What Is an Expense Ratio in ETFs?

An expense ratio represents the annual fee charged by an ETF provider to manage and operate the fund. It is expressed as a percentage of the fund’s total assets. For example, an ETF with a 0.50% expense ratio will deduct $5 for every $1,000 invested per year to cover management and operational costs.

Components of an Expense Ratio:

Management Fees: Paid to the fund manager for running the ETF.

Operational Costs: Administrative expenses, legal fees, audit costs.

Other Fees: Marketing, custodial, or regulatory costs.

Example: A $10,000 investment in an ETF with a 0.40% expense ratio will cost $40 per year. Over decades, these costs can compound, significantly impacting overall returns.

Why Expense Ratios Matter in ETFs

Expense ratios are one of the most critical factors investors often overlook. While a 0.1% difference might seem insignificant, small fees compound over time, quietly eating into your long-term wealth. Understanding their impact is key to building a portfolio that truly grows.

1. The Power of Compounding Fees

Even a seemingly tiny expense ratio can drastically alter returns over decades. This is because fees are deducted from your investment annually, reducing the amount that can grow through compounding. Over time, this effect snowballs, especially for long-term investors.

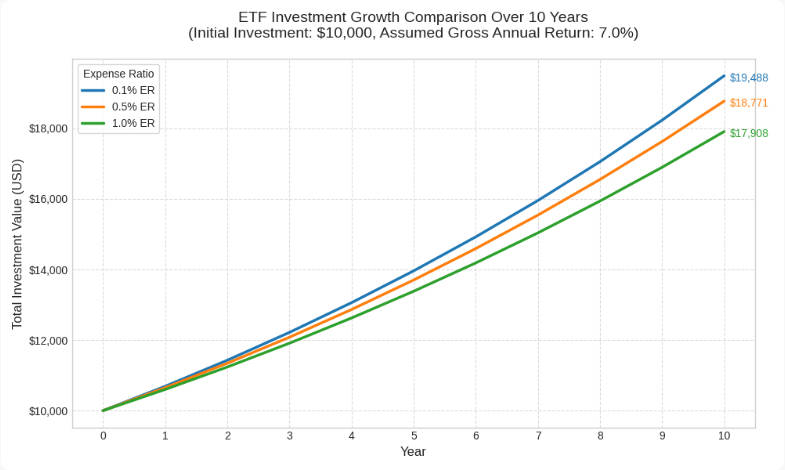

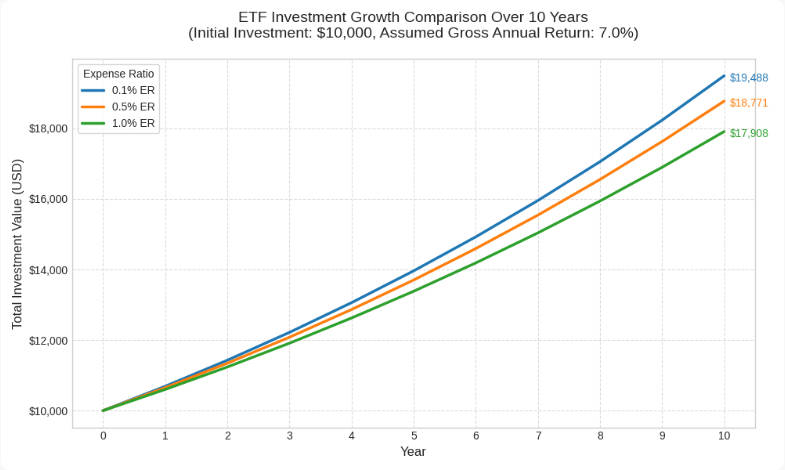

Imagine investing $10,000 in three ETFs with different expense ratios and assuming a 7% annual growth rate:

| Expense Ratio |

10-Year Value on $10,000 |

Difference from Lowest-Fee ETF |

| 0.10% |

$19,786 |

Base |

| 0.50% |

$19,066 |

$720 less |

| 1.00% |

$18,308 |

$1,478 less |

Over a decade, paying a seemingly small 0.5% fee costs you $720, while a 1% fee can shave off nearly $1,500. Imagine this effect over 20 or 30 years—it becomes life-changing for your wealth accumulation.

2. Why Fees Can Outweigh Performance

Many investors focus on chasing high returns but forget that fees directly reduce net returns. Even if an ETF performs exceptionally well, a high expense ratio can wipe out a significant portion of gains. Low-fee ETFs often outperform higher-cost alternatives simply because less money is drained from the portfolio over time.

3. Long-Term Investor Perspective

For long-term investors, expense ratios are silent wealth killers. Minimising fees is often the easiest way to improve net returns without taking additional market risk. For example, a 30-year investment in a broad market ETF with a 0.05% expense ratio can end up tens of thousands of pounds ahead of a similar fund charging 0.50%, assuming identical market growth.

Therefore, investors should always consider the expense ratio alongside performance history, investment goals, and total cost of ownership. Even tiny savings today can translate into substantial wealth tomorrow.

How Expense Ratios Are Calculated

The expense ratio formula is:

Expense Ratio = (Total Annual Fund Costs/Average Assets Under Management)×100

If an ETF manages $100 million and incurs $1 million in annual expenses, the expense ratio is:

(1,000,000/100,000,000)×100 = 1%

Different types of ETFs often have varying expense ratios:

| ETF Type |

Typical Expense Ratio |

| Broad Market Index |

0.03% – 0.10% |

| Sector/Industry ETF |

0.20% – 0.50% |

| Actively Managed ETF |

0.50% – 1.00%+ |

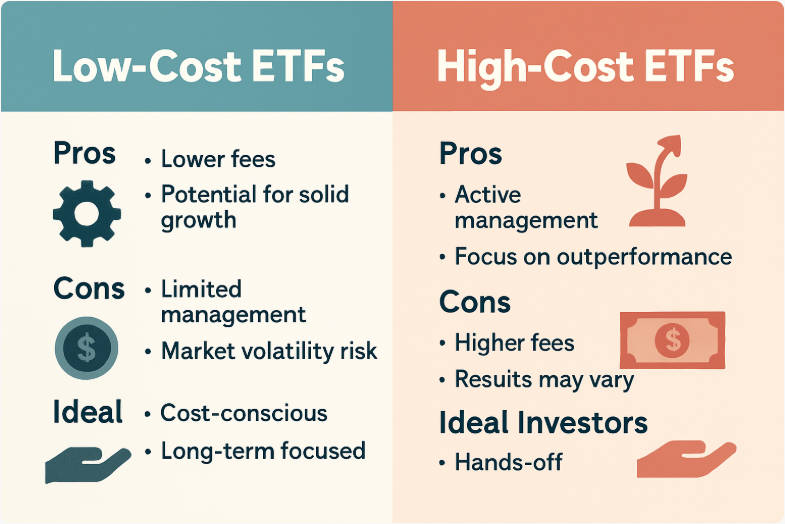

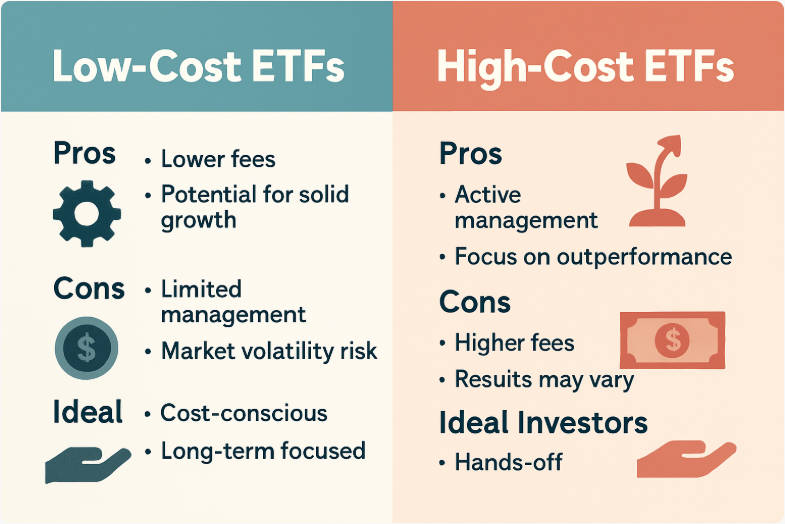

Low vs High Expense Ratios: What Investors Should Know

When evaluating ETFs, focusing solely on the expense ratio can be misleading. While fees are important, they are just one piece of the puzzle. Understanding the trade-offs between low-cost and higher-cost ETFs can help you make smarter, long-term investment decisions.

1. Advantages of Low Expense Ratios

1) More of Your Money Stays Invested

Low expense ratios mean a smaller portion of your investment is used to cover fees. This leaves more capital actively working in the market, which over time can significantly boost your portfolio's growth.

2) Enhanced Long-Term Compounding

Even small differences in expense ratios can have a dramatic effect over decades. For example, an ETF with a 0.05% expense ratio versus 0.50% may seem negligible annually, but over 30 years, this difference can result in tens of thousands of pounds more in returns due to compounding.

3) Ideal for Passive Investing

Broad market index ETFs and other passively managed funds generally come with lower fees. These funds track a benchmark rather than trying to outperform it, which aligns perfectly with a long-term, buy-and-hold strategy.

2. Advantages of Higher Expense Ratios

1) Access to Active Management and Expertise

ETFs with higher expense ratios are often actively managed. Skilled fund managers may use research, market timing, or alternative strategies to outperform the market. For some investors, the potential for higher returns justifies the additional cost.

2) Exposure to Specialised or Niche Strategies

Higher-cost ETFs may focus on specific sectors, commodities, emerging markets, or innovative strategies not available in low-cost alternatives. This allows investors to diversify their portfolios beyond standard index funds.

3) Additional Services and Features

Some higher-fee ETFs provide extra benefits, such as currency hedging, dividend optimisation, or sustainability-focused strategies. These features can add value that low-cost ETFs do not offer.

Tips for Investors

Compare Like with Like

Always compare ETFs that target the same market or sector. A high-fee ETF might make sense if it provides unique exposure, but comparing it to a broad market index fund is misleading.

Assess Historical Performance Relative to Fees

A higher expense ratio only pays off if the ETF delivers better returns after accounting for fees. Look at long-term performance over 5–10 years rather than short-term fluctuations.

Consider Your Investment Horizon

For long-term investors, low-cost ETFs often outperform higher-cost alternatives simply because fees compound against you. Active ETFs may make more sense for shorter-term strategies or specialised goals.

Evaluate Fee Justification

Ask yourself: does the ETF's strategy or management justify the higher cost? If not, a low-fee ETF may be a smarter, more efficient choice.

Hidden Costs and Considerations

Even if an ETF has a low expense ratio, it does not mean investing in it is entirely free of costs. Savvy investors must consider the total cost of ownership, which includes several subtle but impactful factors that can quietly erode returns over time.

1. Trading Fees

Every time you buy or sell ETF shares, brokers may charge a commission. While many brokers now offer commission-free trading, others still impose fees that can accumulate, especially for frequent traders. Even small costs per transaction can add up over time and reduce overall portfolio growth.

2. Bid-Ask Spreads

The bid-ask spread is the difference between the price a buyer is willing to pay and the price a seller is asking. ETFs with low liquidity or niche market exposure often have wider spreads. This "hidden cost" effectively increases the price you pay when entering or exiting positions, particularly for larger trades.

3. Taxes on Dividends and Capital Gains

Taxes can quietly reduce net returns, especially in taxable accounts. ETFs that frequently distribute dividends or generate capital gains may trigger tax events. While index ETFs are generally tax-efficient, actively managed ETFs or sector-focused funds can create higher tax liabilities, reducing the benefit of low expense ratios.

4. Tracking Error

Some ETFs may not perfectly replicate the performance of their underlying index. Differences arise due to management techniques, fees, or market inefficiencies. This tracking error can subtly affect returns, meaning you may earn slightly less than expected even after accounting for the expense ratio.

5. Currency and International Costs

For ETFs that invest in foreign markets, additional costs such as currency conversion fees, foreign taxes, or international transaction expenses can further impact returns. Investors in global or emerging market ETFs should consider these extra layers of cost.

6. Opportunity Cost of Misaligned ETF Choices

Sometimes, investing in an ETF with low fees is not enough if the fund's strategy does not align with your goals. The hidden cost here is missed returns from better-performing alternatives or diversification gaps that could have enhanced long-term growth.

In summary, focusing solely on the expense ratio can be misleading. To make truly informed investment decisions, evaluate all associated costs, including trading fees, bid-ask spreads, taxes, tracking errors, and international charges. Understanding the full cost picture helps investors optimise returns and avoid unpleasant surprises over time.

How to Reduce Your ETF Costs

Reducing ETF costs can dramatically improve your long-term investment returns. Small savings on fees compound over years, often resulting in significantly higher wealth. Here are practical strategies to lower costs effectively:

1. Choose Low-Cost ETFs for Long-Term Investing

Not all ETFs are created equal. Broad market index ETFs often have the lowest expense ratios, sometimes as little as 0.03%. Opting for low-cost ETFs ensures more of your money remains invested, allowing compounding to work its magic over time. While tempting to chase niche or actively managed ETFs, always weigh higher fees against potential outperformance.

2. Use Commission-Free Brokers

Trading fees can quietly erode returns, especially for frequent investors. Many brokers now offer commission-free ETF trades. Leveraging these platforms allows you to invest regularly without losing a portion of your capital to trading costs. Even small savings per trade add up over multiple years.

3. Reinvest Dividends Automatically

Dividends may seem small, but reinvesting them automatically accelerates compounding. Most brokers and ETFs allow dividend reinvestment plans (DRIPs), which use dividends to buy more shares without extra costs. Over decades, this strategy can significantly boost overall portfolio value, even if the ETF's expense ratio is modest.

4. Consider Tax-Efficient ETFs

Taxes are a hidden cost that many investors overlook. ETFs that distribute fewer capital gains or employ tax-efficient strategies help retain more of your earnings. For example, index ETFs typically generate fewer taxable events than actively managed funds. Understanding how taxes affect your ETF returns can save thousands over time.

5. Avoid Frequent Trading

Buying and selling ETFs too often can create additional costs through bid-ask spreads and capital gains taxes. A long-term, buy-and-hold strategy minimises these hidden costs while letting your investments grow naturally.

6. Monitor Expense Ratios Periodically

ETF expense ratios are not fixed forever. Providers can adjust them based on operational changes. Regularly reviewing your holdings ensures you aren’t paying more than necessary and allows you to swap into lower-cost alternatives when available.

7. Bundle ETFs When Possible

Some investors benefit from ETFs that combine multiple asset classes in one fund. These "all-in-one" ETFs reduce the need to purchase multiple funds separately, lowering cumulative fees while maintaining diversification.

In conclusion, by carefully selecting low-cost ETFs, minimising trading fees, reinvesting dividends, and considering tax implications, you can maximise returns and grow your portfolio more efficiently. Even modest savings on fees compound substantially over decades, making this a crucial step in smart investing.

Frequently Asked Questions (FAQs)

Q1: What is a typical expense ratio for ETFs?

A: Most broad market index ETFs charge between 0.03% and 0.10%, while sector or actively managed ETFs may range from 0.20% to over 1%. Understanding the type of ETF helps set expectations.

Q2: Does a lower expense ratio always mean better returns?

A: Not necessarily. While lower fees reduce costs, some actively managed ETFs with higher fees may outperform the market. Evaluate historical performance alongside the expense ratio.

Q3: How often are ETF expense ratios charged?

A: Expense ratios are deducted daily from the fund's assets and reflected in the ETF's net asset value. Investors do not pay directly but see reduced returns over time.

Q4: Can expense ratios change over time?

A: Yes, fund providers can adjust expense ratios due to changes in management costs, operational expenses, or fund strategy. It is important to review periodically.

Q5: Are expense ratios the only cost to consider in ETFs?

A: No. Trading fees, bid-ask spreads, and taxes can all impact net returns. Total costs should be considered when selecting an ETF.

Conclusion

Understanding the expense ratio in ETFs is essential for any investor seeking long-term wealth growth. Even small fees can significantly impact returns over decades. By choosing low-cost ETFs wisely, considering hidden costs, and assessing whether active management justifies higher fees, investors can maximise their portfolio's growth potential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.