In today's volatile markets, where central bank surprises, AI-driven trading, and geopolitical headlines can flip trends within hours, traders need sharper tools to identify when the market's character changes.

That's precisely where CHOCH (Change of Character) comes in. Imagine watching EUR/USD rally steadily, only to see it suddenly break the last swing low after an ECB statement; this sudden reversal is a textbook CHOCH. It's a signal that buyers may no longer be in control.

But how do you know if it's a real trend change or just a trap? Let's dive deeper.

What Is CHOCH in Trading?

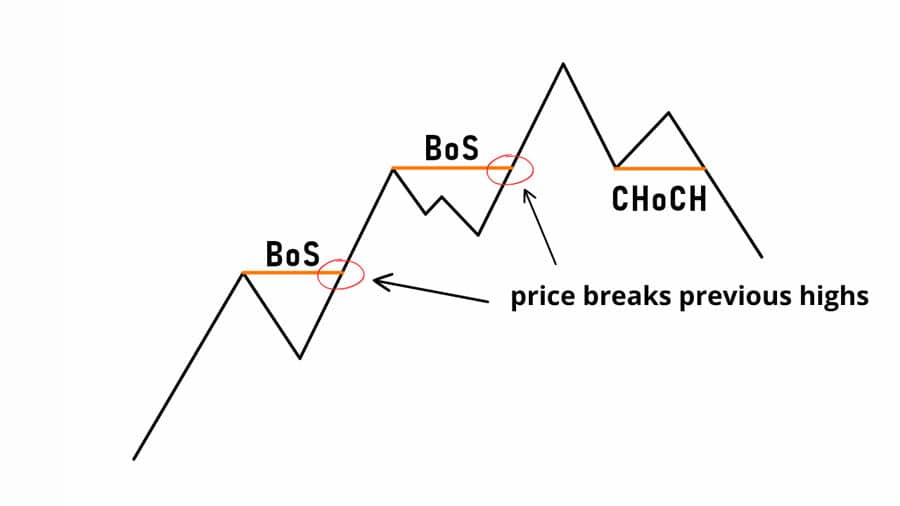

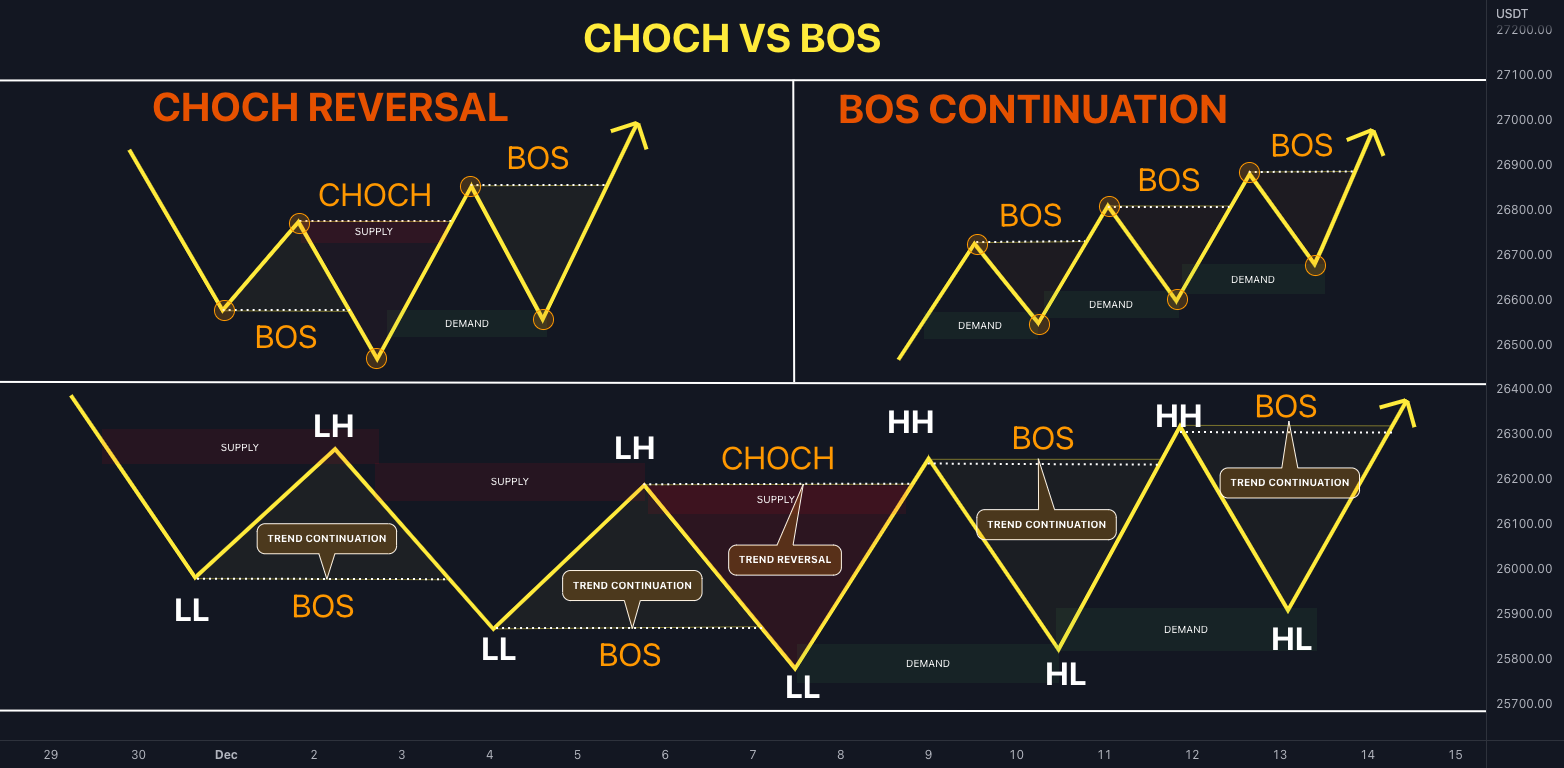

CHOCH, short for Change of Character, is a concept from Smart Money Concepts (SMC). It describes the moment when the market shifts from an existing trend (uptrend or downtrend) into the first sign of reversal.

Unlike random pullbacks, CHOCH often involves a clear break of a recent structural high/low and signals a shift in market sentiment.

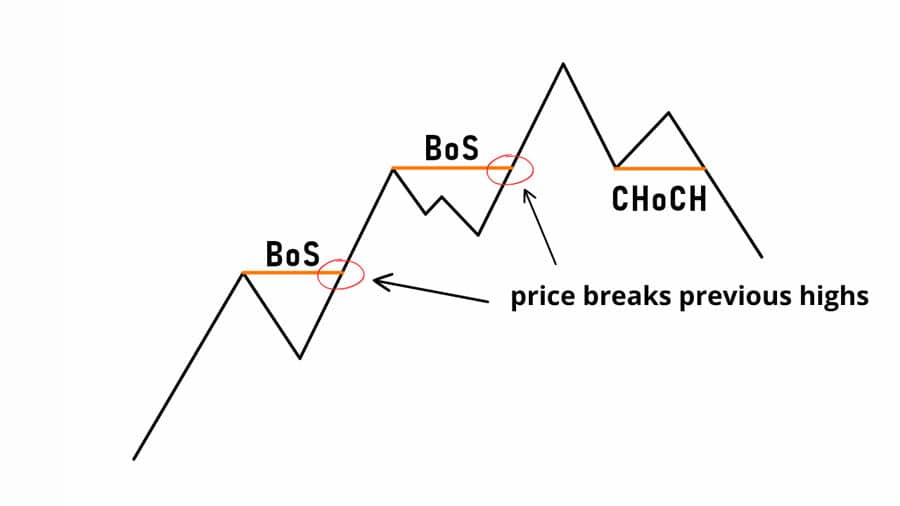

In a bullish trend, CHOCH occurs when the price breaks the previous swing low.

In a bearish trend, CHOCH happens when the price breaks the previous swing high.

This positions CHOCH as a prominent indicator, suggesting that a Break of Structure (BOS) or complete reversal may occur next.

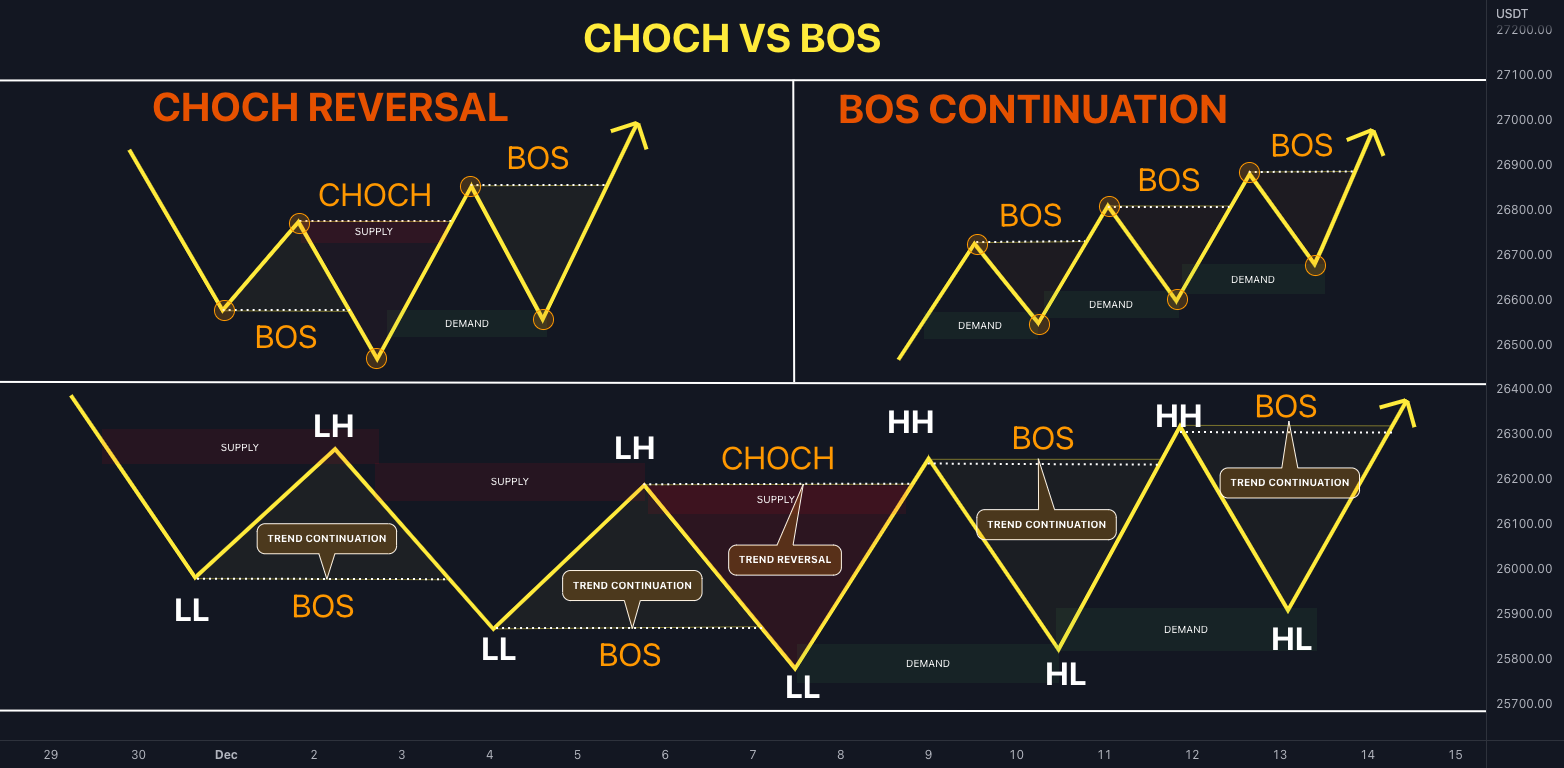

CHOCH vs. BOS (Break of Structure): Key Differences

| Aspect |

CHOCH (Change of Character) |

BOS (Break of Structure) |

| Timing |

Early signal of trend shift |

Confirms continuation or reversal |

| Strength |

Often weaker, needs confirmation |

Stronger and more reliable |

| Use Case |

Spotting potential reversals |

Validating trend direction |

| Risk |

More false signals if used alone |

Less likely to mislead but comes later |

Note: Think of CHOCH as the first knock on the door. BOS is when the door swings open.

How to Identify CHOCH: Step-by-Step Guide

Determine the current trend (higher highs suggest bullish, while lower lows indicate bearish).

Spot a structural break (e.g., bullish trend breaks a prior swing low).

Check volume and momentum, as a valid CHOCH usually has strong participation.

Look for confluence with support/resistance, order blocks, or indicators.

Example: In June 2025, GBP/USD broke its prior swing low after UK inflation data missed forecasts. That sudden shift signalled a CHOCH, followed by a 150-pip bearish move within hours.

How Traders Apply CHOCH in Their Trading Strategy

Firstly, traders often integrate CHOCH into a structured plan rather than using it alone:

Entry: Wait for a CHOCH break, then confirm with volume or retest of structure.

Stop-loss: Place just beyond the broken high/low.

Target: Use Fibonacci levels, order blocks, or support/resistance zones.

Case Study (2025): On July 31, the Nasdaq 100 formed a bullish CHOCH after the Fed hinted at slower rate hikes. Early CHOCH traders caught a breakout before the index rallied 3% in two days.

Common Mistakes Traders Make with CHOCH

Many beginners struggle because they:

Jump in at the first break without waiting for confirmation.

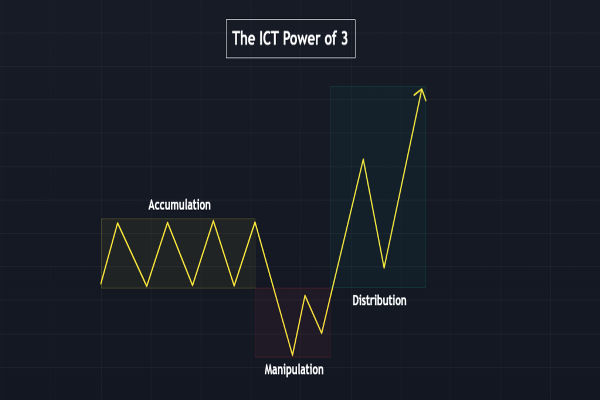

Trade CHOCH in choppy, sideways markets where false signals are frequent.

Ignore volume or market context, treating all breaks as equal.

Rely on CHOCH alone instead of integrating it with BOS, order blocks, or indicators.

To filter high-probability setups, we recommended following this CHOCH Checklist:

Identify the current trend and recent swing points.

Confirm CHOCH with strong momentum or volume.

Align with a higher timeframe bias.

Seek confluence (support/resistance, order block, FVG).

Manage risk with tight stop-losses near structure.

What Are the Pros and Cons of Using CHOCH

| Pros |

Cons |

| Provides early reversal signals |

High risk of false signals in ranging markets |

| Works across forex, stocks, crypto |

Requires confirmation tools (volume, BOS) |

| Helps align with smart money concepts |

Lower reliability on very small timeframes |

| Enhances risk-reward setups when used well |

Easy to misinterpret without trend context |

Frequently Asked Questions

Q1: Is CHOCH More Reliable in Forex, Stocks, or Crypto?

CHOCH works across all markets, but forex (with high liquidity) tends to produce cleaner signals. Crypto often gives more false CHOCH due to volatility.

Q2: What Timeframe Is Best for CHOCH?

Most traders use 15M–1H charts for entries, confirmed by higher timeframes (4H, Daily). Lower than 5M often produces noise.

Q3: Can CHOCH Be Used With Indicators?

Yes. It is recommended to use CHOCH with RSI divergences, moving averages, and volume indicators in its setups.

Q4: How Often Does CHOCH Give False Signals?

Quite often, if used alone. Some traders believe that 40–50% of unconfirmed CHOCH breaks are false signals lacking confluence.

Conclusion

In conclusion, CHOCH is a powerful tool for traders seeking early clues of market reversals, but it's not foolproof. The essential element is confluence: integrating CHOCH with BOS, order blocks, volume, and biases from higher timeframes.

When practised consistently, CHOCH can determine whether one seizes the beginning of a trend or finds themselves on the losing side.

Final Tip: Practise spotting CHOCH on historical charts before trading it live. The more patterns you see, the sharper your instinct becomes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.