Indian investors seeking long-term capital appreciation in green energy stocks should focus on names like Adani Green Energy, Tata Power, JSW Energy, ReNew Energy Global, NTPC Green, Suzlon, Inox Wind, Borosil Renewables, KPI Green Energy, and Waaree Solar.

These firms lead in capacity expansion, stable PPAs, strong financials, and government momentum behind India's 2030 clean energy targets.

Below, we will explain more about why these ten green energy stocks stand out among the rest, what their attractive features are, and why you should invest in them.

Top 10 Green Energy Stocks to Buy Now

| Company |

Core Segment |

Market Value (Approx.) |

Revenue / Profit Growth |

P/E Ratio (Approx.) |

Risk Profile |

| Adani Green Energy Ltd |

Solar & Wind IPP |

$38–40 bn |

Revenue CAGR ~18–20% |

Not meaningful (earnings still ramping; EV-based valuation used) |

Medium |

| Tata Power Company Ltd |

Integrated Utility & Renewables |

$18–20 bn |

Revenue growth ~10–12% |

~30–35× |

Low |

| NTPC Green Energy Ltd |

PSU Renewables |

$15–17 bn |

Revenue growth ~15–17% |

~35–40× (forward, limited history) |

Low |

| JSW Energy Ltd |

Power Producer (Transitioning Green) |

$9–10 bn |

Revenue growth ~14–16% |

~25–30× |

Medium |

| ReNew Energy Global Plc |

Solar & Wind IPP |

$7–8 bn |

Revenue growth ~16–18% |

Not meaningful (volatile earnings) |

Medium |

| NHPC Ltd |

Hydropower & Renewables PSU |

$9–10 bn |

Revenue growth ~10–12% |

~14–16× |

Low |

| Waaree Renewable Technologies Ltd |

Solar Modules & EPC |

$3–4 bn |

Revenue growth >40% |

~40–50× |

Medium |

| Sterling and Wilson Renewable Energy Ltd |

Renewable EPC |

$2.5–3 bn |

Revenue growth ~20% |

Loss-making / P/E not applicable |

Medium |

| KPI Green Energy Ltd |

Captive Solar & Hybrid |

$1.8–2 bn |

Revenue growth ~25–28% |

~28–32× |

Medium |

| Suzlon Energy Ltd |

Wind Turbines |

$6–7 bn |

Revenue growth ~30% |

~45–60× (normalised earnings) |

High |

1. Adani Green Energy Ltd

Market value: ~$38–40 billion

Revenue growth (FY25–FY26E): ~18–20%

Operational capacity: ~16 GW; pipeline >25 GW

The company remains the largest pure-play renewable producer in India. Revenue growth continues to be driven by new solar-wind hybrid commissioning and rising plant load factors. Nearly all capacity is tied to long-term PPAs, providing multi-decade cash-flow visibility. Capital intensity remains high, but scale advantages and falling cost of capital are improving return metrics steadily.

2. Tata Power Company Ltd

Market value: ~$18–20 billion

Revenue growth: ~10–12%

Renewable capacity: ~6.5 GW operational; >15 GW pipeline

It combines renewable generation, transmission, distribution, rooftop solar, EV charging infrastructure, and clean-energy manufacturing under a single integrated platform. Growth is steady rather than aggressive, but earnings quality remains among the strongest in the sector. Backward integration into solar manufacturing enhances margin resilience as domestic solar deployment continues to accelerate.

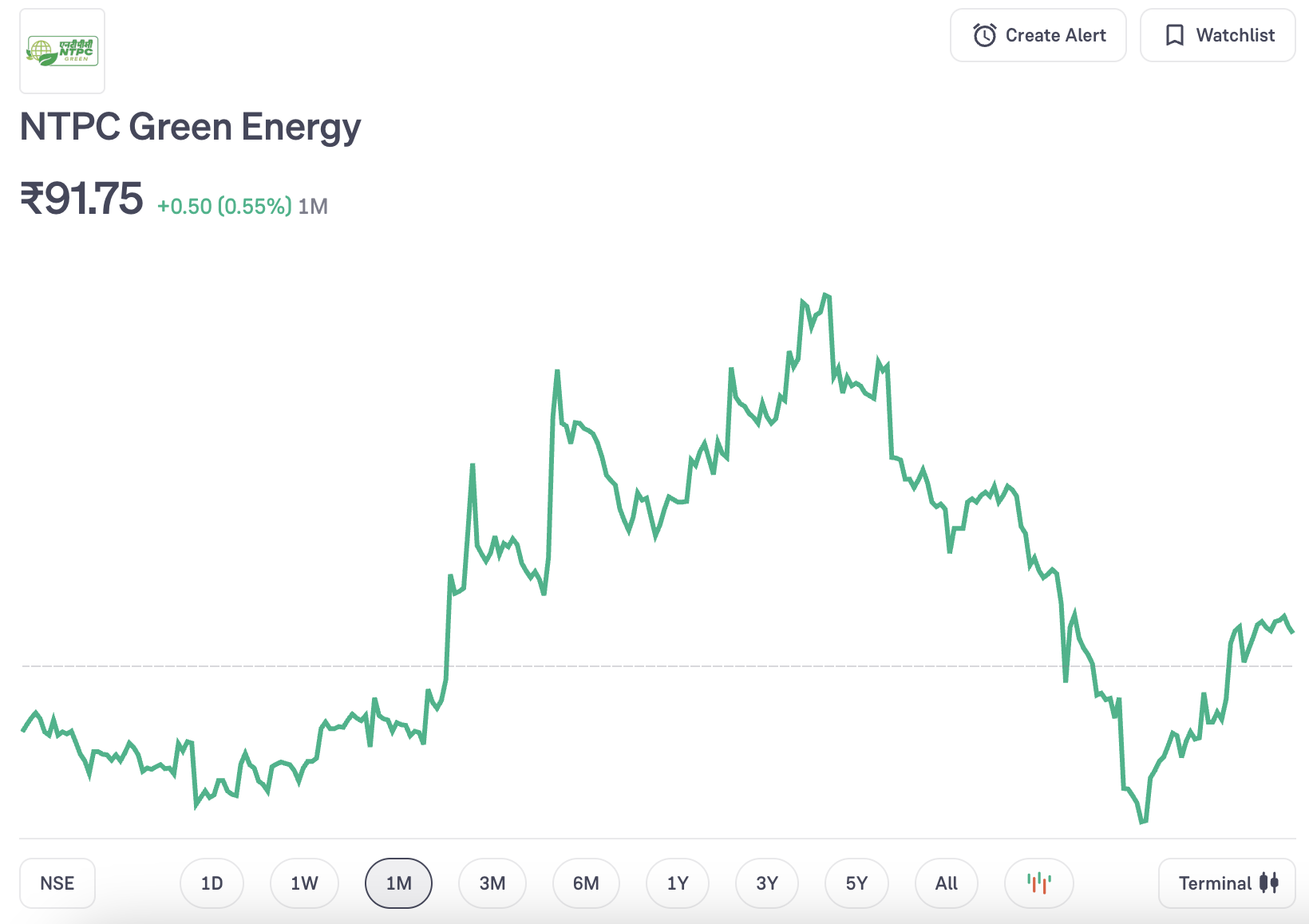

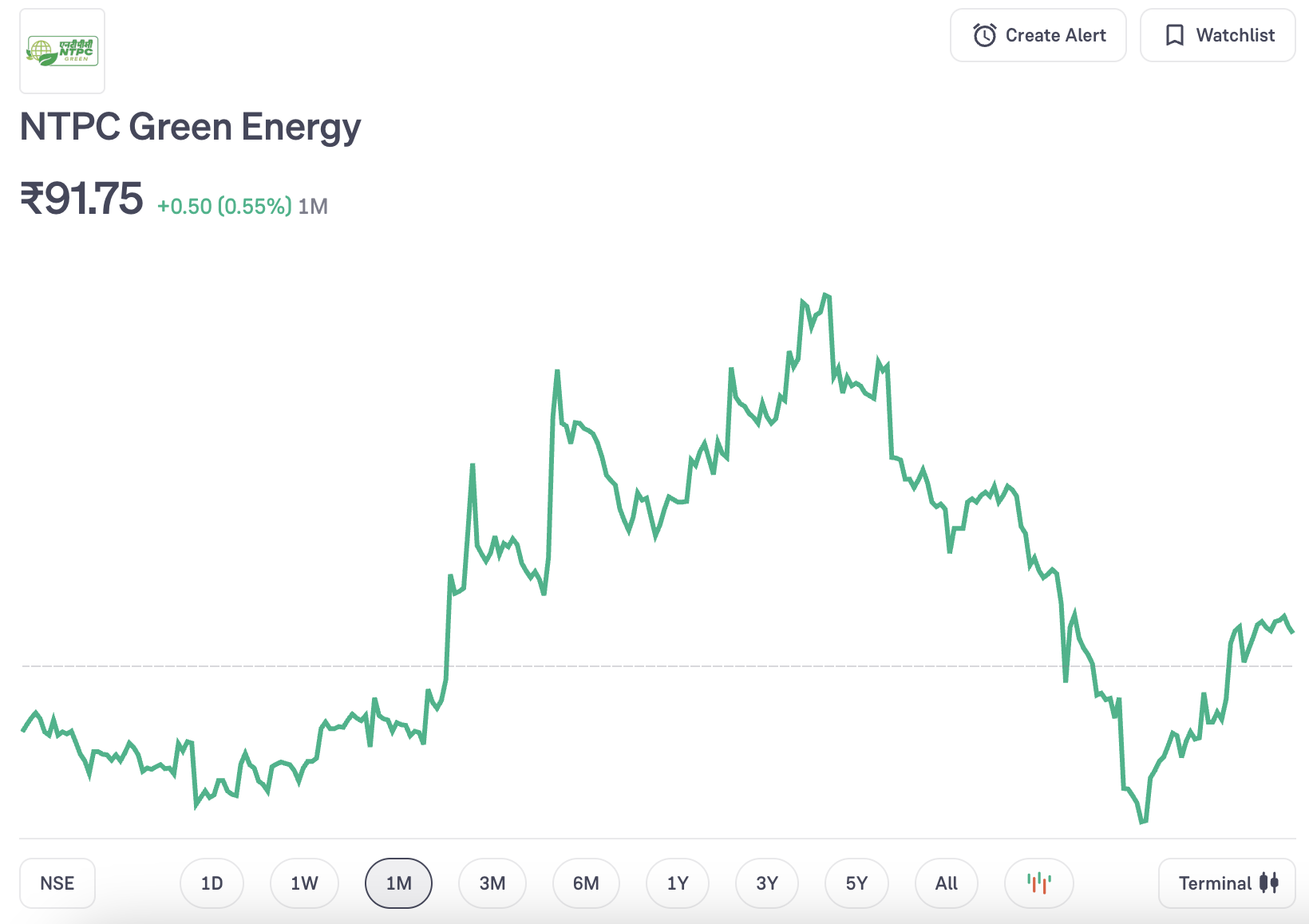

3. NTPC Green Energy Ltd

Implied market value: ~$15–17 billion

Revenue growth: ~15–17%

Renewable capacity: ~5.5 GW operational; >20 GW under development

Backed by a strong PSU balance sheet, this company has emerged as one of the fastest-expanding renewable platforms in Asia. Its focus on utility-scale solar, wind, floating solar, and early-stage green hydrogen positions the business at the core of India’s long-term energy security strategy. Financial risk remains among the lowest in the sector due to sovereign support and conservative funding structures.

4. JSW Energy Ltd

Market value: ~$9–10 billion

Revenue growth: ~14–16%

Operational capacity: ~7 GW; pipeline >20 GW

JSW Energy is transitioning rapidly from thermal-heavy generation to renewables. Recent acquisitions and organic solar-wind projects have materially lifted forward growth visibility. Its capital structure remains conservative relative to peers, and future earnings are increasingly PPA-backed, improving earnings predictability.

5. ReNew Energy Global Plc

Market value: ~$7–8 billion

Revenue growth: ~16–18%

Commissioned capacity: ~13 GW

While its international listing and capital structure add complexity, the underlying asset base remains high quality. Cash generation improves materially as legacy projects mature and merchant exposure stays limited.

6. NHPC Ltd

Market value: ~$9–10 billion

Revenue growth: ~10–12%

Installed renewable capacity: ~7.4 GW

NHPC is India’s largest hydropower producer and a key PSU player in the country’s renewable transition. While hydro remains its core asset base, NHPC is steadily expanding into solar and wind through competitive bidding and joint ventures. Long asset lives, regulated tariffs, and government backing provide earnings stability, making NHPC a lower-risk renewable exposure within India’s green energy landscape.

7. Waaree Renewable Technologies Ltd

Market value: ~$3–4 billion

Revenue growth: >40%

Business mix: Solar modules, EPC, project execution

This company benefits directly from India’s push toward domestic solar manufacturing and lower import dependence. Order inflows remain robust, export exposure is rising, and operating leverage is driving outsized profit growth. Volatility is higher, but structural demand support is strong.

8. Sterling and Wilson Renewable Energy Ltd

Market value: ~$2.5–3 billion

Revenue growth: ~20%

Order book: Solar EPC projects across India and overseas

As installations scale nationwide, EPC players gain relevance. Sterling & Wilson’s execution capability and international exposure position it to capture both domestic and export-led growth. Margins remain cyclical, but volume visibility is improving meaningfully.

9. KPI Green Energy Ltd

Market value: ~$1.8–2 billion

Revenue growth: ~25–28%

Portfolio: ~1.8 GW captive and hybrid projects

Focusing on captive and group-captive solar for industrial clients, a segment seeing accelerating demand due to rising grid tariffs, it is one of the well-known green energy company in India. Long-duration contracts and hybrid configurations improve revenue stability. Growth remains faster than sector averages, albeit with mid-cap volatility.

10. Suzlon Energy Ltd

Market value: ~$6–7 billion

Revenue growth: ~30%

Order book: ~6 GW wind projects

Suzlon’s turnaround has restored profitability and balance-sheet stability. India’s revival of wind auctions has sharply improved turbine demand. Execution risk remains, but operating leverage means earnings growth continues to outpace sector averages during upcycles.

Why Invest in Green Energy Stocks in India

India’s green energy sector offers a compelling long-term investment opportunity as the country accelerates toward large-scale renewable adoption. Ambitious national targets, rising power demand, and consistent policy support are driving sustained capacity additions across solar, wind, and hybrid projects. This creates a clear growth runway for companies with scalable assets and long-term power contracts.

Green energy stocks also add diversification to an equity portfolio. Their earnings are increasingly supported by regulated or contracted revenues, which tend to behave differently from cyclical or commodity-linked sectors.

As India’s electricity needs expand alongside industrialisation and electrification, renewable energy companies are structurally positioned to capture demand growth while contributing to a cleaner and more resilient energy system.

Why Green Energy Stocks Are Increasing in Appeal?

India’s push toward 500 GW of non-fossil fuel capacity by 2030 has moved firmly into execution mode. Large solar, wind, and hybrid auctions, along with faster grid expansion, are translating policy targets into visible project pipelines and long-term power contracts.

Investor confidence has also improved. Global sustainable investing regained momentum through 2025 as capital shifted toward profitable, asset-backed clean energy companies. In India, leaders such as Adani Green Energy Ltd, Tata Power Company Ltd, JSW Energy Ltd, NTPC Green Energy Ltd, and ReNew Energy Global Plc benefit from long-term PPAs, policy support, and expanding scale.

Together, these factors are positioning green energy stocks as durable infrastructure investments rather than short-term thematic trades.

Frequently Asked Questions (FAQs)

1. Is 2026 a good time to invest in green energy stocks in India?

Yes. By 2026, India’s renewable expansion is firmly execution-driven rather than policy-led alone. Capacity additions, long-term PPAs, and improving grid infrastructure have enhanced earnings visibility, making green energy stocks more suitable for long-term investors than in earlier cycles.

2. Which segments within green energy offer the most stability?

Utility-scale solar and wind projects backed by long-term PPAs offer the highest stability. Companies such as Tata Power Company Ltd and NHPC Ltd benefit from regulated or contracted revenues that reduce volatility.

3. Are green energy stocks overvalued in India?

Valuations vary widely. Large developers like Adani Green Energy Ltd trade at premium multiples due to long growth runways, while PSU-backed names and diversified utilities offer more moderate valuations. Assessment should focus on cash-flow visibility rather than headline P/E alone.

4. How do green energy stocks perform during market volatility?

Many renewable companies have revenues tied to fixed tariffs and long-term contracts, which can cushion earnings during economic slowdowns. However, stocks with high leverage or aggressive expansion plans may still experience price volatility in risk-off market phases.

5. What role does government policy play in these investments?

Government policy is a major driver, particularly through renewable auctions, transmission build-out, and payment security mechanisms. While policy support lowers risk, investors should still focus on execution quality, balance sheets, and counterparty strength.

6. Are PSU green energy stocks safer than private players?

PSU stocks generally offer lower risk due to sovereign backing, easier access to capital, and regulated returns. Private developers may deliver higher growth but often come with higher leverage and valuation risk. A balanced portfolio typically includes both.

7. Can green energy stocks help diversify an equity portfolio?

Yes. Renewable energy stocks often show different earnings drivers compared to sectors like banking, IT, or commodities. Their long-term contracted revenues and infrastructure-like characteristics can improve diversification and reduce overall portfolio cyclicality.

Conclusion

In conclusion, India's energy transition opens up compelling multi-decade opportunities. For long-term investors seeking exposure to India's clean energy mission, this curated selection has scale, diversification, and thematic alignment.

However, remember to monitor execution risk, policy clarity, and market valuations as they unfold, and consider phased entry via SIP or staggered purchases.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.