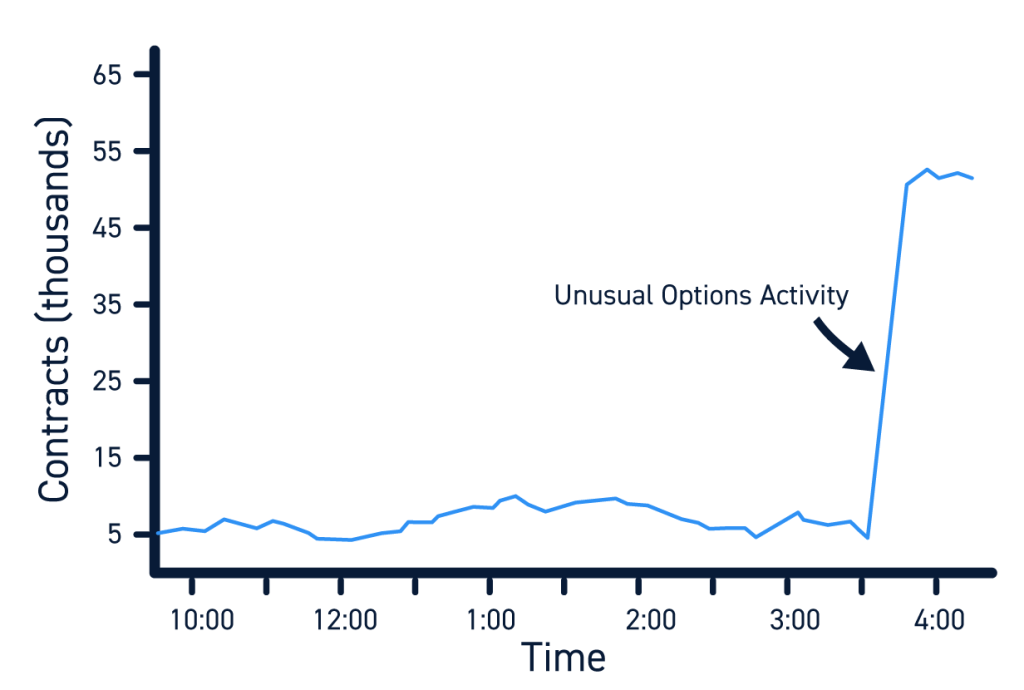

Unusual options activity occurs when there is a sudden, significant spike in options volume or open interest, especially if it's not accompanied by corresponding stock price movement or public news.

Traders use this as a potential signal that large institutional investors—or the so-called "smart money"—are positioning ahead of an anticipated event.

These activities often show up in the form of:

The idea is that such trades are not accidental. Big players typically have access to better research or insider knowledge, and following their actions could offer a clue to potential market movements.

How to Identify

Volume vs Open Interest: If the volume in a contract abruptly surpasses the total open interest, it suggests new positions are being established, which can be notable to observe.

Unusual Size: Institutional trades are generally large and occur in round lots (multiples of 100 contracts). If you see a sudden trade for 10,000 calls in an otherwise inactive option, it's worth investigating.

Direction of Trade: Whether the options being purchased are calls or puts gives insight into whether the trader is bullish or bearish.

Time to Expiration: Traders may use options expiring in a few days or months, depending on the type of event they're expecting. Very short-term or long-term unusual trades often stand out.

Implied Volatility: A spike in implied volatility and heavy options volume suggests the market is pricing in an anticipated event.

Types

1) Bullish UOA

A trader buying thousands of deep out-of-the-money call options on a stock that hasn't moved much could be betting on an upcoming catalyst such as earnings or a product launch.

If these options are purchased with high urgency and rising premiums, it often reflects strong bullish sentiment.

2) Bearish UOA

Heavy buying of put options—especially far out-of-the-money—can indicate bearish expectations. It might be tied to negative news that hasn't been released publicly yet or concerns about market sentiment or broader economic events.

3) Hedging Activity

Sometimes, unusual trades are purely for hedging purposes. For example, a fund holding a large position in a tech stock might buy options to protect against downside risk.

4) Spread Strategies

Unusual activity can also appear in complex spreads, such as call spreads, put spreads, or iron condors. These setups suggest a more nuanced view of the stock, such as limited upside or downside movement.

Why Unusual Options Activity Matters

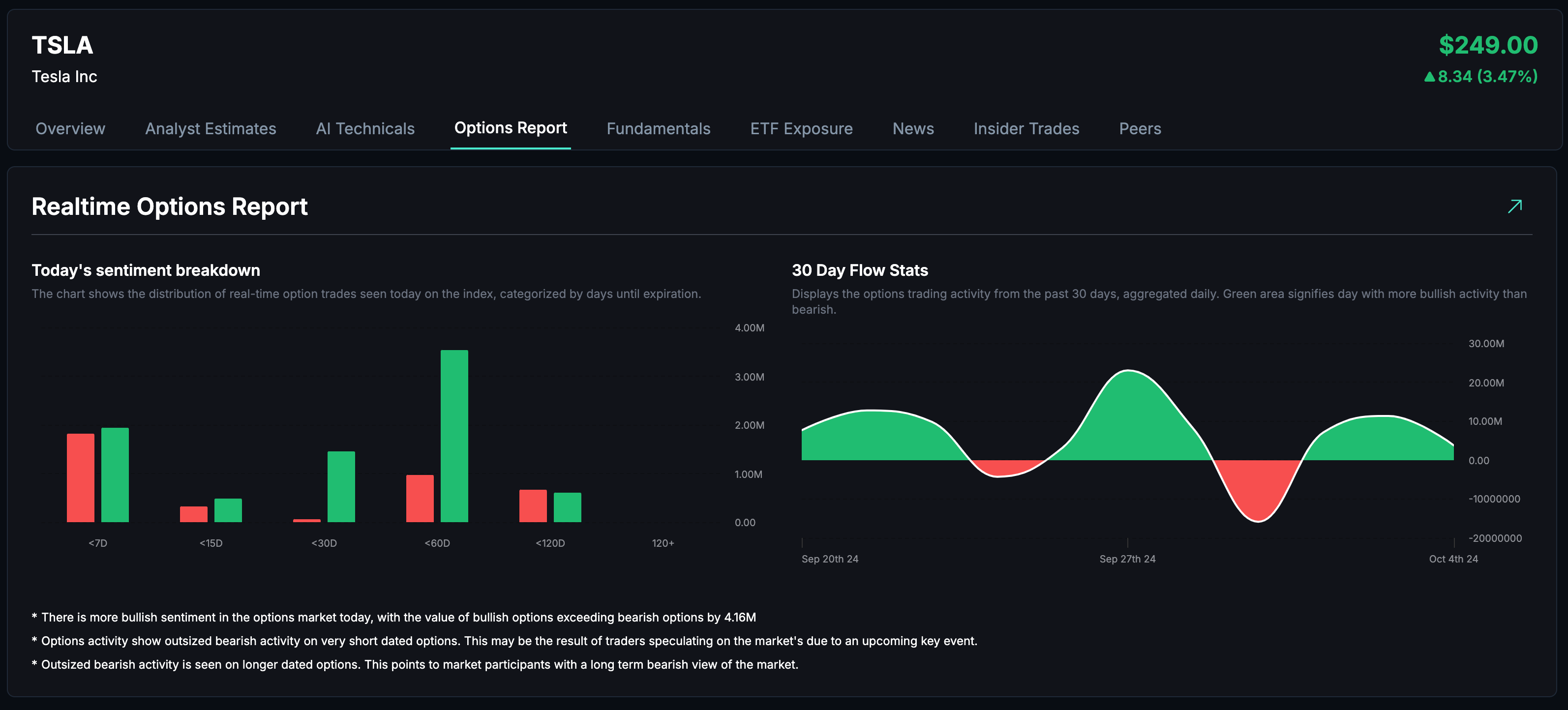

Unusual options activity provides insight into market sentiment and can help predict directional movement. Since institutional traders often make large moves in the options market before buying or selling the actual stock, UOA can serve as a leading indicator.

There are several key reasons why UOA matters:

1. Insider Clues

Institutional investors may have access to proprietary information or analysis that is not yet public. Their options trades can serve as subtle clues about upcoming catalysts.

2. Market Sentiment

Large, aggressive options trades can indicate a shift in sentiment—bullish or bearish—before the broader market catches on.

3. Risk Management

Unusual activity can help traders hedge existing positions or take preemptive action to protect portfolios from anticipated volatility.

4. Opportunity for Profit

Retail traders who spot and analyse unusual activity correctly can ride the wave of institutional moves and profit from rapid price changes.

How to Use Unusual Options Activity in Your Strategy

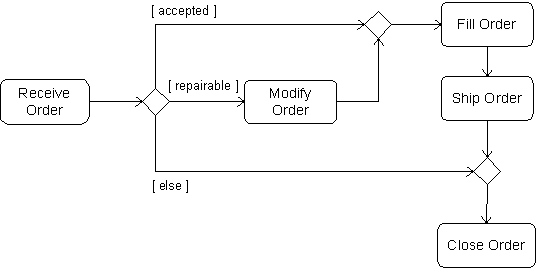

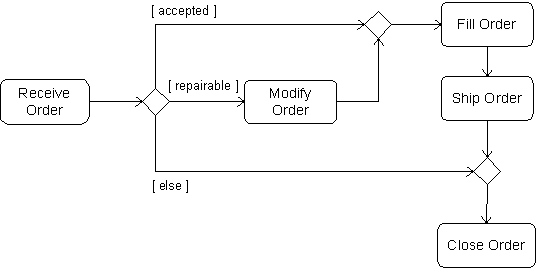

Step 1: Scan for UOA

Use a scanner or flow tool to identify spikes in volume, new open interest, or large trades.

Step 2: Analyse Context

Check for news, earnings dates, or macroeconomic events that could justify the activity. Rule out routine hedging if possible.

Step 3: Confirm with Technicals

Use Chart Patterns, indicators, and support and resistance levels to validate the direction suggested by the UOA.

Step 4: Position Accordingly

If the trade aligns with your thesis, you can enter a similar options trade or trade the underlying stock, but always manage risk carefully.

Real-World Examples

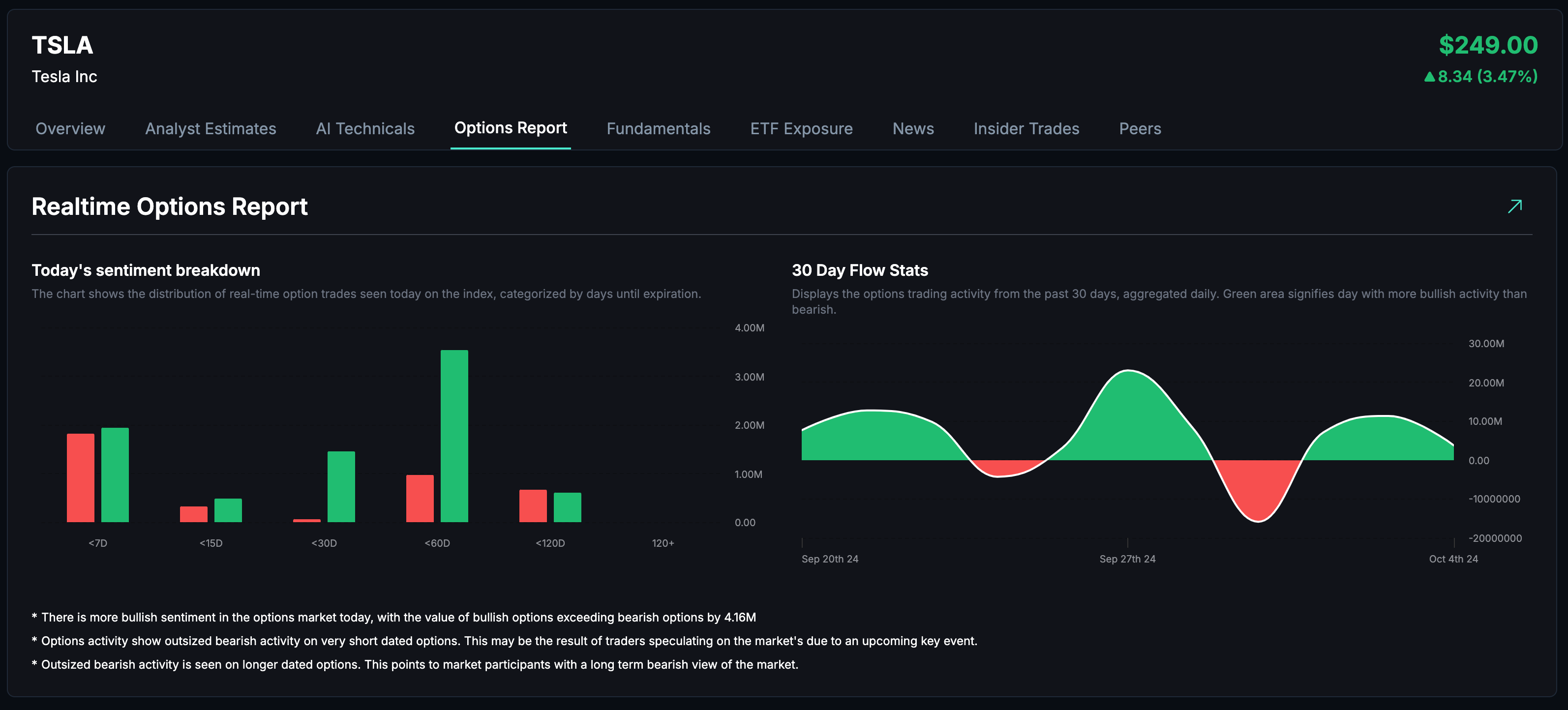

Example 1: Tesla (TSLA) Before Earnings

In July 2020, a large number of call options were acquired for Tesla just before its earnings report. The stock rallied 20% post-earnings, validating the options flow as predictive.

Example 2: Boeing (BA) During a Crisis

In early 2020, a surge of put buying on Boeing hinted at investor fear over travel restrictions. The stock plummeted weeks later during the COVID-19 lockdowns, confirming the bearish options activity.

Common Mistakes to Avoid

Relying solely on UOA without deeper analysis can lead to costly errors. Here are mistakes beginner traders should steer clear of:

Chasing Every Signal: Not every unusual activity justifies trading. Volume spikes can occur for various non-directional reasons.

Ignoring Fundamentals: Just because big money is buying calls doesn't mean a stock will skyrocket. Fundamentals still matter.

Overleveraging: UOA can lead to overconfidence and excessive risk-taking. Stick to your risk management rules.

Misreading Intent: Sometimes, what looks like bullish activity might be part of a bearish strategy (e.g., covered call writing).

Tips for Beginners

Start by paper trading or using a demo account to practice interpreting UOA signals.

Limit your exposure by only risking a small portion of your capital.

Combine UOA with other methods such as earnings analysis, sector trends, and macroeconomic data.

Follow a consistent routine for checking and analysing flow data daily.

Stay informed about upcoming news events that could explain or invalidate the activity you're tracking.

Conclusion

In conclusion, unusual options activity can be a powerful tool in your trading arsenal when used correctly. It offers a glimpse into the actions of institutional investors and may serve as a leading indicator of significant stock moves. However, it should not be relied upon in isolation.

In 2025, with more tools than ever available to track options flow, there's never been a better time to incorporate UOA into your trading strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.