Crude oil prices are influenced by a complex web of factors, from geopolitical tensions to supply and demand dynamics. For traders and investors, predicting the price of oil for the next day requires a keen understanding of both market fundamentals and technical indicators. As we approach tomorrow's trading session, key elements such as OPEC+ decisions, US shale production, and global economic data will play pivotal roles in shaping the direction of WTI and Brent crude prices.

Current Price Data and Key Levels for WTI and Brent Crude

As of the latest available data (August 2025):

What the Charts Suggest

Both benchmarks are hovering just below crucial support, which technically is a bearish signal. However, these levels often act as strong floors where buying interest might emerge:

Trading below $64.71 support puts WTI at risk of further decline towards the next psychological level around $60. The resistance at $70.47 remains a significant hurdle that would need to be overcome for any sustained rally.

Brent is under pressure with support at $67.76 tested. Failure to hold this level may open the path toward $64–$65 range. The resistance at $73.64 marks the key upside target if the market reverses.

Traders should watch price action closely at these support levels for potential rebounds or breakdowns that signal the next directional move.

Crude Oil Inventory Reports and Supply/Demand Outlook

The latest EIA data for the week ending August 1. 2025. highlights the following:

Refinery inputs rose to 17.1 million barrels per day, increasing by 213.000 barrels compared to the previous week, with refineries operating at 96.9% capacity.

Gasoline production decreased slightly to 9.8 million barrels per day, while distillate fuel production fell by 104.000 barrels to 5.1 million barrels per day.

Crude oil imports dropped by 174.000 barrels per day to 6.0 million barrels, marking a 9.7% decline compared to the same period last year.

Commercial crude inventories declined by 3 million barrels to 423.7 million barrels, which is about 6% below the five-year average for this time of year.

Gasoline inventories also fell by 1.3 million barrels, standing approximately 1% below the five-year average.

Distillate inventories decreased by 0.6 million barrels, now around 16% below the five-year average.

Overall, total petroleum demand averaged 20.6 million barrels per day over the past four weeks, up 1.6% compared to the previous year.

For Brent Crude, the global production outlook remains heavily influenced by global supply factors, primarily governed by OPEC+ production policies:

OPEC+ Production Cuts:

OPEC+ continues to limit output by roughly 1 million barrels per day (bpd) to manage supply amid uneven demand recovery (source: OPEC Monthly Oil Market Report, August 2025). These cuts help maintain tighter global supply and support Brent prices near current levels.

Saudi Arabia's Voluntary Reductions:

Saudi Arabia has implemented additional voluntary production cuts, reinforcing overall supply restraint and aiding price stability (source: OPEC statements).

Declining Global Imports and Inventories:

According to the EIA, US crude imports have dropped nearly 10% year-on-year, reflecting a global trend of lower imports and shrinking inventories. US commercial crude stocks are about 6% below the five-year average, signalling supply tightening that supports Brent pricing.

Upcoming OPEC+ Meetings:

Markets anticipate OPEC+ may extend or deepen production cuts in their next session, which would likely bolster Brent prices, potentially pushing them toward the $70+ mark.

Geopolitical Risks:

Geopolitical tensions continue to drive Brent crude volatility, with upcoming US-Russia peace talks creating uncertainty, US tariffs on Indian oil imports raising supply concerns, and ongoing risks in the Middle East—especially near the vital Strait of Hormuz—keeping markets on edge.

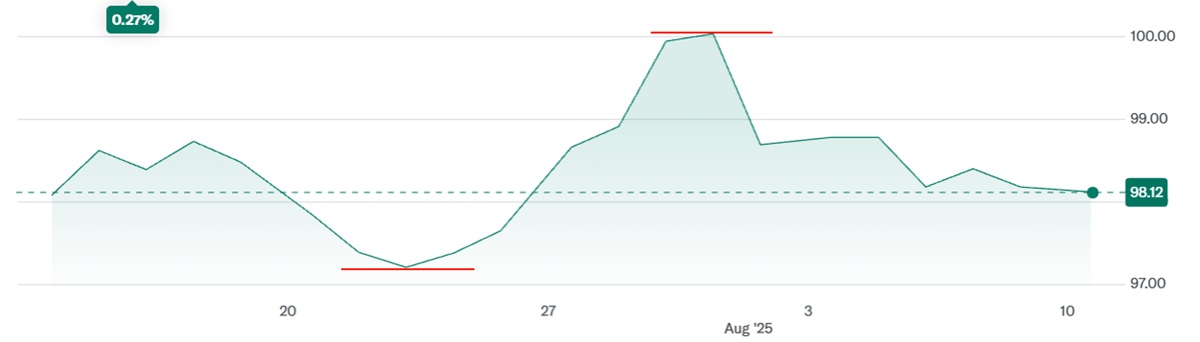

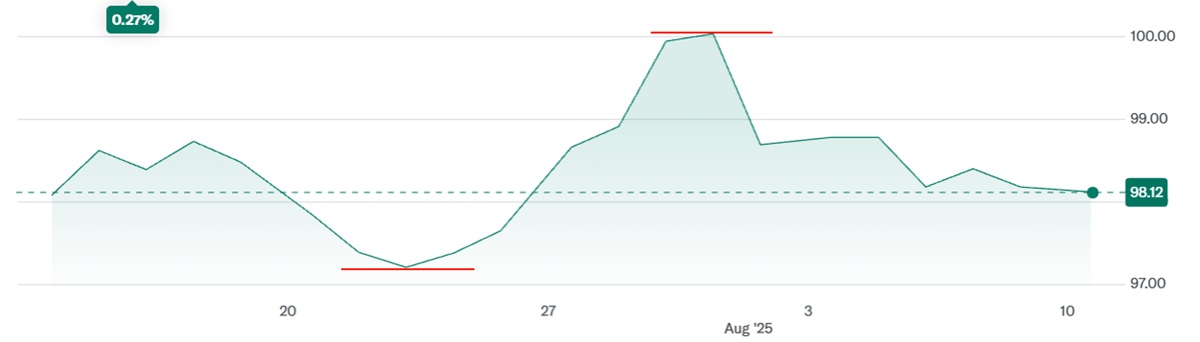

Influence of the US Dollar on Crude Oil Prices

The US Dollar Index (DXY) currently trades at 98.18. between a support level of 97.22 and resistance at 100.03.

If the dollar strengthens above 100.03. crude oil prices, including WTI and Brent, could face downward pressure as a stronger dollar makes oil more expensive for other currencies.

If the dollar falls below 97.22. it could support higher crude prices by making oil cheaper globally.

At its current neutral range, the dollar is unlikely to cause significant moves in oil prices unless it breaks these key levels.

Market Sentiment and Trading Strategies

Market sentiment remains cautious with crude prices near critical support levels. Traders often wait for clear signals before committing to positions, balancing the risk of further declines against potential rebounds.

Short-term strategies may focus on monitoring price action around support and resistance levels: buying on confirmed support holds or selling on breakdowns below key levels. Risk management is essential given the possibility of sudden volatility driven by news events, inventory reports, or geopolitical developments. Staying informed and flexible allows traders to adapt to rapidly changing market conditions.

Conclusion: What to Expect Tomorrow

With WTI trading below its $64.71 support and Brent below $67.76. tomorrow's crude oil prices face downward pressure unless a significant catalyst emerges to shift momentum. Inventory data and OPEC+ developments will be key drivers, alongside the US dollar's movement and geopolitical news.

For WTI, a sustained move below support could lead to testing lower price points near $60. while Brent may move towards the mid-$60s if it fails to hold support.

However, if buyers defend these levels, look for potential rebounds aiming for resistance at $70.47 for WTI and $73.64 for Brent.

Traders and investors should monitor price action around these key levels closely to guide their decisions in tomorrow's session.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.