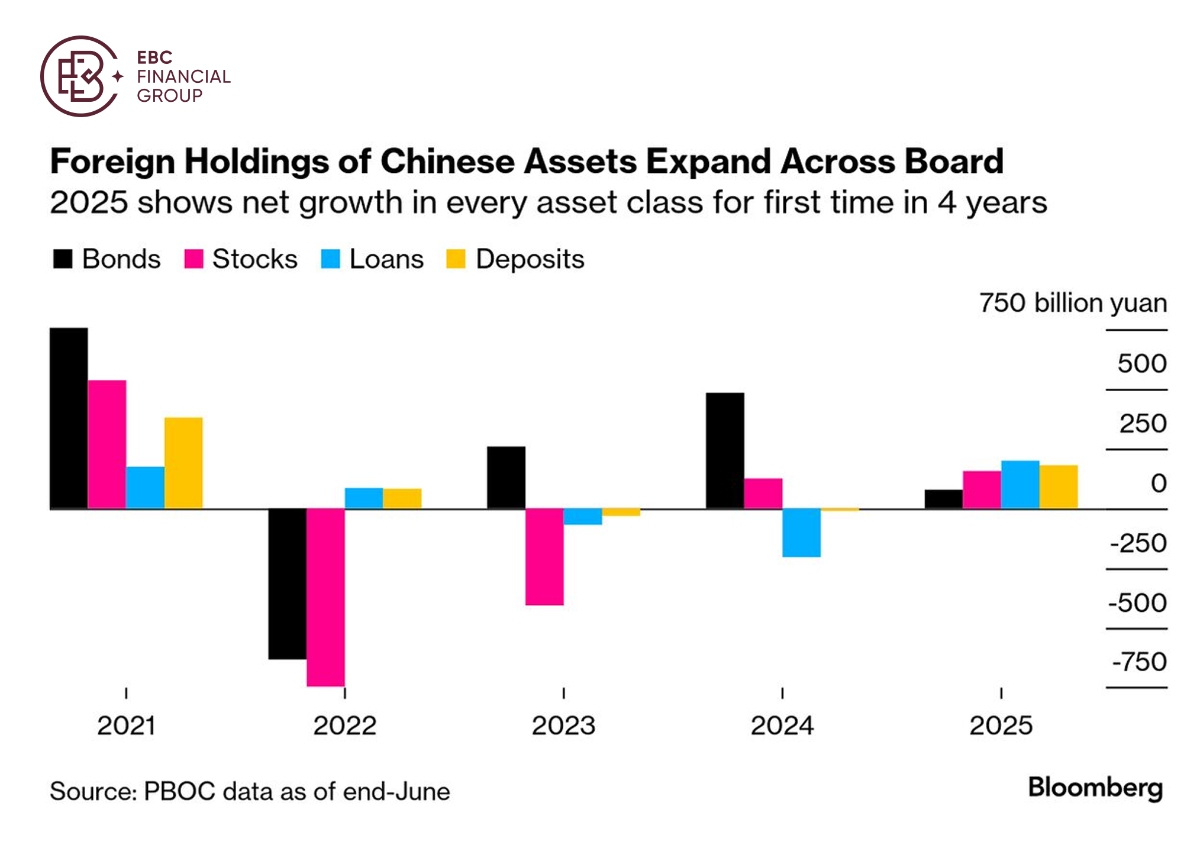

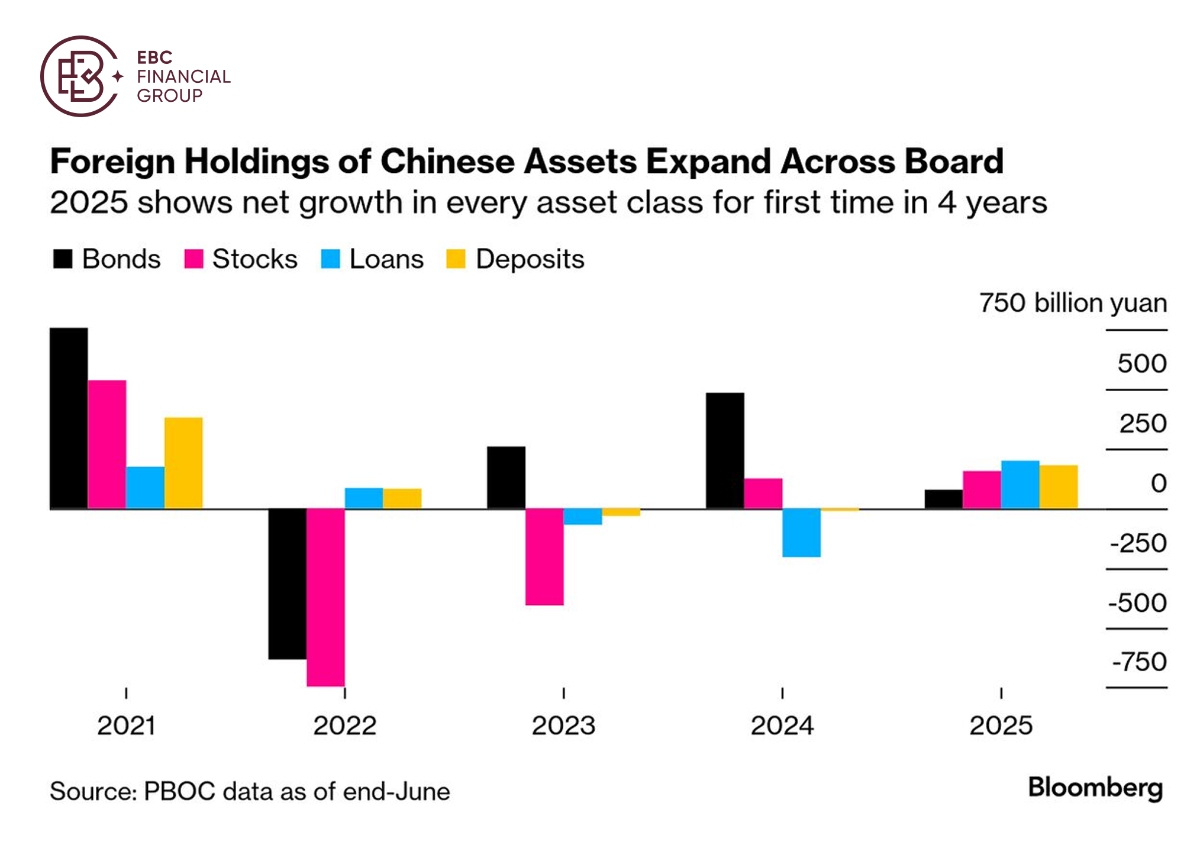

Chinese assets have been back in favour, especially previously unloved

equities. Official data show foreign inflows rising across asset classes, a

coordinated advance that's only happened in three of the past 10 years.

The A50 index has climbed about 11.8% since the start of the year and is

hovering close to more than three-year high. Moreover, the Hang Seng index is

among the world's best-performing major stock markets so far this year.

Global funds are still 1.3 percentage points underweight China despite some

improvement, according to Morgan Stanley, while Asia ex-Japan managers have

turned overweight.

"The vast gap between China's global economic footprint and the low

single-digit allocation from global investors represent a significant long-term

opportunity," said Thomas Fang, head of China global markets at UBS.

Underpinning the shift in perception is the technology sector's advance.

Shares of Alibaba Group skyrocketed in September, driven by its accelerated AI

push and a deeper Nvidia partnership.

Cathie Wood's Ark Investment Management also reopened positions in Alibaba's

ADRs this month for the first time in four years – a stark contrast to Munger's

selling them at a loss in 2023.

Trump's trade policies, the Fed's rate-cut cycle and a ballooning US budget

deficit have encouraged investors to seek alternatives to dollar assets,

prompting a fresh look at the vast Chinese market.

Frothy rally

The World Bank on Tuesday raised its 2025 growth forecast to 4.8% for China.

Growth in exports helped offset real estate slump and tepid consumption, but the

momentum is expected to slow.

China's factory activity improved slightly but extended its decline into a

sixth month — the longest slump since 2019 — with the economy at risk of a

slowdown after a growth spurt to start the year.

The government's campaign that aims to ease overcapacity and excessive

competition among companies is also taking its toll, which has contributed to a

fall in output for products like steel.

As retail investors push the market higher, and bulls cheer liquidity support

and policy tailwinds, some experts are raising questions if the market is

entering bubble territory.

The net profit margins of US listed companies in tradeable goods averaged

around 12% last year, more than double the 4.9% of their Chinese peers,

according to the research from Bloomberg Economics.

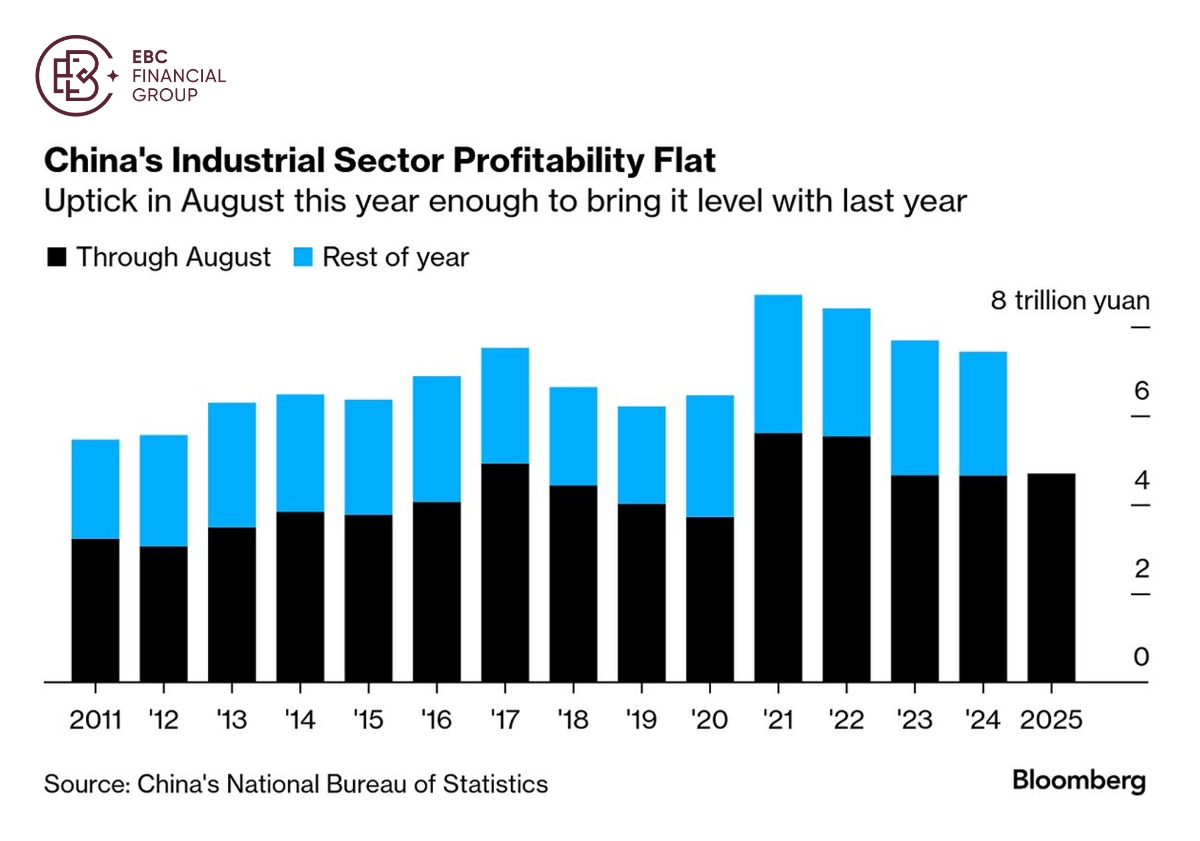

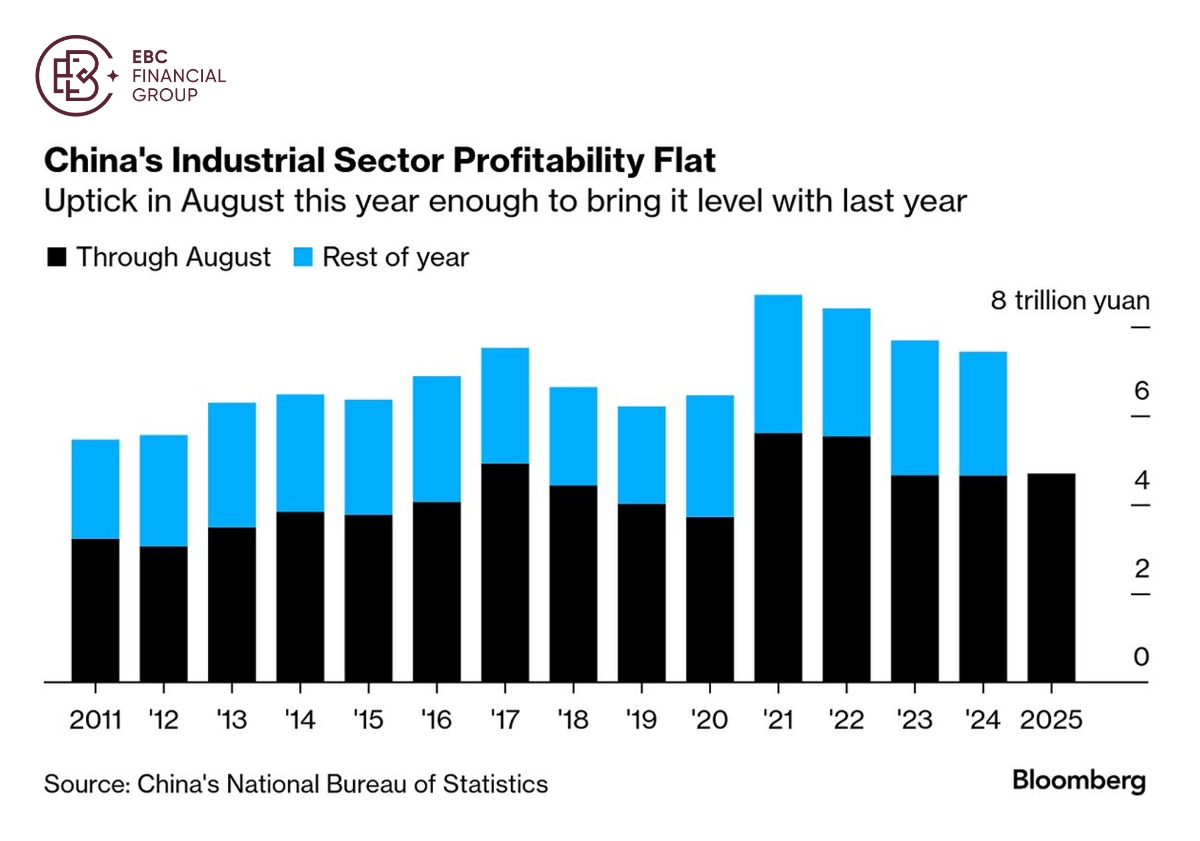

Profits of large Chinese industrial firms in the first eight months of this

year were up less than 1% from last year. In the year through July, 29% of these

firms were making a loss.

Technology valuations may have "priced in very optimistic expectations,"

leaving the market vulnerable to pulling back before earnings catch up, said

Chaoping Zhu, global market strategist at JP Morgan Asset Management.

Asian year

Asian stocks have far outperformed global markets this year buoyed by

monetary loosening and China's AI boom. The Kospi index led the rally, with a

yearly increase of 48%.

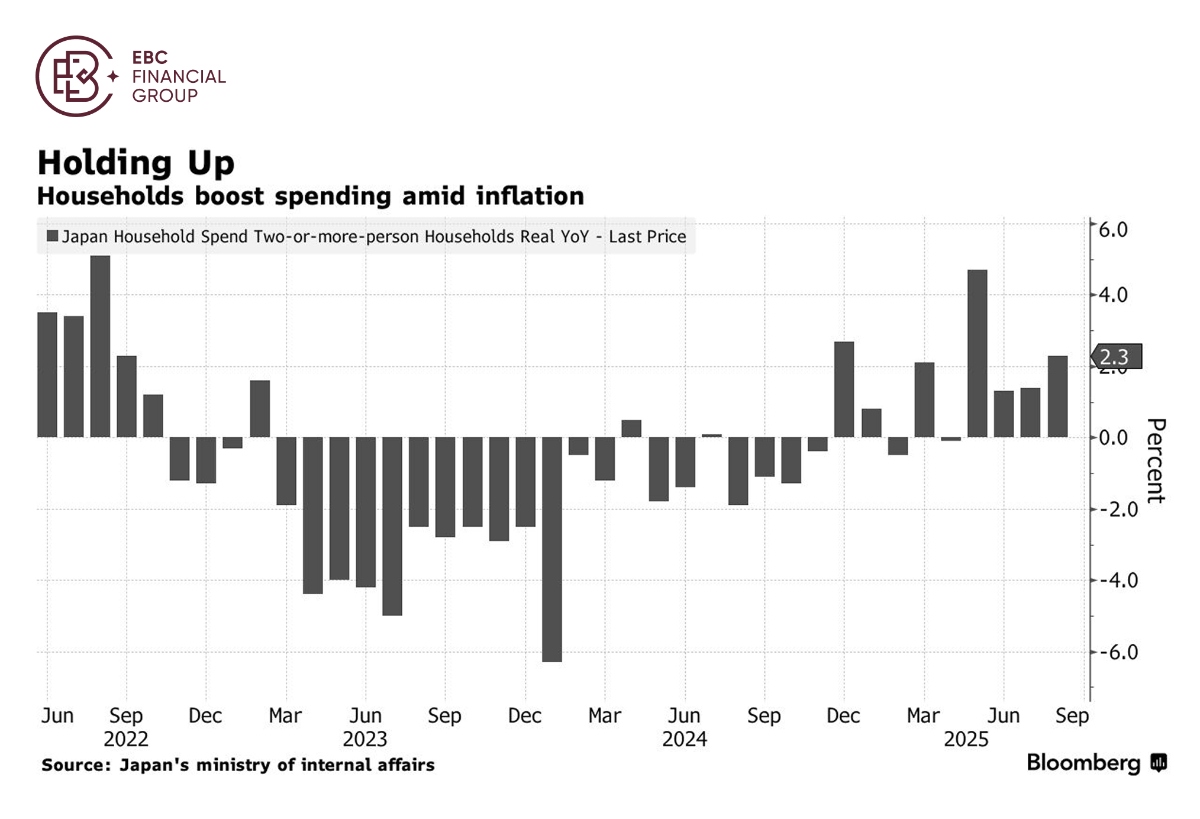

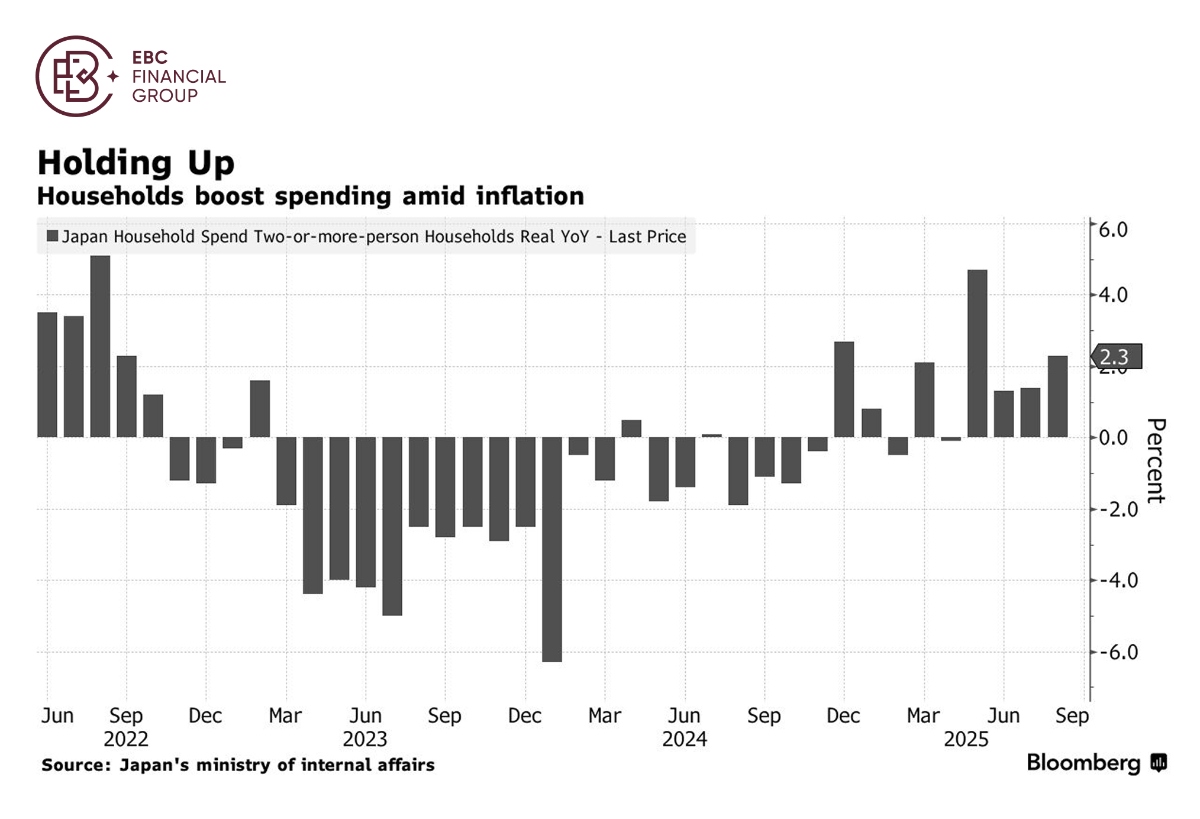

The Nikkei 225 is up 21.4%. Japan's economy grew faster than expected in Q2

in the face of tariffs and political uncertainty which could weigh on business

investment and consumer spending.

Sanae Takaichi, who won the ruling party's top job on Saturday to replace

Shigeru Ishiba, is expected to compile fresh economic measures to help bolster

consumption and thereby revive growth.

But her penchant for aggressive monetary easing may complicate the BOJ's plan

to keep raising interest rates gradually, increasing the possibility that

inflation will remain elevated for longer.

India's Nifty 50 and Australia's ASX 200 fail to impress as both have notched

single-digit gains. The Trump administration first imposed a 55% tariff on

Indian goods in August due to Russian oil buying.

In addition, Trump has announced a $100,000 visa fee for new H-1B visas,

which are reserved for high-skilled foreign workers. Of the nearly 400,00 H-1B

visas issued in 2024, 71% were for Indian nationals.

Across the Indian Ocean, the Australian share market is encumbered by mining

sector which suffers China's weaker demand. The country's crude steel output

fell 3.1% in the first seven months of this year.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.