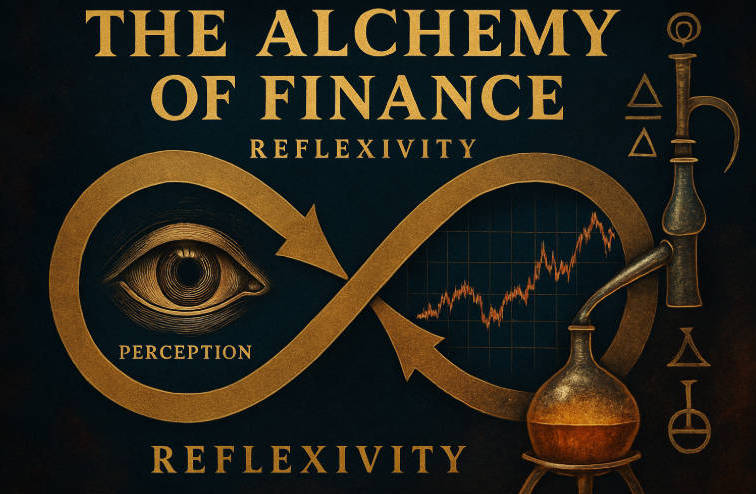

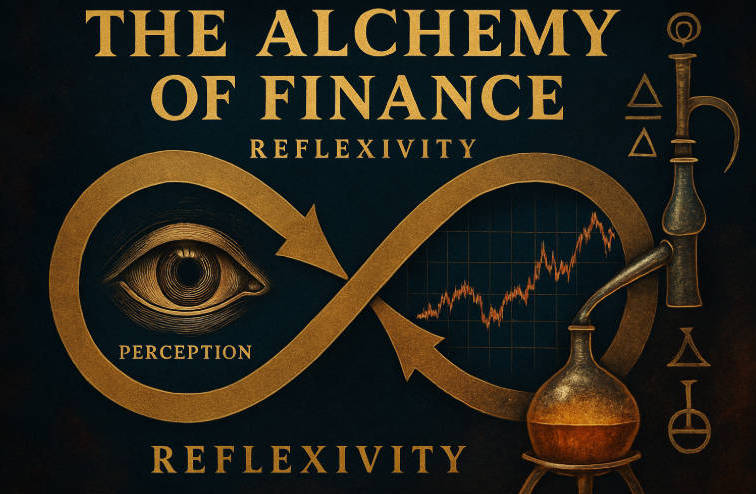

At its essence, The Alchemy of Finance posits that financial markets are not passive mirrors of economic fundamentals, but rather dynamic laboratories where investor perceptions and actual outcomes engage in a self-reinforcing feedback loop.

Below, this article will explore how this alchemy unfolds, how its principles may be applied in today's macro-landscape, the thematic implications for capital flows, the challenges inherent in the approach, and finally the strategic outlook that emerges from the framework.

Reflexivity Revisited: Markets as Dynamic Laboratories

The central pillar of The Alchemy of Finance is the so-called "theory of reflexivity", a concept developed by George Soros.

Traditional financial doctrine holds that markets reflect economic fundamentals and tend toward equilibrium; in contrast, Soros argues that investor expectations influence prices, and prices influence fundamentals, producing a two-way feedback loop.

This reflexive mechanism explains why markets can diverge far from "intrinsic" values, why booms persist beyond fundamental support and why busts can accelerate once sentiment reverses.

By acknowledging that participants' views, though imperfect and biased, actually reshape the very environment they seek to anticipate, one recognises that markets resemble alchemical furnaces more than mechanistic equilibrium machines.

Traditional Market Theory vs. Reflexivity in The Alchemy of Finance

| Concept |

Traditional View |

Soros' View (Reflexivity) |

| Role of price in fundamentals |

Price reflects underlying fundamentals |

Price influences fundamentals as well |

| Market behaviour |

Markets tend toward equilibrium |

Markets are driven by feedback loops and disequilibrium |

| Role of perception |

Perceptions adapt to reality |

Perceptions shape reality and markets |

| Implication for booms/busts |

Bubbles are anomalies |

Bubbles are intrinsic to the reflexive process |

Hence, the "alchemy" is the transmutation of perceptions into reality via markets, and the corresponding transformation of fundamentals by the very price action that participants generate.

From Theory to Trade: Applying the Alchemy in the Contemporary Macro Landscape

Soros did not confine his work to academic musings; in The Alchemy of Finance, he included what he called a "real-time experiment," a trading diary in which he evaluated his positions in response to evolving macro conditions. This experiential dimension highlights a crucial practical lesson: successful investing under this paradigm requires adaptability, humility, and continuous recalibration.

In the present environment, where narrative shifts (for example technological disruption, energy transitions, geopolitics) may precede visible fundamental change, the reflexivity mindset offers a lens to frame how investor beliefs might catalyse structural outcomes rather than simply react to them. To apply this:

Monitor where market sentiment and fundamentals diverge, and ask whether the divergence might itself change fundamentals.

Position for structural catalysts rather than assume a mean-reversion equilibrium.

Manage risk by recognising that reflexive processes can reverse abruptly when beliefs change, and that fallibility is not only inevitable but potentially advantageous in preserving optionality.

Thus the alchemical investor is not simply seeking undervalued assets, but rather assets at the nexus of evolving narratives, flowing capital and shifting perceptions.

Emerging Markets & Thematic Flows: The Alchemist's Portfolio

One of the more compelling implications of the alchemy framework lies in thematic capital flows. In The Alchemy of Finance, Soros discusses how debt, currency regimes and credit cycles produce opportunities as much in transitions as in stable states.

For example, allocations to sectors such as semiconductors, new energy, gold, and rare materials may reflect not only valuation arbitrage but also the expectation that markets will eventually recognise structural change, with that recognition itself accelerating the transformation.

In your own portfolio exposure to chip-focused funds, gold-linked ETFs, and emerging thematic funds, this logic becomes evident: belief in change drives flows, flows affect pricing, pricing shapes perceptions, and perceptions ultimately influence fundamentals.

Thematic Capital Flows Interpreted Through The Alchemy of Finance

| Portfolio Theme |

Example Exposure |

Alchemical Logic |

| Semiconductors / Tech Chips |

(e.g. chip-thematic ETF) |

Belief: tech transition → flows → pricing → further investment → structural scale-up |

| Gold / Safe Assets |

Gold-linked ETFs |

Belief: structural risk / monetary shifts → flight to “transmutation” into gold → pricing feedback |

| Emerging Thematic / Resource-Intensive |

Rare earth / resource-thematic funds |

Belief: resource shift → capital allocation → pricing signal → expands exploitation/investment |

In essence, the "base metals" of yesterday may become the "gold" of tomorrow via structural transformation re-inforced by investor belief and capital flows.

The Limits of Alchemy: When the Reaction Fails

While compelling, the alchemy metaphor is not without pitfalls. Soros himself notes that his success arises partly from recognising his own fallibility: the assumption of being wrong acts as a hedge against hubris. Markets can remain irrational longer than one expects, and feedback loops may reinforce the wrong direction for longer than logic predicts.

Additionally, the reflexivity model does not substitute for disciplined analysis; it complements it. Soros stated: "A reflexive model cannot take the place of fundamental analysis: all it can do is provide an ingredient that is missing from it." Hence, investors should be wary of over-reliance on narrative without structural support or liquidity.

Another limitation is timing: being "right" on structural change is insufficient if executed too early, or without recognition of liquidity, sentiment and regulatory cycles. Thus, the alchemist must also be a tactician: aware of when the feedback loops may reverse, when flows dry up, when regulators intervene, when narratives flip.

The Alchemist's Outlook: Strategy for the Next Cycle

Bringing together the insights from above, what strategic principles emerge for the investor who embraces the alchemy of finance?

Seek assets at the intersection of structural change and flowing capital.

Expect markets to deviate from "fair value" for extended periods — treat deviation as part of the opportunity, not simply risk.

Embrace fallibility: size positions modestly, monitor feedback signals, and be ready to exit when narrative reverses.

Recognise that investor beliefs are part of the fundamentals; therefore, track not just economic data but sentiment, policy shifts and flow dynamics.

Use the alchemical framework as a strategic lens rather than a rigid formula; markets remain complex and entangled.

In short, the next cycle will favour those who understand that markets are not merely passive conduits of fundamentals but active arenas of transformation.

The alchemist investor watches for ignition points where belief, capital, and structural change converge, and positions accordingly.

Conclusion

The Alchemy of Finance offers a distinctive and intellectually rich paradigm for interpreting market behaviour. It invites the investor to think beyond equilibrium, to appreciate the self-reinforcing interplay of perceptions and realities, and to engage actively with the temporal and structural dimensions of finance.

By adopting this mindset, while remaining disciplined and adaptable, one may turn the base elements of market upheaval into the gold of strategic opportunity.

Frequently Asked Questions

1. What is The Alchemy of Finance about?

It argues that markets are shaped by a feedback loop between investor beliefs and actual outcomes, not just fundamentals.

2. What is reflexivity?

Reflexivity is the principle that perceptions influence reality and vice versa, creating self-reinforcing market trends.

3. How can investors apply reflexivity today?

By spotting divergences between sentiment and fundamentals, focusing on structural catalysts, and staying adaptable.

4. How does this differ from traditional investing?

It views markets as active, feedback-driven systems rather than equilibrium-based, emphasising narrative and structural change over static valuations.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.