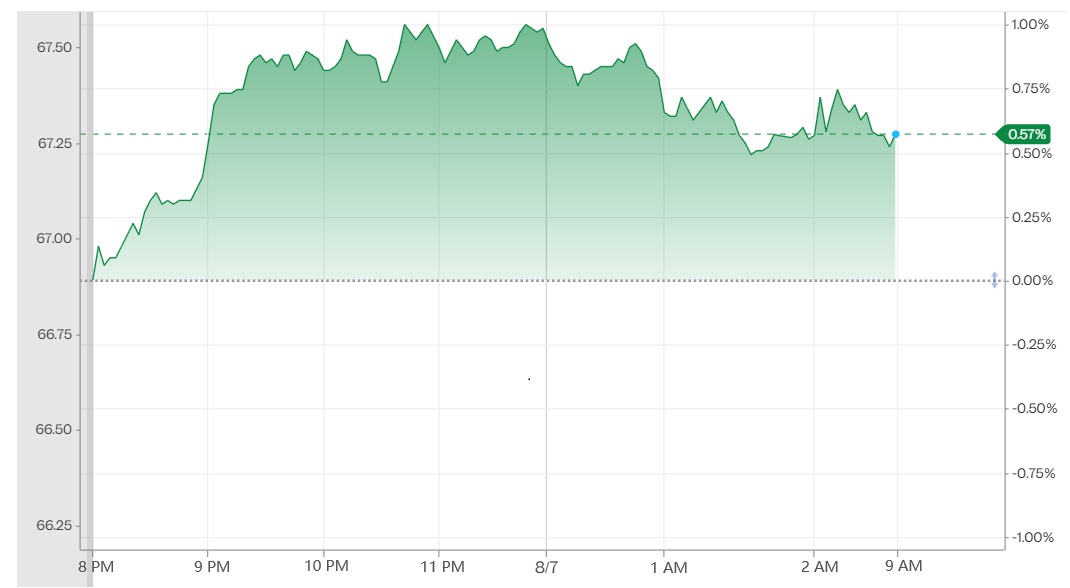

Current Oil Prices Today (as of August 7. 2025)

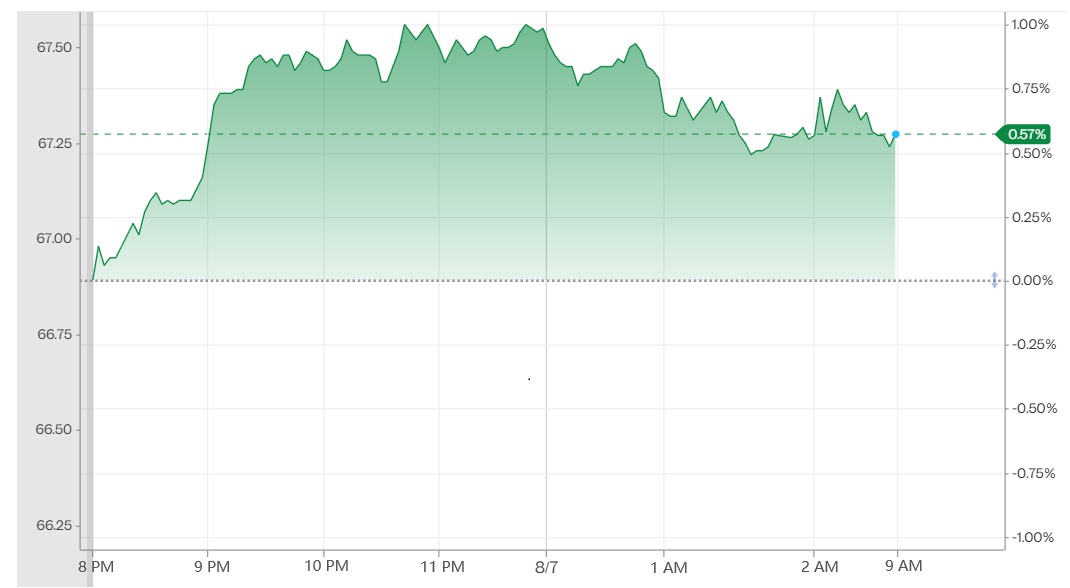

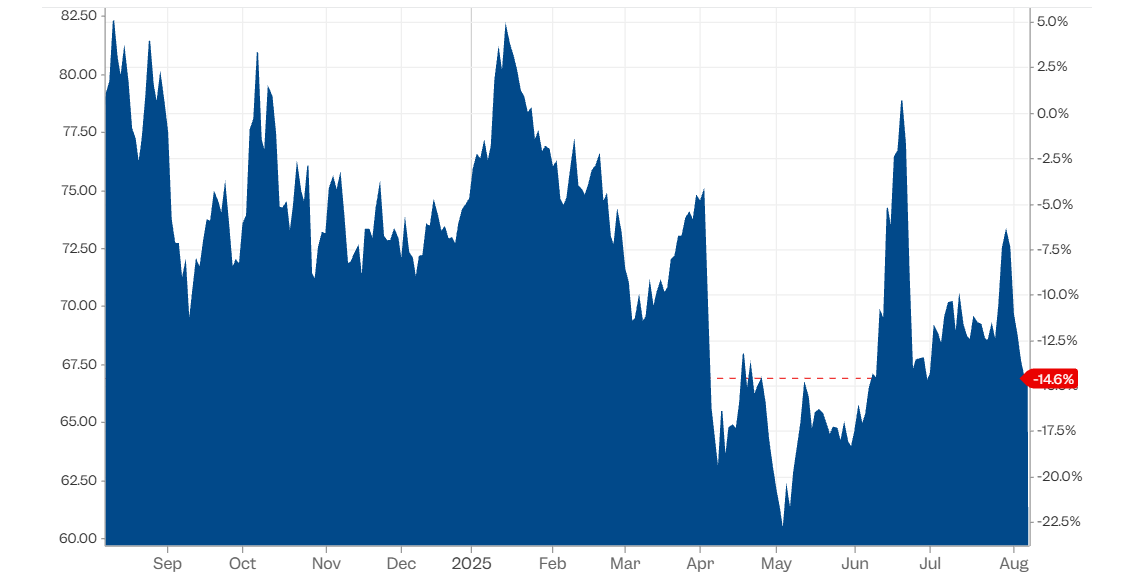

Brent Crude is trading at approximately $67.24 per barrel, up $0.36 (+0.57%) today.

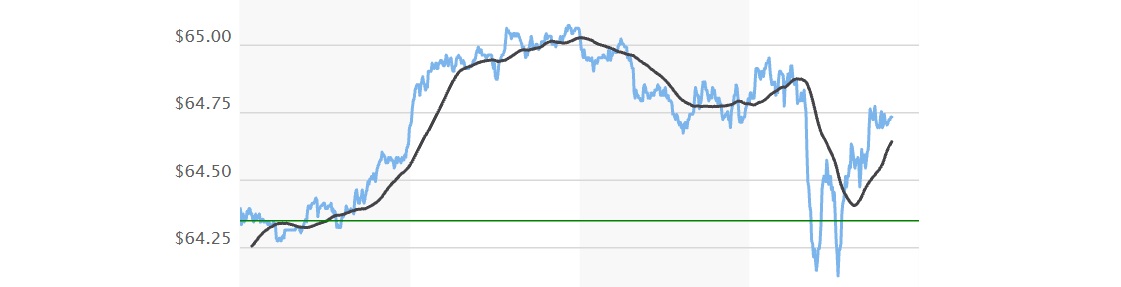

WTI (West Texas Intermediate) is around $64.73 per barrel, gaining $0.34 (+0.38%) today.

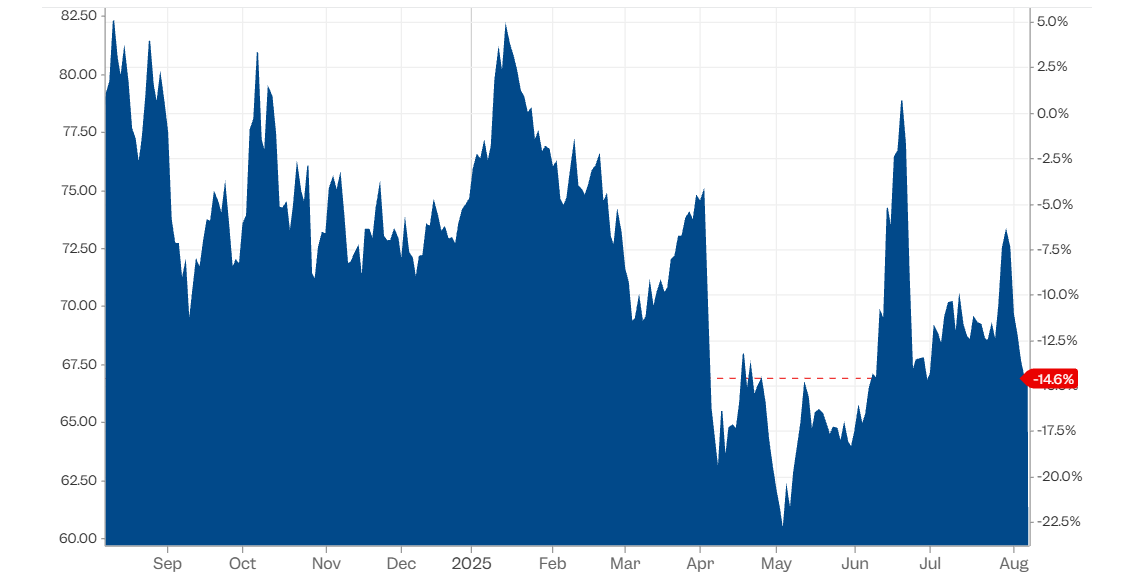

These numbers reflect a rebound after a recent five-day losing streak, supported by strong U.S. demand and a larger-than-expected draw in U.S. commercial crude inventories.

Another report indicates slightly higher values: Brent at $67.51 and WTI at $65.03. buoyed by similar demand dynamics and supply concerns.

What's Driving Crude Oil Market Today

U.S. crude inventories plunged by 3 million barrels in the week ending August 1. reaching about 423.7 million barrels—approximately 6% below the five-year seasonal average.

This was spurred by reduced imports (down 174.000 bpd), elevated exports (up 620.000 bpd), and high refinery utilization (96.9%).

This inventory decline, driven by exports and refining activity, supported a rebound in oil prices.

Markets remain jittery amid US–Russia tensions—Trump's vows for further sanctions and tariffs on India (25%) and potential similar actions against China have clouded outlooks.

A pause or rollback of Russia-related sanctions, or success in US–Russia dialogue, could ease supply anxieties, though uncertainty prevails.

Despite OPEC+ pledging to increase output by 2.5 million bpd between March and September, actual increases have been significantly lower—only 540.000 bpd added between April and June.

Summer-driven demand—from power generation in the Middle East and Chinese stockpiling—continues to absorb much of the supply.

The IEA points out that the market remains tighter than statistics suggest. Seasonal refinery runs and steep backwardation signal limited physical supply.

OPEC+ has committed to further increases: 411.000 bpd for July, 548.000 bpd for August, and an additional 547.000 bpd planned for September.

Despite this, trader skepticism persists: many producers may struggle to meet stated output capacities.

WTI vs Brent: Benchmarks and Market Implications

WTI: U.S. benchmark, light and sweet, traded on NYMEX.

Brent: North Sea benchmark, slightly heavier and sourer, traded on ICE.

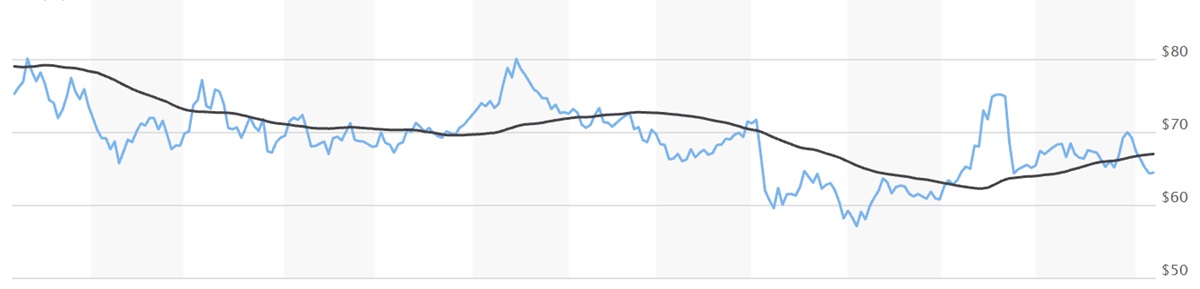

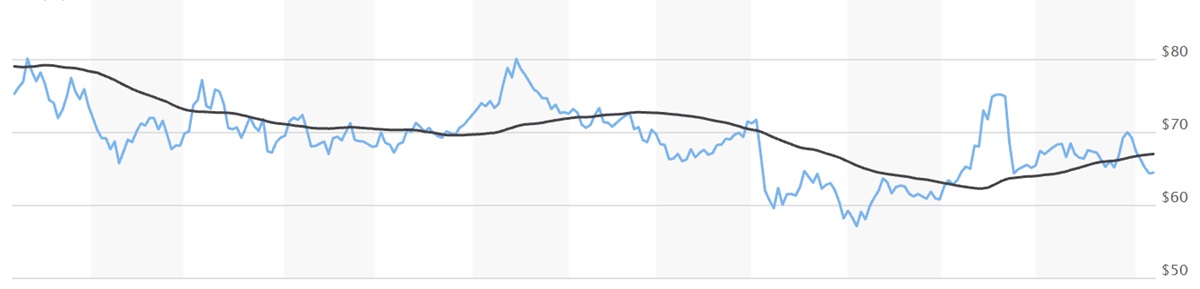

Historically, WTI held a premium, but since 2011. it's predominantly traded at a discount to Brent due to U.S. logistical bottlenecks and inland supply surpluses.

Brent continues to lead price movements internationally, while WTI reflects tighter U.S. market conditions.

Outlook & Analyst Views

Analysts expect oil prices to remain within the $60–70 per barrel range, sustained by U.S. demand and limited supply adjustment.

The physical crude market remains tight, and futures reflect higher near-term premiums.

While global supply is projected to grow, demand remains slow, and refinery capacity is stretch-run—supportive of prices now but setting up potential longer-term slack.

Keener focus on China's demand—July imports were up 11.5% YoY, but down 5.4% from June.

Overcapacity may emerge—analysts at S&P Global and others forecast a potential dip below $60 by Q4 if demand wanes or supply rises faster than expected.

Implications for Consumers and Markets

Companies like Exxon, Chevron, and others are preparing for weaker earnings due to price volatility and tariff impacts.

Elevated Brent and WTI prices translate into higher pump prices and inflation, particularly in import-reliant economies.

Currency volatility may follow as seen in rupee markets after Mid-East unrest.

Tariff threats could disrupt refining margins and trade flows, especially for markets reliant on discounted Russian crude.

Monitoring & Toolkit for Traders

Stay Updated: Follow Reuters, IEA, EIA, and Investing.com for real-time pricing and reports.

Watch Key Data: U.S. inventory updates, OPEC+ decisions, geopolitical moves, and tariff developments.

Trading Strategy:

Pay attention to backwardation, which can affect timing of futures trades.

Monitor crude spreads and demand shifts for investment traction.

Risk Readiness: Keep an eye on seasonal demand downturns, sustained tariff disruptions, or new supply lines (e.g., Venezuelan exports).

Summary Table

Crude Oil Price Today: Key Market Insights at a Glance

| Topic |

Insight |

| Brent Price |

~$67.24 per barrel (up ~0.57%) |

| WTI Price |

~$64.73 per barrel (up ~0.38%) |

| Key Drivers |

U.S. inventory draw, tight OPEC+ supply execution, geopolitical risk |

| Market Structure |

Tight physical market—shown by backwardation |

| Outlook |

Range-bound ($60–70) short-term, with tail risk of decline |

| Risks to Watch |

Tariffs, China demand, OPEC+ capacity constraints |

| Implications |

Higher fuel costs, earnings pressure on energy majors |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.