A bearish pennant is a continuation pattern that typically appears after a sharp downward move; it signals a likely resumption of the decline once price breaks down from a brief converging consolidation.

This article explains the structure, detection criteria, trading mechanics, confirmation techniques and risk controls you should use when trading bearish pennants.

Key Takeaways

The bearish pennant is a useful continuation pattern when it appears after a convincing downward move and satisfies volume and shape criteria.

Trade it with disciplined entry confirmation, a logical stop above the pennant, and a target derived from flagpole projection.

Use volume and at least one momentum indicator to filter false breakouts, and always manage risk through position sizing and stops.

Backtest and journal trades to develop a personalised, repeatable approach — the pattern delivers best results as part of a coherent trading plan, not as a standalone signal.

What is a bearish pennant and when is it used in trading?

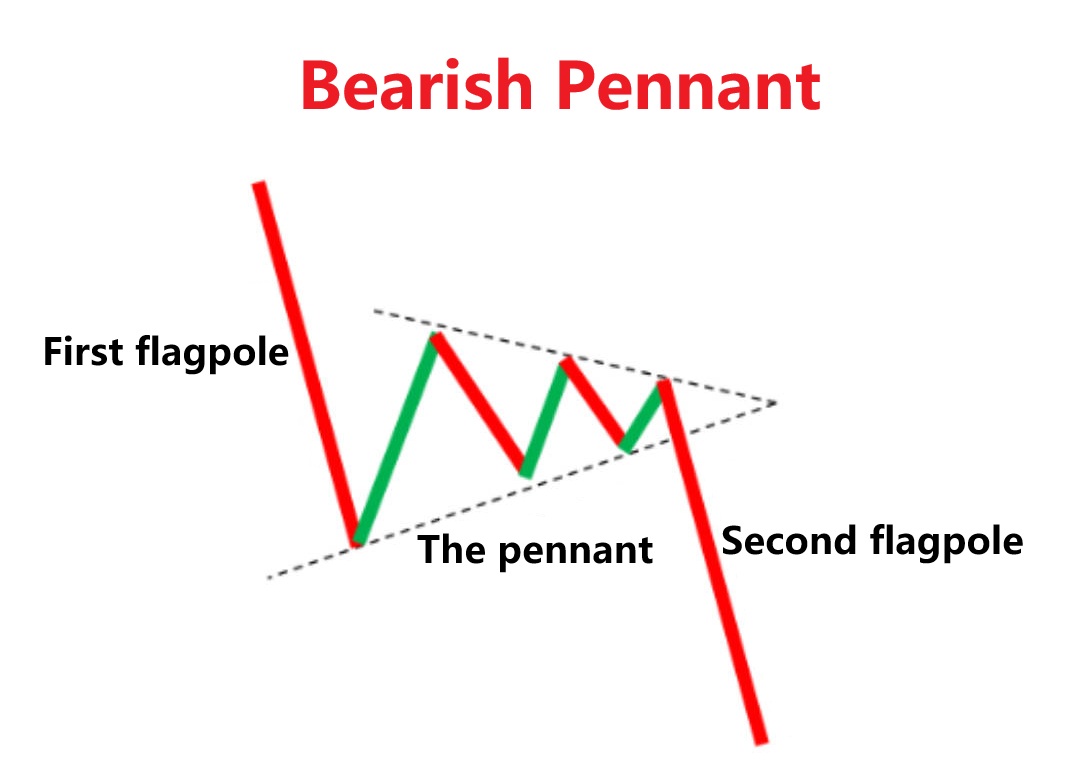

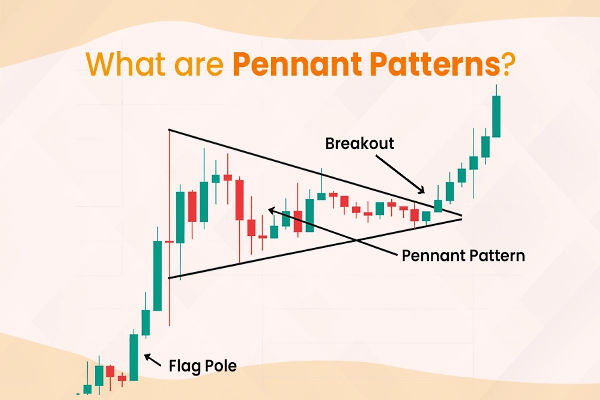

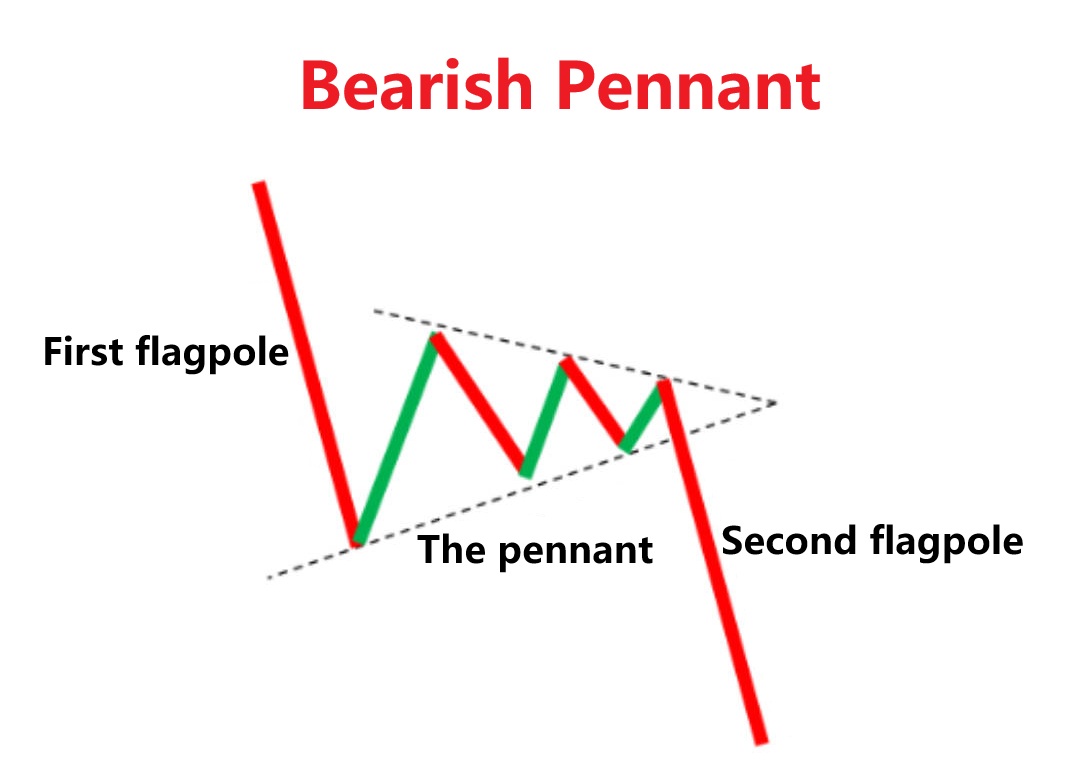

A bearish pennant is a short-term consolidation pattern that follows a pronounced price decline (the flagpole) and takes the shape of a small symmetrical triangle (the pennant).

It is interpreted as a continuation pattern: after sellers force price down, market participants pause and trade in a narrowing range; when sellers regain control the previous downtrend typically resumes.

Traders use the pattern because it offers defined entries, stops and measurable profit targets.

How does a bearish pennant form?

How to recognise a valid bearish pennant

Use this checklist to decide whether a pattern is tradable.

1) Strong prior downtrend (flagpole):

2) Converging consolidation:

3) Volume profile:

4) Limited retracement:

5) Timeframe coherence:

See the validation checklist table below for a compact summary.

How should traders plan entries, stops, and targets?

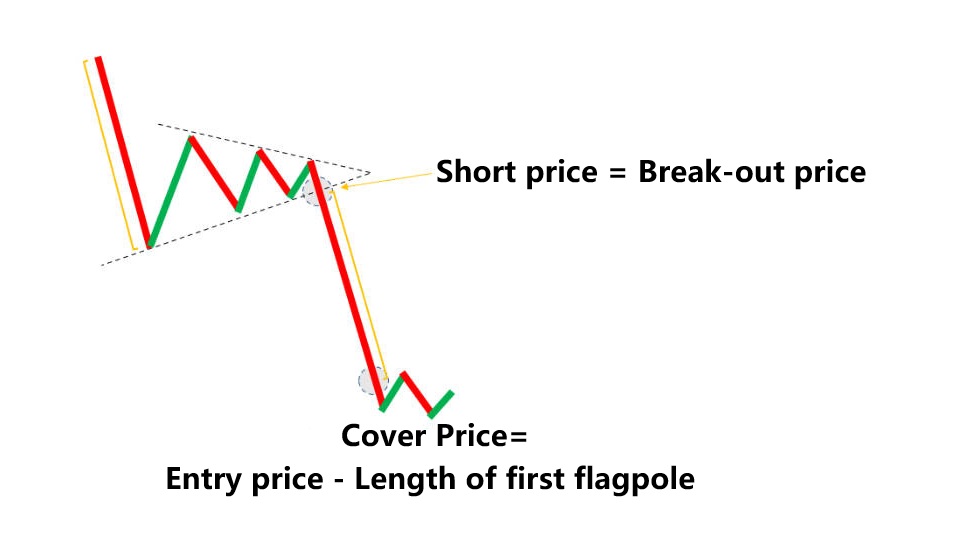

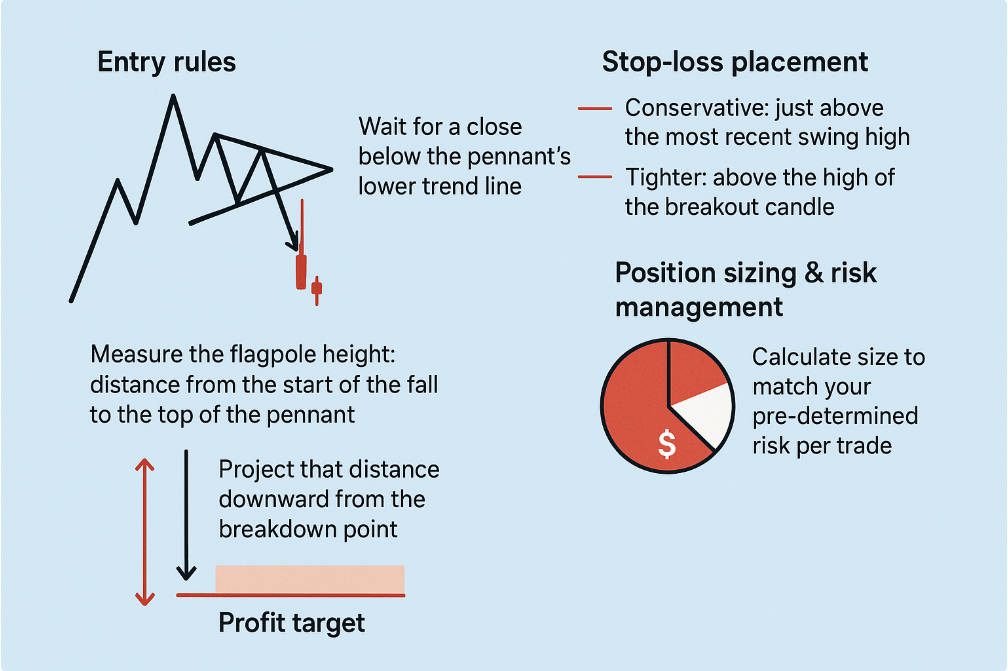

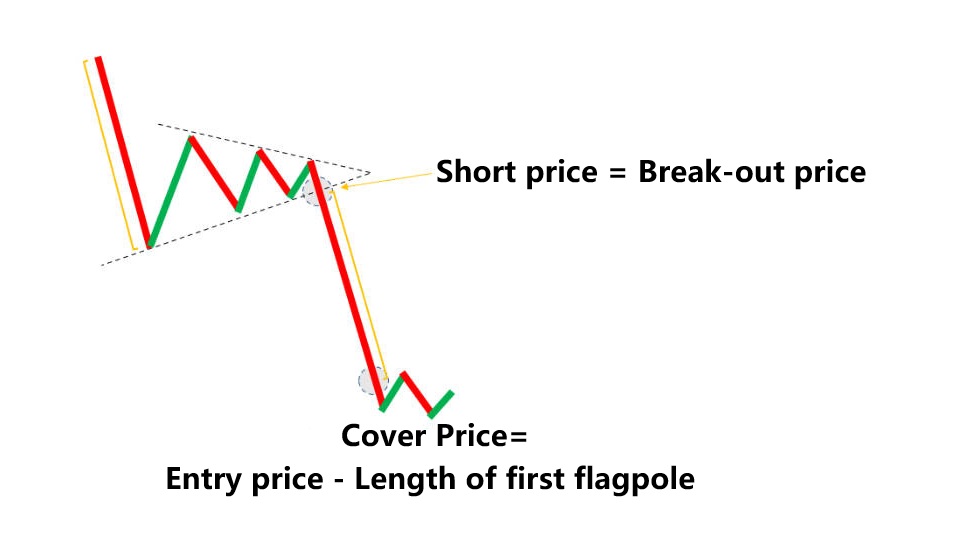

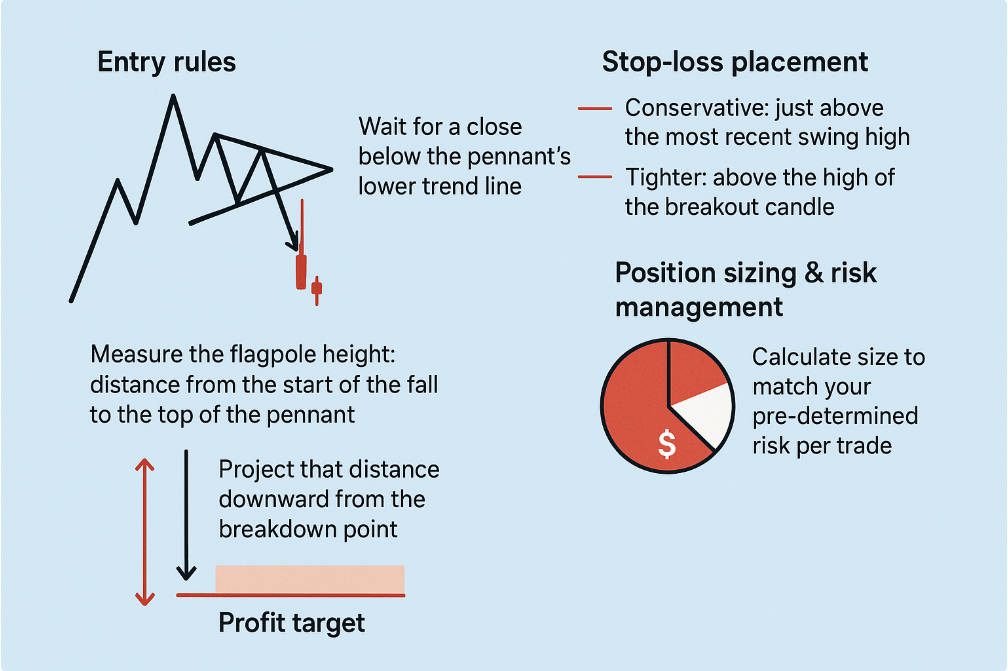

1) Entry rules (serialised):

Wait for a close below the pennant's lower trend line.

Better confirmation: a breakdown accompanied by increased volume or a momentum indicator confirming bearish bias.

Alternative aggressive entry: enter on the first break below the trend line (accept higher chance of false breakout).

2) Stop-loss placement (serialised):

Conservative: just above the most recent swing high or the upper pennant trend line.

Tighter: above the high of the breakout candle (if you require a closer stop and take on greater chance of being stopped out).

3) Profit target calculation (flagpole projection):

Measure the flagpole height: distance from the start of the fall to the top of the pennant.

Project that distance downward from the breakdown point — this gives a first objective.

Consider existing support zones and previous swing lows as additional targets or to adjust expectations.

4) Position sizing & risk management:

Calculate size so that the monetary risk (entry to stop) matches your pre-determined risk per trade (e.g. 1% of account).

Use scaling out or a trailing stop to lock profits as the trade moves in your favour.

Which indicators confirm a bearish pennant breakout?

Use these tools to reduce false breakouts and improve probability:

RSI: a falling or oversold RSI at breakdown supports bearish continuity.

MACD: a bearish MACD crossover or negative histogram expansion on breakdown adds weight.

Moving averages: price below a medium-term moving average (e.g. 50-period) strengthens the case for continuation.

Support / resistance and Fibonacci levels: check if the projected target coincides with prior support — this will often reduce the upside of the projected move.

Practical example and trade plan

Below is a simple, hypothetical trade illustrating measurement and risk-reward.

Item

|

Value / calculation |

Note

|

| Flagpole start price |

100 |

start of sharp decline |

| Pennant top (flagpole end) |

80 |

top of consolidation |

| Flagpole height |

20 |

100.00 − 80.00 |

| Breakout (entry) price |

85 |

price closes below lower pennant line |

| Target (flagpole projection) |

65 |

85.00 − 20.00 |

| Stop-loss |

90 |

above upper pennant trend line |

| Risk per share |

5 |

90.00 − 85.00 |

| Reward per share |

20 |

85.00 − 65.00 |

| Risk : Reward |

1:04 |

favourable setup |

Use this table to calculate position size: if your acceptable risk is £200. position size = £200 / risk per share (i.e. 200/5 = 40 shares).

Common pitfalls and how to avoid them

When bearish pennants are most and least reliable

Most reliable when:

The overall trend is strongly downwards across multiple timeframes.

Volume behaviour conforms to the expected pattern (contraction then expansion).

No major economic or company-specific events are imminent.

Least reliable when:

The consolidation is unusually long or the pennant shape is unclear.

Market is range-bound or lacks a dominant directional bias.

Volatility is driven by news rather than technical structure.

Backtesting and journaling: discipline tools for pattern traders

Backtest the bearish pennant criteria on your chosen market and timeframe to estimate win rate and average return. Use consistent entry and exit rules.

Keep a trade journal that records: pattern image, entry, stop, target, outcome, and notes on why the trade worked or failed.

Review periodically and refine rules (for example, minimum flagpole length, acceptable pennant duration).

Further reading and practice suggestions

Backtest the pattern on at least two markets (e.g. equities and forex) and two timeframes.

Practise spotting the pattern on historical charts: mark flagpole, pennant, breakdown and actual outcome.

Combine technical pattern recognition with robust money management: this is usually where profitable traders separate themselves from amateurs.

Conclusion

A bullish pennant pattern signals temporary consolidation within an established uptrend.

When traded with confirmation and disciplined risk management, the bullish pennant offers a high-quality continuation setup with well-defined parameters.

Frequently Asked Questions

1. How long does a bearish pennant usually last?

Typically one to three weeks on daily charts, or a few sessions on intraday timeframes, depending on volatility.

2. Can a bearish pennant fail?

Yes. A failed pattern occurs when price breaks above the upper trendline instead of below, often due to a shift in market sentiment or weak volume confirmation.

3. Is a bearish pennant the same as a bear flag?

No. A bear flag forms between parallel lines, while a bearish pennant has converging trendlines forming a small triangle.

4. What timeframes are best for trading bearish pennants?

They appear on all timeframes but are generally more reliable on 4-hour, daily, or weekly charts, where price noise is reduced.

5. Can bearish pennants appear in forex and cryptocurrency markets?

Yes. The pattern reflects crowd psychology, not asset type, so it appears in stocks, forex, commodities, and crypto alike.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.