Market structure offers a direct approach to understanding price action, and Break of Structure (BOS) provides a straightforward method for assessing whether that structure persists. In trading, BOS serves primarily to confirm trend continuation rather than to predict future movements. When a significant swing level is decisively broken, positioning, stop placement, and momentum frequently align in the direction of the break, resulting in clearer trading opportunities compared to entering trades during ongoing price moves.

This dynamic is particularly relevant in contemporary markets, where liquidity often accumulates near prominent highs and lows, and price movements can accelerate significantly when these zones are breached. For example, in the foreign exchange market, average daily turnover reached $9.6 trillion in April 2025, highlighting the speed at which trading flows can intensify a structural break after key levels are activated.

What Is a Break of Structure (BOS)?

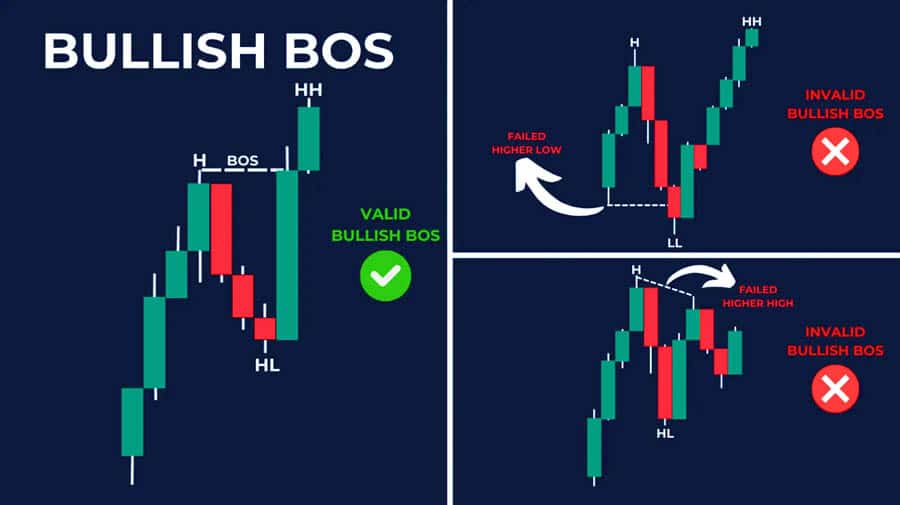

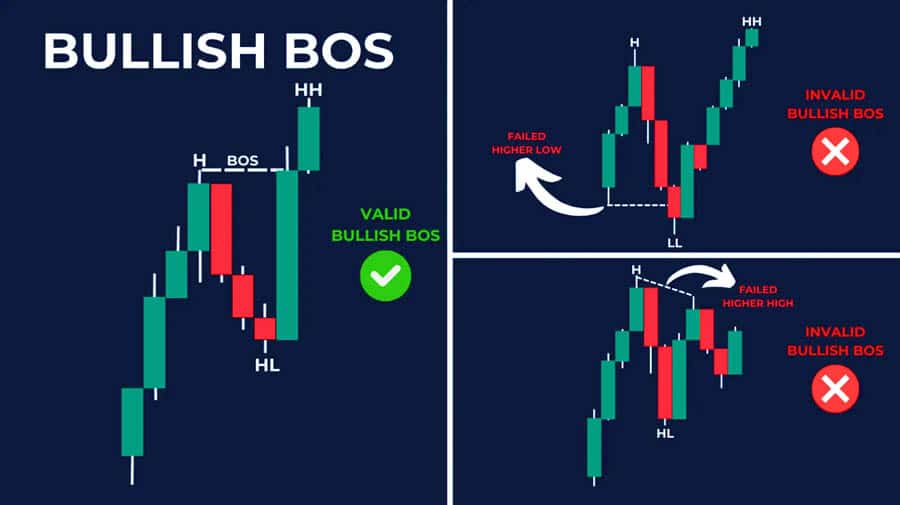

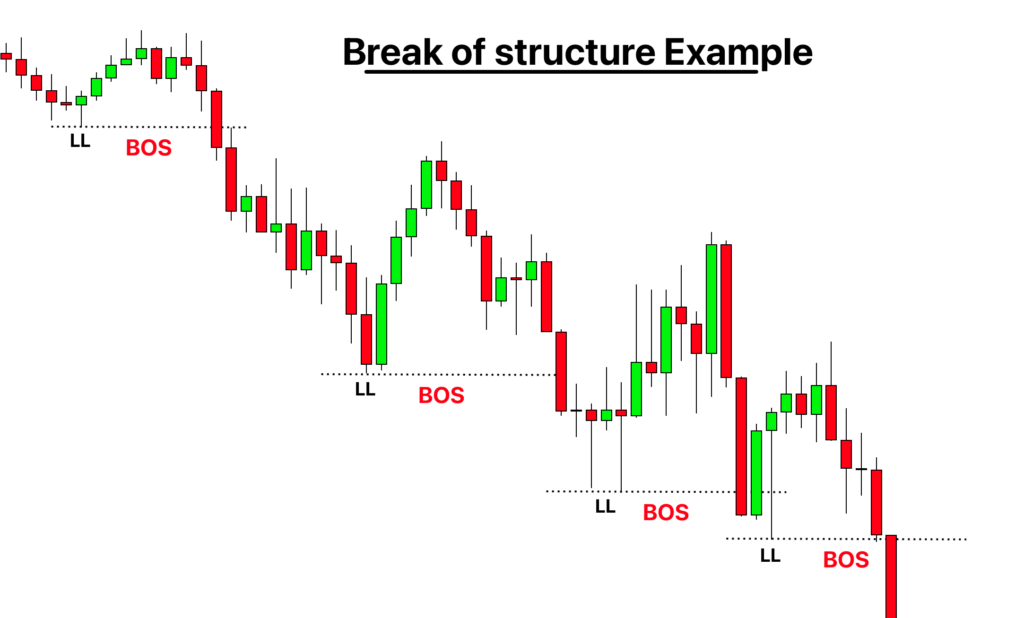

A Break of Structure occurs when price decisively breaks a recent, meaningful swing level that defines the prevailing trend.

In an uptrend, a bullish BOS is confirmed when the price closes above the most recent swing high without first breaking the prior swing low.

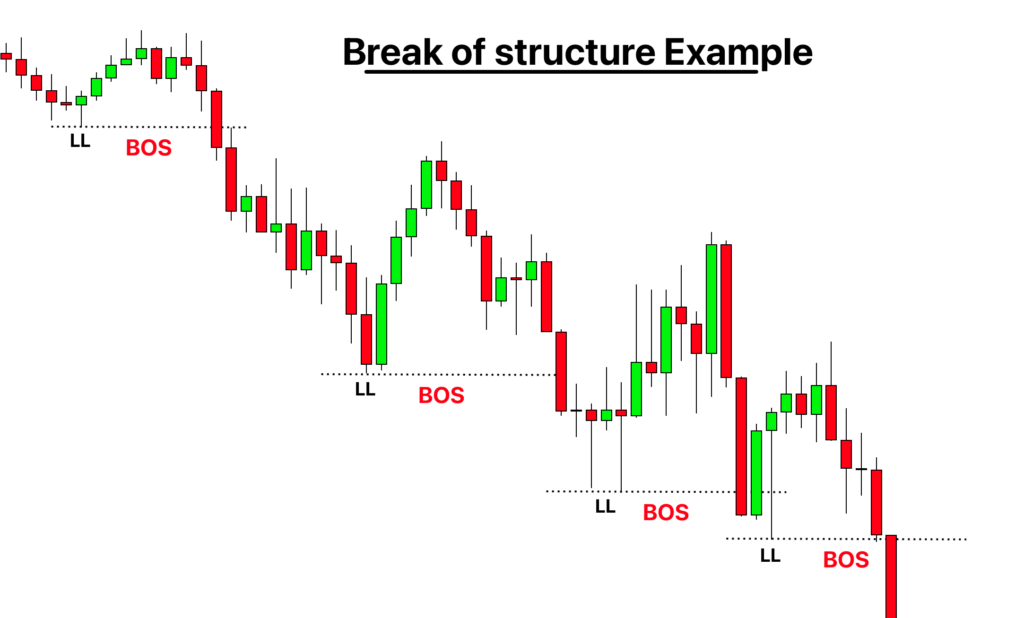

In a downtrend, a bearish BOS is confirmed when the price closes below the most recent swing low without first breaking the prior swing high.

This distinction is critical. BOS does not refer to just any breakout; it specifically denotes a break of a swing level that the market has consistently respected as structural. Consequently, BOS is integral to Smart Money Concepts frameworks, where swing highs, swing lows, equal highs, and equal lows frequently serve as liquidity pools. A structural break often signals the moment liquidity is absorbed and the market direction is confirmed.

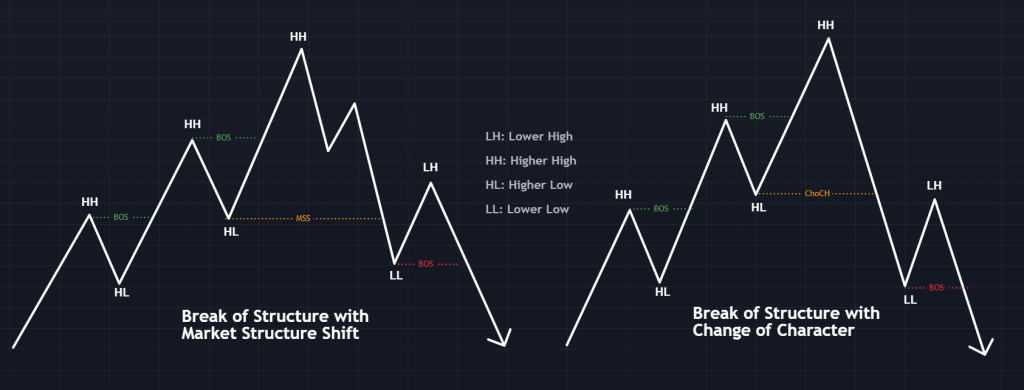

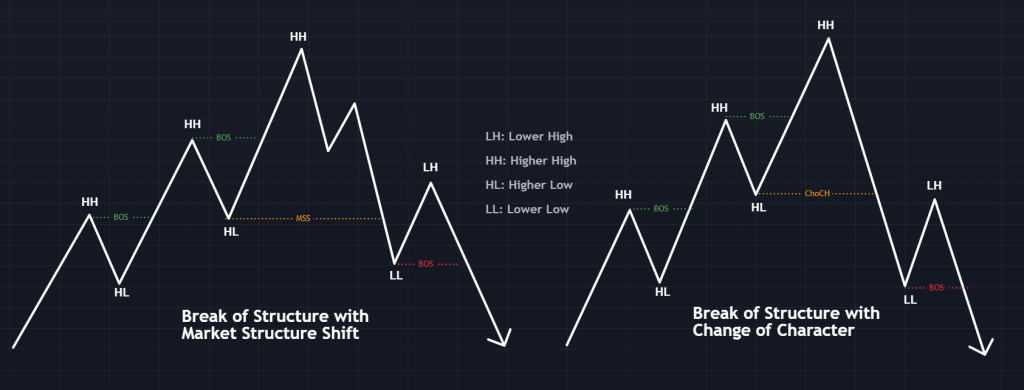

BOS vs CHOCH vs Simple Support or Resistance Break

Mislabeling every level break as BOS is a common and costly error, as it conflates continuation signals with reversal signals and diminishes the clarity of market structure.

| Concept |

What breaks? |

What it signals |

Typical use |

| Support/resistance break |

Any horizontal level |

Potential breakout |

Context-dependent, often noisy |

| CHOCH (Change of Character) |

The opposing swing inside the prior trend |

Early warning that control may be shifting |

Reversal preparation, needs confirmation |

| BOS (Break of Structure) |

The key swing that defines trend continuation |

Confirmation of continuation or confirmed transition |

Trend alignment, entries on retests |

How to Identify a BOS Correctly

1) Start with a clean structure, not micro-noise

Use a higher timeframe first (4H or daily for swing and position traders; 1H for active intraday traders) and mark the obvious swings that the market has respected. The goal is to identify the “organic” high or low that produced the latest impulse, not a minor fluctuation inside a range.

2) Demand a close beyond the swing

A wick that penetrates a level typically indicates a liquidity probe, whereas a candle close beyond the swing serves as a straightforward filter for false breakouts. Many experienced traders also seek signals of urgency, such as a large-bodied candle or a distinct impulse sequence, to demonstrate urgency rather than indecision.

3) Check whether the break has room to run

A BOS that occurs near higher-timeframe supply or demand zones often results in false signals. Before considering the break as a trading opportunity, it is essential to identify the next probable opposing zone, such as a previous weekly swing, prior day high or low, equal highs or lows, or a significant order-flow inflection. This approach helps avoid entering trades at the extremes of the structure.

4) Validate with multi-timeframe alignment

Higher timeframe BOS sets the bias; lower timeframe structure helps execution. A common workflow is:

Daily or 4H to define trend and key swings

1H to confirm BOS and mark the flipped level

15M to time entries on retest or rejection

This keeps BOS meaningful rather than reactive.

5) Prefer confirmation, not perfection

Volume confirmation can improve reliability, but it must be interpreted correctly. In decentralised FX, traders often use tick volume as a proxy for volume. In equities and futures, real volume makes confirmation cleaner. Regardless of market, the core confirmation remains structural: close, displacement, and follow-through.

Why the Break of Structure Matters in Trading?

Traders use BOS to verify that momentum remains aligned with the existing trend, allowing for improved entry, exit, and risk management. It gives clarity on direction: a bullish BOS suggests a long bias, while a bearish BOS suggests a short bias.

It also helps align trading decisions with institutional flows, those big players who move price by hunting liquidity around swing levels. BOS helps define:

Stop-loss placement around broken swing levels

Potential retracement zones

Valid entry zones after retests

Because BOS is versatile across timeframes, it works effectively for scalpers (lower timeframes), swing traders (4H/daily) and position traders (daily/weekly).

Step-by-Step BOS Trading Strategy

1. Define Trend and Structure

Begin with a higher timeframe (daily or 4-hour) to assess if the market is in a trend. Look for a series of higher highs and higher lows (bullish) or lower highs and lower lows (bearish). Identify swing points and track prior structure.

2. Spot BOS and Mark Levels

When price breaks the recent swing high (in a bullish trend), draw a horizontal line at that level. Wait for a close above. It defines your BOS. For a bearish BOS, do the same below the swing lows.

3. Wait for a Retest

Often, price returns to retest the broken structure level. A successful retest and bounce confirm strength. Use shorter timeframes (H1 or 15-minute) to refine entry points by observing price action signals such as a bullish engulfing pattern near a retest.

4. Enter Trade with Defined Risk

For long trades, enter near the retested structure if the price shows a bullish reversal. Place a stop loss just below the cleaned swing low. For shorts, the opposite approach is used.

5. Set Profit Targets

Use recent swing points, Fibonacci levels, or measured moves. Many traders target the next resistant swing high (for longs) or swing low (for shorts), or use risk-reward ratios of at least 1:2.

Position sizing example:

| Account equity |

Risk per trade |

Risk amount |

Stop size |

Value per pip (1.0 lot EUR/USD) |

Position size (lots) |

| $10,000 |

1% |

$100 |

25 pips |

$10 |

0.40 |

| $10,000 |

1% |

$100 |

40 pips |

$10 |

0.25 |

| $25,000 |

1% |

$250 |

30 pips |

$10 |

0.83 |

6. Confirm with Context Tools

A surge in volume during the breakout, combined with Fibonacci retracement, momentum indicators (RSI, MACD), or broader market context, all enhance the reliability of the signal. Steer clear if there's contradictory news or economic catalysts.

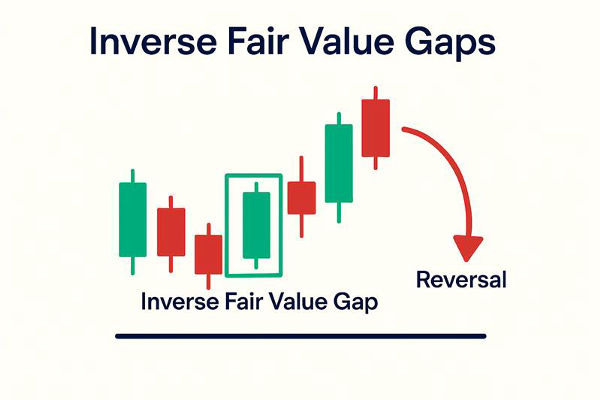

Using BOS For Reversals (The Higher-Probability Sequence)

BOS can also frame reversals, but reversal trading improves when you treat BOS as confirmation rather than a first signal. A higher-quality sequence is:

Liquidity sweep or exhaustion into a key zone

CHOCH appears, signalling that the trend has lost control

BOS in the new direction confirms the transition

Retest entry at the flipped level, order block, or imbalance

This methodology helps mitigate the common error of prematurely attempting to counter a trend.

BOS across timeframes and markets

BOS is fractal. The trade-off is reliability versus frequency.

Scalping (1M-15M): more signals, more noise. Require stronger filters (session timing, higher-timeframe bias, clear displacement).

Intraday (15M-1H): balanced signal quality and opportunity flow.

Swing (4H-daily): fewer signals, typically cleaner structure.

Across forex, indices, stocks, and cryptocurrencies, the underlying principle remains consistent: market structure determines the trading environment, while liquidity and volatility influence the quality of trade execution.

Key Tips & Best Practices

1) Use Multiple Timeframes

Always context-trade BOS. A swing on a daily confirms trend; lower 4H/1H charts offer precise entries. Avoid focusing on low timeframes, which may lack structural relevance.

2) Filter False Breakouts

Look for retests or higher volume confirmation. A wick-through pivot and close-back inside the range often indicates fakeouts.

3) Don't Rely Solely on BOS

Combine BOS with Change of Character (ChoCh), liquidity zones, order blocks, or RSI divergence for stronger setups. Traders using Smart Money Concept frameworks often blend BOS with these elements.

4) Manage Position Size

Wider stop placements may be needed depending on volatility. Use fixed risk per trade (1–2% of capital), and never overleverage.

5) Stay Mindful of News Events

Major data releases can invalidate BOS signals or accelerate momentum beyond expected zones. Avoid trading breakouts before major economic events.

Frequently Asked Questions (FAQ)

1) What does BOS mean in trading?

BOS stands for Break of Structure. It describes a decisive break of a key swing high or swing low that defines trend structure. Traders use it to confirm trend continuation or a confirmed transition in market control, especially when paired with a retest of the broken level.

2) Is BOS bullish or bearish?

BOS can be bullish or bearish. A bullish BOS occurs when the price closes above a meaningful swing high in an uptrend. A bearish BOS occurs when the price closes below a meaningful swing low in a downtrend. The direction depends on which structural level is broken.

3) What timeframe is best for BOS in trading?

BOS works across timeframes, but signal quality typically improves as the timeframe increases. Many traders set bias on 4H or daily charts and time entries on 15M to 1H. Very low timeframes generate more signals but also more false breaks.

4) How is BOS different from CHOCH?

CHOCH is usually an earlier warning that the prior trend may be weakening, often by breaking the opposing internal swing. BOS is confirmation that the structure has been broken in a way that supports continuation or confirms a new direction. Used together, CHOCH can alert, and BOS can confirm.

5) Should you enter immediately on a BOS candle?

Entering immediately often worsens risk-reward and increases the chance of buying the peak of displacement. Many strategies perform better by waiting for a retest of the broken level, then entering on confirmation with a clear invalidation point beyond the structure.

6) Can BOS be used in crypto and stocks?

Yes. The mechanics of structure do not change across markets. What changes are volatility and the reliability of volume signals? Crypto can show sharper stop runs and wider ranges, while large-cap equities and indices often produce cleaner structure when liquidity is deep.

Conclusion

Break of Structure continues to serve as a foundational element of price action analysis by distilling market noise into the essential question of whether structure is maintained or replaced. When BOS is accurately defined using significant swing levels, candle closes, and multi-timeframe alignment, it functions as a reliable confirmation tool for trend continuation and provides a disciplined framework for reversal confirmation when combined with CHOCH.

The primary practical advantage of BOS is its consistency. BOS offers a systematic process for establishing bias, determining entries, setting invalidation points, and identifying targets. This structured approach, when integrated with effective risk management, transforms theoretical concepts into a tangible trading edge.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.