The financial markets operate on timing as much as strategy. Traders often refer to "Power Hour" as one of the most critical periods of the trading day. This term isn't just jargon—it references specific periods when market activity intensifies and unique opportunities emerge.

Whether you're a day trader or a swing trader, understanding and using Power Hour effectively can significantly enhance your returns.

In this guide, we'll explore what Power Hour is, why it matters, and how traders can use it strategically to maximise gains while managing risks.

What Is Power Hour in Trading?

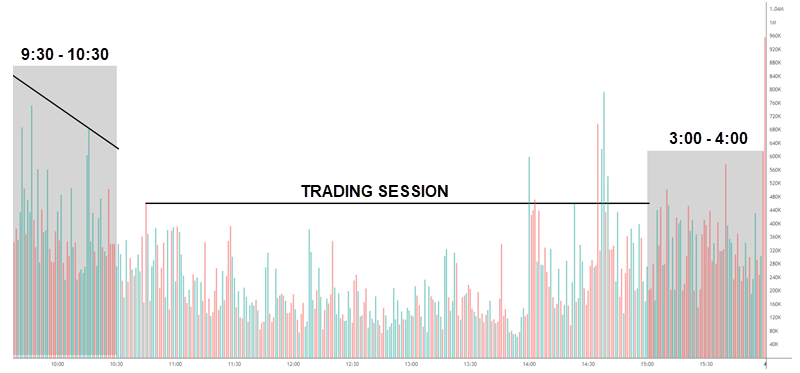

Power Hour in trading refers to a time window of elevated volume and volatility, typically occurring during the first and last hours of a trading session. These windows are characterised by increased participation from institutional traders, significant price swings, and high liquidity.

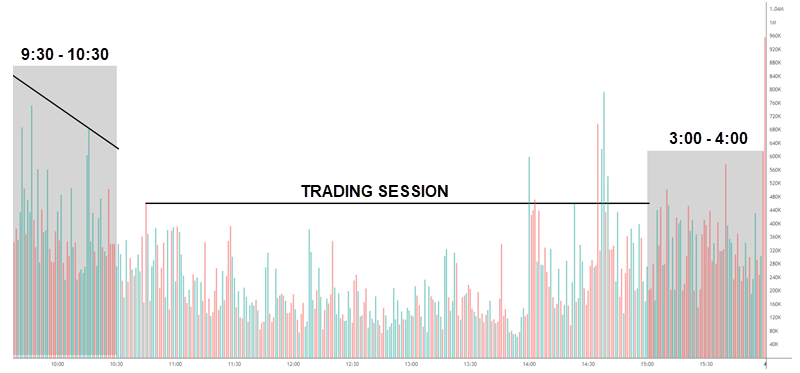

For most U.S. markets, Power Hour is considered to be:

While these timeframes are most common in U.S. stock markets such as the NYSE and NASDAQ, similar patterns exist in global markets. In forex, commodity, and futures trading, these "rush hours" may vary based on regional market openings and closings.

Morning vs Afternoon Power Hour

While both hours are important, they serve slightly different functions on the trading day. Let's compare:

Morning Power Hour (9:30 AM – 10:30 AM EST)

This hour marks the official opening of the market. It's often chaotic, with orders from overnight trading flooding in. Traders interpret news, earnings releases, and pre-market moves during this time. Volatility is usually highest right at the open and may begin to taper by 10:30 AM.

This period is ideal for quick scalps, momentum plays, and identifying potential breakout stocks based on early volume spikes.

Afternoon Power Hour (3:00 PM – 4:00 PM EST)

The last hour of the trading day is more strategic. Institutions finalise their trades, and retail traders often return to the market. If the overall trend of the day has been up, many traders may buy into strength toward the close. Conversely, if markets are down, end-of-day selling can intensify the drop.

This hour is also suitable for swing traders looking to spot entry or exit points based on how the day closes, which often signals sentiment for the next session.

Why Power Hour Matters to Traders

Power Hour matters because it reflects the convergence of market factors: institutional trading activity, news absorption, and end-of-day positioning. This confluence creates a potent environment for traders to identify patterns, momentum plays, and reversals.

The high volume and volatility can present short-term opportunities that don't exist during the quieter middle hours. For traders who thrive on price movements—such as scalpers and day traders—Power Hour can be the most profitable time of the day.

Additionally, it's when the market displays its hand. Breakouts, breakdowns, and major trend continuations frequently occur during Power Hour, revealing investor sentiment and potential next-day direction.

Institutional Influence

As mentioned above, one of the main drivers behind Power Hour volatility is institutional trading. Large investment firms, hedge funds, and mutual funds generally place large orders during market opening and closing hours. These trades can significantly impact the direction and market volume.

In the morning, institutions react to overnight news, earnings reports, and global market developments. In the closing hour, they make final adjustments to their portfolios, often based on daily performance targets or fund inflows and outflows.

This institutional activity creates a domino effect as retail traders and algorithms react to the surge in movement. Understanding this behaviour can help individual traders anticipate moves and ride the momentum intelligently.

How to Trade and Maximise Returns During Power Hour

1) Prepare Before the Market Opens

Success during Power Hour starts with pre-market planning. Use pre-market volume scanners, earnings calendars, and major news headlines to identify high-potential stocks or assets.

Establish price levels and support/resistance zones, and define trade setups for preparation. Having a watchlist and understanding your entry and exit rules will keep you from making emotional decisions when the market becomes chaotic.

2) Focus on Volume-Backed Moves

One of the best indicators during Power Hour is volume. Large spikes in volume—especially at key technical levels—can signal institutional interest. It often precedes strong breakouts or reversals.

Look for price action supported by volume rather than chasing random movement. Volume confirmation improves the probability of follow-through.

3) Use Scalp or Momentum Strategies in the Morning

The first hour is best for short-term trades. Traders employ scalp strategies and analyse 1-minute and 5-minute chart setups to seize quick market movements. Common setups include:

Gap and go

Opening range breakout

VWAP reversals

As volatility is high, traders must also use tight stop-losses and stay alert to rapid reversals.

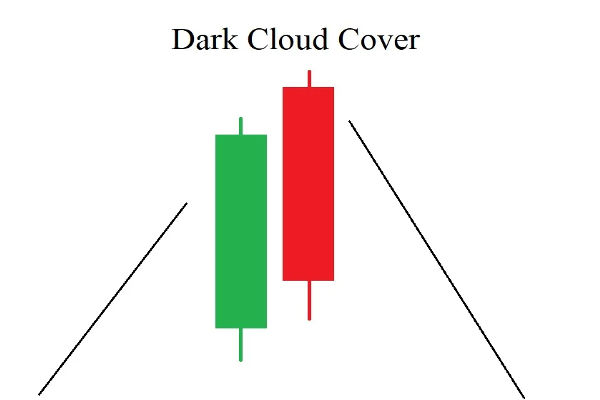

4) Use Technical Analysis in the Final Hour

The afternoon session allows more time for pattern development. Traders rely on hourly chart levels, trendline breaks, and candlestick patterns to time their trades.

Common setups include:

Intraday trend continuation

Double bottoms or tops forming near support/resistance

Bull flags/bear flags showing momentum strength

Risk-reward ratios improve when trades are based on clearly defined end-of-day patterns.

Best Markets to Trade

Not all markets behave the same during Power Hour. Here are the ones most affected:

Stocks

U.S. equities are highly reactive to Power Hour volatility. High-volume stocks such as Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA) often experience such moves. Traders focus on daily volume leaders and earnings movers.

Index Futures

S&P 500 E-mini, Nasdaq futures, and Dow futures are commonly traded during Power Hour due to their high liquidity and tight spreads. These instruments react quickly to institutional positioning at open and close.

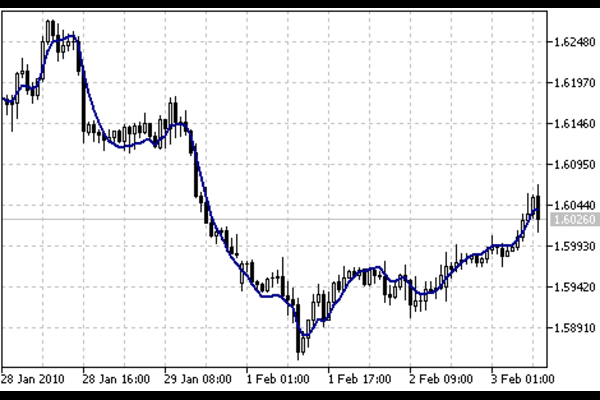

Forex

For forex, Power Hour overlaps with the London/New York sessions—typically between 8:00 AM and 12:00 PM EST. However, the 3:00–4:00 PM window can still see action based on U.S. economic data or Federal Reserve commentary.

Commodities

Gold, oil, and natural gas also experience volatility during Power Hour, particularly with sudden geopolitical news or inventory reports. Crude Oil Futures often see spikes during the final hour of trading.

Is Power Hour Trading Suitable for Beginners?

Power Hour can be intimidating for beginners due to its speed and volatility. However, it can also be a great training ground when approached cautiously. Beginners should:

Start by watching the market for several weeks

Use demo accounts to simulate live trading

Focus on one or two setups

Trade small position sizes

With time and discipline, beginners can develop confidence and eventually scale their strategies for better results.

Common Mistakes Traders Make During Power Hour

Overtrading

The fast pace and adrenaline rush of Power Hour can tempt traders to take too many trades. This often leads to poor setups and unnecessary losses. Stick to your plan and avoid impulsive decisions.

Ignoring Stop-Losses

Some traders let losses run, hoping for a reversal that never comes. During Power Hour, moves can be fast and brutal. Always use stop-losses to protect your capital.

Chasing Breakouts

Not every breakout sustains. Entering trades too late or without confirmation can lead to losses. Patience is key—wait for pullbacks or volume confirmation before entering.

Lack of Preparation

Jumping into Power Hour without a clear game plan is ill-advised. If you haven't analysed potential trades before the bell or before the final hour, you may fall into emotional trading traps.

Conclusion

In conclusion, power Hour represents some of the most active and opportunity-rich periods in the trading day. Whether at the open or close, these 60-minute windows are fueled by institutional activity, liquidity, and emotional reactions—all of which can be leveraged for fast profits.

Mastering Power Hour requires preparation, speed, and discipline. By focusing on volume-backed setups and technical levels and applying strong risk management, traders can turn these volatile moments into consistent profit-making sessions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.