Indian shares fell to their lowest levels in over three months in a

broad-based sell-off, led by IT shares and Reliance Industries, as tepid

corporate earnings and global trade worries bit.

Economy is projected to grow 7.4% in the fiscal year ending March 2026,

higher than 6.5% in the last fiscal year, according to first advance estimates.

Still iShares MSCI India ETF has extended weaknesses from last year.

The market significantly underperformed Chinese, Japanese and Korean stocks

in 2025, reversing its regional lead for the years earlier, as the Modi

government is yet to reach a trade deal with Washington.

Negotiation has stalled as key sticking points remain even now, including

agriculture. Washington has been pushing for greater access to India's farm

sector but Delhi has fiercely protected it.

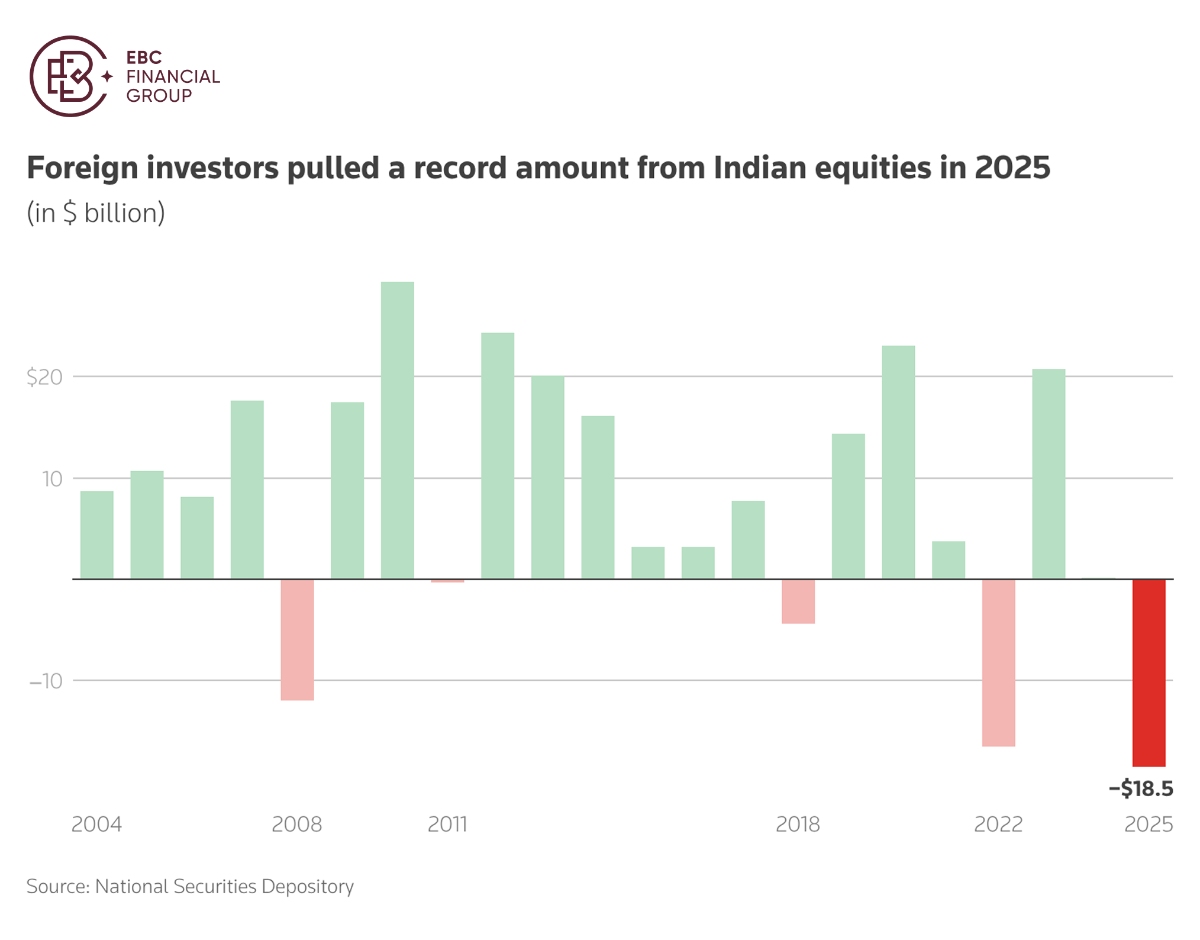

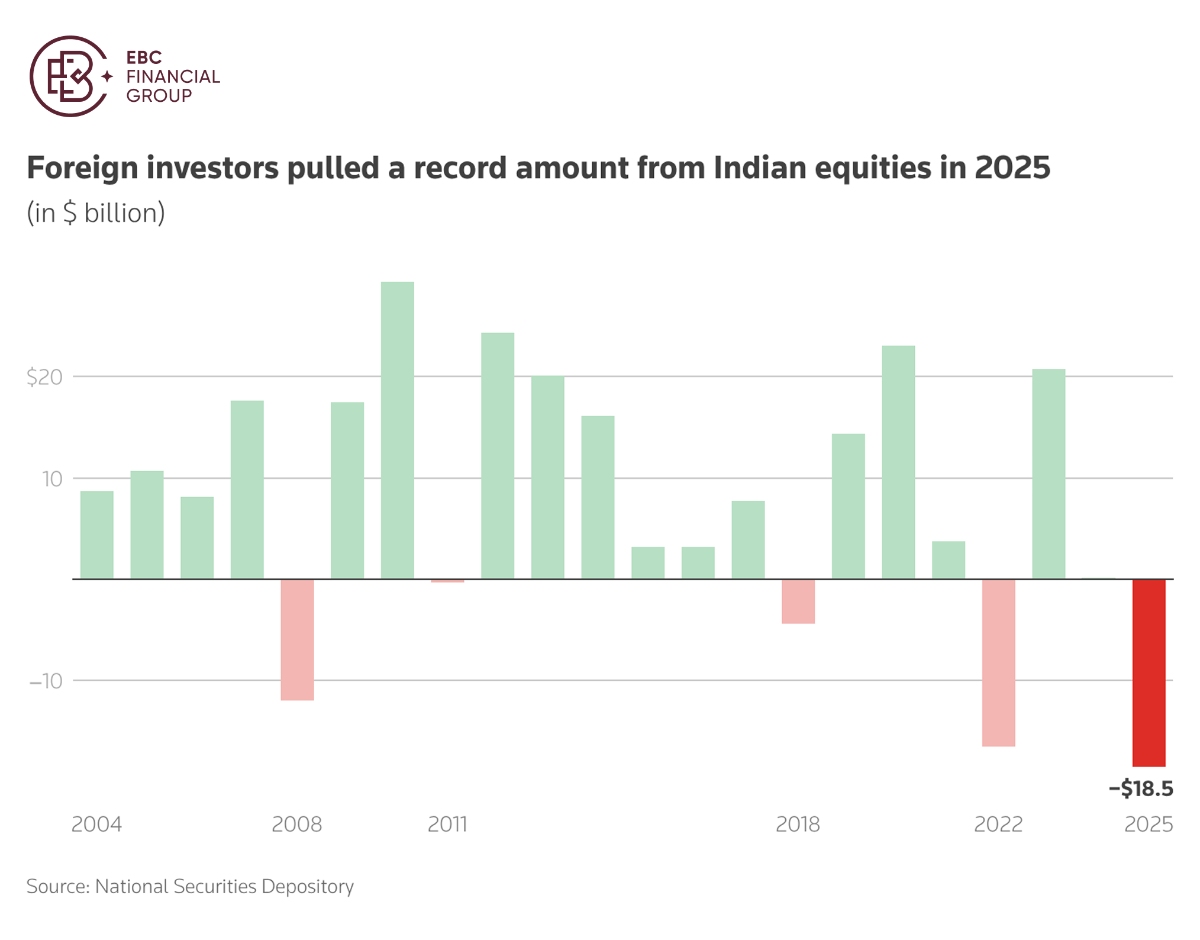

Foreign portfolio investors sold about 1.6 trillion rupees of shares during

the year, the highest annual outflow on record. Tech stocks were the hardest

hit, a contrarian trade amid AI boom.

India's valuation premium relative to EM peers has been back to its

historical average, according to HSBC Mutual Fund. The institution expects "a

return of FII investors into India in the coming year".

India has imposed a 30% import duty on pulses and lentils originating from

the US, this week, a move that intensifies tensions. Thus a deal is unlikely in

the short run, with Trump engrossed in Iran and Greenland.

Asia Gambit

India's exports to China soared in December while shipments to the US

declined. During the first nine months of the current fiscal year, the shipments

to mainland China and Hong Kong rose about 37% and 25% respectively.

Relations between the two countries have been thawing since Modi and Chinese

President Xi met at the Shanghai Cooperation Organization summit in September

sharing a vision of being partners.

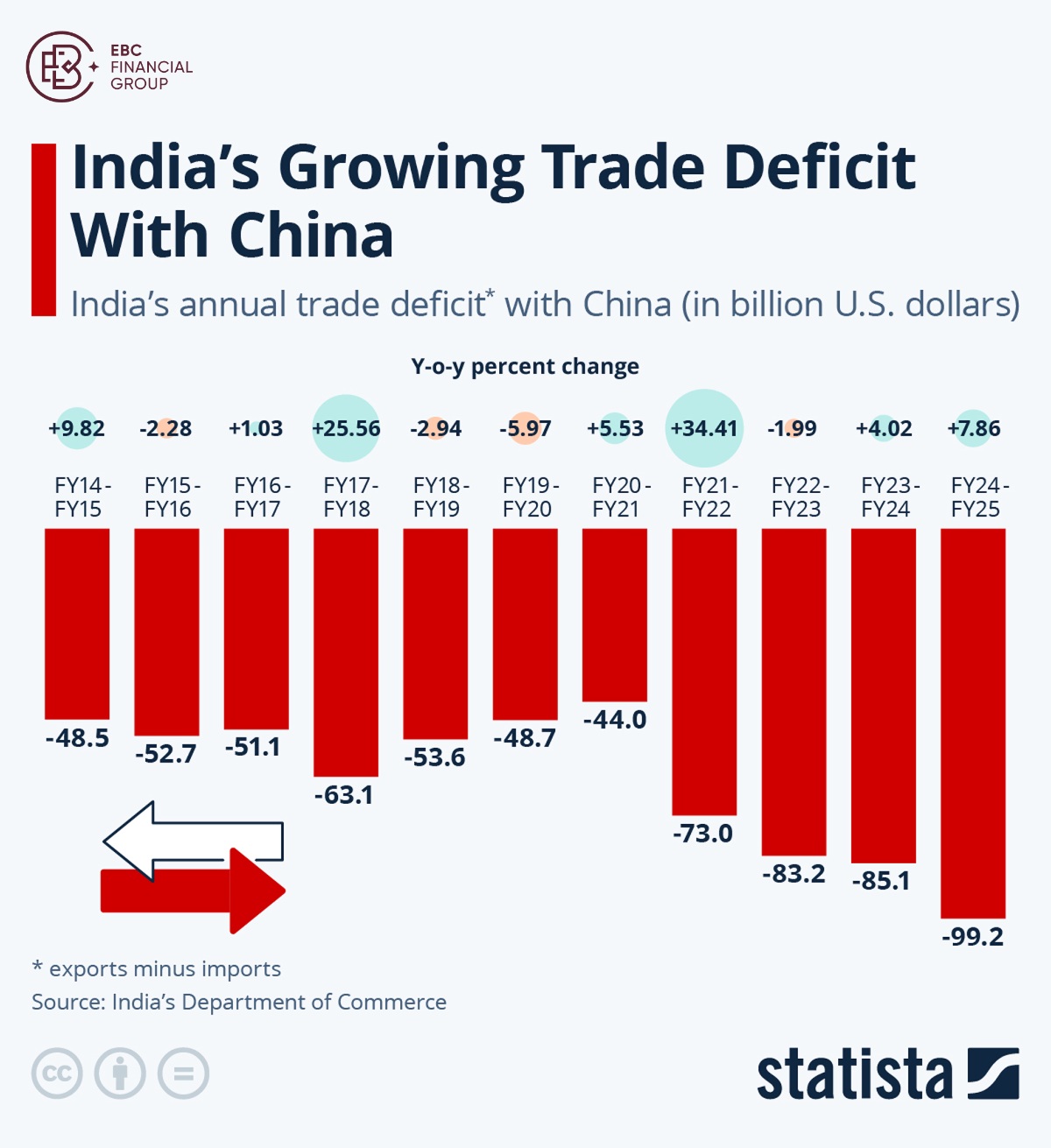

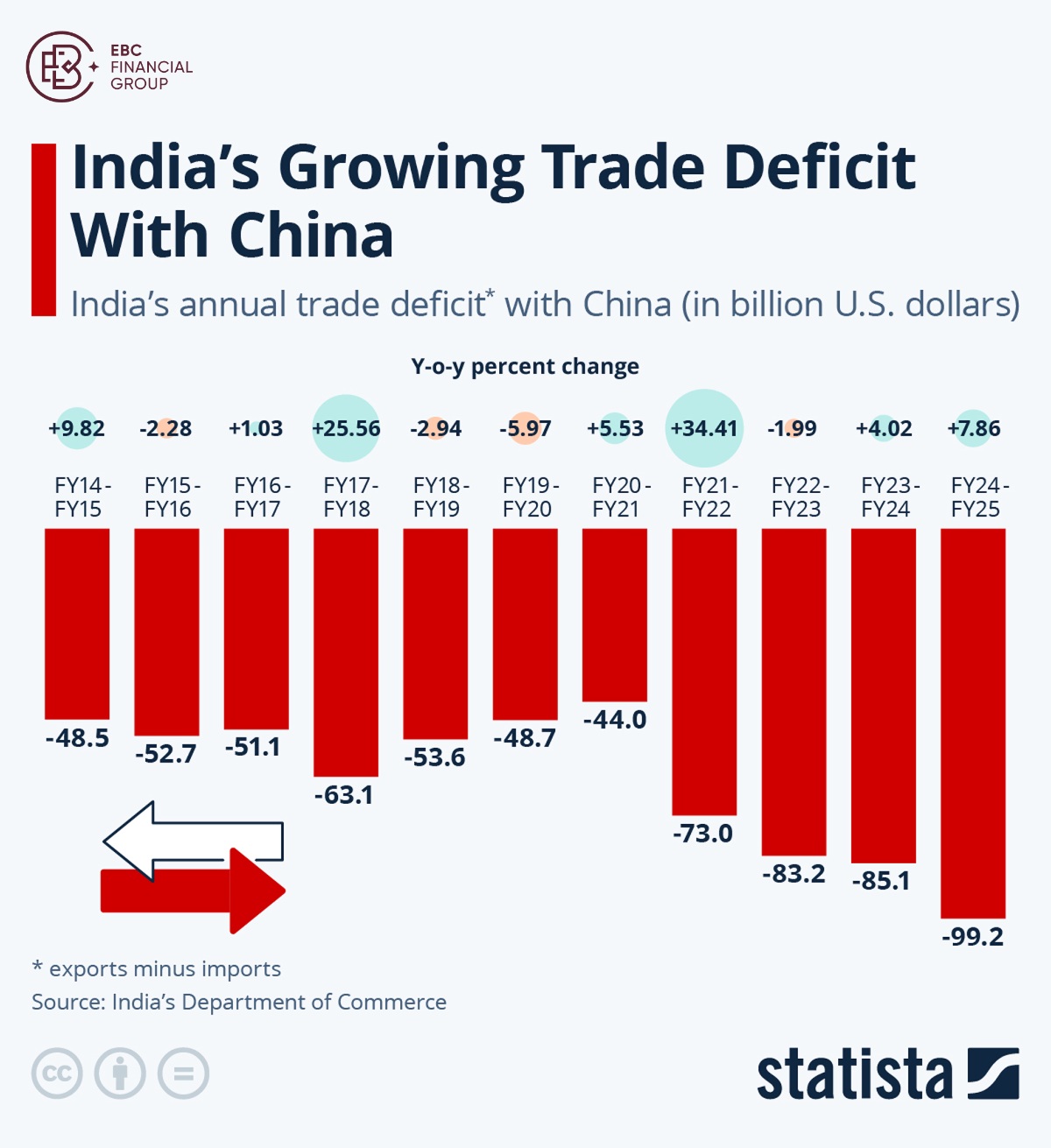

Even as the country's widening trade deficit with Beijing and border disputes

hampers closer engagement, it could prompt New Delhi's reconsideration of stand

on joining RCEP.

India and New Zealand secured a landmark Free Trade Agreement in December.

India's labour-intensive sectors - textiles, clothing, leather and footwear - as

well as automotive companies are poised to benefit.

The two countries aim to double bilateral trade within 5 years. It also means

India has had such deals with all the countries in the RCEP except for China, in

effect gearing up for diversification away from the US.

Moreover, India expects to conclude a long-sought deal with the EU this

month. It is expected to spur European investment in Indian manufacturing,

renewable energy and infrastructure.

India has a "well-diversified and resilient export footprint," said S.C.

Ralhan, president of Federation of Indian Export Organisations. He added "global

trade routes are being reshaped".

Save rupee

India's consumer inflation rose to 1.33% in December, below expectations of a

1.5% increase. According to the RBI, the reading will return to 2% for the

fiscal year ending March 2026.

That gave policymakers room to cut its policy rate by 25 bps to 5.25%. Ac

conundrum is that the rupee remains within touching distance of a fresh record

low – a big investor turn-off.

Despite no evident tailwinds for the currency, the dollar weakness is acting

in its favour. Trump has reiterated his plans to control Greenland, downplaying

the likelihood of resistance from Europe.

He also threatened to impose 200% tariffs on French wines as Macron

reportedly showed few interests in "Board of Peace" on Gaza. Whereas Europe

stock rout continued following the headline, the euro surged.

The Pentagon rushed more F-15E Strike Eagles to the Middle East in recent

days amid high tensions with Iran. The potential fall of Iran's revolutionary

Islamic regime has sequential implications for India.

Iran is ramping oil production back to record 2024 levels of around 4.3

million bpd despite US sanctions. New Delhi stopped buying the country's oil in

2019, and is now ordered to halt Russian oil imports.

If Trumps manages to take down Khamenei and reconcile with his successor,

India may well be allowed to source cheaper energy from there again. In that

case, trade deficit narrowing and consumption increase is likely.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.