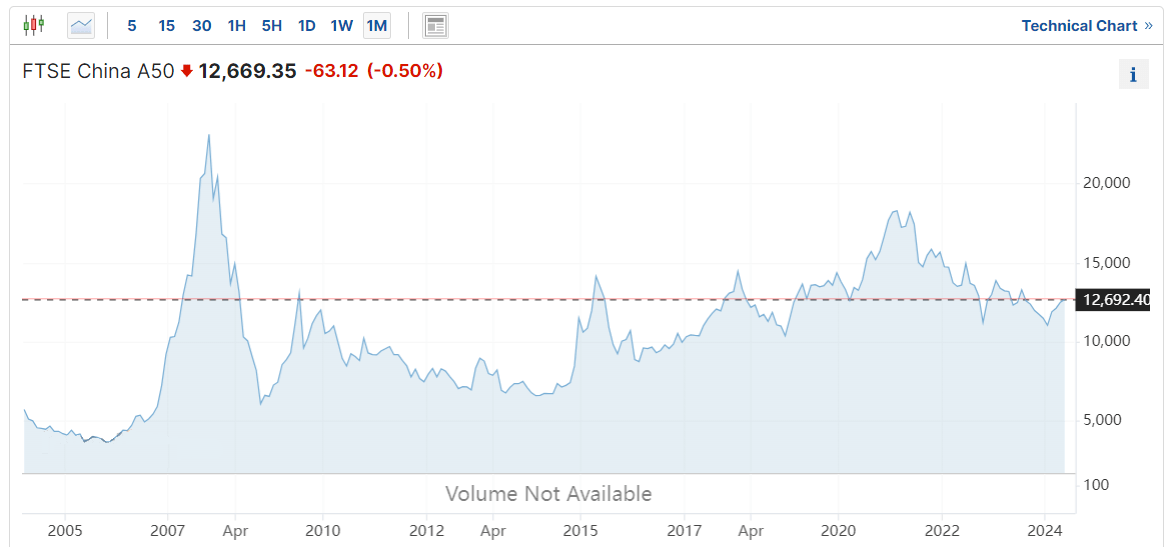

Although the Chinese stock market started late, it is gradually catching up with the international market. Not only do domestic investors trade in the A-share market, but international investors are also showing great interest in the Chinese stock market. The ftse china a50 index is the China A-share index for international investors who are subject to investment restrictions. It is not only welcomed by the majority of international investors, but it also becomes the best reference for domestic investors to predict the rise and fall of A-shares on the following day. Today we will introduce in detail the FTSE China A50 index and futures trading guide.

What does the FTSE China A50 Index mean?

What does the FTSE China A50 Index mean?

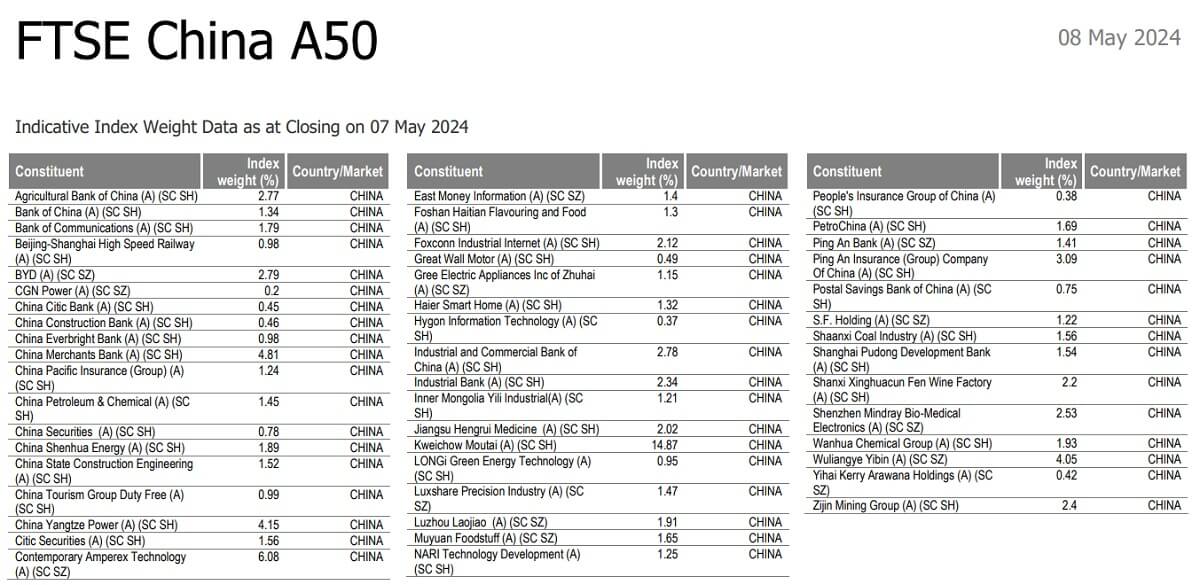

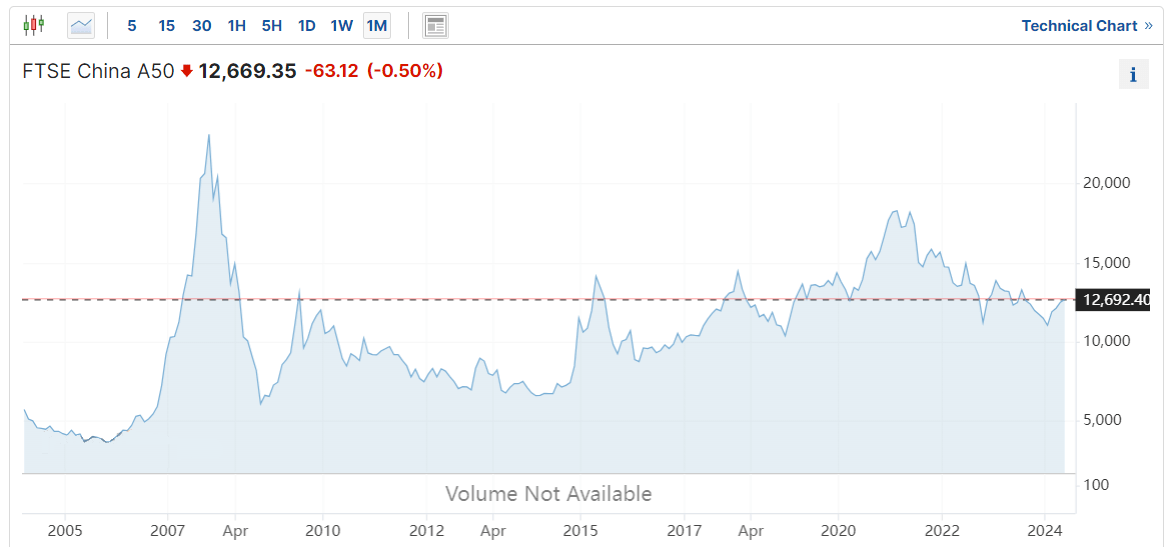

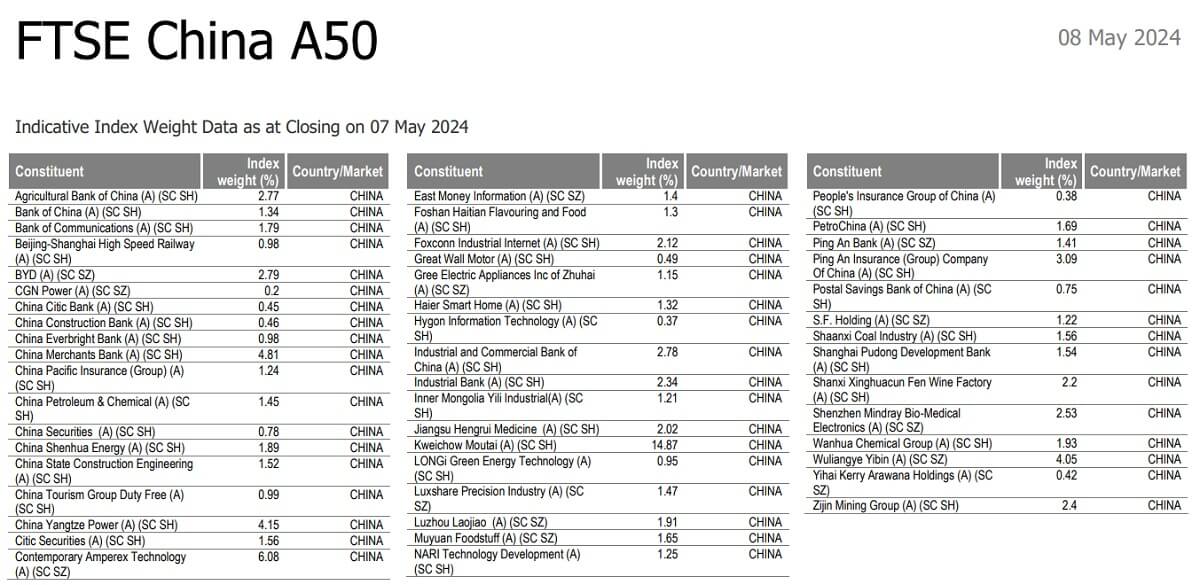

It is an index compiled by the UK's FTSE Group (FTSE Group) that contains the stocks of the 50 companies with the largest total Market Capitalization listed on the Shanghai or Shenzhen stock exchanges. These companies represent a portion of the major market share of China's A-share market, and as such, they are considered one of the key indicators of the overall performance of the Chinese stock market.

The FTSE China A50 Index covers the 50 most representative companies listed in China's A-share market, including leading companies in a wide range of sectors such as banking, insurance, energy, technology, and consumer goods. This makes the index broadly sector-representative, reflecting the overall performance of China's economy as well as the development of individual sectors.

Because the financial sector plays an important role in China's economy, the financial sector is an important part of the index's constituents. Next is the consumer sector, which reflects the dynamism of China's consumer market and consumption trends. And because these companies typically have high market capitalization and strong liquidity in their respective sectors, the index is seen as an important indicator of the performance of the Chinese market as a whole.

FTSE Russell regularly evaluates and adjusts the index's constituents and weighting allocations on a regular basis to ensure that the index always reflects the performance of the 50 most representative listed companies in the market. Such adjustments and maintenance are designed to maintain the accuracy and representativeness of the index so that it continues to reflect the dynamics of China's A-share market. It also ensures that the index is balanced and diverse.

FTSE Russell evaluates the index constituents on a regular basis, usually on a quarterly basis. The constituents in the index are adjusted based on a company's market capitalization, liquidity, and other criteria. If a new company rises in the market or an existing constituent underperforms, FTSE Russell may replace the constituent to maintain the representativeness of the index.

Constituent weightings are adjusted in line with changes in market capitalization, which ensures that the index reflects the true weighting of the companies in the market in terms of total market capitalization. In order to avoid over-concentration of the index on a few companies with large market capitalization, the FTSE A50 Index sets a cap on the weight of a single stock. Typically, this cap is such that the weight of a particular stock cannot exceed a specific percentage (e.g., 10%) of the total index weight.

During the adjustment process, FTSE Russell also looks at the distribution of the index across different sectors to ensure that the index is representative of a number of key sectors. For example, following the March 2022 index review, the top ten profiles of constituents are more diverse. One financial and essential consumer product was subtracted from each, and utilities were added as well as the health care sector.

In addition to constituent and weighting adjustments, FTSE Russell performs technical maintenance to ensure that the index calculation and publication process are accurate. For example, consider the quality of the data sources and the accuracy of the calculation models. Through these adjustments and maintenance, the FTSE A50 Index is always able to accurately reflect the performance of major companies and sectors in the market, providing investors with a reliable market reference indicator.

Compared with other indices such as SSE 50 and CSI 300. the FTSE China A50 Index, as an offshore index, is more recognized by the international capital market. Moreover, the indices are still traded in the offshore market during the A-share market closure, which means that they are able to reflect the international market dynamics related to the Chinese market in real time.

By observing the changes in these indices, investors can understand the expectations and attitudes of international investors towards the Chinese market. These expectations and attitudes may be affected by the global macroeconomic environment, political situation, policy changes, and other factors, so they can provide some reference for the opening trend of the A-share market on the following day.

As the FTSE China A50 Index reflects the overall performance and key trends of China's A-share market, it is widely used for investment decisions and market analysis. In addition, stock index futures products based on the index, such as the FTSE China A50 Stock Index Futures, are also traded on international markets such as the Singapore Exchange, providing global investors with the opportunity to participate in the Chinese market.

FTSE China A50 Index Futures

FTSE China A50 Index Futures

It is a futures contract underlying the FTSE China A50 Index, a financial product traded on the Singapore Exchange (SGX) for overseas investors. Since its listing on the SGX in 2006. it has become the only standardized contract outside of China that tracks the China A-share market.

As international investors are subject to certain restrictions when investing in China's A-share market, the FTSE China A50 Index and its futures contract provide them with an indirect way to invest in the Chinese market. By trading the A50 futures index, international investors can circumvent the restrictions on direct investment in A-shares.

Although the FTSE China A50 stock index futures are a product of the offshore market, there is a close link between them and the A-share market. And it tracks the stocks of the 50 companies with the best market capitalization and liquidity in China's A-share market, reflecting the overall performance of the Chinese market. As a result, the movement of the futures index usually has some correlation with the movement of the A-share market.

FTSE China A50 stock index futures reflect international investors' expectations of the Chinese market through their trading in the global market. Such expectations may be based on international market developments, economic data releases, geopolitical events, global macroeconomic changes, and other important information. When the A-share market reopens, these expectations may have an impact on the opening movements of the A-share market.

And it not only reflects international investors' expectations of the Chinese market but also has a feedback effect on the A-share market. After major events occur in the A-share market (e.g., policy adjustments, the release of important economic data, etc.), the FTSE China A50 stock index futures will immediately react to such information during the trading session in overseas markets.

Its correlation with the SSE 50 Index in terms of constituents and movements is usually high, as both track the stocks of the 50 companies with the best market capitalization and liquidity in the China A-share market. However, they differ in terms of trading hours. As the FTSE A50 futures trade over a longer period of time, this allows investors to trade over a wider timeframe and react instantly to changes in the Chinese market.

The SSE 50 Index reflects changes in the constituent stocks of the SSE 50 Index during normal trading hours on the Shanghai Stock Exchange (typically 9:30 a.m. to 3:00 p.m. on weekdays, excluding the lunch break). FTSE China A50 Index futures, on the other hand, are traded on the Singapore Exchange, where trading hours last from 9:00 a.m. to 5:00 a.m. the following day.

Such long trading hours cover the trading hours of several global markets, including Asia, Europe, and the Americas. It also allows investors to trade during the Chinese A-share market closure, providing more trading opportunities and time windows. In addition, it allows investors to better respond to dynamic changes in the global market.

Meanwhile, the long trading hours of nearly 20 hours allow futures prices to reflect international investors' views on the Chinese market in a real-time market environment and provide feedback on domestic and international market fluctuations. Therefore, after the A-share market closes, investors can make a prediction of the A-share market movement on the following day by observing the movement of the FTSE China A50 Futures Index.

By observing the movement of the FTSE China A50 Index, investors can better understand the international market's expectations of the Chinese market and thus make a more accurate prediction of the A-share market's movement on the following day. However, it should be noted that the trend of the futures index is not an absolutely accurate predictor; investors still need to combine it with other factors to make a comprehensive judgment.

FTSE China A50 Index Futures Trading Tips

As a type of stock index futures tracking Chinese listed companies, it provides international investors with a financial product related to the Chinese A-share market, allowing them to speculate, hedge, or allocate their assets to the movement of the Chinese market. Such futures trading provides investors with the opportunity to trade in real time during Chinese market closures, allowing them to adjust their investment strategies in line with global market dynamics.

FTSE A50 Index futures contract sizes are typically based on the number of index points multiplied by the value of each point, and futures trading hours last from 9:00 a.m. to 4:45 a.m. The futures offer investors the opportunity to trade for extended periods of time during different market hours around the world. Investors can speculate, hedge risk, or allocate assets through A50 Index futures, and the contracts are cash-settled rather than delivered in actual shares.

As for Chinese investors, they can make predictions about the future movements of the Chinese market by watching the FTSE A50 Index futures. This is because the A50 Index futures are traded in offshore markets for a longer period of time, covering global market changes during the Chinese A-share market's closure.

It is important to realize that FTSE China A50 Index futures trade from 9:00 a.m. to 5:00 a.m. the following day, which is much longer than the daily trading hours of the SSE 50 (9:30 to 15:00). During the time period when the domestic market is closed, the A50 Index futures continue to trade in the international market, which means that they can continue to digest and reflect all kinds of global events and changes in the international market.

As a result, the A50 Index futures will form a spread with the closing price of the SSE Index when it generates large gains and losses during the Chinese market closure. Such spreads are usually viewed as the market's expected reaction to what may happen next in the Chinese market (e.g., economic data, policy changes, or the impact of international markets).

And when looking at the movement of the A50 futures, investors may notice that during the trading period of the A50. if there is a significant upward or downward movement, the spread between it and the domestic market will increase, which may result in the A-share market opening higher or lower the following day by a relatively large margin.

However, if the A50 futures are flat, sideways, or volatile during the trading period, then the A-share market may open the following day with a smaller high or low open. This spread usually needs to be repaired at the opening of the A-share market, which is one of the reasons for the high or low open.

Therefore, in order to anticipate the movement of the A-share market index, investors can observe the movement of the A50 Index futures during the daily timeframe of 9:00 to 9:30 a.m., thus predicting the possible high or low open of the A-share market at the open. A similar strategy can be used for other commodity futures to predict the movement of the domestic market by observing the relevant varieties in the international market.

The movement of the FTSE China A50 Index futures is particularly important in predicting the performance of the domestic market when it opens during a long holiday period. During a long holiday, if the A50 Index futures show a significant unilateral move that creates a large spread, then the domestic market is likely to open significantly higher or lower after the holiday. This scenario can be predicted by observing the movement of the A50 Index futures prior to the post-holiday market opening.

Similarly, for commodity futures, e.g., crude oil, precious metals, etc., investors can use the same approach to predict the movement of the domestic market. By looking to benchmark against international counterparts, investors can observe whether the domestic and international markets are trending in the same direction.

It should also be noted that FTSE China A50 Index futures trading wants to take advantage of market fluctuations to make profits, and must accurately judge and grasp the market trend in order to ultimately realize profits. Generally speaking, it is recommended to establish a short-term trading strategy, that is, to buy and sell within a day, to take advantage of short-term market fluctuations to profit.

This requires investors to have a certain level of experience and expertise and to utilize technical analysis tools to identify market trends and ensure that rational decisions are made during market fluctuations. It is also important to set modest profit targets in trading, such as earning 5% to 10% per day, a robust strategy that helps to reduce risk.

Meanwhile, night trading is a significant advantage of FTSE A50 Index futures as it allows investors to continue trading after the Chinese A-share market has closed. This round-the-clock trading feature enables investors to reflect changes in international markets or policy adjustments in a timely manner and react quickly to market developments during the night trading session.

This helps investors stay in close contact with the market during the Chinese market closure and adjust their trading strategies in a timely manner when major events occur in the global market. Through night trading, investors can better capitalize on opportunities in the international markets and gain a more favorable investment position when the Chinese market reopens.

Although FTSE China A50 Index futures trading offers a wealth of investment opportunities, the risk is high as the leverage of the contract amplifies the impact of price fluctuations. Investors should exercise caution when trading, understand the risks of trading, set reasonable stop-loss and take-profit points, and ensure that trading is carried out within a tolerable level of risk.

FTSE China A50 Index Futures Trading Tips

| Tips |

Precautions |

| Technical Analysis |

Adjust the parameters to avoid excessive trading. |

| Short-Term Trading |

Control the trading frequency and avoid frequent operations. |

| Night Trading |

Night trading is highly volatile and requires cautious operation. |

| Hedging Risks |

Ensure that the hedging strategy matches the investment portfolio. |

| Watching Spreads |

Spreads vary; use comprehensive judgment. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What does the FTSE China A50 Index mean?

What does the FTSE China A50 Index mean?

FTSE China A50 Index Futures

FTSE China A50 Index Futures