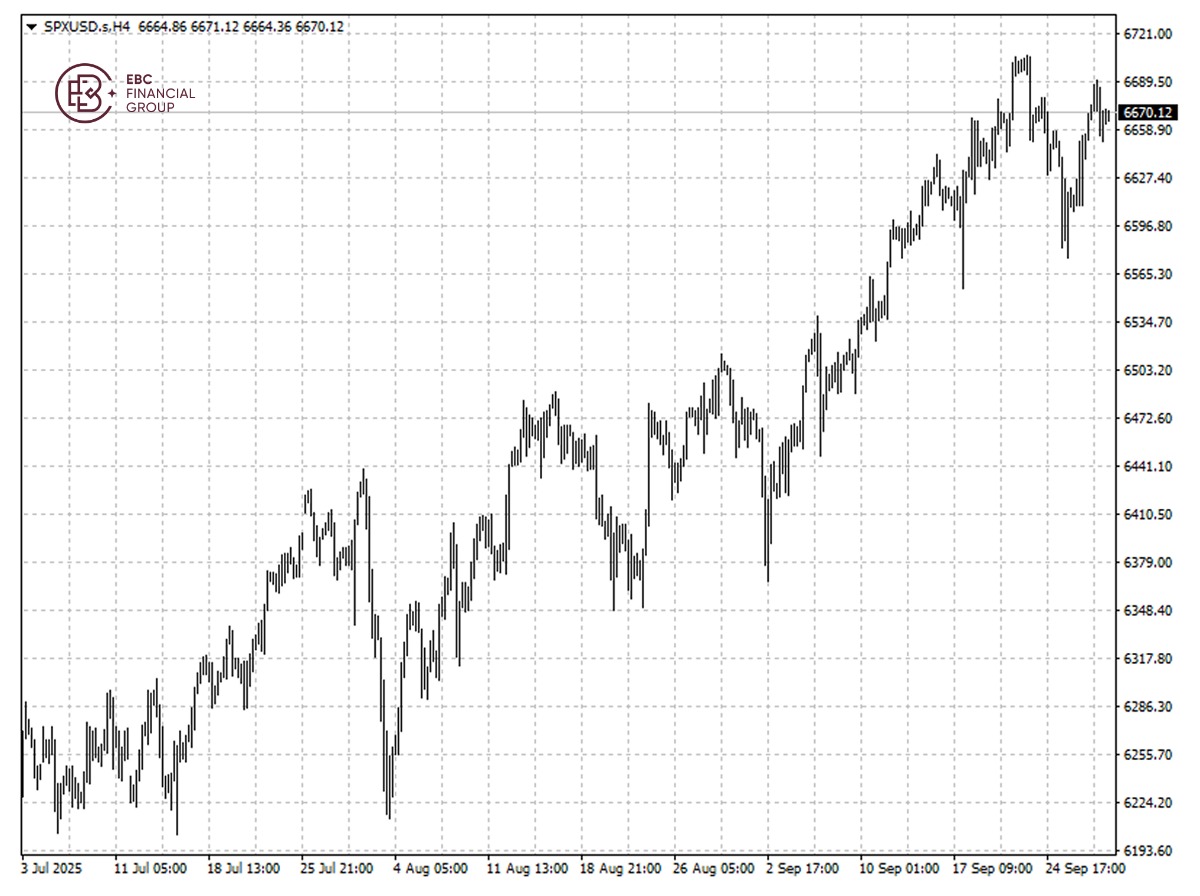

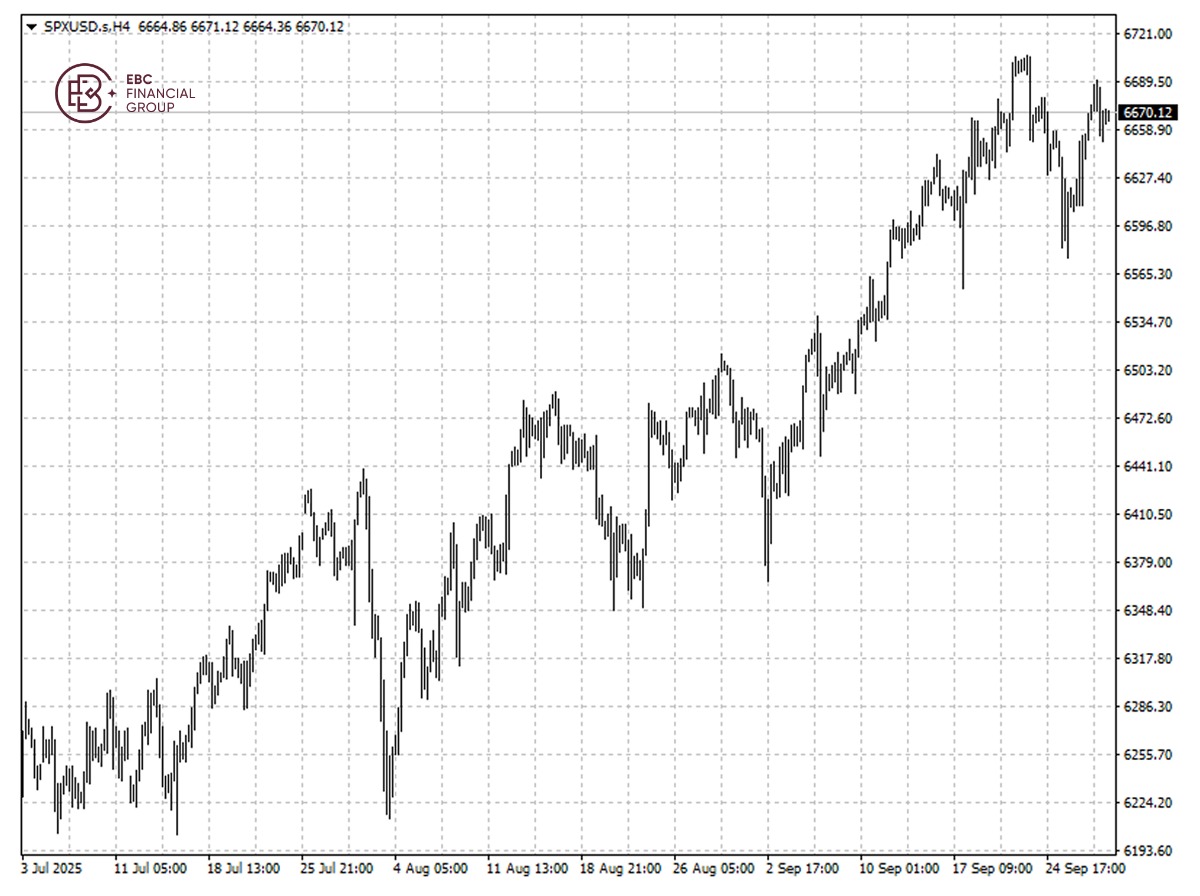

Wall Street indexes closed up on Monday with the Nasdaq 100 leading gains

despite a standoff between Republicans and Democrats over funding raising the

prospect of a government shutdown beginning Wednesday.

Global equities are likely to extend a rally into the year end given a

resilient US economy, supportive valuations and a dovish pivot from the Fed,

according to Goldman Sachs strategists.

They also raised their target for the S&P 500 earlier this month,

expecting it to gain another 2% to 6,800 points over three months. Fed Chair

Powell on Tuesday noted that asset prices were at elevated levels.

Wall Street analysts also say shunning stocks because they appear "expensive"

is a strategy that fails to stand the test of time. A research shows the average

valuation range has leaped over the course of this century.

That is a potential offset to bearish arguments that today's AI frenzy is

destined to end like the Internet boom and bust of the late 1990s when interest

rates even exceed today's levels.

According to the BofA, less financial leverage, lower earnings volatility,

increased efficiency and more stable margins than in decades past help to

support benchmark index's higher multiples.

The S&P 500 remains skewed towards upside risks following the recent

pullback. We expect it to retest the resistance of 6,700 in the near term if

upcoming job report does not disappoint.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.