Wall Street's rally hit a wall on Friday Trump's renewed tariff threats

against China triggered a broad sell-off across risk assets. His hostile remarks

caught markets by surprise ahead of talks between Beijing and Washington.

China dramatically expanded its rare earths export controls on Thursday,

adding five new elements and extra scrutiny for semiconductor users as Beijing

tightens control over the sector.

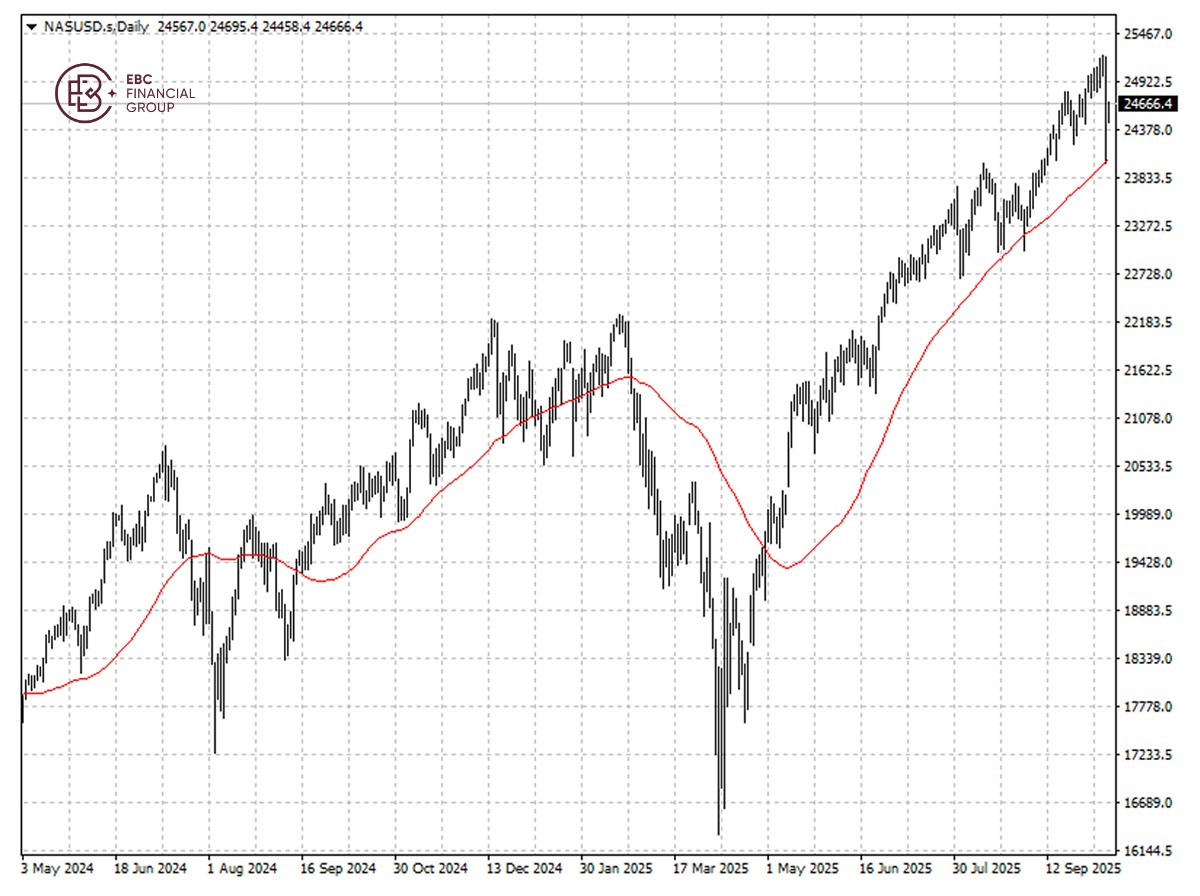

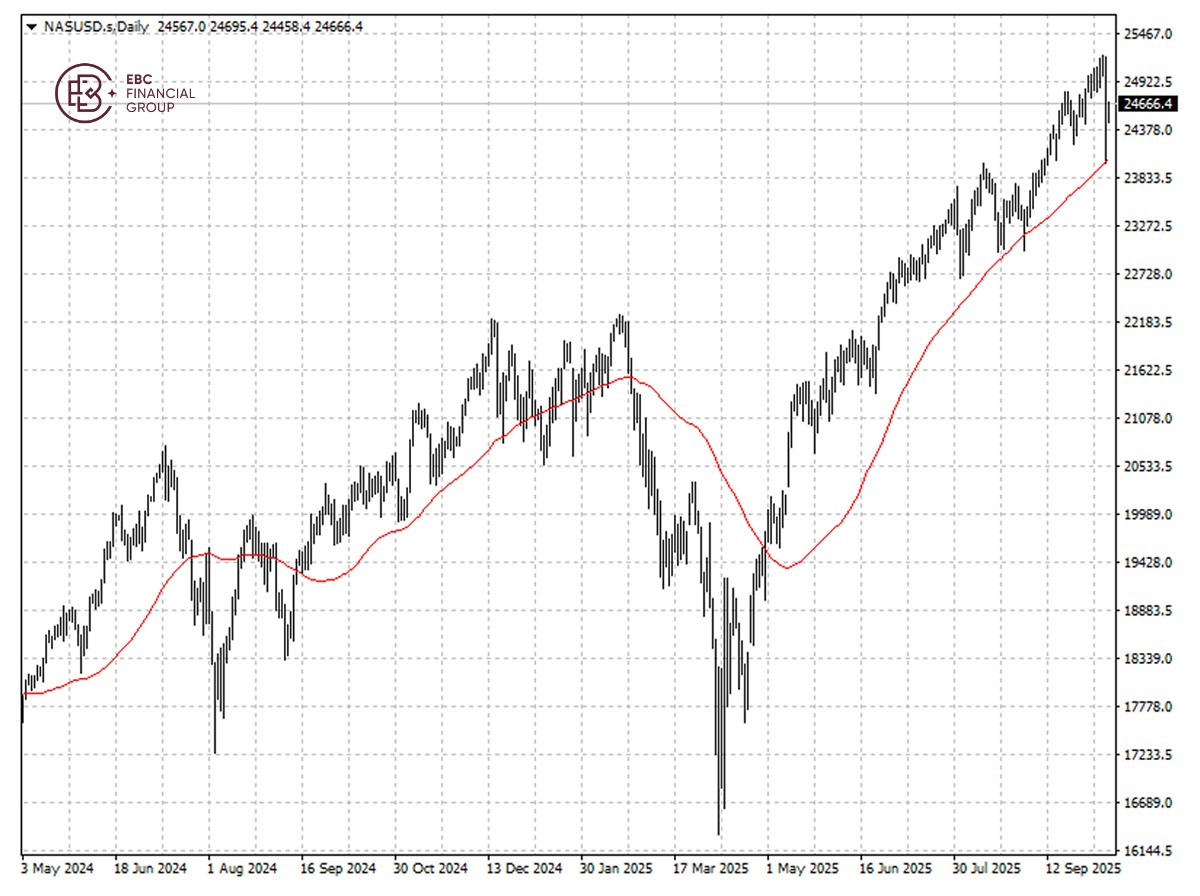

The S&P 500 and Nasdaq 100 both posted their sharpest one-day losses

since April, while the VIX volatility index spiked nearly 25%. The Magnificent

Seven wiped out $500 billion in total.

An escalating trade war between the two largest global economies could

trigger major supply chain disruptions, particularly for the technology,

electric vehicle and defence industries.

The BOE has warned that the risk of a "sharp market correction" has

increased, noting that valuations appear stretched, particularly for AI-focused

tech firms.

It added that "downside factors included disappointing AI capability/adoption

progress or increased competition, which could drive a re-evaluation of

currently high expected future earnings."

The Nasdaq 100's sharp decline was capped by its 50 SMA, but the risk remains slightly towards the downside. We see the index digest the latest loss in the immediate term.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.